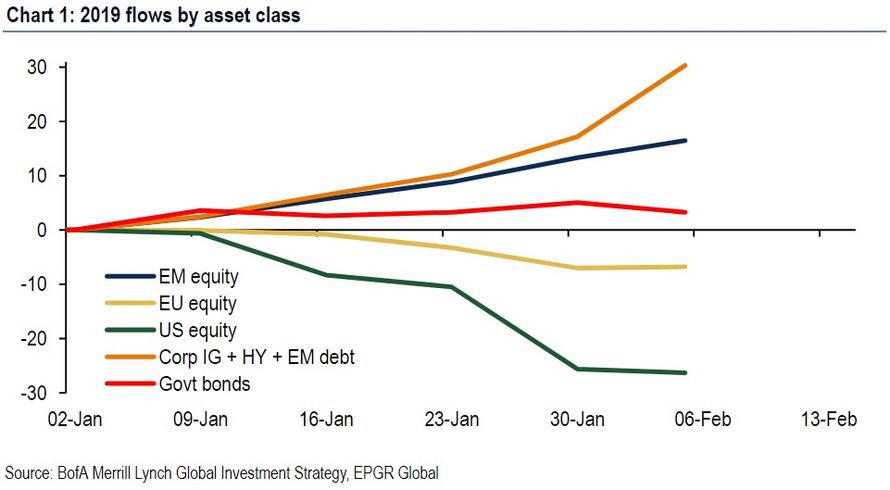

One of the bizarre observations to emerge over the past month has been that despite the torrid rebound in stocks so far in 2019, culminating with the best January for the S&P since 1987, investors have generally shunned US equities, selling stocks when they should be buying, and allocating the proceeds into bonds and emerging markets, as the following recent chart from Bank of America demonstrated.

This peculiar behavior has prompted several questions, among them how much longer can professional investors stand on the sidelines as stocks continue to surge (assuming the rally persists of course) and, more importantly, if investors are selling stocks who is buying, with the most likely culprits being the return of stock buybacks and a historic short squeeze.

We recently covered this perplexing behavior in the past few weeks in the following posts:

- Is It All Just One Giant Short Squeeze: Investors Rush To Pull Money Out Of US Stocks

- Deutsche Bank: The Market’s Rally Makes No Sense

- “This Is Strange”: Despite Historic Rally, Investors Continue To Dump Equities

Now, in the latest BofA Fund Manager Survey which CIO Michael Hartnett has aptly titled “My Big Fat Buyers’ Strike”, we get a conformation that the rally of the past 7 weeks has indeed been mostly shunned by professional investors because as Hartnett writes, there has been virtually no improvement in investor sentiment, and investors continue to slash exposure to stocks while allocating to bonds and cash. In other words, Wall Street has been boycotting the rally.

Here are some of the key findings from the latest survey which polled 218 respondents who manage $515 billion in assets under management.

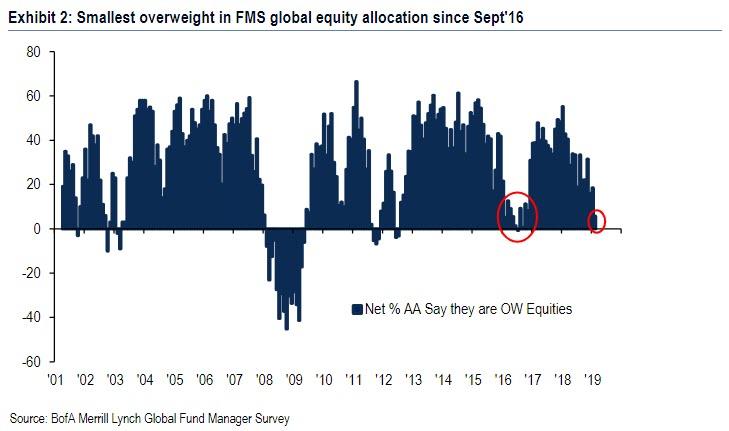

First and foremost, the allocation to global equities tumbled 12% to just net 6% overweight, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan’19 survey) to Feb 7th (end of Feb’19 survey) on record. This confirms that nobody has any faith in the current rally, which may indeed be simply a lingering artifact of Steven Mnuchin calling in the Plunge Protection Team in late December.

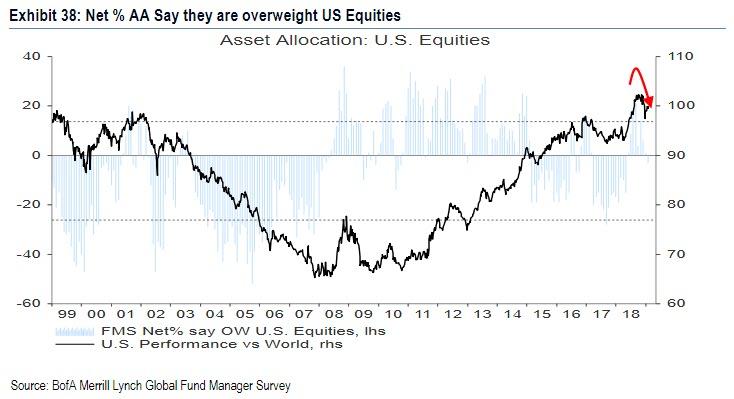

While investors shunned stocks in general, they especially hated the US, as allocation to U.S. stocks fell to the lowest in 9 months to a 3% underweight, with the region being the 2nd least favored among money managers.

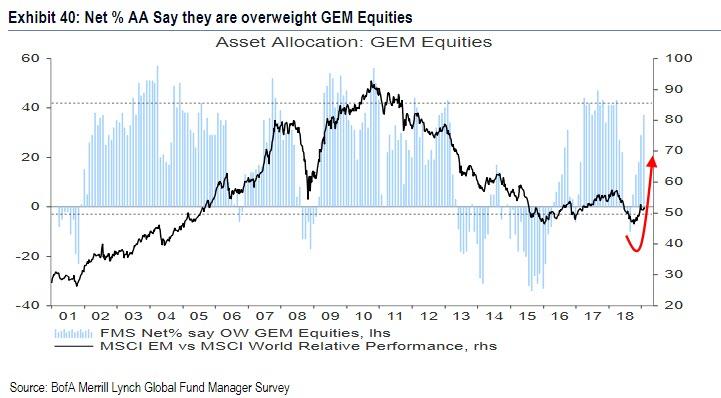

In contrast, euro-zone equities saw a jump in allocation to a 5 percent overweight, ending an 18-month streak of investment cuts. Exposure to emerging-market stocks kept rising to a 37% overweight…

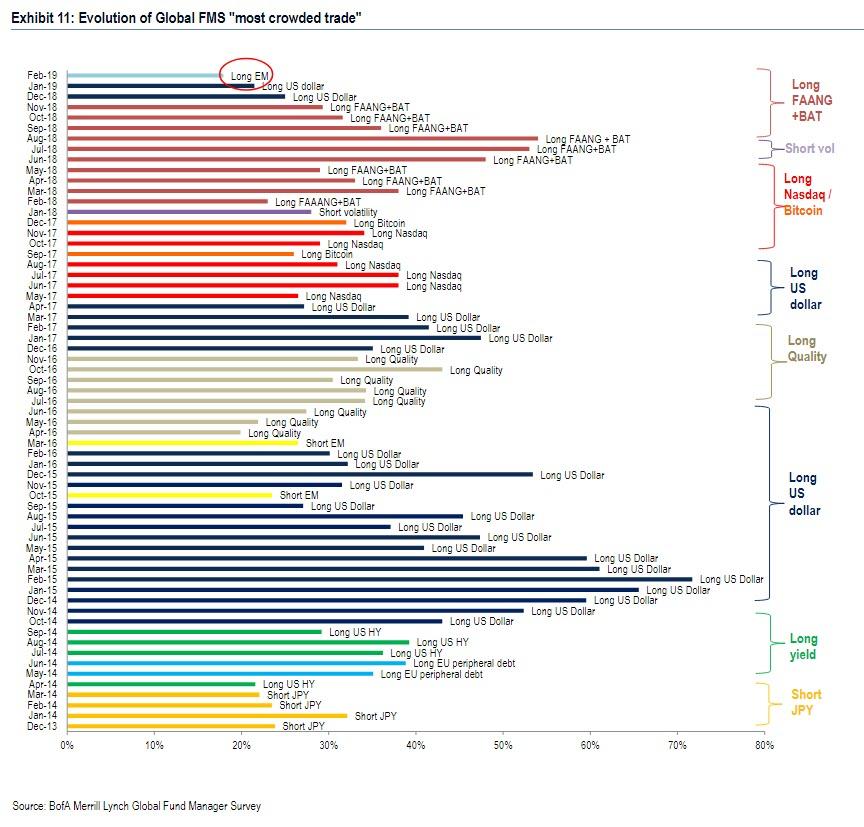

… and as a reminder, “Long EM” is now seen on Wall Street as the “most crowded trade.”

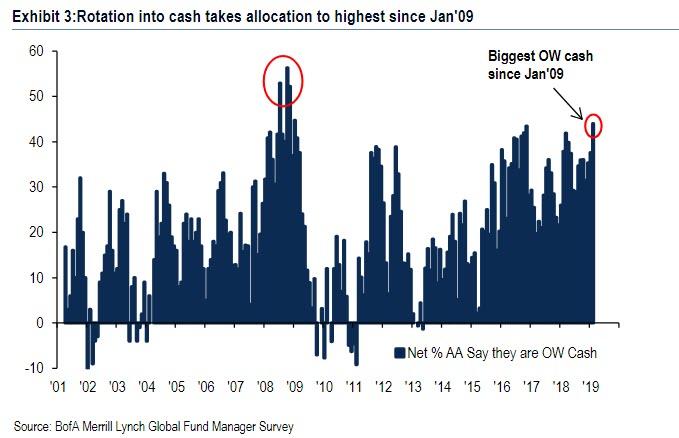

Meanwhile, as they dump stocks, investors’ allocation to cash surges 6% to net 44% overweight, the highest overweight since January 2009.

Summarizing the above, the “February fund manager survey shows a big rotation from equities into cash,” Michael Hartnett said.

Why are investors so bearish? Two answers, “macro” and “corporate”:

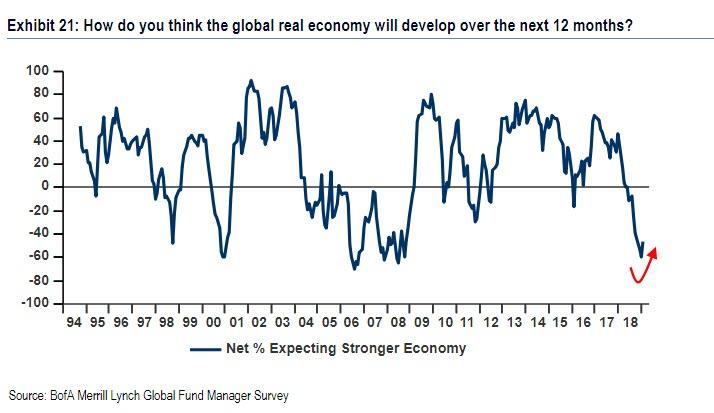

A net 46% of FMS investors expect global GDP growth to weaken even more over the next 12 months, which is up 14% from 60% in Dec’18 (which was consistent with 2000/01 & 2008/09 recessions), but still very low vs. FMS history and 64% still expect weaker growth…

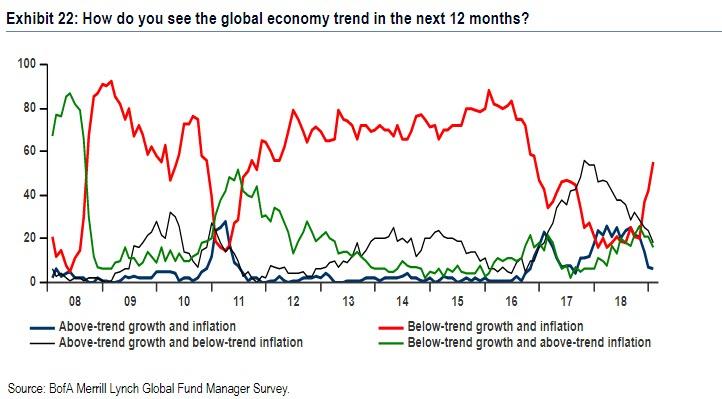

… while secular stagnation is once again the consensus view among FMS investors, with 55% of those surveyed bearish on both the growth and inflation outlook for the global economy next year, the highest since Dec 16, confirming a return to post-GFC theme of secular stagnation amongst FMS investors.

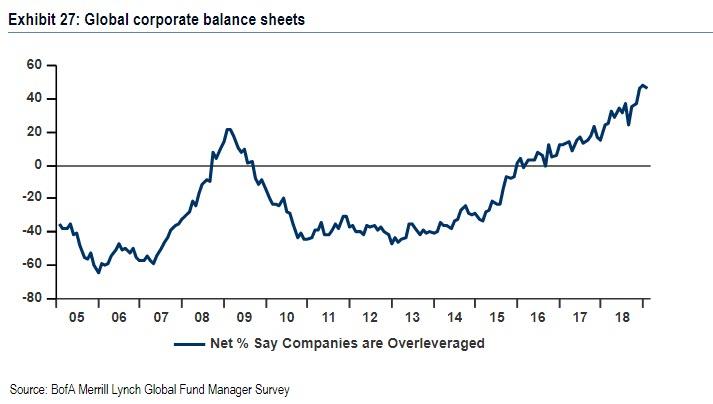

Meanwhile, on the corporate side, investors’ worries about the credit cycle remain elevated, falling just 2ppt from last month, as net 46% of fund managers find corporate balance sheets to be overleveraged. As usual, this is beyond hypocritical, as none of these “concerns” have prevented fund managers to flood right back into the junk or leveraged loan market, where they are once again chasing every piece of yielding paper for sale.

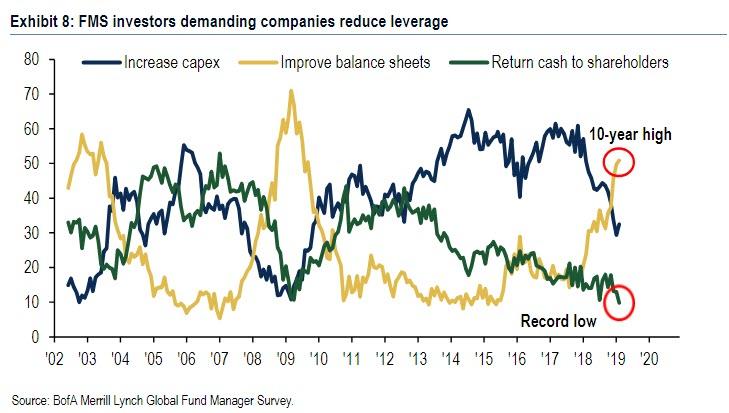

The latest poll also – bizarrely – showed a 10-year high in the number of investors demanding companies reduce leverage; this contrasts with a record low in investor desire for stock buybacks & dividends; and yet, none of this is preventing investors from boycotting the bond market where bond issuance is once again being used for, what else, stock buybacks. After all, it is these same “concerned” investors whose purchases of corporate bonds allow companies to have record high leverage…

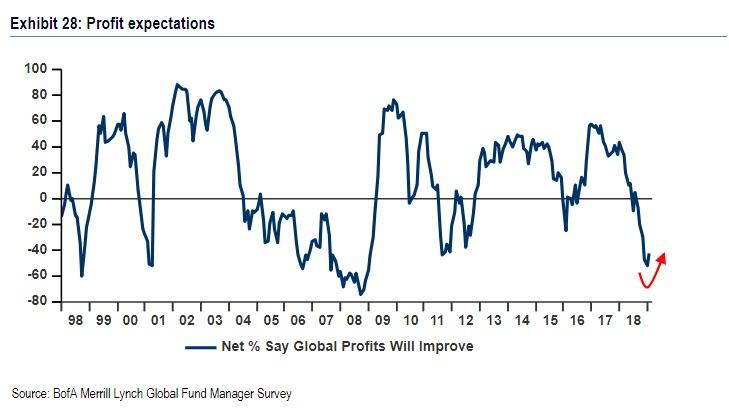

However, there was one silver lining: while a net 42% of investors expect global profits to deteriorate in the next year – a major reversal from 37% saying profits would improve 12 months ago – this is a 10% improvement on last month’s decade-long low. Green shoots anyone?

Summarizing all of the above, Hartnett says that it “does not show an improvement in investor sentiment” to which the BofA strategist manages to find a silver lining as “bearish investor positioning remains first-quarter positive for asset prices.” Unless of course, the bears are right and not even all central banks turning dovish and companies unleashing billions in buybacks manages to lift stocks higher from here.

via ZeroHedge News http://bit.ly/2DBNJfc Tyler Durden