But, but, but… it’s the day before an FOMC meeting – we were promised equity market gains…

After yesterday’s meltup in China, stocks flatlined on Tuesday…

Europe was up across the board on better ZEW data…

US equities all started off excitedly anticipating the pre-Fed drift higher, but US-China trade-talk headlines casting doubt on the deal prompted weakness and stocks never really recovered – despite trying…NOTE – look at the blue line (S&P) which was ramped in the last few seconds to close 0.001% higher

Trannies were really ugly today – worst day since Jan 22nd

The Dow gave up 26,000…

“Most Shorted” stocks faded in three down legs – mirroring yesterday’s 3 up-legs…

Semis, Biotech, and CAT all tumbled on the China trade talks headlines. FANG stocks tumbled after reports of the big tech companies being called to Washington over censorship…

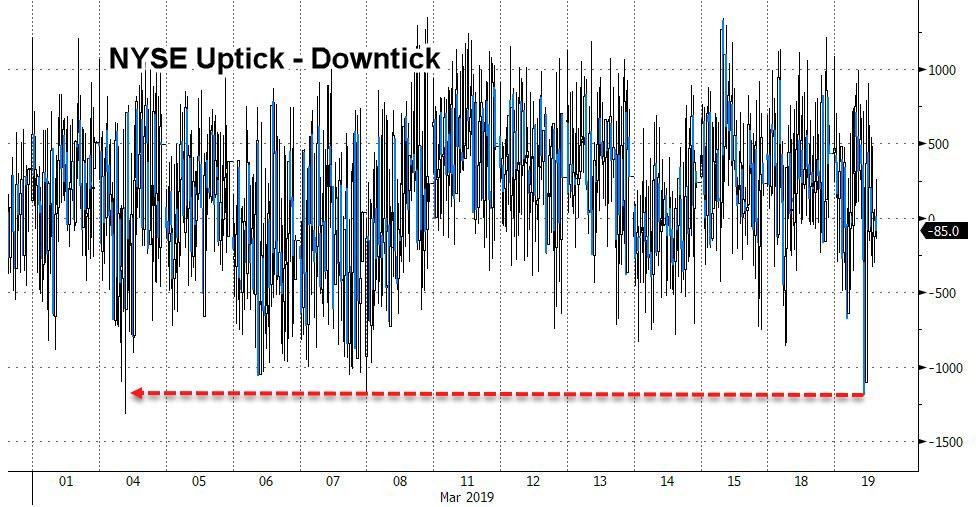

Notably, the China headlines prompted the most negative TICK in two weeks…

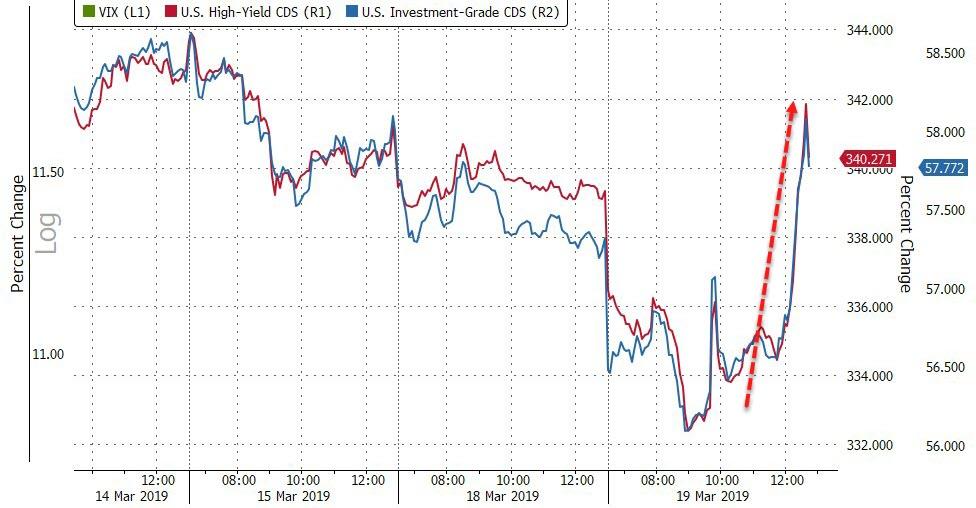

VIX and stocks have decoupled in the last two days…

Notable spike in IG and HY spreads intraday today…

US Treasury yields were very marginally higher on the day – roller-coastering intraday…

30Y is trading like a penny stock…

The dollar index (DXY) extended its recent run lower…NOTE – dollar is down 7 of last 8 days – after rising 7 straight days…

Yuan spiked lower on the China trade headlines, but recovered most of the drop – and still closed higher on the day…

Cryptos were broadly higher on the day…

PMs managed gains as crude and copper slipped lower on the day…

Gold extended its gains above $1300…

WTI tested below $59 intraday…

Finally, we note another disturbing divergence – between ‘median’ stocks and the major indices…saying this rally is bullshit.

As Sven Henrich notes, this is a similar set-up we saw during the all time highs in September all the while $SPX has formed a massive bearish wedge.

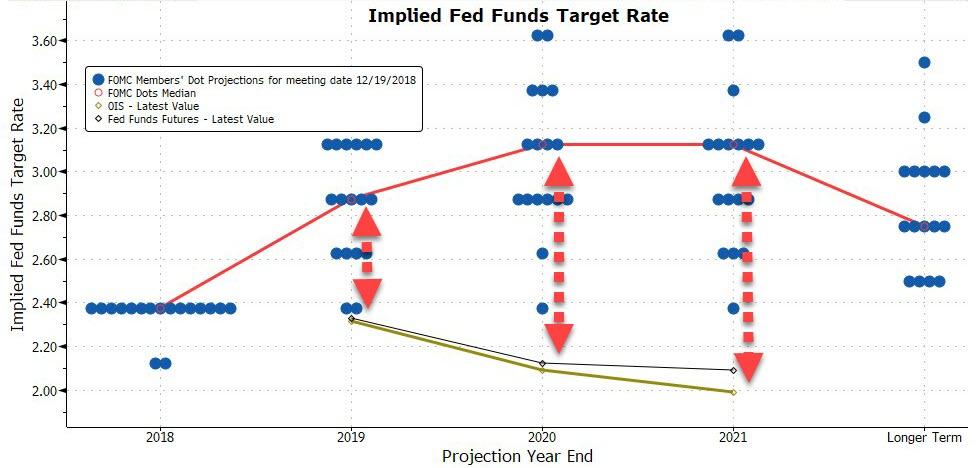

We wish Jay Powell the best of luck tomorrow – with the market already pricing in 16bps of rate-cuts for 2019, he has his work cut out to come across dovish enough…

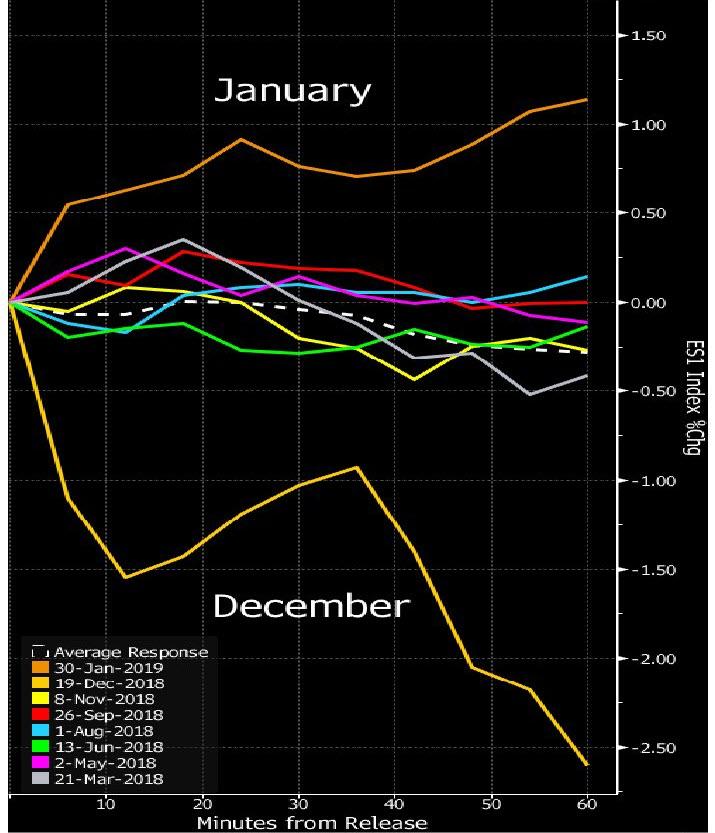

And in case you were expecting a big day tomorrow, here is the reaction function for the last few FOMC meetings…

via ZeroHedge News https://ift.tt/2Fnk8YN Tyler Durden