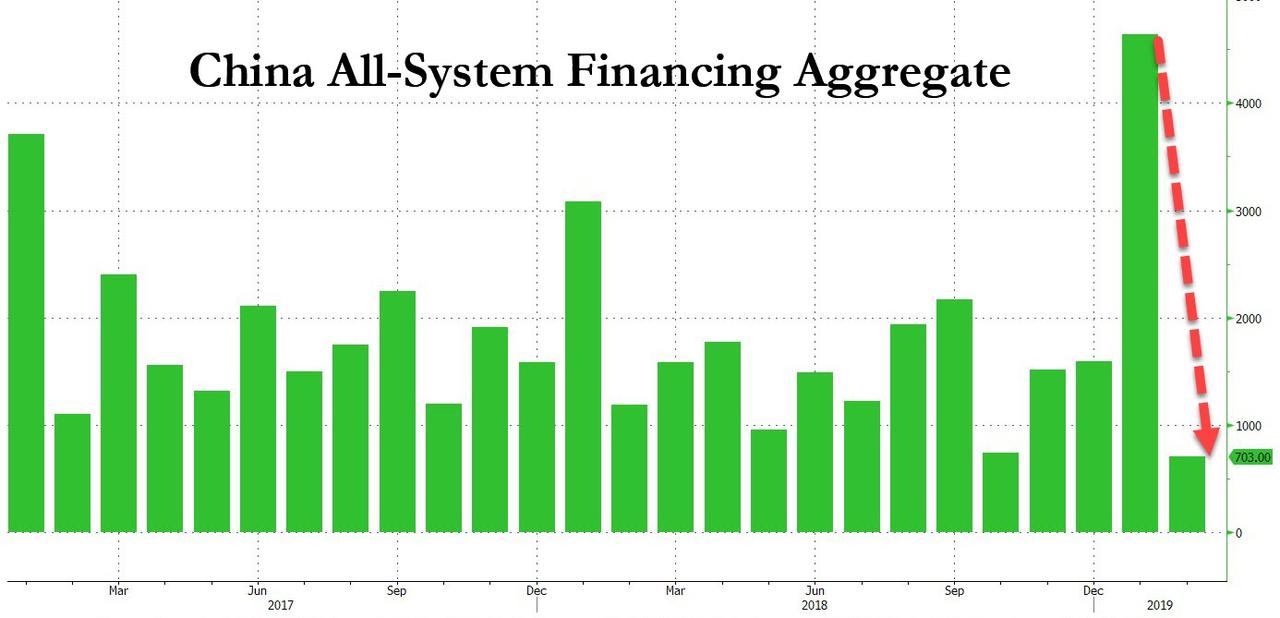

After January’s record surge, February saw China’s credit growth unexpectedly collapse prompting notable downgrades in expectations for tonight’s macro data bonanza.

Chinese central bank reported that in February, aggregate financing increased by a paltry 703 billion yuan, roughly half the expected 1.3 trillion…

… and the lowest print on record in the recently revised series. Additionally, growth in China’s broad money supply, or M2, once again slumped and after a modest rebound in January, in February M2 Y/Y growth dropped back to 8.0%, the lowest print in series history.

The February collapse in credit creation following January’s extravagant print likely means that just like most other Chinese data in the pre-New Year period, this too was distorted by the Lunar New Year, and as a result the January surge, far from indicative of a major new reflationary boost may simply suggest that China will maintain a prudent approach to overall economic leverage, which however will be bad news for the stock market which in the second half of February went all in on bets that China has doubled-down on reflating both its, and the global economy.

And China’s credit impulse has weakened back after January’s rebound:

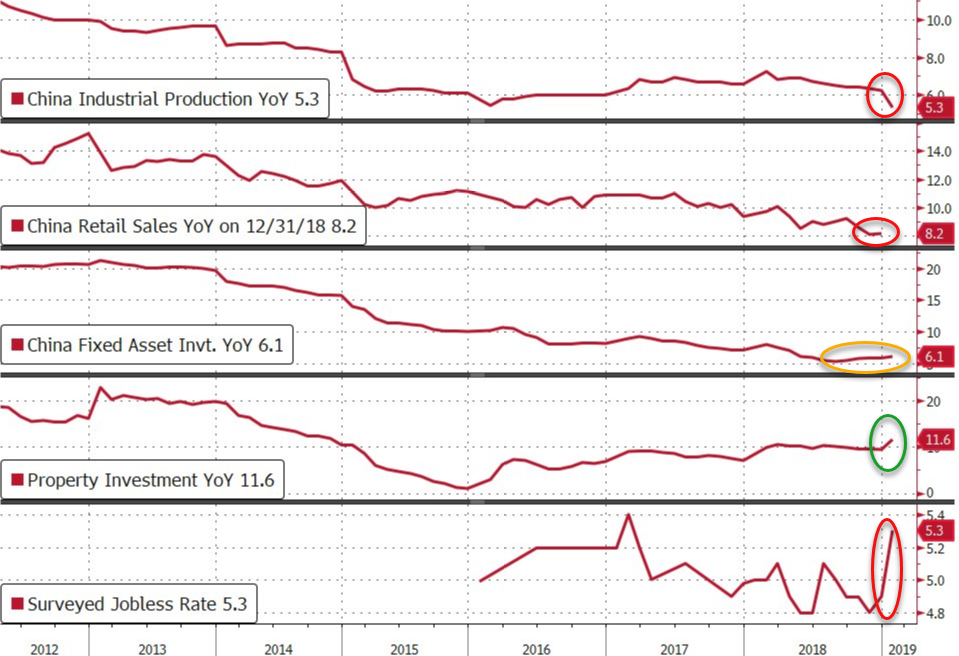

Heading into the data, Chinese macro data has been extremely weak despite endless streams of stimulus:

But, as Bloomberg reports, the latest PMI figures out of China have suggested some stabilization in an economic slowdown that hit last year. Though the blow from the trade war to exports and production probably hasn’t fully hit as yet.

So what did February’s data look like:

-

China Industrial Production YoY MISS +5.3% vs +5.6% exp and +6.2% prior

-

China Retail Sales YoY MEET +8.2% vs +8.2% exp and +9.0% prior

-

China Fixed Asset Investment YoY MEET +6.1% vs +6.1% exp and +5.9% prior

-

China Property Investment YoY BEAT +11.6% vs +9.5% prior

-

China Surveyed Jobless Rate WEAKER 5.3% vs 4.9% prior

This is the weakest Industrial Production growth since March 2009 and Retail Sales growth is hovering near its weakest since May 2003. But perhaps the most worrisome for Chinese officials is the surge in the surveyed jobless rate to 5.3%, the highest since Feb 2017.

Graphically:

Of course, all of this comes with a warning that figures for this time of year can be volatile due to the lunar new year holiday in China, when factories and offices are significantly affected by a week-long break. The timing of the holiday shifts. Early February 2019, mid-February 2018 and late January to early February 2017, for example. So it really distorts the Jan/Feb data.

Offshore yuan was fading into the data (and ChiNext was extending its losses from the last two days) and extended its losses after the data disappointment…

The soft reading on industrial output is probably the key takeaway from these numbers, opening the big question of whether this is reflective of a deeper downturn than anticipated as the trade war effects start to bite in earnest (or if it can be blamed on the Lunar New Year effect)?

via ZeroHedge News https://ift.tt/2Uv88JU Tyler Durden