Summarizing Q1 in one chart: Stocks soared alongside a renewed surge in global money supply as top-down and bottom-up fun-durr-mental data collapsed…

It seems the world’s central banks have re-embraced their “don’t panic” role as they see something that’s just too scary for us average joes to be told…

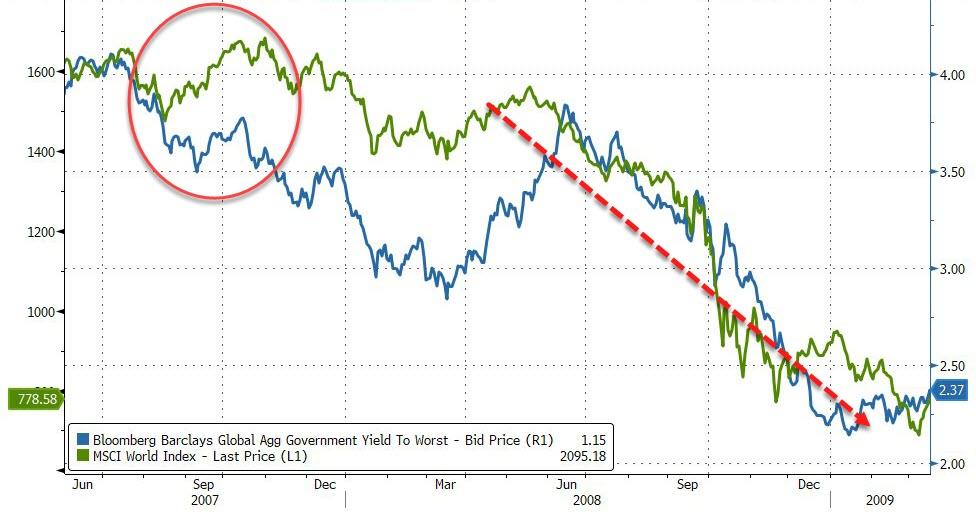

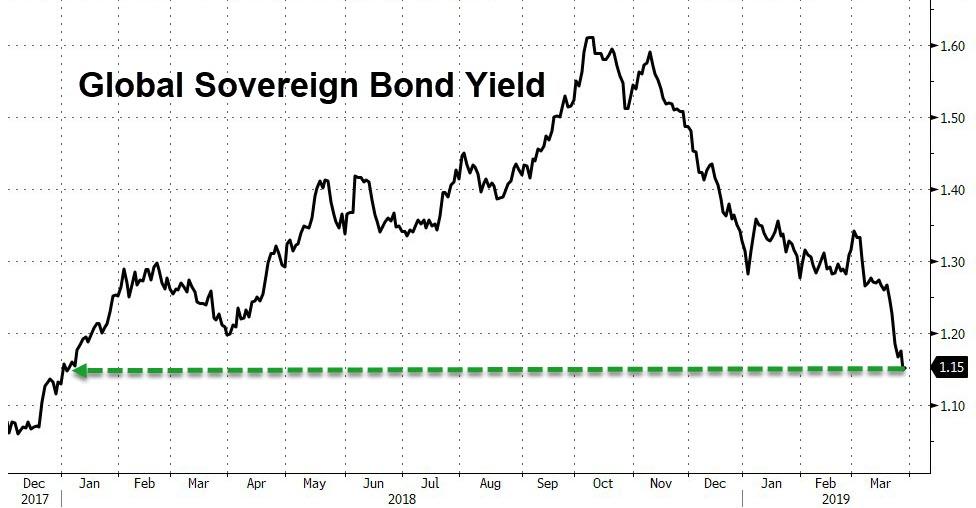

Global stocks and global bond yields have decoupled dramatically in Q1…

We have seen this before…and it did not end well.

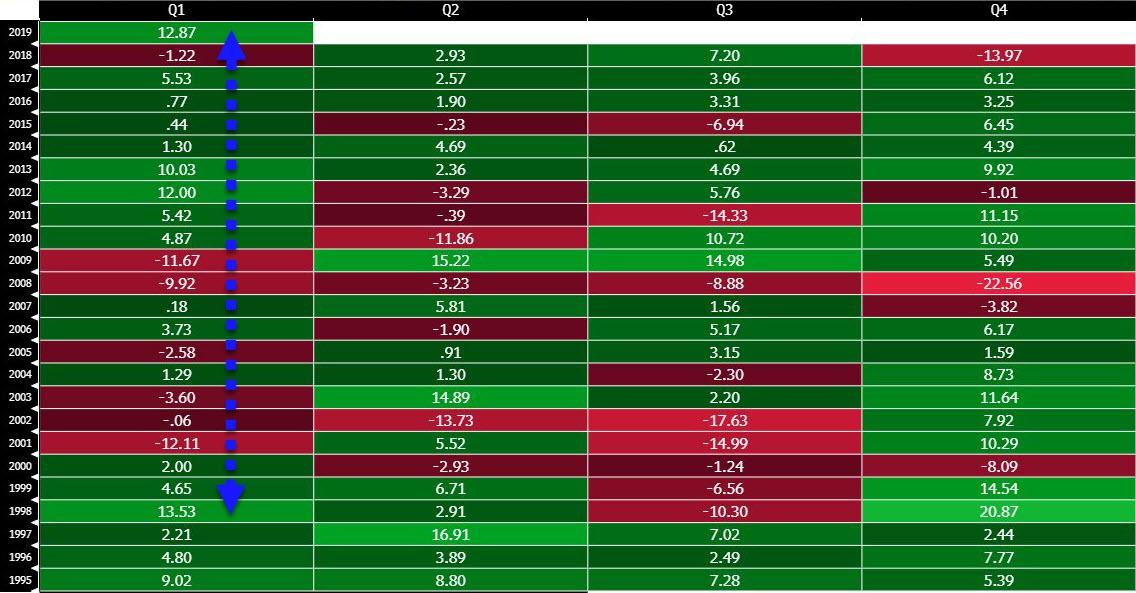

Quite a quarter!

-

Best quarter for world stocks since 2012

-

Best quarter for US stocks since 2009

-

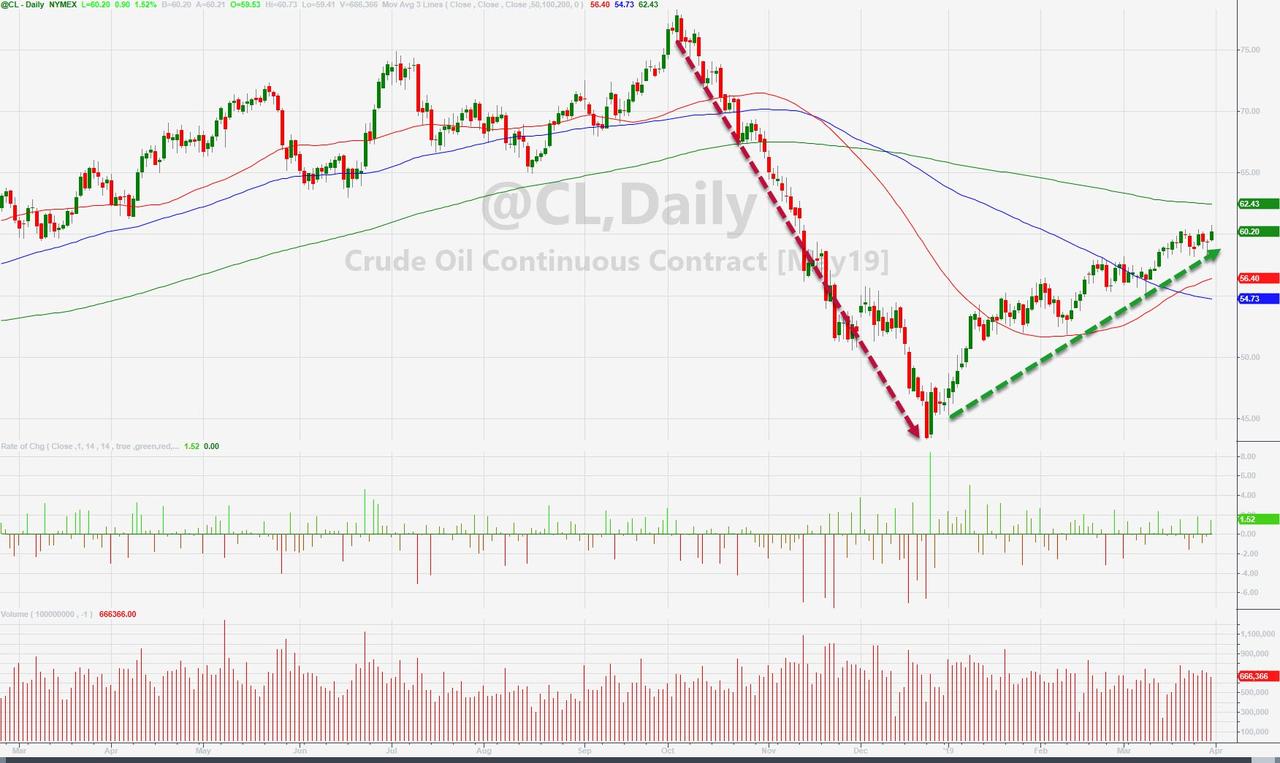

Best quarter for oil since 2009

And…

Chinese stocks were panic bid overnight, ending the quarter up 24% (China’s best quarter since Q4 2014, and best Q1 since 2009)…

European markets ended Q1 up 12.3% led by a 16.1% gain for Italy (best quarter and best Q1 since 2015)

Best start to a year for S&P since 1998

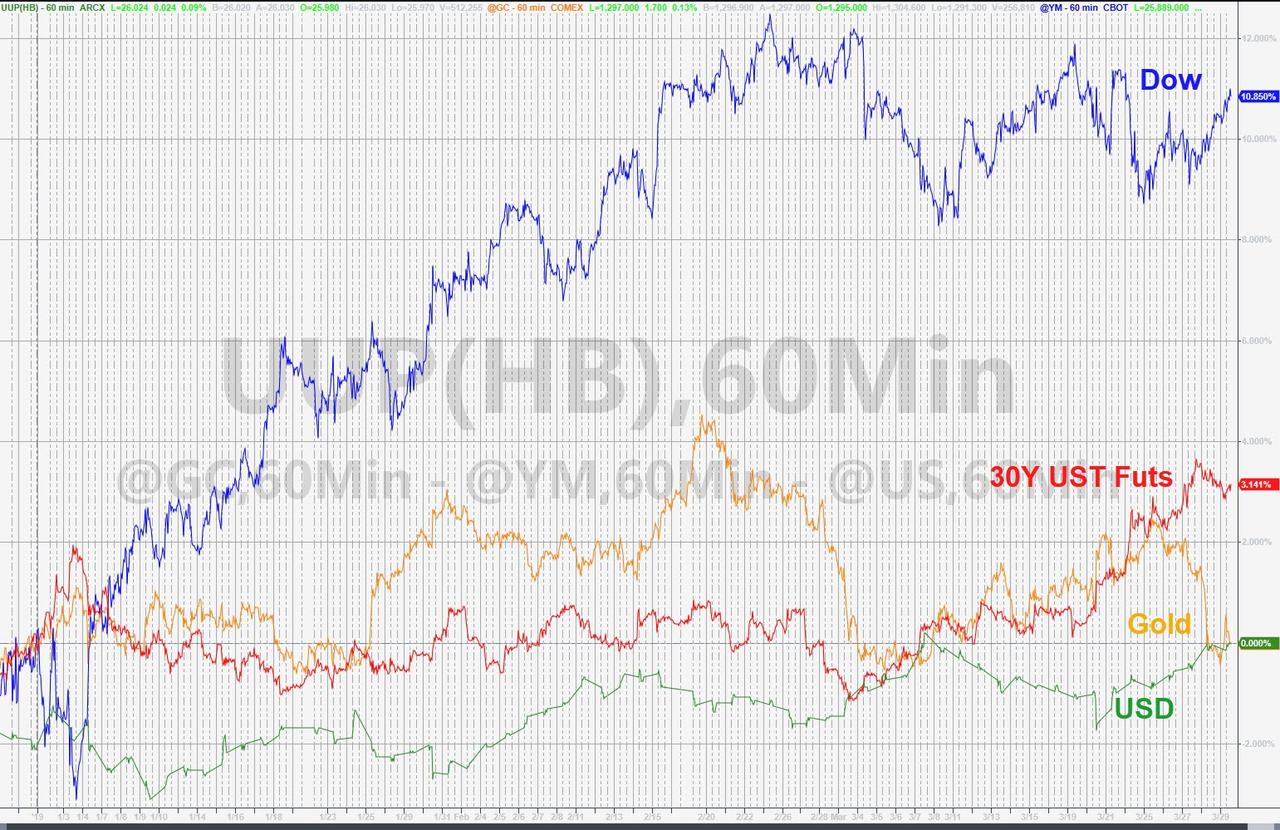

US Stocks outperformed bonds dramatically as Gold and the dollar ended unchanged in Q1…as S&P earnings expectations tumbled by the most since Q1 2016

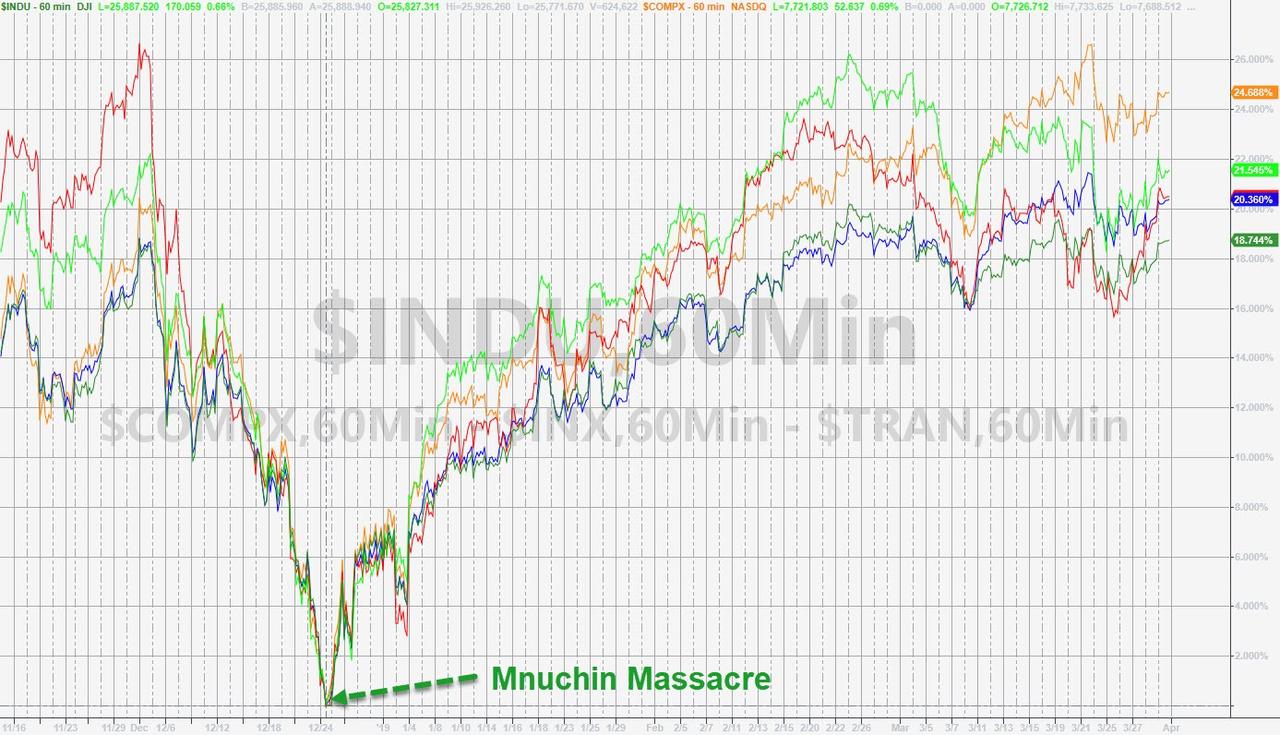

From the Mnuchin Massacre lows on Christmas Eve, the Nasdaq is up almost 25% and the Dow lagging at a mere 18.75%!!

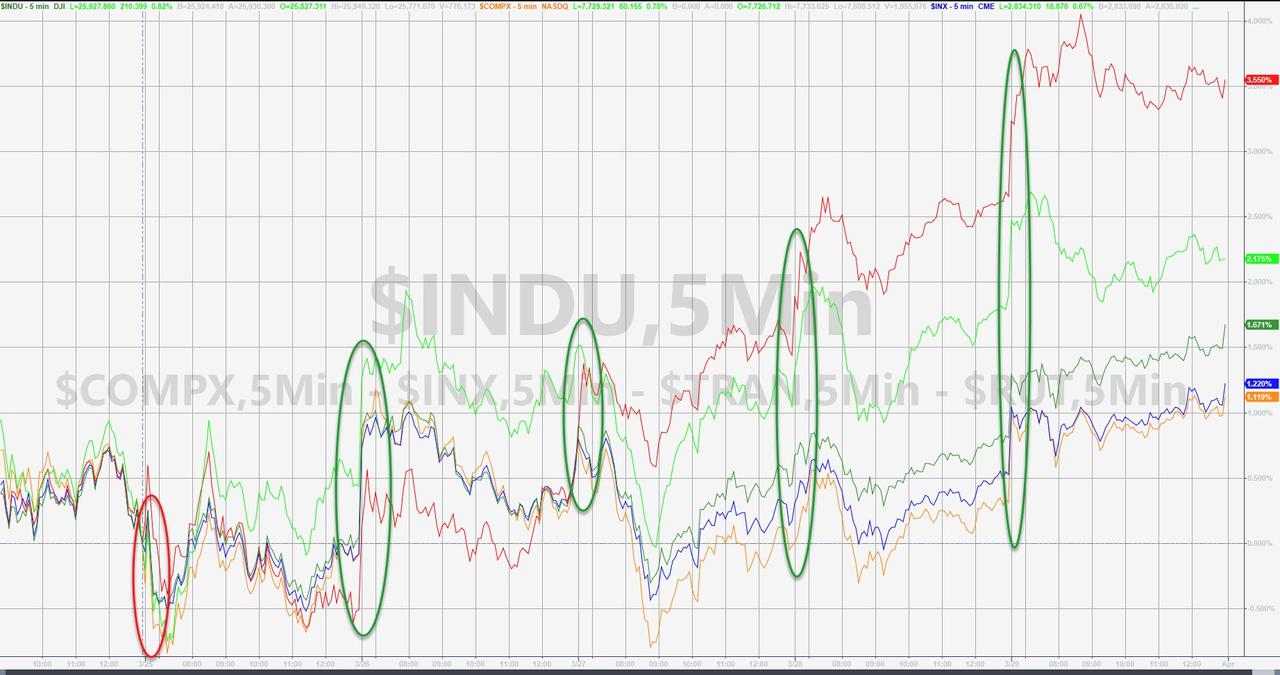

Trannies and Small caps were up most on the week, Nasdaq and S&P lagged…

The S&P 500 manage to get back above 2800 but is still struggling to follow-through…

LYFT IPO opened at $87.24 (after pricing at $72) but faded from the open…they defended $80 but that broke into the close…

FANG stocks soared in Q1 by 23.5% – the best quarter since Q3 2013

Credit (HY CDX -100bps, IG CDX -24bps, biggest quarterly drop since Q1 2012) and equity (VIX -11.6 vols, biggest Quarterly drop since Q4’11) protection costs collapsed in Q1…

Global sovereign bond yields plunged in Q1 (and Q4 2018) to their lowest since Jan 2018… (this is the biggest 2Q drop in sov yields since the growth crisis in 2016)

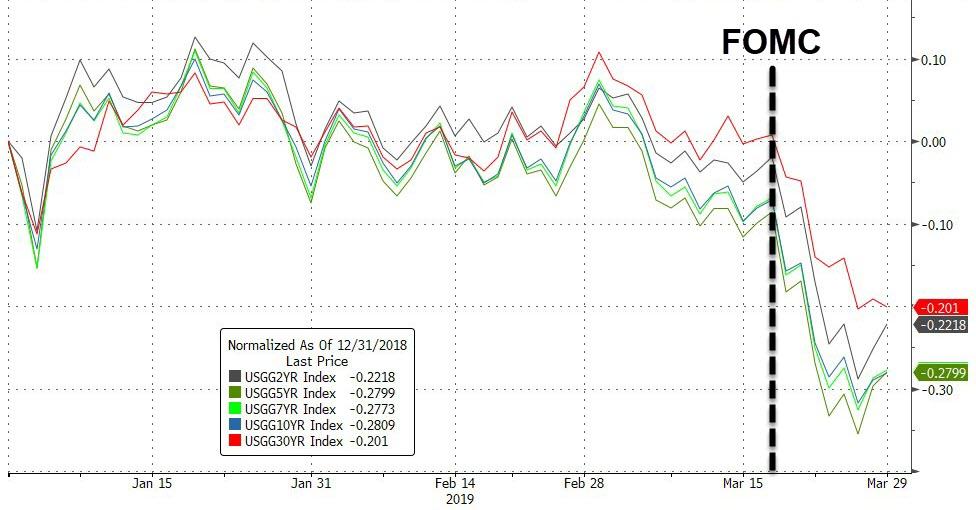

US Treasury yields plunged in Q1 (extending Q4’s collapse)…

30Y Yields are below 3.00%, 10Y below 2.50%, and the rest of the curve plunged…

The US yield curve has now flattened for 8 of the last 9 quarters, plunging into inversion this week…

Overall, the dollar trod water in Q1 (ending up around 1%) – the 4th quarterly rise in a row…

Cable tumbled back to recent lows today after May’s 3rd (and final) attempt to get her deal done failed…

Cryptos managed gains on the week with Bitcoin back above $4000, but it is Litecoin that dramatically outperformed in Q1…

Crude and Copper surged this week as PMs lagged…

Gold eked out some gains for the second straight quarter as The Fed went full dovetard and after being dumped yesterday, found support at the 100DMA today…

WTI soared in Q1 by the most since Q2 2009 (after collapsing in Q4)…

Finally, we note that the markets have seen an unprecedented swing in their outlook for The Fed…

Rescuing stocks (for now) from their 1037 analog…

via ZeroHedge News https://ift.tt/2I0vDr1 Tyler Durden