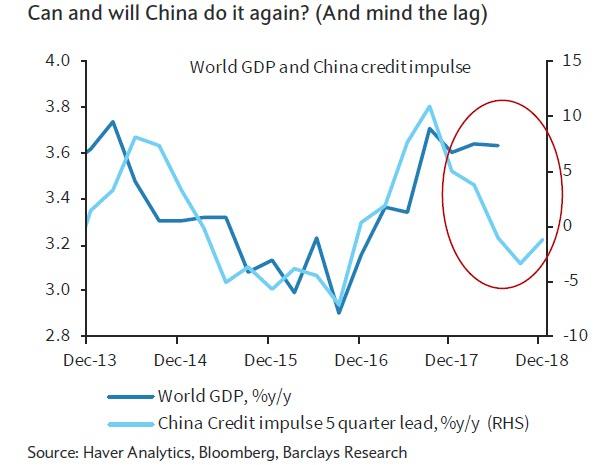

Back in June 2017, we wrote that if one had to follow just one macro indicator that impacts virtually every aspect of the global economy, that would be the Chinese credit impulse. Not surprisingly, the article was titled “Why The (Collapsing) Credit Impulse Is All That Matters.” Then, last December, just in case there was any confusion, we once again wrote “

Why The Collapsing Chinese Credit Impulse Is All That Matters“

Fast forward two months, with the world once again on the verge of a recession and with China – whose recent economic data has been on the verge of disaster – closely watched as the spark that could light the next global economic and financial conflagration, it’s all about, once again, China’s credit impulse.

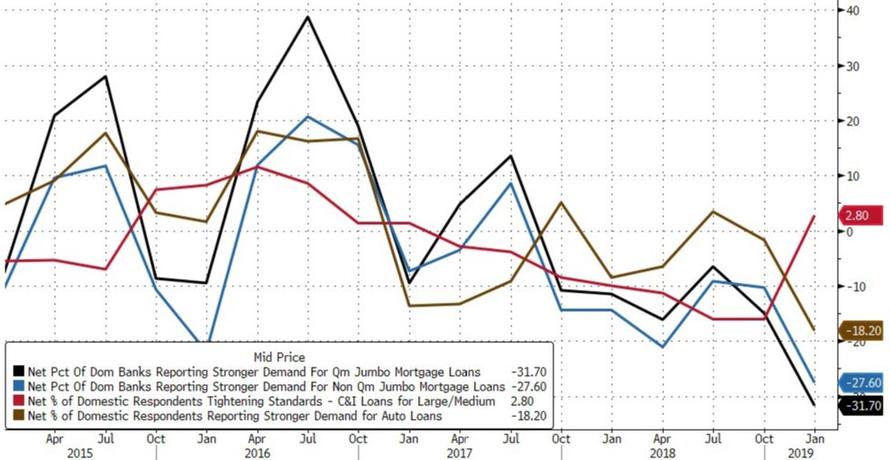

The reason is simple: since the Fed reassured markets of its patience last week, incoming US data have painted a relatively healthy picture of the US economy, although while holding up well, US growth is unlikely to re-accelerate at this point in the cycle, and last week’s dismal loan officer survey illustrated the fickleness of credit conditions and risks of tighter lending standards even as loan demand has collapsed, suggesting the US economic engine is on the verge of shutting down.

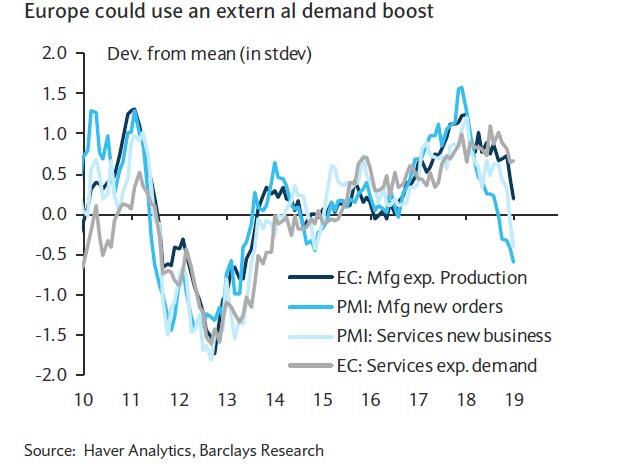

Meanwhile, the outlook for Europe has rarely been gloomier, as discussed this morning in “Europe Emerges As World’s “Weakest Link“”

While it’s not a disaster yet, as some Q4 GDP prints have been somewhat better than survey data had suggested, the forward-looking data still do not show any meaningful rebound. Besides Italy’s recession, the continued softness in German activity is a key concern. German factory orders and industrial production surprised on the downside, signalling protracted weakness, rather than the swift bounce-back expected earlier.

The host of challenges for the German auto sector, including from the slowdown in its biggest market, China, and potential US import tariffs, casts doubts about the strength of this nascent recovery.

Finally, as Barclays notes, with Europe lacking the ability (monetary) or willingness (fiscal) to provide meaningful policy stimulus, it remains highly exposed on developments in external demand and political event risks (no-deal Brexit, US tariffs, domestic turmoil).

This leaves China as the only source to provide fresh impetus to global momentum, in turn depending on its own ability and willingness provide yet another stimulus to its domestic economy.

In other words it’s all up to, you guessed it, China’s credit Impulse, which brings us once again to the only chart that matters, because as Barclays vividly shows, when it comes to global GDP, the only variable that will impact global GDP (with a 5 quarter lag) is how much credit China is injecting at any given moment. In fact, even if China is again successful in reflating its credit conditions without bringing its entire house of credit cards crashing down – and with the ongoing crackdown on shadow banking this is questionable at best – global GDP has a long way to drop before it even catches down to China’s credit impulse.

The bigger problem is that despite a modest uptcking in China’s credit impulse from post-crisis lows, Chinese data have continued to disappoint, and after this week’s Chinese New Year holiday, although a batch of fresh data next week will provide additional information, including new loans, money supply, external trade and international reserves.

For the record, Barclays expects Chinese data to remain weak for several months, “before stimulus measures start showing an effect. Until then, the global economy can hope for signs of stabilisation, but no meaningful rebound.” Yet even if China’s growth boost arrives some time in the second half of 2019, Barclays expects it to be weaker than the surge of 2016-17.

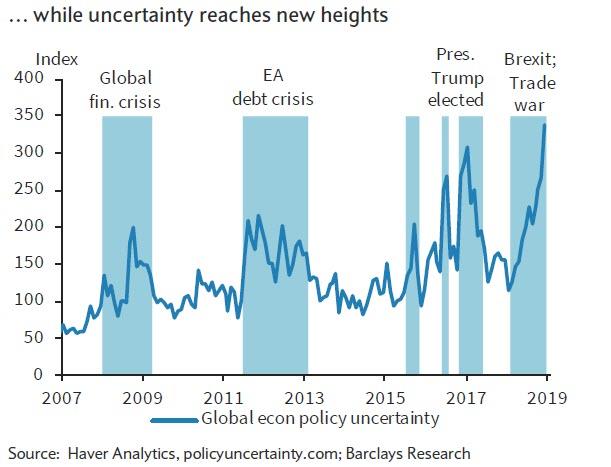

Meanwhile, amid a gloomy macro picture, political uncertainties are only rising, and if anything, last week’s Brexit developments suggest the process will run into the 11th hour (ie, end-March rather than end-February), with an increased risk of a no-deal Brexit, even if all involved parties would prefer to avoid it. At the same time, optimism on a US-China trade deal, while gyrating day by day, will ultimately end up being disappointed as the best the two countries can do with just weeks left until the March 1 deadline, is kick the can on the tariff hike yet again.

As Barclays writes, “this sort of brinkmanship on issues with potentially significant economic consequences will not only keep financial markets nervous but likely also affect decision-making by agents in the real economy. And more tensions seem underway: last week brought the first leaks from a report the US administration is expected to publish on 17 February on EU car imports, which leaves the threat of a 25% tariff on the table. Moreover, ongoing yellow-vest protests in France and the related diplomatic row between France and Italy further highlight the tensions the European elections in May could bring.”

In other words, even as China and the US posture for the political upper hand in the form of who ends up “on top” in the ongoing trade war, the reality is that as long as China keeps sinking, it is only a matter of time before it drags down not just the US but the entire world down with it.

In the meantime, after flirting briefly with “normalization”, the global race to the bottom is back in full force as central banks globally are falling in line with the Fed’s dovish message: the Bank of England downgraded 2019 forecasts to below ours and that of the consensus, signalling that a hike this year is unlikely; earlier in the week, Australia’s RBA governor departed from the bank’s forward guidance, suggesting the chances for the next move being a hike or cut are equal. India’s RBI surprised us and the consensus by delivering a rate cut; Brazil’s central bank remained on hold, but did acknowledge that the inflation outlook had become more benign, and markets are no longer pricing any hikes in 2019. Mexico’s Banxico remained on hold and signalled a pause in its hiking cycle, while Russia kept its rates on hold as well.

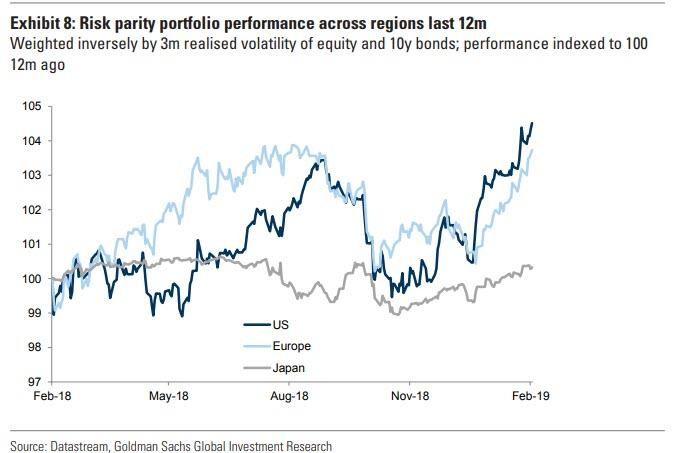

In short, unless China can shoulder the burden of sparking global growth as it did back in 2016 and also after the global financial crisis, it will be all up to the central banks, all of which have seen their tightening initiatives hit a brick wall, with easing next on deck, and eventually even more QE. Which, of course, has resurrected traders’ Pavlovian response to “buy everything” back from hibernation in response to coming QE/NIRP, with both stocks and bond surging in recent weeks, which in turn has made risk parity funds, which are long both of these asset classes, the best performers of 2019.

via ZeroHedge News http://bit.ly/2TORR22 Tyler Durden