Just as it appeared that European stocks, whose shorts are supposedly the “most crowded trade” on Wall Street, were set for a major breakout, here comes UBS.

After a painful close to 2018 for most banks, when despite a surge in volatility most flow and prop desks suffered major losses, investors had great hopes for the start of 2019, if for no other reason than the 20% surge in the S&P500 in the past three months.

Alas, at least for the largest Swiss bank it was not meant to be.

Speaking at the Morgan Stanley London European Financials conference, UBS CEO Sergio Ermotti gave a dismal outlook for his bank’s prospects, saying conditions in the first three months have been among the most difficult in recent years.

The investment bank had “one of the worst first-quarter environments in recent history,” Ermotti said Wednesday, blaming it on the lack of merger or IPO activity outside of the U.S. As a result, UBS investment banking revenues were down about one third compared with a year ago. The bank is slowing hiring and some IT projects as it seeks to make up for weak markets.

Ermotti’s comments mean the quarter has deteriorated even more than the bank suggested last week, when it said clients remained cautious in the first months of this year. Similar to Deutsche Bank, UBS has cut thousands of investment banking jobs over the last decade as it tilted to private banking. While the procyclical strategy has become a blueprint for rivals including Credit Suisse, it has left the bank open to revenue dips after market corrections and when clients trade less, like right now.

Ermotti also warned that global wealth management revenue is down about 9% from a year ago, but was hopeful that new money should be positive, and the bank aims to offset the drop in revenue with a 5 percent reduction in costs, he said.

But the biggest pain was for the UBS investment bank division, where Q1 continues a slide first observed in the final months of last year, when it posted a $47 million loss because clients, particularly in Asia, stayed on the sidelines. That, according to Bloomberg, was a stark contrast to the prior year, when the investment bank was a bright spot that consistently beat analyst expectations under former boss Andrea Orcel who in September accepted an offer to become CEO of Banco Santander, though the offer was later rescinded in a dispute over pay and appears headed for litigation.

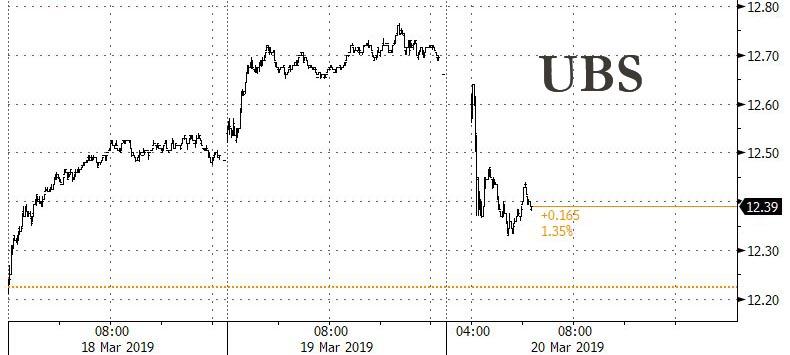

Meanwhile, his successor, Ermotti, like most European bank CEOs, has been struggling to persuade investors that he can further extend UBS’s position in European banking. The stock lost a third of its value last year, and continued the slump on Wednesday following the dismal warning, as UBS shares fell 1.7% at 9:54 a.m. in Zurich trading, the second-worst performer in the Bloomberg Europe 500 Bank and Financial Services Index.

In retrospect, perhaps all those shorts were right…

via ZeroHedge News https://ift.tt/2FoLjSZ Tyler Durden