Authored by Sven Henrich via NorthmanTrader.com,

As promised a bit more color to some comments I made this morning on CNBC. Look, I’ve been pretty clear I think: The trifecta of dovish central banks, record buybacks and the constant dangling of the China trade deal carrot has been massively supportive of equities during the first 2 months out of the year and ultimately perhaps that is enough to keep markets on a bullish trajectory BUT, and this is the big but, the case that this all has been a bear market rally is not invalidated as of yet.

Here’s the interview from this morning and I’ll give you some additional background below:

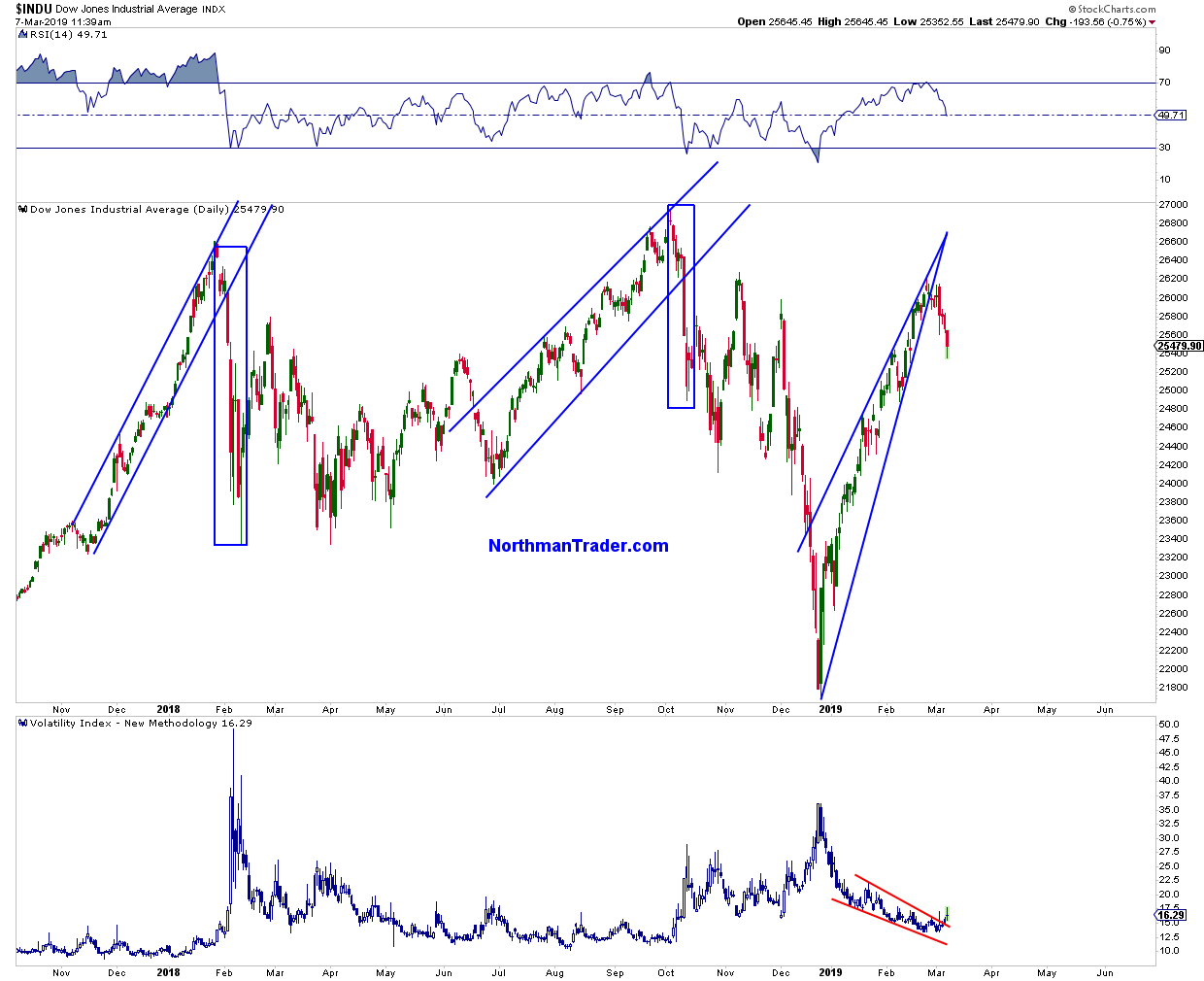

This rally so far in 2019 has a bit of a Deja Vu feel compared to last year and markets may be repeating the sins of last year:

Relentless drift higher, volatility compression, vast technical extension of select stocks amid building negative divergences, and massive optimism and any negatives ignored. Last year it was tax cuts that drove the optimism, now it’s hope for a China trade deal.

Big differences to last year:

The rally then was driven by expectations of record earnings growth, 3-4% GDP growth, now earnings growth is slowing or regressive and GDP growth has slowed down. Call last year the Four Seasons rally as everything was gorgeous, call this year the Motel 6 rally as everything looks rather shabby from a fundamental perspective.

So why the rally then into the 2800 range now? Because it has morphed from a technical bounce rally to the most jawboned rally in history: Non stop dovish Fed speakers on the one hand, and non stop carrot dangling of a China trade deal on the other hand.

My point in the interview about Magic Risk Free Fridays:

The result: We went from massive oversold to massive overbought, hence the pullback this week makes more than sense and for all I know it may even set up for a rally during next week’s OPEX week.

But the larger question is this: Is this rally real or a just an aggressive bear market rally?

A checklist of things to keep an eye on:

$SPX just rallied back to the broken bull market trend line going back to 2009, this is now resistance and we just pulled back from there:

Potential larger topping patterns. Unless we get new highs these larger structures could still play as larger topping patterns. This is not a pretty pattern on $SPX or the $DJIA as I outlined last weekend ($VIX Crush).

Divergences.

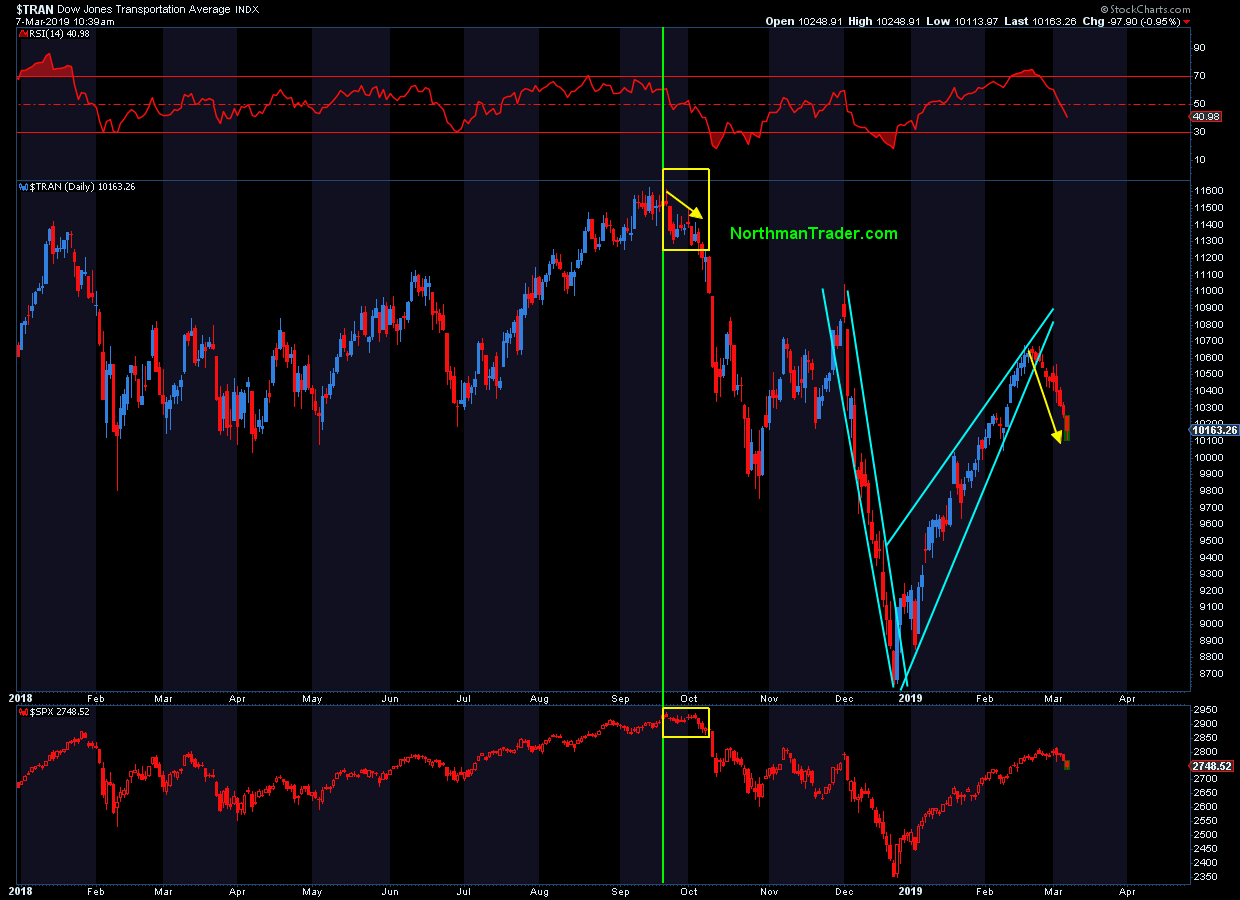

Last year transports led the downside and topped before markets. We may be seeing the same here as transports have already broken the recent uptrend. I discussed transports this week in Chart in Focus and here’s the updated chart:

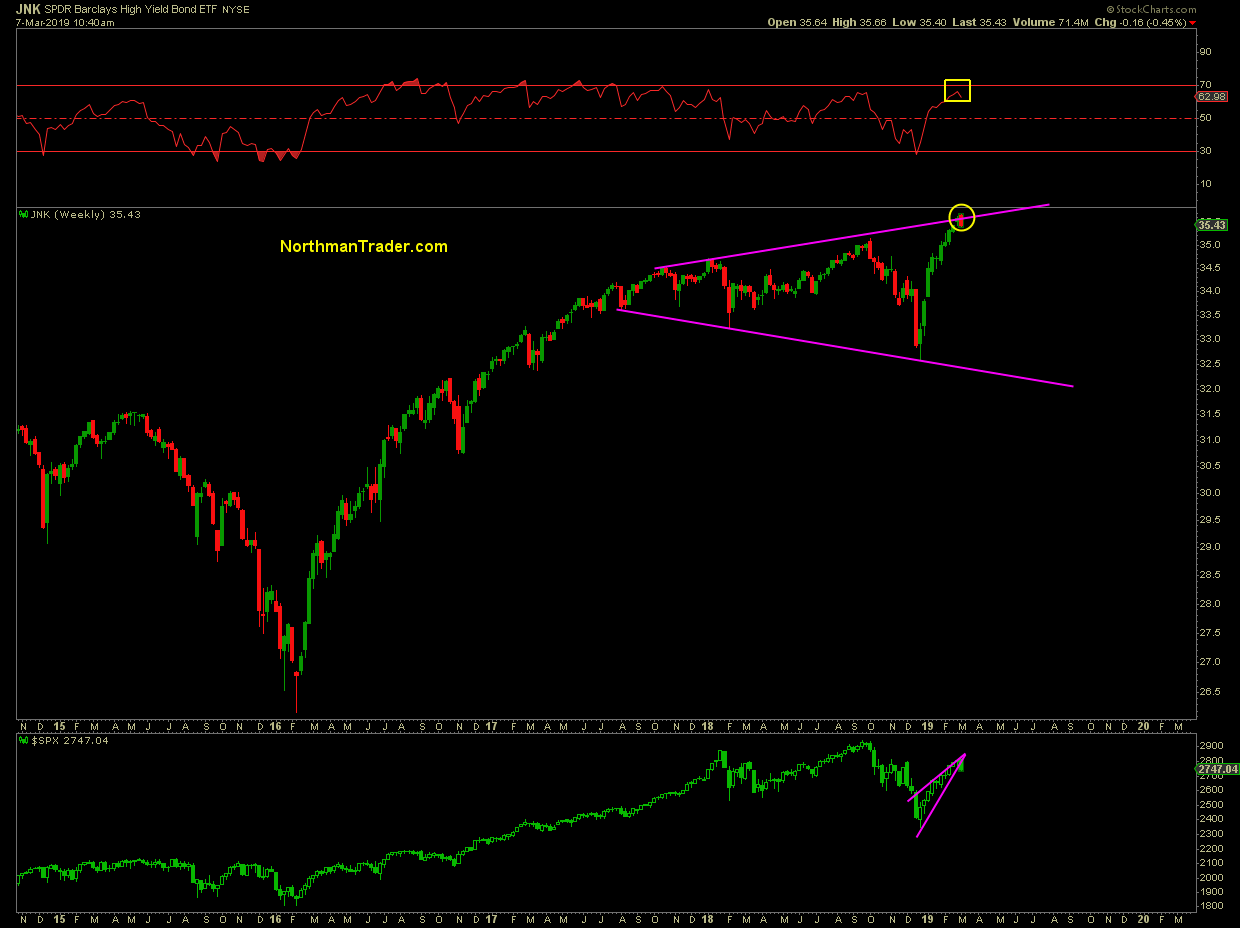

High yield credit has made new highs, markets have not, that’s a divergence versus last year as highs in high yield have come with new new highs in markets. Not this time and something to keep an eye on and this week’s reversal with $SPX breaking its wedge should give anyone reason to curb their rally enthusiasm here:

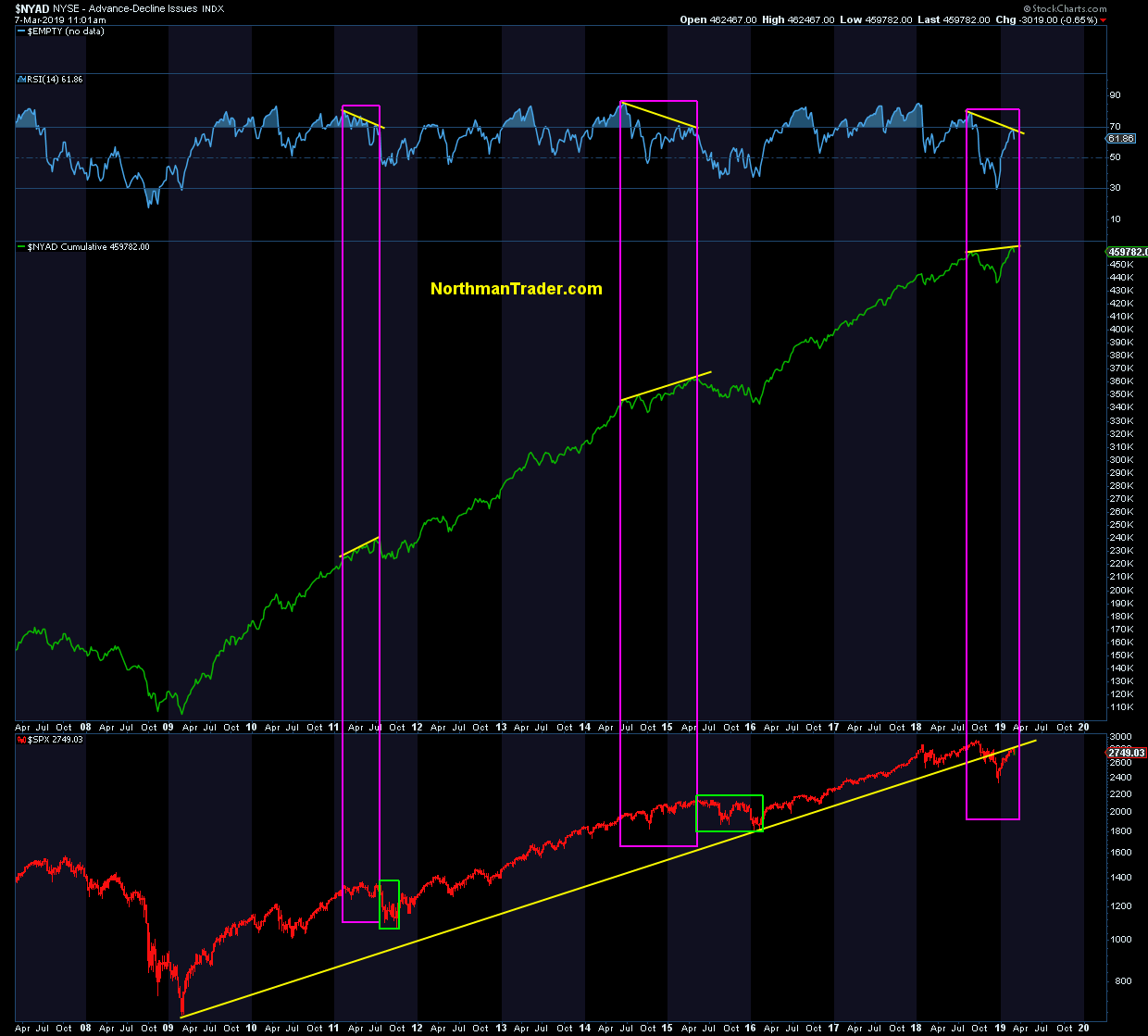

Breadth, while making new highs, markets have not and breadth readings are coming in on a negative divergence versus last year, a cautionary sign.

Stock technical extensions – Last week I made a technical case about Boeing being highly extended and at risk of a reversal along with the Dow Jones (Boeing Danger). It’s been acting like the $FANGs last summer. Since I posted the article $BA has dropped nearly 6%:

China deal. How real is it? The March deadline has passed and we keep getting conflicting signals. It is clear the US administration wants to push markets higher via well timed tweets and TV appearances, hence the question: How much has a deal been priced in? Have expectations now been set too high? Markets may run out of patience as the OECD has once again revised global growth targets lower.

Buyback window closing. Q1 earnings are coming in next month and the liquidity coming in from buybacks will disappear for a while. How much of this rally has been additionally driven by buybacks? How will markets handle this source of liquidity drying up?

It’s an important question as the combination of jawboning and buybacks have greatly contributed to volatility compression.

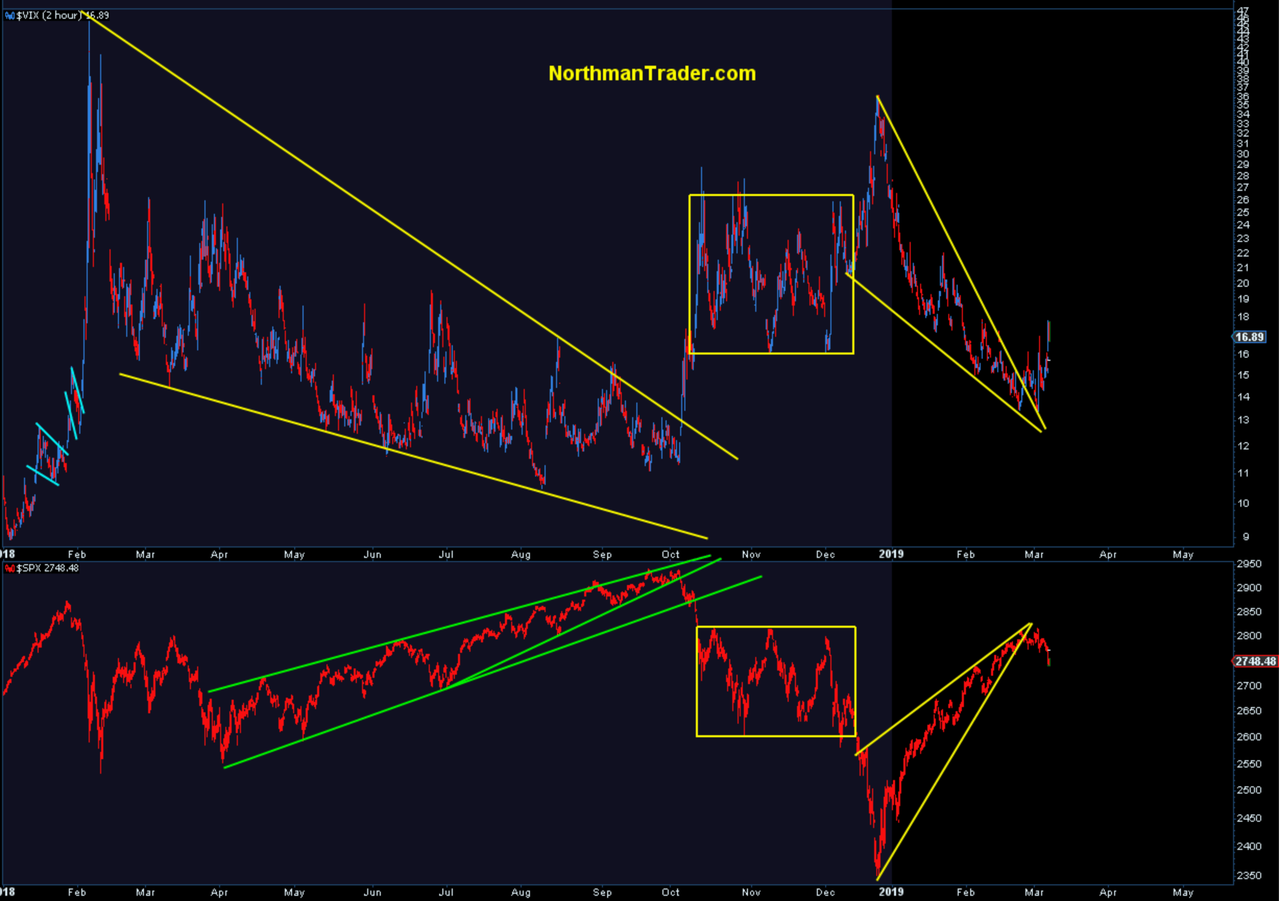

This week we got a glimpse of how volatility compression can end suddenly as the $VIX has jumped from 13.5 to 17 as the wedge patterns are breaking:

The rally since the December lows has not had a proper technical retest yet. What is notable is that the weakness this week is coming off of that 2009 trend line retest and a failure to sustain a move above 2800.

My general view here: As of now, nothing’s been proven either way. Markets are currently on an inside year and overbought. There’s a wide range of support in the areas between 2600-2750. A successfully concluded China deal could spike prices higher at any time, however the sustainability of any such bounce is questionable without knowing the substance of any such deal. There are larger structural issues at play, not just trade deals. And until all these things are ironed out I suggest everyone curb their enthusiasm.

Without new highs and a recapturing of the broken 2009 trend line, markets remain at risk of this rally turning out to be a bear market rally. A sustained break below 2650/60 on $SPX would bring this question front and center. In the meantime: Happy trading

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2Hq6cyu Tyler Durden