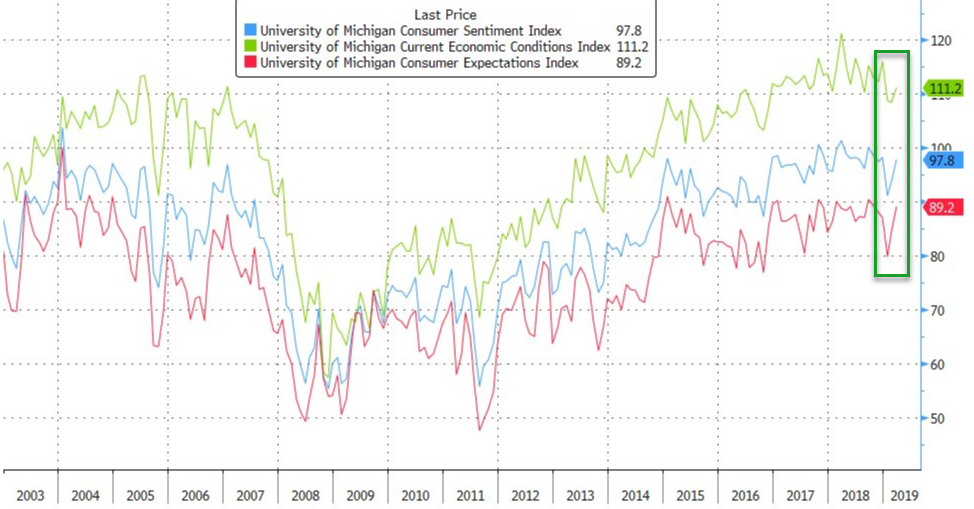

University of Michigan consumer sentiment survey was expected to rebound further in March and it did…dramatically, from 93.8 to 97.8.

In preliminary data, ‘Hope’ led the way, spiking from 84.4 to 89.2 (above 88.1 exp) with current conditions rising from 108.5 to 111.2 (below 112.0 expectations)

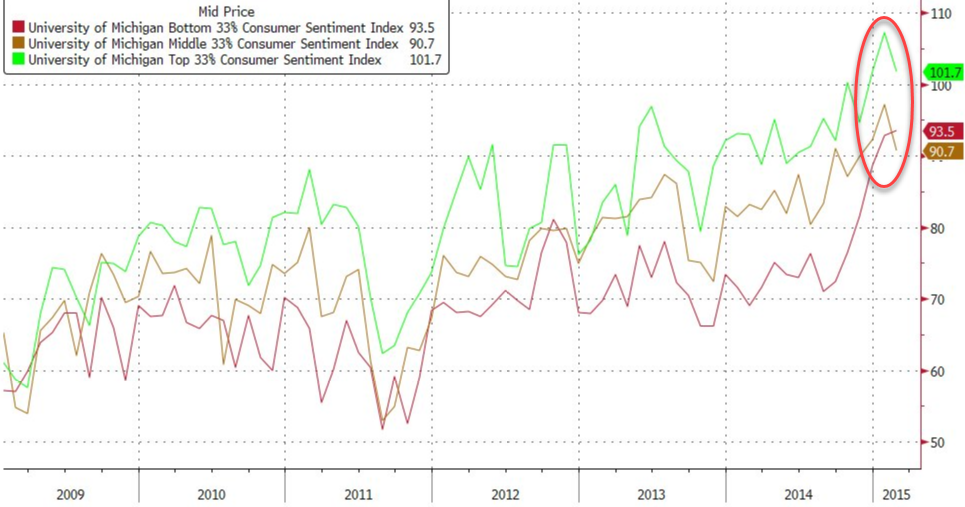

Nearly equal proportions of income groups reported improved finances in early March, but the factors underlying those gains were distinct. Households with incomes in the bottom two-thirds were more likely to cite net income gains compared with last month (+11 percentage points); in comparison, upper income households were more likely to report declines (-4 percentage points) from last month.

Short-term (1Y) inflation expectations tumbled from 2.6% to 2.4%, but longer-term (5-10Y) expectatiosn rose from 2.3 to 2.5%…

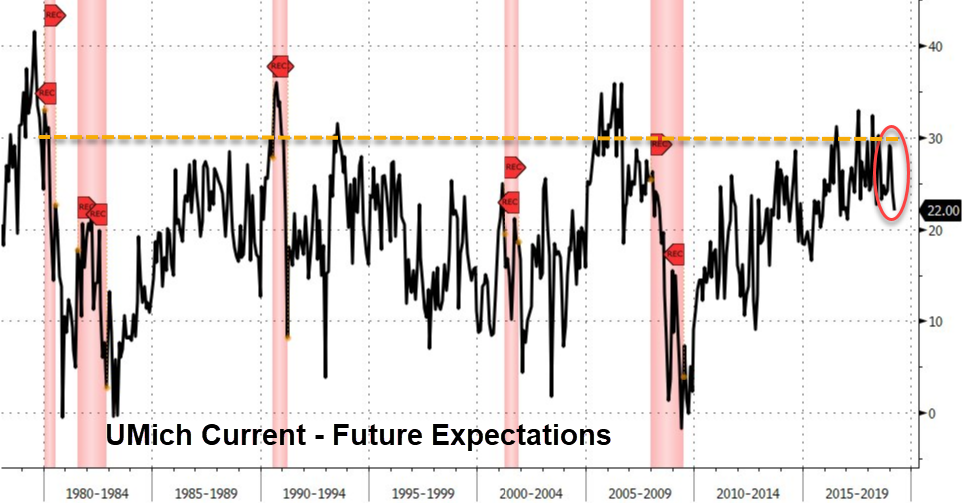

Finally we note that the spread between current (high) and future expectations (low) remains extremely wide (pre-recessionary) but has started to correct back…

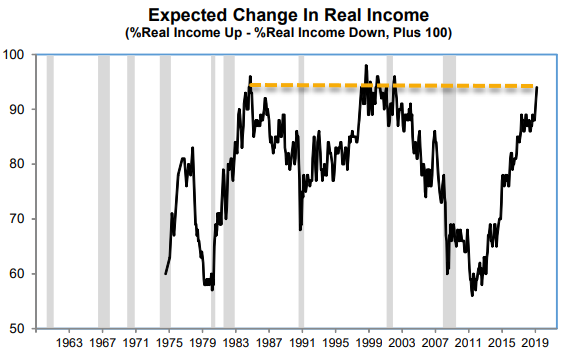

The difference that accounted for the divergence was how households evaluated their personal finances, as lower income households expressed much more positive assessments. The divergence was due to a monthly jump of one-percentage point in income expectations among middle and lower incomes compared to a change of just one-tenth of a percentage point among those with incomes in the top third. Rising income expectations were accompanied by lower expected yearahead inflation rates, resulting in more favorable real income expectations…

via ZeroHedge News https://ift.tt/2FdP2me Tyler Durden