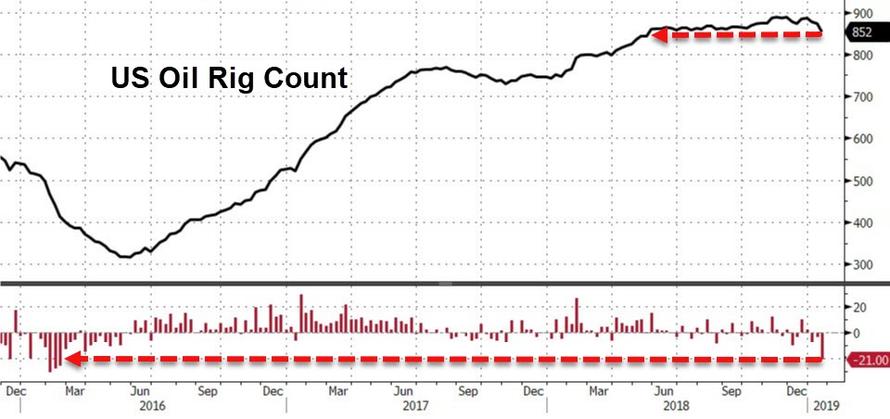

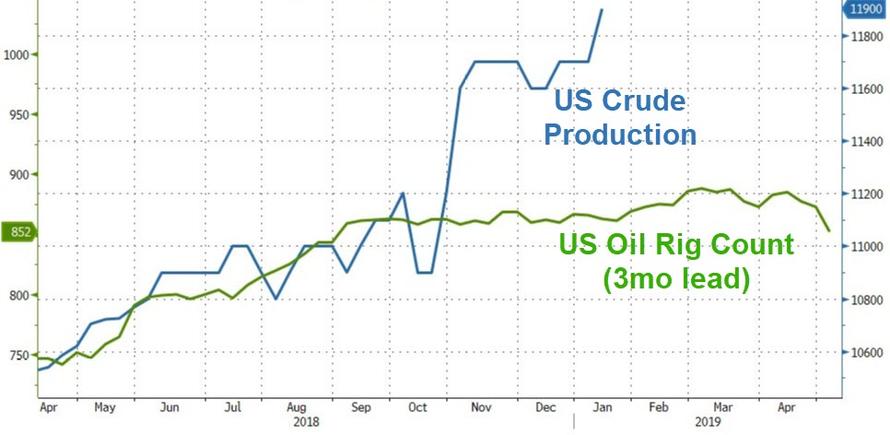

After surging 200k b/d in the last week to a new record for US crude production, Baker Hughes reports that the US oil rig count has plunged by 21 in the last week – the biggest drop since Feb 2016.

Is this the turn for the Permian? Perhaps, but, as OilPrice.com’s Nick Cuningham notes, while low oil prices are beginning to slow the growth of U.S. shale, in the years ahead oil and gas drilling could be curtailed by a different problem: a shortage of water.

Water is a crucial ingredient in the fracking process, and drillers use copious volumes of it. The problem for the U.S. oil industry is that so much of the output growth expected over the next half-decade or so depends very heavily on the Permian basin, where water is increasingly scarce.

Water already accounts for about 15 percent of the cost of a shale well, according to analysts at Morgan Stanley. “In the Permian, total spending on water is expected to double over the next 5 years, to $22B, with E&Ps on avg using 50 barrels (bbls) of water for each lateral foot completed,” the investment bank wrote in a new report. “Assuming 10k lateral feet per well, this implies that the ~5,500 existing Permian well permits will require ~2.75 billion bbls of water to complete.”

That’s a lot of water in an area that doesn’t have a lot of it. “Given the sizeable water need, we believe drought and water scarcity present long-term risks to shale economics, particularly in the Permian, a core area of growth in a drought-prone region,” Morgan Stanley warned.

It’s worth pausing and noting that the warning is not coming from an environmental group, or even a local community organization opposed to a drilling presence. It’s coming from a major Wall Street investment bank, which says that drilling economics in the world’s hottest shale basin could be upended because of water scarcity.

It’s a rather ironic development. Greenhouse gas emissions from oil and gas drilling are fueling climate change, which in turn could make the most desirable oil and gas play increasingly costly due to growing water problems.

Morgan Stanley goes on to provide further detail into the scale of the problem. Morgan Stanley overlaid water scarcity data from the World Resources Institute with Permian well locations, finding that “53% of Permian wells being drilled today are located in areas with high water risk,” the investment bank concluded. “While operators are comfortable with water availability at the moment, there are precedents (most recently in 2011/2012 in Oklahoma) where severe drought conditions materially affected completion performance.”

There is also another separate water problem facing shale drillers. “Produced water” – water that comes out of a well when drilled – must be handled somehow. The volume of produced water that comes out of a shale well can exceed that of oil by a ratio of 10 to 1. The ratio also increases over time as the oil from individual wells begins to deplete, so the cost-per-barrel for water disposal also rises.

Water can be injected underground into disposal wells, which carries environmental and seismic risk. Or it is trucked away for recycling or some other form of disposal, often done by third parties, at huge expense. Last year, Wood Mackenzie said that the rising cost of water disposal alone would increase the breakeven price in the Permian by between $3 and $6 per barrel, potentially shaving off future Permian oil production by around 400,000 bpd by 2025.

Morgan Stanley notes that shale drillers are increasingly recycling the water they use to drill wells, injecting it back underground to be used again in the next well. That saves on water use, of course, but it also cuts down on the cost of water disposal. The investment bank says simply recycling water could save around $1 per barrel.

“Water risks to date have largely been described as a cost issue, but as projects continue to build scale, the risks become more serious,” Ryan Duman, principal analyst with Wood Mackenzie’s Lower 48 upstream team, said in a June 2018 statement accompanying the report. “They could impact the ability to actually carry out operations. Investors and project partners should challenge operators on how water is being managed.”

To sum up, costs could rise because the amount of oil coming from legacy wells is increasing as drilling proliferates; water scarcity is getting worse, which could increase the cost of water needed to drill a well; and as the Permian frenzy ages, drillers are pushed into less desirable locations on the periphery, where well economics may be worse to begin with.

via RSS http://bit.ly/2Dkf0Uw Tyler Durden