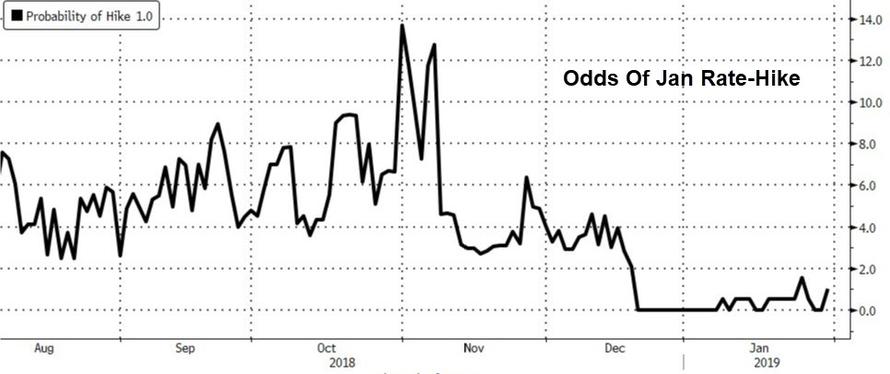

With a 1% probability of a rate-hike today, all that matters is The Fed’s tone (better be uber dovish) and any language shifts on the balance sheet normalization.

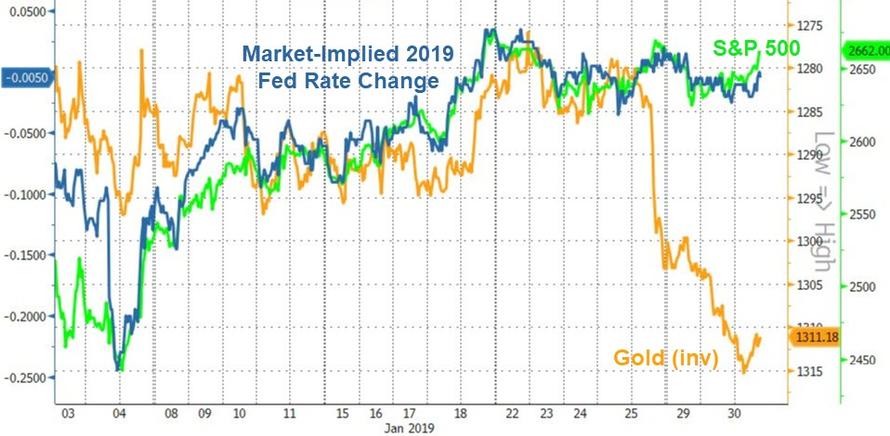

Since The Fed hiked rates in December, Gold is the clear winner…

But we note that stocks and the market’s perception of The Fed’s dovish/hawkish-ness are joined at the hip…

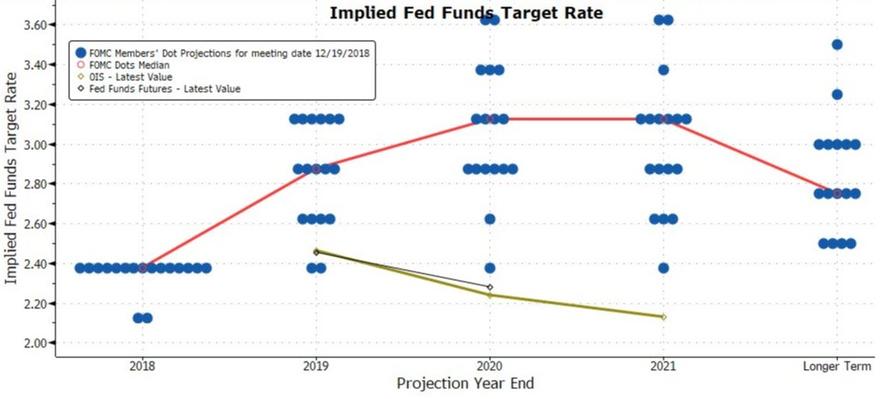

Somehow, The Fed has got to slowly but surely jawbone its outlook down to the market’s uber-dovish perception without spooking investors that something very serious is going on…

Markets faded from their highs into the Fed Statement:

So, did The Fed deliver?

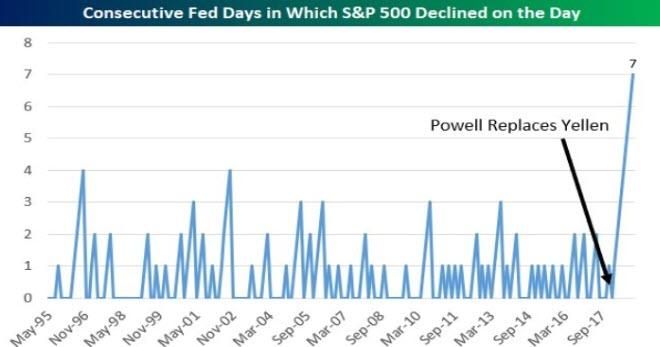

Bear in mind that the S&P 500 Index has declined on the day of each of the seven decisions he’s presided over. According to Bespoke Investment Group, that’s the longest Fed-Day losing streak on record.

* * *

Full redline Fed statement below:

via ZeroHedge News http://bit.ly/2Uw63gy Tyler Durden