Europe’s conversion into Japan is accelerating.

After years of justified complaints by Deutsche Bank and other European banks that the ECB’s NIRP policy is crushing their profits, the ECB appears ready to take a page from the BOJ playbook and according to Reuters, the central bank is “studying options to lower the charge that banks pay on some of their excess cash as a possible way to offset the side-effects of its ultra-easy policy.”

While no policy proposal has been made on the matter yet, the purpose of the move – which the BOJ has had in place for years without much beneficial impact to bank bottom lines – would be to return some of more than 7 billion euros ($7.90 billion) a year the ECB collects in interest from banks, Reuters reported.

This so-called deposit rate “tiering” would mean banks are exempted in part from paying the ECB’s 0.40% annual charge on their excess reserves, boosting their profits as they struggle with an unexpected growth slowdown.

In other words, the ECB will soon be forced to admit that when it comes to the financial part of Europe’s economy, its policies have been an outright failure, something Deutsche Bank has said for years. Meanwhile, when it comes to the “boost” negative rates provide to the rest of the economy, not to mention the ECB’s QE and its bloated, multi-trillion balance sheet, one look at Europe’s raging recession should end all debate there.

While tiering would crush what’s left of the ECB’s credibility, another problem with a tiered rate is that it would signal that rates are going to stay low for a very long time, in potential conflict with the ECB’s forward guidance, which sees rates at record lows only until next year. That said, it’s not like the market cares much about the ECB’s guidance any more: markets have already priced out a deposit rate hike for almost another two years as it has now become all too obvious that Mario Draghi will never hike rates during his tenure which appropriately ends on Halloween. Neither will his successor.

As a reminder, the ECB’s Governing Council discussed the merits of a tiered deposit rate at its March 2016 meeting but ultimately decided against it. It appears it has now changed its mind, especially since excess cash sloshing around the euro zone and paying a punitive negative interest rate has ballooned as a result of the ECB’s 2.6 trillion euro bond-buying program.

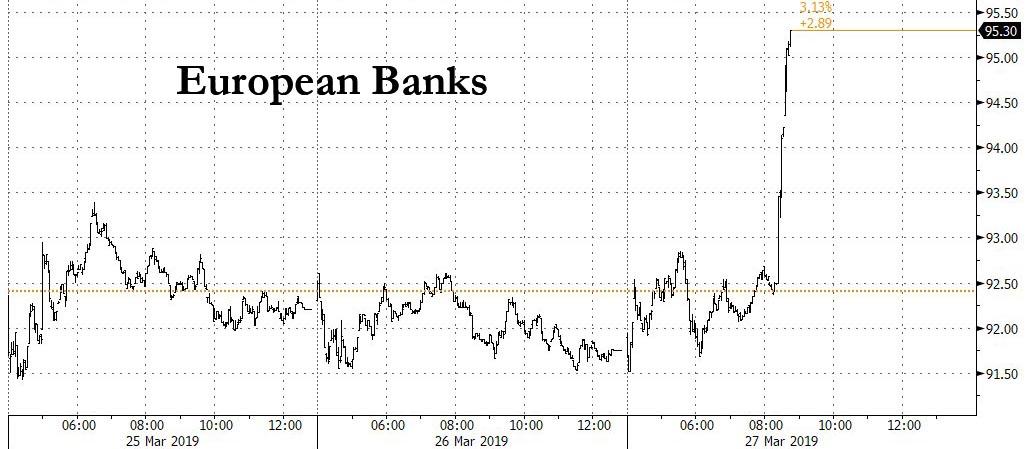

One thing to note: various forms of tiered rates have been introduced in Japan, Denmark, Sweden and Switzerland; none of them have been successful in actually boosting bank profits. But that consideration did not matter to traders this morning, with the news of possible tiering paring losses in the Stoxx Europe 600 Index, and pushing it up as much as 0.4% in a volatile session, thanks to surging bank stocks as the Stoxx banking sector index jumped as much as 2.2%.

via ZeroHedge News https://ift.tt/2HVrCnF Tyler Durden