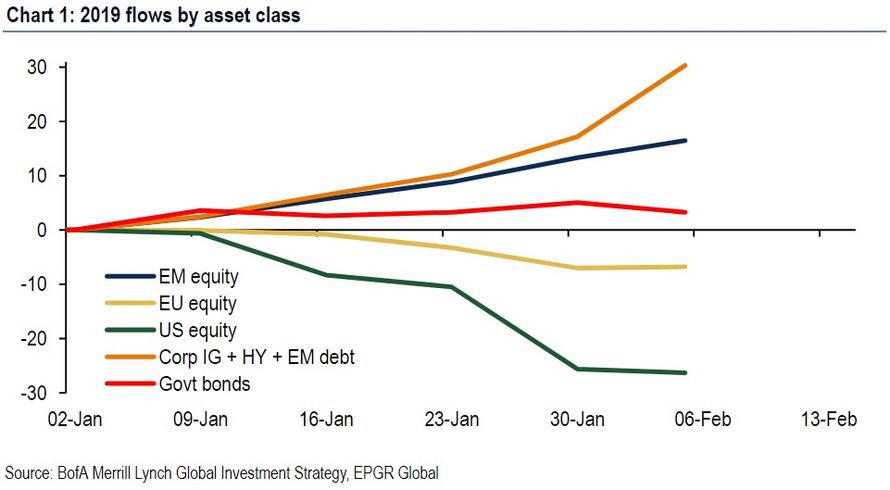

One of the bigger “mysteries” of the market in 2019 has been how, with virtually everyone selling US equities, something confirmed not only by fund flow data…

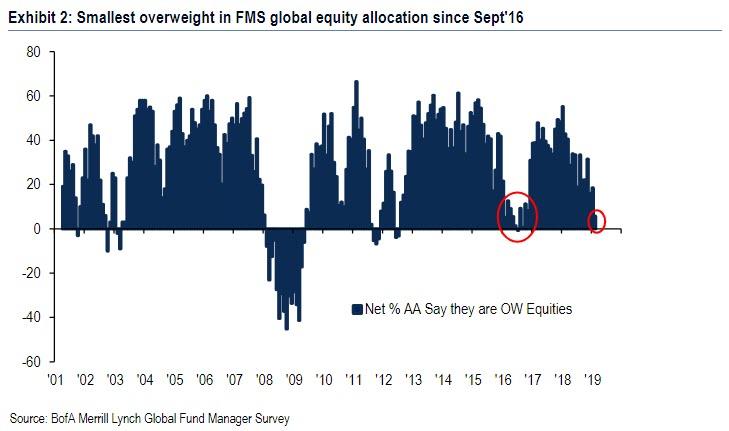

… but also the latest BofA Fund Manager Survey, which showed that that professional investors’ allocation to global equities tumbled 12% to just net 6% overweight, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan’19 survey) to Feb 7th (end of Feb’19 survey) on record…

… have stocks managed to stage not only a dramatic rebound from the December lows, but also enjoyed the best January since 1987, with the rally continuing well into February. In fact, as shown in the chart below, the YTD performance in the S&P is tied for second best since 1990 (on par with 1997) and only trailing the return of the 1991 market.

Meanwhile, the selling has continued, and according to Bank of America’s latest client flow trends, last week BofAML clients were all net sellers of US equities for the second consecutive week. In fact, as BofA clarifies, all three client groups (hedge funds, institutional clients and private clients) were net sellers of US equities, with sales of both single stocks and ETFs by all three.

Worse, as BofA also discloses, its clients’ six-week selling streak in equity ETFs is the longest in the bank’s history (since 2017), with sales of ETFs overall (for five weeks) the longest streak since June.

Which leads us to the obvious question: with everyone selling, who is buying?

To be sure, we do know that one powerful force lifting stocks higher has been short covering, which we showed recently has been instrumental in if not so much lifting stocks higher, then certainly causing further distress to hedge funds, which just as they loaded up on shorts, found themselves forced to cover these shorts.

But it is hardly likely that mere short selling has offset the 7 weeks of consecutive institutional and retail sales since the December lows.

So, once again, we ask who is buying?

As it turns out, the answer is familiar to all, and especially to those politicians such as Marco Rubio, who have waged into the highly politicized debate over stock repurchases. The answer, for those who still haven’t figured it out, is stock buybacks.

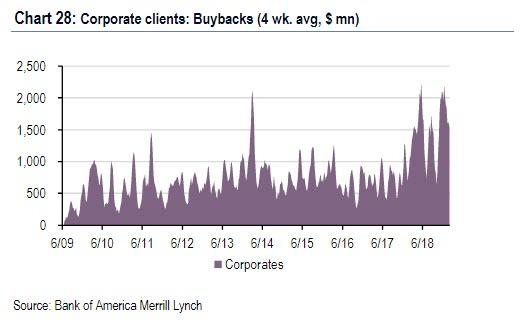

As Bank of America notes, corporate buybacks last week not only offset the selling by all of the bank’s other clients, leading clients to remain aggregate buyers of single stocks overall…

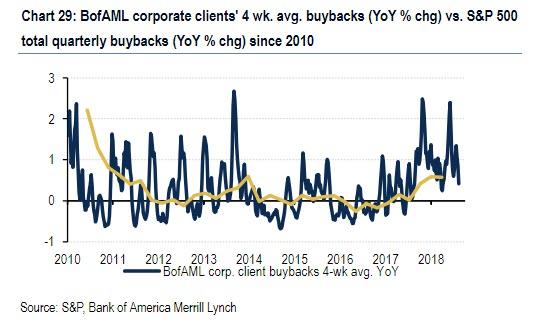

… but on a year-to-date basis, buybacks are already tracking far above last year’s records, and are in fact a whopping +78% higher compared to the same period in 2018 (as a reminder, total announced buybacks in 2018 hit a record $1 trillion).

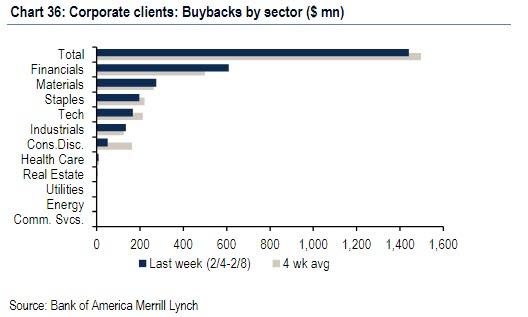

As BofA further notes, stock repurchases have affected virtually every segment, and as BofA notes, “our corporate clients were largest in Financials and Materials last week, similar to the prior week. Materials buybacks remain near record levels.”

And while we hardly have to explain why this is a big issue, Bloomberg did it for us, writing in its mid-day recap that “stocks faded from the highs after Senator Marco Rubio announced he will soon introduce a bill to tax buybacks on an equal footing with dividends” thereby putting future buybacks (which some so-called experts continue to claim have no impact on aggregate stock prices) in jeopardy.

Will soon file bill making immediate expensing permanent & tax corporate buybacks same way as dividends. No tax advantage for buybacks over dividends. But we’re going to give permanent preference to investments that will drive the creation of jobs & increase in wages.

9/9

— Marco Rubio (@marcorubio) February 13, 2019

To this our only response is: be careful what you ask for, Marco, because while we appreciate the clearly populist nature of this proposal, which is meant to boost Rubio’s political standing – perhaps as a presidential candidate for Democrats this time – the one thing that can scuttle one’s political career overnight is if one’s proposal is seen as the cause for a market crash.

And if, as we have shown, the only buyer of stocks in 2019 is prohibited from further buying due to fears over regulation or political considerations, it is only a matter of time before the S&P crashes right back to its 2018 lows, before proceeding far lower, until such time that the “Powell Put” is retested once again, forcing the Fed to not only “pause” but launch QE4.

via ZeroHedge News http://bit.ly/2TTFFxj Tyler Durden