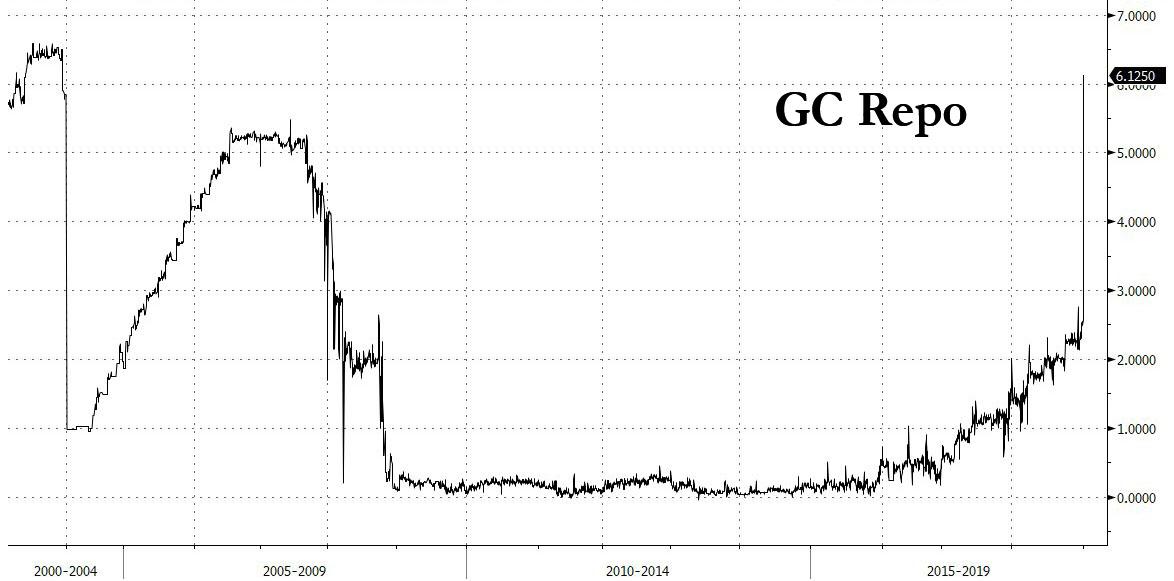

Back on January 1, we showed what was arguably the strangest move that took place on the last trading day of 2018, when the overnight general collateral repo rate shot up from 2.5% to as high as 6.125%, the biggest one day move on record, bringing overnight GC repo to the highest level since January 2001.

While violent quarter and especially year-end moves are well-known in the overnight funding markets, the magnitude of the Dec 31 surge was simply unprecedented, and commenting on the GC Repo surge, Scott Skyrm, EVP at Curvature Securities said that “the cash never came in,” noting that while “funding pressure should be about 50 basis points” and yet what we got was “350 basis points.”

What he is referring to is the odd predicament the US financial system finds itself in, whereby in complete opposite from 2015 when there was a shortage of safe assets, there is now a glut, largely thanks to the flood of T-bills and coupon Treasurys required to fund the soaring US budget deficit coupled with what appears to be a shortage of excess reserves, which as recent events in the market demonstrated are not nearly enough, and is the reason why the Fed ended its balance sheet rolloff prematurely (it is now expected to end around September, well ahead of its previous summer of tentative 2020 due date).

Now, as we have discussed on prior occasions, one means to address this collateral mismatch is the proposed and speculated Fed overnight fixed-priced, full allotment overnight repo facility, which would eliminate such year-end general collateral repo spikes which are the result of too many securities chasing too little cash. However, in the biggest surprise from the most recent FOMC meeting, the Fed did not indicate that it was preparing to rollout such a facility, which means that until there actually is an operating Fed-backed O/N repo facility, we will continue to see collateral spikes like the one shown above.

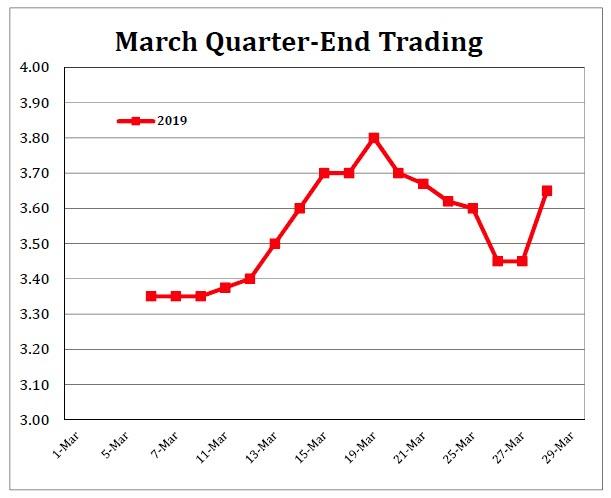

Which brings us to tomorrow’s quarter-end, which will likely result in more general collateral repo fireworks.

Commenting on what to expect, we go back to Curvature Securities’ repo-market expert Scott Skyrm, who in his daily note writes that “quarter-end is everything in the Repo market right now and how it trades tomorrow will impact not just on financing P&L, but future quarter-ends, and potentially Fed policy tools in the future (an RP facility?).”

As noted above, last year-end, so many banks had cut their balance sheets so that there was insufficient cash to fund the Repo market and overnight rates spiked to over 7.00%, and as Skyrm writes, “the Repo market is worried that the same scenario could occur tomorrow. As a result, the Repo market is “on edge.”

Case in point, on Thursday – one day before the end of the month and the quarter – the quarter-end General Collateral moved from 3.50% this morning up to 3.85%, then down to 3.45% and now back up to 3.65%, just in the space of several hours.

And while Skyrm is not sure the direction of rates tomorrow, he is sure that “there will be volatility” and predicts that “rates will trade anywhere between 5.00% and 2.00% during the day.” In short, it is very possible that in addition to the now familiar pension rebalancing, the market may experience a severe, if brief, liquidity shortage as banks scramble to soak up the repo flood with increasingly scarce dollars.

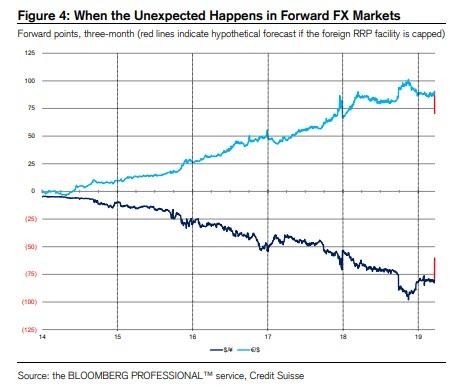

Incidentally, an interesting proposal that was floated this week by former Fed analyst and current Credit Suisse repo-wizard Zoltan Pozsar, arguably the most erudite voice when it comes to repo-market recommendations, when it comes to releasing much of the dollar liquidity currently stuck in various shadow markets, Pozsar called on the Fed to “use the exorbitant privilege” of the reserve currency state and to cap the foreign Reverse Repo facility, a step that would release as much as $200 billion in new liquidity and would likely make its way into the bill market where there is a growing glut of paper chasing not enough dollar funds:

$200 billion hitting the FX swap market indirectly or directly is a lot, especially when cross-currency bases are barely negative (on a Libor-Libor basis). Barely negative bases mean that the €/$ and $/¥ markets are pretty much clearing through matched books, and so a marginal $200 billion of new lending could tip the basis quite positive, quite fast – that’s the scenario where Libor-OIS goes negative (re-read page 13 here, s-l-o-w-l-y).

Sometimes, when you come in to work, weird stuff just happens. The SNB ending the Swiss franc’s peg to the € was one of those days. It sent spot FX flying (see Figure 3). If the Fed re-caps the foreign RRP facility, we could have another one of those days: a day when the FX swap market realizes the amount of flow that’s about to hit directly or indirectly and traders re-price forward dollars to discount an abundance of dollar supply.

Figure 4 shows what that day could look like on your screens…

…similar to the day when the franc’s peg ended, but different in that the big move was in the spot FX rate back then, whereas the big move would be in forward FX rates today.

For more, please see “Global Money Notes #21 It’s Time to Use the Exorbitant Privilege”, authored by Zoltan Pozsar and published by Credit Suisse on March 25.

Which brings us to the TL/DR version: keep a close eye on repo GC tomorrow – if the financial system liquidity shortage has gotten worse since Dec 31, and it likely has as the Fed’s balance sheet has shrunk by over $100 billion since then, then expect fireworks. Just how big those fireworks will be will indicate how bad the overall liquidity shortage in the system is, which provides a critical glimpse into the overall systemic weakness that exists on US bank balance sheets if one eliminates the roughly $1.5 trillion in Fed-created excess reserves.

via ZeroHedge News https://ift.tt/2JO1iyt Tyler Durden