One week ago, when looking at the dramatic collapse in consensus Q1 EPS estimates, we noted that the “profit party” is over and the days of near record earnings growth are about to end with a bang as a result of the recent barrage in profit warnings and negative preannouncements, first and foremost starting with Apple, which issued a shocking guidance cut one month ago for the first time since 2001.

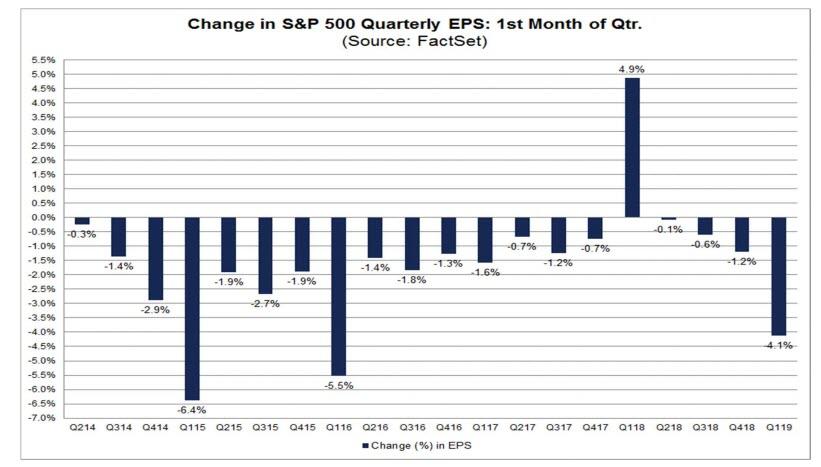

As a result, analysts have slashed their S&P500 earnings estimates for the first quarter, and the Q1 bottom-up EPS estimate dropped by 4.1% (to $38.55 from $40.21) during this period.

Strikingly, the first quarter marked the largest decline in the bottom-up EPS estimate during the first month of a quarter since Q1 2016 (-5.5%). At the sector level, all eleven sectors recorded a decline in their bottom-up EPS estimate during the first month of the quarter, led by the Energy (-22.5%) and Information Technology (-7.3%) sectors. Overall, seven sectors recorded a larger decrease in their bottom-up EPS estimate relative to their 5-year average and their 10-year average for the first month of a quarter.

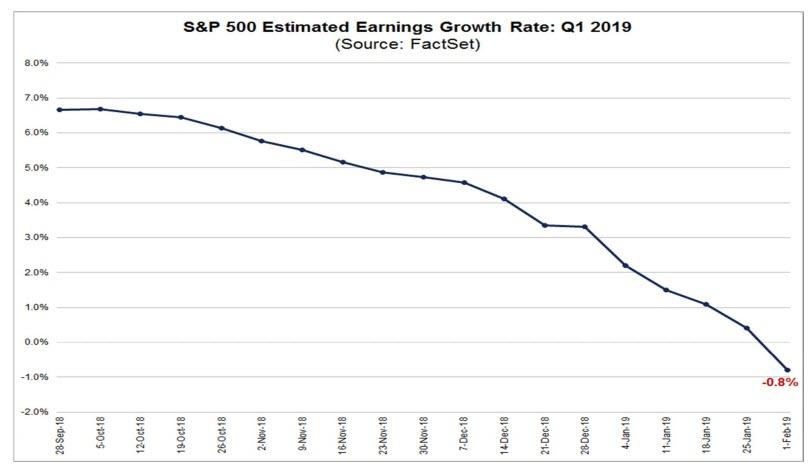

What is even more stunning is just how fast Q1 earnings have been slashed lower, with the S&P expected to post a 3.3% growth as recently as Dec 31, a number which is now down to -0.8%, as consensus for the first time expects Q1 EPS to post an annual decline due to downward revisions to EPS estimates during the month.

If analysts are correct, and the index does report an actual decline in earnings for the first quarter, it will mark the first year-over-year decline in earnings since Q2 2016 (-3.1%).

Fast forward to today, when one day after Morgan Stanley’s Michael Wilson noted that “Earnings Revisions Have Been Some Of The Worst We’ve Ever Observed“, the chief equity strategist is out with his latest dire proclamation, namely that the “Earnings Recession Is Here.“

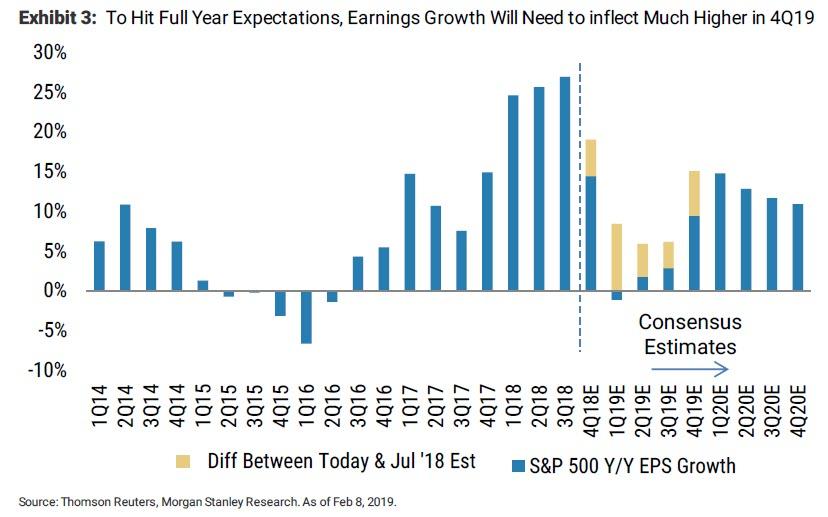

Having long been one of the most pessimistic strategists on Wall Street, predicting that it is only a matter of time before an earnings recession strikes, Wilson today writes that his earnings recession call is playing out even faster than he expected, adding that “when we made our call for a greater than 50% chance of an earnings recession this year, we thought it might take a bit longer for the evidence to build.” In retrospect it took just over a month for forward guidance to collapse and “on the back of a large downward revisions cycle during 4Q earnings season, it’s becoming more clear.” Indeed, as we noted last week, consensus numbers have already baked in no growth for 1H19 (1Q projected growth is actually negative) with a hockey stick assumed in 2H19 that brings the full year growth estimate to ~5%.”

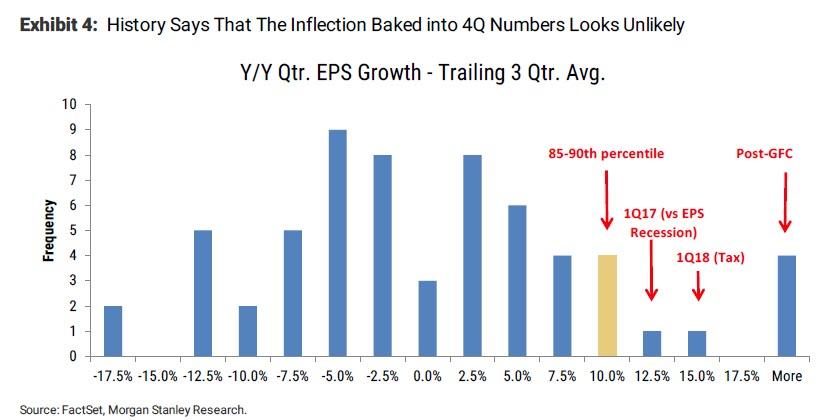

However, as Wilson is quick to note, “history says be skeptical of the inflection forecast.” Why? Because the projected y/y EPS growth in 4Q19 is ~9.5%.

This compares to an average projected rate of growth of 1% over 1Q – 3Q19, an inflection of ~8.5%. While we have seen this kind of inflection happen a few times since the early 2000s, these inflections were all related to

- comping against negative or slower EPS growth or

- tax cuts mechanically lifting the growth rate.

Neither of those forces are at play this year. In fact, it’s the opposite making the achievability of these estimates even more unlikely, to wit:

We are increasingly convinced that consensus earnings expectations for 2019 have further to fall and that the optimistic uptick currently baked into 4Q19 estimates is unlikely to happen. A modest further decline in earnings will deliver the earnings recession we called for. Equity returns can still be positive in this environment, but they will likely be weaker than they otherwise would have been and the odds of outright price declines are substantially elevated. Whether prices move higher or lower, volatility will likely rise meaningfully. So in essence, we are still looking at a bumpy, range bound market at the index level and think investors should continue to try and take advantage of the swings in price in both directions.

Furthermore, as Wilson puts it wryly, company managements tend to be an optimistic group. As such, we’re not surprised they are calling for a trough in 1Q. However, Wilson would advise against taking too much comfort in these calls for a trough in 1Q19 of the down cycle from the same people who didn’t see it coming in the first place. In addition to a trough in 1Q, consensus estimates are now forecasting a big second half inflection in growth.

Anything is possible, but we have little confidence in such an inflection given sharply falling top line growth and disappointing margins in the face of very difficult comparisons for the rest of this year. If we accept that an earnings recession is here, the key questions are how deep will it be and how long will it last? Again, it’s hard to know, but we can look to history for some context on how expectations for a large upward inflection in earnings usually play out.

And as the chart below shows, the kind of hockey-stick inflection point which consensus expects in Q4 is virtually impossible absent a positive reversal in virtually everything.

So what does it mean for markets if Wilson is right and an earnings recession is indeed nigh, while Wall Street’s rosy outlook is set for major disappointment?

As the strategist explains, when consensus is embedding an inflection further out, downward revisions, some drag on price returns and higher volatility are all to be expected. To analyze the impact of such a substantial cognitive bias, Wilson examined what tends to happen when consensus embeds a big jump in growth 4 quarters out compared to the next three quarters. He found that the numbers for all 4 quarters ahead tend to fall but the growth quarter tends to fall the most. In other words, “if current estimates move in line with history, we could see a full year decline of ~3.5% in S&P earnings.”

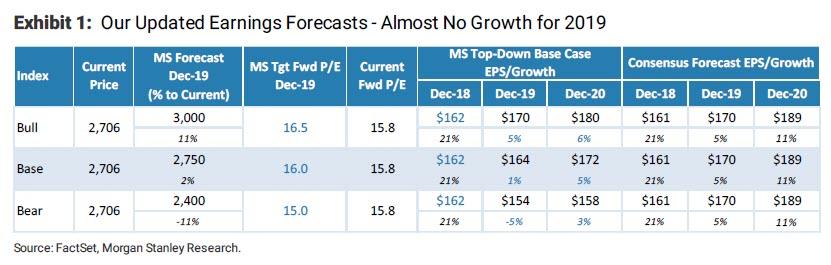

As a result of this analysis, Morgan Stanley is now lowering its Base Case 2019 S&P 500 EPS growth forecast to just 1% from 4.3% (and a token 1% at that, since Wilson effectively makes that case that it is far more likely than not that the final number will be negative). Wilson also notes that “history tells us to expect further downward revisions, higher volatility and a drag on prices.”

Wilson also found that “equity returns can still be positive in this environment, but they will likely be weaker than they otherwise would have been and the odds of outright price declines are substantially elevated. Whether prices move higher or lower, volatility tends to rise meaningfully, with average year ahead price volatility realizing ~5% more than the full period average.”

Still, while Morgan Stanley has revised its earnings numbers lower, surprisingly, its bull, base, and bear case year end price targets remain unchanged for one simple reason: the lower rate environment provides support for year end target multiples, i.e., the Fed comes to the rescue again.

Even so, Wilson has no problem with strongly hinting to the bank’s clients what he really thinks will happen: “our base case year end target of 2750 is a lot less exciting than it was a month ago.”

via ZeroHedge News http://bit.ly/2GEetyr Tyler Durden