The CBOE may be regretting its decision to halt Bitcoin futures trading this morning, when shortly after midnight Eastern time, bitcoin suddenly broke the calm that had blanketed the crypto space for over three months, when it exploded as much as 23% higher in minutes, rising briefly above $5,000, its highest level since November, and pushing the entire $160 billion cryptocurrency space sharply higher, with rival coins Ether, Litecoin also soaring, as did cryptocurrency-linked stocks including Remixpoint and CMC Markets Plc, as well as that old market favorite Riot Blockchain.

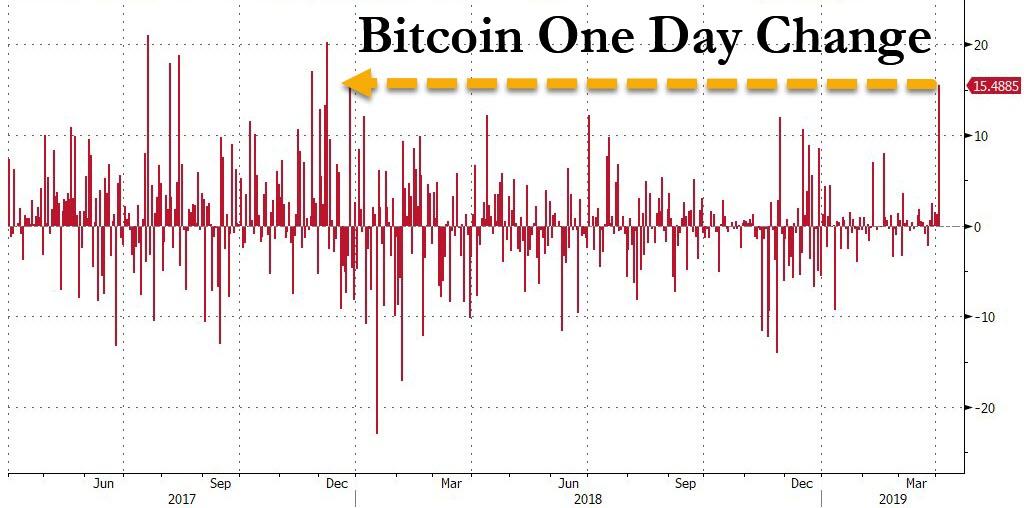

At its peak, the intraday move, which added more than $17 billion to the value of digital assets tracked by CoinMarketCap.com, was the biggest since early 2014. Even after paring some gains, with bitcoin currently up just over 15% at $4,777.81, the daily swing was the biggest since the euphoric peak bubble days of late 2017.

Understandably, traders was keenly focused on identifying the catalyst behind the move although a clear reason for the sudden surge has yet to emerge. George Harrap, chief executive officer at Bitspark, told Bloomberg he’s putting “most things on pause” until the market settles down. His contacts in the Bitcoin community have yet to identify a catalyst for the sudden jump.

“The reason why? Anybody’s guess at the moment,” Harrap said.

Some of the potential triggers cited on trading desks and in social media included a sizable block of expiring puts, short covering by traders who had stop-loss orders around the $4,200 level and an April Fool’s Day story on a little-known online news site claiming that the U.S. Securities and Exchange Commission had approved Bitcoin exchange-traded funds, although that was quickly discounted as the gains persisted even after the story was discounted.

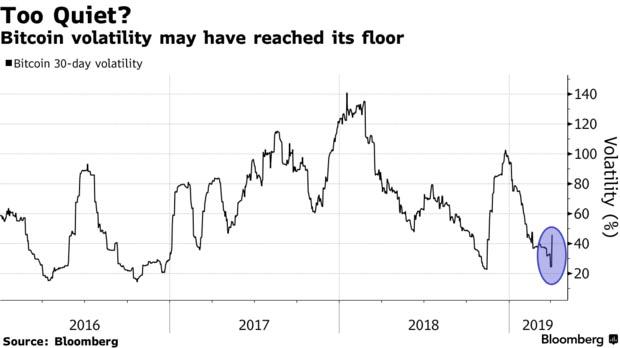

Another possible reason: crypto vol has troughed, prompting renewed interest in the asset class by investors seeking volatility at a time when cross-asset vol has likewise collapsed.

Another theory: renewed interest in money “offshoring” by Asian and/or Turkish investors.

To be sure, bitcoin susceptibility to unexplained, erratic price swings is nothing new and made it very popular among speculators, who are seeking a return to the glory days of 2017 when Bitcoin surged more than 1,400%. However, since its peak around $20,000 in late 2017, bitcoin suffered a 74% crash which eliminated much if not all of the froth in the former asset bubble.

Market participants say big buy orders in Bitcoin can often lead to outsized moves, in part because volume is spread across dozens of venues. Trend-following individual investors and short covering can also exacerbate volatility.

Of course, erratic moves such as this one have deterred institutional investors, whose concerns about cryptocurrencies range from uncertain regulation to exchange hacks and market manipulation.

“Bitcoin is still primarily retail-led,” said Craig Erlam, senior market analyst at Oanda Corp. in London. “It’s still a relatively unsophisticated area of trading.”

Predictably, the skeptics promptly emerged despite the sudden price gains which pushed the price of bitcoin back to levels last seen in November 2018 when the crypto broke down below a former support just above $6,000:

“Events such as today’s will probably be seen negatively, or viewed as this market doesn’t conform to the trading of traditional instruments,” said Dave Chapman, CEO of crypto exchange ANXONE. “We have to realize that this asset class is only a decade old, and it only started getting mainstream attention five years ago.”

* * *

Below we present the full market analysis from Bequant seeking to explain the sudden move:

Last week we asked, “When FOMO?”, pointing to the market where Bitcoin was trying to consolidate above the key $4,000 level while also having to deal with expiring futures and options contracts. In particular, as we pointed out, decent size was noted at 3500 strike (puts). For those that are yet to be convinced of the importance that derivatives market has on the underlying, it is worth pointing out that last Friday was another record day for Deribit with more than $40mln BTC options traded.

The market is very unpredictable, the price action overnight is a testament to that, when Bitcoin rallied over 15% and reached the highest level since November last year. It really remains to be seen whether the gains will be sustained but the market, which is very much retail driven and highly leveraged, but the impact of FOMO is not to be underestimated…

Still, looking into the future (June options), there are early indications that the market is turning more bullish, with plenty of interest noted at 6,000 strike (calls) where there is already OI of 2342.9 (delta 0.23).

Looking elsewhere, as pointed out by The Block, Tether (USDT) has experienced its highest daily volume since first being issued in 2015. According to data from CoinMetrics.io, on March 31, 2019, there were 38,150 USDT transactions processed. As a reminder, Tether Limited updated its website to clarify how its reserves are made up. The company now claims that each coin is backed by “reserves, which include traditional currency and cash equivalents and, from time to time, other assets and receivables from loans made by Tether to third parties.”

Finally, something to ponder about…when Bitcoin futures were launched back in Dec’2017, the influx of hot money saw the prices rocket all the way to $20,000 but what is more interesting is that the futures curve was trading in contango. Since then, the curve has evolved and is generally trading in backwardation. However, Ethereum futures curve has been trading in contango for a long time and many argue that this is because of oversupply. Could it be that the natural state of the Bitcoin & Ethereum curves is a contango? As opposed to Keynes’ longstanding theory that the natural state of commodity markets is backwardation.

via ZeroHedge News https://ift.tt/2CNnEdg Tyler Durden