Crude prices edged higher overnight amid Venezuela disruption concerns after falling to the lowest level in almost a week after a surprisingly large crude build reported by API and as China warned of “serious challenges” to the global economy and the U.S. government shutdown cast a pall over growth.

The White House recognized Juan Guaido as the interim president of Venezuela on Wednesday, a move that carries the risk of further disruption to the nation’s oil exports.

“With the U.S. now clearly taking sides with the opposition, changes might be in the making,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London. “This would deal a further blow to U.S. refiners that rely on whatever Venezuelan oil is still available and as such would be short-term bullish.”

API

-

Crude +6.551mm (-500k exp)

-

Cushing +359k

-

Gasoline +3.635mm

-

Distillates +2.573mm

DOE

-

Crude +7.97mm (-750k exp)

-

Cushing -190k

-

Gasoline +4.05mm

-

Distillates -617k

The API reported a build across the board on nationwide crude, Cushing, gasoline and distillate inventories. We already saw large builds last week in products and that continued with crude also seeing an even bigger build than API…

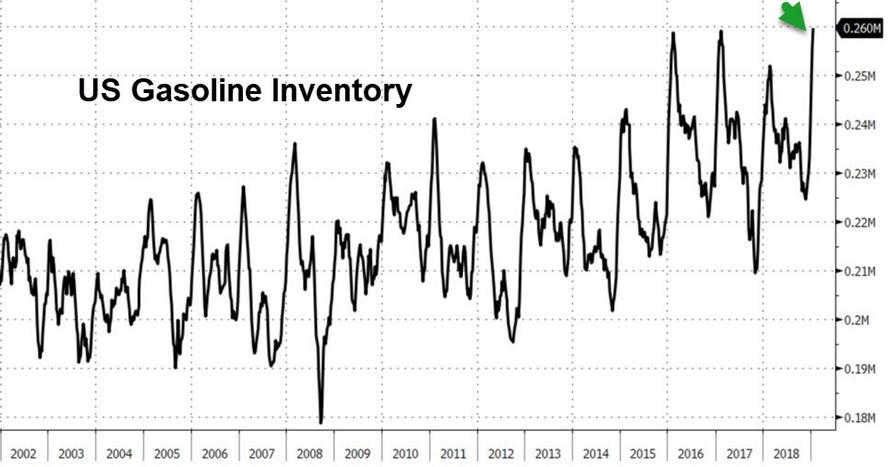

…and Gasoline’s 8th weekly build in a row pushed it to a record high…

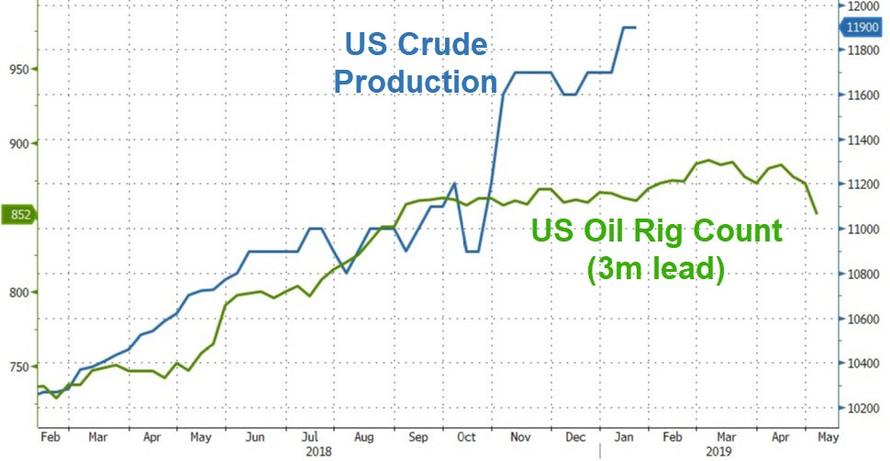

Production hit a new record high last week as the number of US oil rigs tumbled most in years.

WTI crude futures chopped around between $52 and $53 ahead of the DOE data and kneejerked lower after the big surprise crude build…

And then – of course – the algos stepped in and sent crude prices higher (on a huge surprise crude build, record crude production, and record product inventories!!!???)

Bloomberg’s Benjamin Dow notes that with U.S. inventories for both categories of oil products spiking and more volume builds rising to seasonal peaks, including a possible all-time high for distillates, the narrative that the U.S. is overproducing and under-using will continue. The bullish global supply-side case centered around OPEC-Russia cuts, and Iran won’t be able to help WTI in the near term with crude and product numbers ballooning.

via ZeroHedge News http://bit.ly/2RN0woZ Tyler Durden