By: Mark Wallace at http://www.capitalistexploits.at/

We just concluded our Meet Up in Singapore, center of the SE Asian financial universe. It’s a vibrant and energetic place where capitalism is thriving.

Over the course of about a week we heard from experts in the banking, legal, brokerage and risk control industries. CEOs of companies we’ve funded, merchant bankers and residency experts were present to address our attendees, answer questions and provide insight into their businesses and the SE Asian markets they operate in.

We also had the privilege of attending a Bitcoin pitch session held by the guys that run Seedcoin. Founders of a half dozen Bitcoin startups presented their companies to our group of about 30 interested and engaged investors from about a dozen countries. We all walked away impressed and convinced that Bitcoin is a force to be reckoned with!

But today we’re going to talk about crowdfunding startups in SE Asia...

Once upon a time small startups relied almost exclusively on bootstrapping, friends and family, or perhaps a handful of angel investors, for startup capital. The recent buzzword however in small-scale fundraising, is Crowdfunding.

In the North Americas, the Crowdfunding trend has gone mainstream. With the Jumpstart Our Business Startups (JOBS) Act back in 2012, unaccredited investors now have a regulatory framework for investing in equity based Crowdfunding in the United States. The implications of the JOBS act promise to be far reaching and entrepreneurs are moving rapidly forward, setting up a variety of platforms aimed at assisting both startups as well as investors looking to participate in exciting growth companies.

We’ve spoken extensively about Crowdfunding on our site.

Growth in the Crowdfunding space on the other side of the Pacific, here in Southeast Asia where we tend to hang our collective hats, is picking up as well despite the language, regulatory and platform barriers.

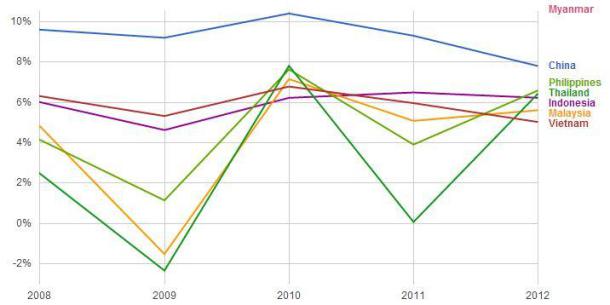

Figure 1: Selected GDP Growth Rate of Major South East Asian Economies

The majority of South East Asian economies withstood the shocks from the Global Financial Crisis relatively well, and those who fared worse than their counterparts are now rebounding (Figure 1).

Southeast Asia is now home to a rapidly emerging entrepreneurial ecosystem. Recent developments indicate that global investors are taking notice of the colossal growth opportunity offered by startups in the region. When compared to North America a lack of Crowdfunding platforms in the region has meant that only more recently have Crowdfunding opportunities arisen.

The task of screening companies in Southeast Asia is complicated due to the lack of information available on startups from a centralized platform, such as Indiegogo. Additionally language barriers have made it difficult, even for investors from neighbouring countries, to cross-invest. A lack of regulatory support from Governments across the region is also holding back the growth potential of Crowdfunding as general solicitation is still not permitted in most countries. Beside a few exceptions, Crowdfunding growth in Southeast Asia is dependent on local, national level, platforms.

KitaBisa, Indonesia

KitaBisa is an Indonesian version of KickStarter. In Bahasa Indonesia, KitaBisa means, “we can” and the founders have certainly proved they can. Since the soft launch in June 2013, a few projects have successfully raised tens of millions of Indonesian Rupiahs through the platform. Based on the KickStarter’s all or nothing formula, KitaBisa has so far funded interesting projects such as the one to empower out-of-work housewives by teaching them how to build handmade crafts and marketing it to local communities.

SeedAsia, China

Based in Shanghai, SeedAsia is offering accredited investors a platform to find and invest in a range of pre-screened Chinese and South East Asian startup companies in the technology niche. Unlike many donations based platforms in Asia, SeedAsia is an equity based Crowdfunding platform. The company screens potential investors and sets a minimum floor of US$2,000 to ensure only serious investors get the opportunity to fund the next Asian Google.

Crowdbaron, Hong Kong

The Hong Kong based Crowdvesting platform , Crowdbaron recently secured funding from Grow VC Group, and are planning to help investors make substantial investments in real estate. The innovative idea behind Crowdbaron is that, unlike timeshares, you will not actually own the right to occupy the premises. A pool of investors will own a property, which will then be rented out. Investors earn periodic rents based on their percentage of stake and may profit from price appreciation. Crowdbaron hopes that people who either can’t or don’t wish to purchase whole properties will be able to utilize their service to gain from the continued appreciation of Hong Kong’s real estate market.

ToGather.Asia

Unlike the others ToGather.Asia is focused on the entire Southeast Asian regional market. Started in 2012, ToGather.Asia is a Singapore based company targeting a broad range of countries in Southeast Asia. It is slowly gaining traction in terms of project creators and crowd funders. According to Bryan Ong , the founder of ToGather.Asia, the majority of the international Crowdfunding sites feature projects from North American, if not European locations. Due to cultural difference, Asian funders find it difficult to trust projects found on existing international sites. Moreover, Asian project creators often fear that due to rampant copyright infringement in the region their ideas might be stolen if they try to Crowdfund their projects. Rather than becoming disheartened by this, ToGather founders saw this as an opportunity to educate people in Asia about Crowdfunding and to converge local creative types and their potential patrons within the region.

While the majority of the Crowdfunding platforms are mushrooming as a copy of the western model, there are some innovative Crowdfunding hubs to keep an eye on in Southeast Asia.

As we’ve mentioned many times before, we believe these emerging economies will become the leading economies within the next few decades, if not sooner. Investing into startups in the region can prove to be an exceptionally well-timed investment as well as provide a good vehicle for diversification for small investors.

Accredited investors can contact us directly if they wish to receive more information about our private, members-only service dedicated to finding such opportunities.

–

– Mark

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/jvT0UXgEGFc/story01.htm Capitalist Exploits