In light of the relative lack of new information in the Fed minutes, which reinforced the Fed’s dovish, patient, “data-dependent” posture with hint of growing dovishness when it comes to future inflation, however coupled with the new data that “almost all” FOMC officials wanted a “plan” to step reducing the balance sheet by year end, it is perhaps not surprising that markets haven’t done much.

Indeed, as Bloomberg’s Ye Xie notes, “many participants don’t know what will be the next move later this year, which perhaps is the definition of being neutral.” Furthermore, the Fed underscored its data-dependence, perhaps to an extreme, after several participants argued that rate hikes are only necessarily when inflation surprises on the upside, while some hawks say higher rates are needed if the economy performs as expected.

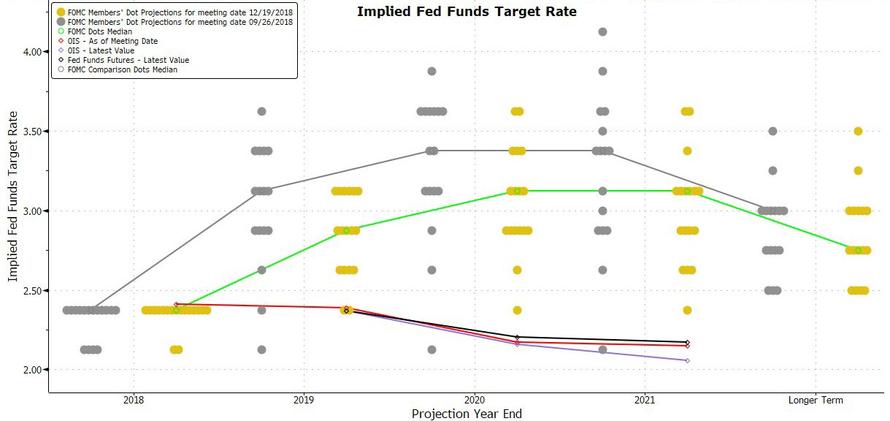

In keeping with this take, there has not been any notable move in Fed Fund expectations, which still call for a rate cut in early 2020, a divergence with the Fed’s dots which will have to be address by the Fed next month when the FOMC releases its latest economic projections and dot plot, which still sees 2 rate hikes this year versus the market’s zero.

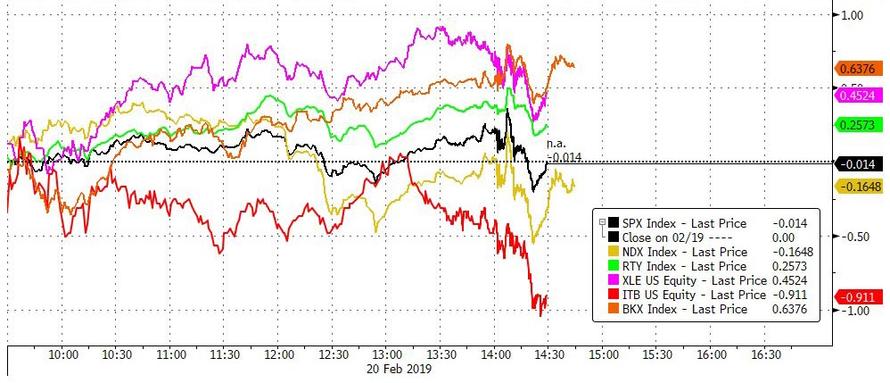

Following the minutes, the broader market has drifted, first sliding to session lows, then rebounding before stabilizing modestly in the green…

… with bank stocks, energy and small caps leading and homebuilders and tech dragging stocks lower.

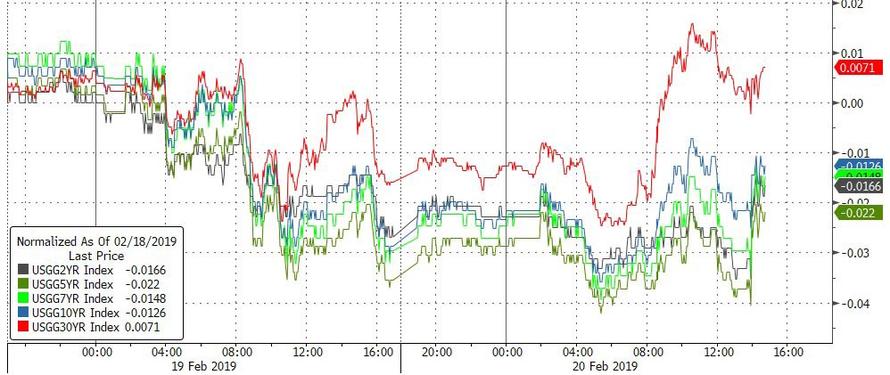

Meanwhile, with the dollar back to unchanged on the day, yields along the curve were pushed modestly higher, led by the long end as the steepening discussed earlier by Charlie McElligott appears to be taking hold:

The bottom line is that the Fed can afford to wait and see because inflation pressure is muted. It’s more about risk management. Bond yields and the dollar moved a bit higher but the minutes shouldn’t move the needle for markets by much.

via ZeroHedge News https://ift.tt/2U0p2Qe Tyler Durden