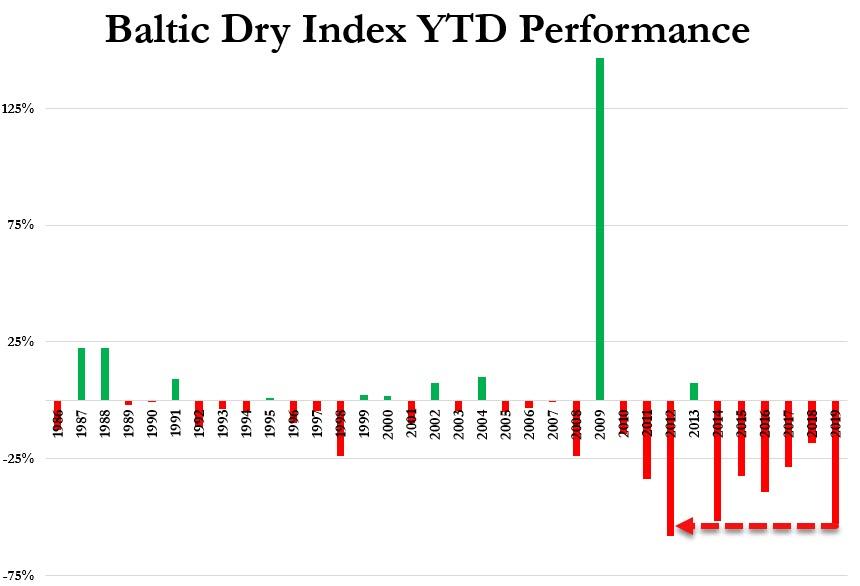

As we noted recently, despite global stock markets soaring, global freight indices have been more-than-seasonally weak so far in 2019 with the Baltic Dry Index in particular crashing.

The Baltic Dry Index represents the cost of renting an ocean-going container ship to move goods from, say, Chinese factories to the Port of Los Angeles. The more stuff being made and sold, the higher the demand for such ships, and thus the higher the price to rent one. And vice versa.

This is definitely one of the vice versa times. After rising to robust levels in mid-2018 the Baltic Dry Index has since collapsed…

This is just shy of the worst start to a year on record (since at least 1984)…

As The Wall Street Journal recenjtly noted, Free-Falling Freight Rates Spell Trouble For Shipping

Dry bulk shipowners face a long period of uncertainty as spot prices collapse and China shipments shrink.

A slowing global economy, coupled with weak demand from China over the Lunar New Year and from Brazil after Vale SA’s iron ore disaster, is dragging shipping rates to near record lows, and few in the industry expect things to improve any time soon.

Brokers in Singapore and London said capesize vessels, the largest ships that move bulk commodities like iron ore, coal and aluminum, were chartered in the spot market for as low as $8,200 a day on Thursday, a $500 decline from Wednesday. Break-even costs for carriers can be as high as $15,000 a day, and daily rates in the capesize market hovered above $20,000 last year.

“Everyone is looking for a catalyst to push the market up, but it’s not there,” said a Singapore broker.

The Baltic Dry Index, which tracks the cost of moving bulk commodities and is considered a leading indicator of global trade, is down more than 50% since the start of the year.

“A long slowdown in the Chinese economy will hurt commodity demand and send shipping rates sharply lower,” Bloomberg Intelligence industry analyst Rahul Kapoor said.

And that is why equity market “believers” should be worried. US equities have soared despite earnings expectations plunging…

And given the leading nature of The Baltic Dry Index (you can’t sell what you haven’t shipped into inventory), the message for US equities is ominous – perhaps fun-durr-mentals will matter once again?

Worse still, as John Rubino previously concluded, the trade war isn’t just a piece of political theater for the US. We really do need factories to come back home if we want to avoid a populist and/or socialist revolution. And next generation manufacturing tech like 3D printers will in any event move production closer to end users, lowering the need for at least some of today’s shipping.

It’s possible, in other words, that the whole free trade/mobile capital/cheap labor/long supply chain Age of Globalization, with its assumption of unlimited rich-country demand and plentiful cheap energy for transport was just an artifact of a very specific time. It was so cheap and easy to move things around that building toys or TVs wherever labor was cheapest and shipping them to wherever the money resided made financial sense.

That might not be a permanent state of affairs, and if it’s not, those giant ships won’t be the only stranded capital out there.

via ZeroHedge News http://bit.ly/2S0Frm5 Tyler Durden