The global stock rally fizzled overnight following a blockbuster start to the week and quarter, with U.S. equity futures unchanged near the highest level of 2019, even as European shares edged up following a muted Asian session while bond yields resumed their ominous slide; the dollar rose to a fresh 3 week high and the pound weakened after Britain’s parliament once again failed to reach a consensus on Brexit.

Following some brightening of the global industrial mood – at least in China and the United States – was competing for attention with another dismal U.S. retail sales report, Britain’s broken Brexit plans and more central bank caution, this time from Australia. Even as positive sentiment in Q1 spilled over into the second, a myriad of risks remain, including Europe’s slowing growth, Britain’s difficult split with the European Union and the lingering trade war. U.S.-China talks are set to resume when Vice Premier Liu He leads a delegation to Washington later this week.

US equity futures were all little changed ahead of the New York open even as European stocks hit 2-week highs with the Stoxx Europe 600 rising 0.3%, led by autos which extended Monday’s sharp rally. The banking sector index rose +0.6% as Swedbank rose the most in more than 5 years after last-week’s slump. Defensive sectors including telecoms and health care underperform. Britain’s exporter-heavy FTSE 100, which climbed as much as 0.5 percent as exporters cheered the fourth fall in sterling in the last five days.

And speaking of sterling, the Brexit tragedy continues as Britain is no nearer to resolving the chaos surrounding its exit from the EU bloc after parliament failed on Monday to find a majority of its own for any alternative to Prime Minister Theresa May’s divorce deal. May is due to hold hours of cabinet meetings with senior ministers on Tuesday to plan the government’s next moves. It meant investors stuck with UK Gilts and safe-haven German bonds, negative yields notwithstanding, in the bond markets despite a pop back higher in key U.S. yields in recent days.

“It does seem that British MPs want to avoid a no-deal Brexit by all means, but they are not voting for any of the alternatives and time is running out,” DZ Bank strategist Daniel Lenz said. “So I think investors have to prepare for the possibility that no-deal Brexit is on its way in 10 days’ time; it’s a little bit affecting yields this morning.”

Earlier, Asian stocks finished unchanged after Japanese shares reversed modest gains to finish lower, while stocks in Shanghai and Seoul rose fractionally. The MSCI Asia Pacific index ex Japan closed 0.2% higher and at a seven-month high after also rallying more than one percent in the previous session and a jump from Wall Street overnight. Chinese stocks hit a 10-month high leapfrogging Colombia to the top of the leaderboard of world share markets, while Australian shares gained 0.4 after the Aussie dollar had dropped following a meeting of the country’s central bank.

On Tuesday, the RBA held interest rates steady and again highlighted the strength of employment, showing no immediate inclination to echo the outright dovish tone of some of its global peers. Nevertheless as Reuters notes, it highlighted “downside risks for the global growth environment” and with national elections coming markets were betting the RBA will ultimately be forced to ease its rates, if only to stop the Aussie dollar from rising.

The market was “front-running” the Federal Reserve’s patience, Vishnu Varathan, head of economics and strategy at Mizuho Bank, said on Bloomberg TV. “At the margin it does provide relief,” he said. “But a lot of this is baked in and we are really running on fumes beyond this.”

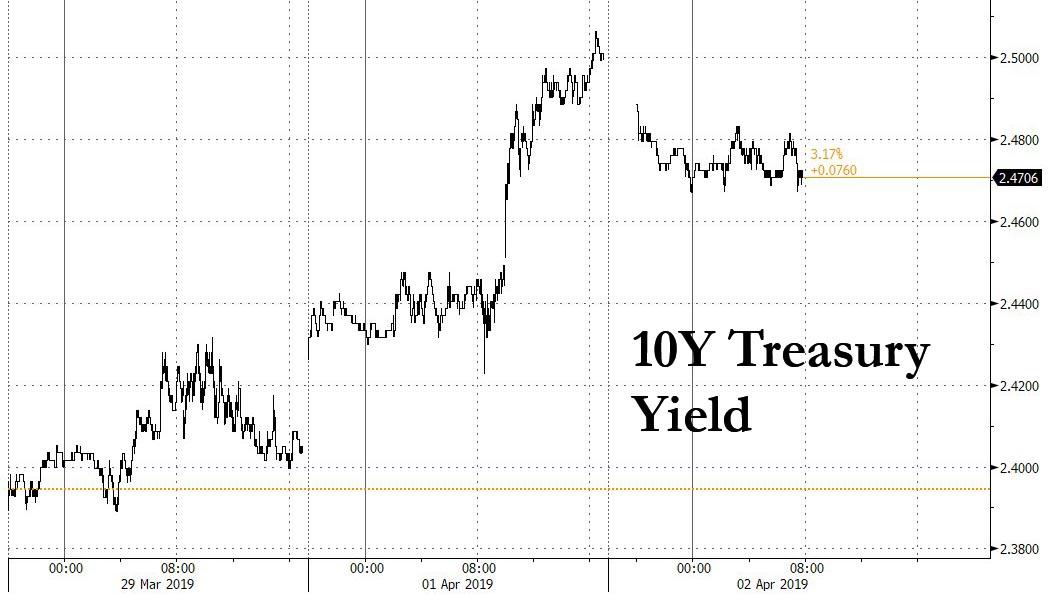

And with markets “running on fumes”, attention drifted back to the bond complex, where the yield on 10-year Treasuries declined three basis points to 2.47 percent after surging on Monday and disinverting the 3 Month/10 Year curve, if only for the time being.

Germany’s 10-year yield decreased one basis point to -0.03 percent. Britain’s 10-year yield declined three basis points to 1.017 percent, the biggest fall in more than a week. The spread of Italy’s 10-year bonds over Germany’s increased two basis points to 2.5547 percentage points.

In the latest Brexit news, UK Parliament rejected all 4 Brexit options in indicative votes as MPs voted 273 For vs. 276 Against Motion (C) on Customs Union and voted 261 For vs. 282 Against Motion (D) for a Common Market 2.0, while MPs voted 280 For vs. 292 Against Motion (E) which called for a Confirmatory Public Vote and 191 For vs. 292 Against Motion (G) on Parliamentary supremacy. Following the rejection of all four options, Conservative Remainer MP Boles (one of the architects of the indicative vote plan) left the party stating “I accept I have failed. I have failed chiefly because my party refuses to compromise”.

As a result, as we reported overnight, Chancellor Hammond will tell the Cabinet on Tuesday that Tories may have to consider a referendum as neither party nor country can afford an election, according to Times political editor. Prior to the Cabinet Meeting reports indicated that it has been delayed and shortened, ministers are now going in at 09:30BST-11:30BST and there may be no afternoon session; source adds ‘maybe last night was not what was expected’., Daily Mail’s Doyle. Today’s cabinet meeting was initially supposed to be 5 hours long, with a ‘political cabinet’ initially to discuss party matters, followed by a traditional cabinet meeting.

The other big shift taking place in recent days was in oil markets where prices hit fresh 2019 highs after a U.S. official had said Washington was considering more sanctions on Iran and a key Venezuelan export terminal halted operations. U.S. crude futures traded at $61.82 per barrel, up 0.4 percent on the day while Brent futures were eyeing $70 a barrel for the first time since November at $69.19.

“China’s PMI number was the most significant monthly increase since 2012, which should ease concerns around a potential threat to oil demand,” said Stephen Innes, head of trading and market strategy at SPI Asset Management.

Copper and gold both ticked down in the industrial and precious metals markets but it was Bitcoin that stole the attention overnight when it suddenly exploded back to life, when it jumped as much as 23% to touch $5,000, its highest since November. Crypto-analysts pointed to a large order in a thin market, though there wasn’t any obvious trigger for than order immediately apparent.

The surge helped Bitcoin break through its 200-day moving average for the first time in more than a year. The crypto crashed 74% last year as authorities globally tightened their regulation on the market.

In currencies, the euro fell for a sixth day on growth concerns and the pound slid amid the Brexit impasse, boosting the Bloomberg Dollar Spot Index to a three-week high. Antipodean currencies led Group-of-10 losses as the Australian central bank’s statement was seen as dovish. In emerging markets, gains in MSCI’s EM share index were capped at 0.16 percent, after losses in countries such as Turkey and South Africa that were under pressure from political tension and weak local manufacturing.

The Turkish lira gave up 1.6 percent after the United States halted delivery of equipment related to the F-35 fighter aircraft to Turkey. The disagreement is the latest of a series of diplomatic disputes between the United States and Turkey, which were partly responsible for pushing the currency into a crisis last year. Playing into the lira’s recent volatility have been heavy-handed clampdown on the international lira market. Local elections at the weekend saw President Tayyip Erdogan’s AK Party lose Istanbul and Ankara.

Economic data include durable goods and capital goods orders. Walgreens Boots and Lamb Weston are due to report earnings

Market Snapshot

- S&P 500 futures down 0.1% to 2,867.50

- STOXX Europe 600 down 0.02% to 383.58

- MXAP unchanged at 161.42

- MXAPJ up 0.2% to 535.70

- Nikkei down 0.02% to 21,505.31

- Topix down 0.3% to 1,611.69

- Hang Seng Index up 0.2% to 29,624.67

- Shanghai Composite up 0.2% to 3,176.82

- Sensex up 0.4% to 39,040.37

- Australia S&P/ASX 200 up 0.4% to 6,242.36

- Kospi up 0.4% to 2,177.18

- German 10Y yield fell 1.1 bps to -0.037%

- Euro down 0.1% to $1.1199

- Brent Futures up 0.2% to $69.13/bbl

- Italian 10Y yield rose 1.9 bps to 2.153%

- Spanish 10Y yield fell 0.3 bps to 1.138%

- Brent Futures up 0.2% to $69.13/bbl

- Gold spot down 0.06% to $1,286.92

- U.S. Dollar Index up 0.2% to 97.39

Top Headline News from Bloomberg

- Theresa May is expected to confront her most senior ministers with the potentially explosive option to delay Brexit by months, as the U.K. struggles to find a plan for leaving the EU

- European Commission President Jean-Claude Juncker stepped up his criticism of Chinese trade practices just days after President Xi Jinping sought to soothe European concerns in Paris

- Investment intentions among U.K. firms slumped to an eight-year low, just one of the measures of economic health that weakened “considerably” amid recent Brexit turmoil, according to the British Chambers of Commerce

- Australia’s central bank remained on the sidelines as it waits to analyze the economic impact of a fiscal injection designed to catapult Prime Minister Scott Morrison to a come-from-behind election victory.

- European Union governments are struggling to reach consensus on a mandate to begin trade talks with the U.S., risking a delay that would further provoke Donald Trump’s ire after the bloc’s refusal to include agriculture in the negotiations

- Mario Draghi is spending a chunk of his final year in office multitasking as a stopgap solution for the swelling empty-chair problem at the European Central Bank’s supervisory arm

- Oil added to its biggest advance in more than two weeks after fresh evidence of the OPEC+ coalition’s resolve to cut output and a deepening crisis in Venezuela supported a bullish outlook for prices

- European Union governments are struggling to reach consensus on a mandate to begin trade talks with the U.S., risking a delay that would further provoke Donald Trump’s ire after the bloc’s refusal to include agriculture in the negotiations

- The Russian ruble has gained more than any currency in the world this year, and unrivaled carry returns fueled further inflows into ruble assets, making hedge funds the most bullish ever. But the best may be over if implied yields are any indication

- Signs that China’s economy is stabilizing have kicked off a debate about whether the central bank should keep injecting liquidity into financial markets, with a former senior official warning of the risk of asset bubbles

Asian equity markets were mostly higher as the regional bourses picked up the bullish baton from Wall St where sentiment was underpinned and growth fears were eased by strong PMI data from US and China. ASX 200 (+0.4%) and Nikkei 225 (U/C) traded positive with tech, energy and financials leading the upside in Australia and with price action in the Japanese benchmark mainly currency-driven. Furthermore, participants had been awaiting any dovish clues from the RBA, as well as the Federal Budget which is seen as a platform for upcoming elections and is expected to include income tax cuts, billions for infrastructure spending and its first surplus in 12 years of AUD 4.1bln. Hang Seng (+0.2%) and Shanghai Comp. (+0.2%) remained upbeat after the recent recovery in factory data and amid optimism ahead of this week’s US-China trade talks in Washington, while outperformance was seen in gambling names following the better than expected Macau gaming revenue figures. Finally, 10yr JGBs were lower on spill-over selling from USTs and as the positive risk tone continued to dampen safe-haven demand, although some of the losses were pared following stronger demand and lower supply in today’s 10yr JGB auction.

Top Asian News

- Australia Budget 2019: Winners and Losers

- India Opposition Leader Gandhi Pledges to End Poverty by 2030

- Bonds Advance as India’s Cash Boost Adds to Wagers of Rate Cuts

- India Top Court Quashes RBI Attempt to Tighten Default Rules

A subdued session for European equities thus far [Eurostoxx 50 +0.2%] after the bullish momentum seen on Wall Street and Asia faded wherein major bourses were buoyed by the risk appetite. UK’s FTSE 100 [+0.5%] remains the outperformer as the export-heavy index benefits from the Brexit-beaten Pound. Sectors are relatively mixed with defensive sectors gaining as jittery investors hedge downside. In terms of individual movers, Pandora (-5.3%) fell to the foot of the of the Stoxx 600 (Unch) after Carnegie noted concern over the company’s Q1 results, adding that they would sell the stock at current levels. Elsewhere, Roll-Royce (-1.7%) nursed some losses after opening at the foot of its index Singapore Airlines grounded some planes due to their Rolls-Royce engines. On the more optimistic note, Pernod Ricard (+1.3%), Remy Cointreu (+1.1%) and Carlsberg (+0.4%) are all benefiting from an overweight initiation at Barclays. In recent US newsflow sources indicate that Exxon (XOM) hopes to raise USD 3bln for the potential sale of both onshore & offshore oil and gas assets in Nigeria.

Top European News

- Korea Seeks Extradition of Ex-Deutsche Trader Over Manipulation

- FTSE 100 Outperforms as Brexit Impasse Sends Pound Lower

- Billionaire Mordashov Seeks $1.8 Billion Deal for Russia’s Lenta

- Pandora Falls Amid Concerns Over China Sales in First Quarter

In currencies, AUD/NZD/GBP – The clear G10 underperformers, with Aud/Usd extending post-RBA declines to 0.7065 from a knee-jerk peak around 0.7130 on the back of much stronger than expected Australian building approvals overnight. The RBA maintained rates as widely expected, but alongside an ongoing neutral policy stance there was a tweak to the accompanying statement suggesting that keeping the status quo may not be enough to support growth as it has for the past 2 ½ years. Instead, data and developments will be monitored to see if the Cash Rate requires an adjustment. Note, little reaction to the pre-election Budget despite a significant rise in the projected 2019/2020 surplus vs December’s forecast and a proposed Aud158 bn tax cut package as the Government also acknowledged the emergence of genuine and clear downside risks that might impact an otherwise sound domestic economy. Elsewhere, Nzd/Usd has fallen in sympathy from circa 0.6804 to 0.6768, but also independently in response to a marked deterioration in Q1 NZIER sentiment, while Cable has retreated further from 1.3100+ highs due to UK-specific factors as yet another round of IVs in the HoC found no common ground on any of the 4 alternative Brexit strategies put forward, albeit with the CU motion moving a lot closer gaining a majority. Cable has pared some losses from a 1.3025 low and Eur/Gbp has eased back from a whisker under 0.8600 on a firmer than forecast UK construction PMI, though still sub-50. Technically, 1.3030 is daily chart support for Cable and the 200 DMA is 1.2977, while flow-wise a hefty 1.2 bn option expiry between 1.3045-55 may cap a firmer rebound, as could 1 bn rolling off in Aud/Usd at the 0.7100 strike.

- CAD/EUR/CHF/JPY – All weaker vs the Greenback, as the DXY edges closer towards 97.500 and ytd peaks in wake of yesterday’s upbeat US manufacturing PMI and profiting from the demise of major rivals. Usd/Cad remains above 1.3300 after Monday’s disappointing Canadian PMI, while the single currency is struggling to keep hold of the 1.1200 handle where a hefty option expiry sits (1 bn) and has dipped just a few pips short of key Fib support (1.1187/6) protecting the 2019 low at 1.1177. Elsewhere, slightly above consensus Swiss CPI has not held the Franc recover vs the Buck within a par-0.9984 range, but it is holding just above 1.1200 against the Euro. Usd/Jpy has nudged up towards 111.50 and the 200 DMA (111.48) after its recent range break and clearance of chart resistance, but may yet be drawn back to the 111.00-20 region given 2.4 bn expiries.

- EM – The Lira continues to underperform regional counterparts on political grounds and renewed Turkish-US tensions following the latter’s decision to suspend deliveries of F-35 jets, with Usd/Try back up near the upper end of a 5.6125-5.4775 range.

- Australian Building Approvals (Feb) M/M 19.1% vs. Exp. -1.0% (Prev. 2.5%). (Newswires) Australian Building Approvals (Feb) Y/Y -12.5% vs. Exp. -27.0% (Prev. -28.6%)

In commodities, WTI (+0.9%) and Brent (+0.5%) futures extended earlier gains as supply-side developments keep the benchmarks afloat. Supply in Venezuela has been disrupted after its main oil port had to shut due to a lack of electricity, and with the US eyeing secondary sanctions on Iran, traders are speculating about further supply upsets. “Oil prices should move higher over the next two quarters as supply fundamentals remain constructive, with OPEC+ making good progress on pledged output cuts” says BNP Paribas Global Head of Commodities. Elsewhere, gold (Unch) trades lacklustre and remains near its lowest levels in over 3 weeks amid a firmer greenback and as safe-havens were shunned, while copper was steady and took a breather from recent advances amid the tentative tone around the market. Finally, Dalian iron ore futures hit a record intraday high with further supply concerns as BHP warned that iron ore output will fall by 6-8mln tonnes after damage caused by cyclones in Western Australia last week.

US Event Calendar

- 8:30am: Durable Goods Orders, est. -1.8%, prior 0.3%; Durables Ex Transportation, est. 0.1%, prior -0.2%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.05%, prior 0.8%; Cap Goods Ship Nondef Ex Air, est. -0.1%, prior 0.8%

- Wards Total Vehicle Sales, est. 16.8m, prior 16.6m

DB’s Jim Reid concludes the overnight wrap

It might not quite be 21 years yet but it feels that way for all of us following Brexit as the House of Commons once again gathered last night to vote on the slimmed down list of options for the indicative votes or as one scribe wrote “vindictive votes”. Every motion failed to achieve a parliamentary majority though. The proposal for a customs union with the EU came the closest yet, losing by a vote of 276-273, while the option for a second referendum came second-best with a 292-280 loss. Some MPs argued for linking the two options into a single proposal later this week, but other members contended that watering down either motion would lose more votes than it would gain. Meanwhile parliament will have another chance to take over Brexit on Wednesday when further set of votes on alternatives are planned.

So with things looking deadlocked in the House of Commons, attention will shift to today’s marathon cabinet meeting, scheduled for 9am to 12pm and then again from 1pm to 3pm. The morning session will be political officials only, no civil servants, meaning that PM May and her team are likely to consider the options including calling for a general election. That’s the base case from DB’s Oliver Harvey, though there is space in the parliamentary timetable for May to bring her WA for a fourth vote tomorrow if she wanted to. Sterling had traded firmer through much of yesterday and was up around +0.52% when New York went home. After the votes, the currency dropped over half a percent and is trading slightly above those levels this morning.

In contrast to UK politics, markets have been a lot simpler to dissect over the last 24 hours. “China hints at a cycle turn, the world parties” would be a way of describing it as a Chinese proverb. Indeed the positive China PMI provided the excuse to rally all day and the excuse to not worry about the softer parts of the global data releases from yesterday. To be fair a similarly stronger-than-consensus US manufacturing ISM helped too. In the middle of that we had a slightly disappointing round of final manufacturing PMIs in Europe but if China is turning this will be seen as backward looking. If you wanted a confusing summary though of life in Europe then the strongest link Germany now has the lowest manufacturing PMI in the region (44.1) and the angst ridden, economic precipice leaning, Brexit suffering UK the highest (55.1) outside of the Scandi countries even if stockpiling was the reason. Also Greece (54.7) is now around 10pts higher than Germany and even Turkey (47.2) – for all the political and economic turmoil – is ahead of Europe’s powerhouse.

We’ll touch on these in more micro detail shortly but just quickly onto markets first. We saw the S&P 500 climb +1.15% last night to take it to a fresh 25-week high. Industrials and financials led the charge while the NASDAQ also climbed +1.29% for its third daily gain in a row and 12th in the last 16 sessions. In Europe, even downbeat comments from the EC’s Juncker about China’s trade practices failed to stop the STOXX 600 climbing +1.21% while European Banks rallied +2.80% for their biggest one-day gain since February 15th. The VIX fell to 13.40 (-0.31pts) as a result of all that and the V2X to 14.79 (-0.49pts) – both well below their YTD averages of 16.4 and 15.5, respectively. It was similarly strong for credit where HY spreads were -8bps tighter in Europe and -11bps tighter in the US. EM FX rose +0.85% with notable gains for the likes of the South African Rand (+2.30%) and Turkish Lira (+1.37%).

The big contrast was in rates where we saw a big slide. The most notable move was 10y Treasuries selling off +9.6bps, the most since January 4th, to take them back to 2.501%. That is also 16.3bps off the intraday lows from last week however yields are still -26.5bps off their March highs. The yield curve steepened, with the 2y10y and 3m10y spreads rising +3.0bps and +10.4bps, respectively, for a +5.4bps and +22.6bps improvement from last week’s lows. The spread between the 18m forward 3m yield and spot 3m yield rose +12.2bps to -12.2bps, which is +33.7bps off of last week’s low. So a big turnaround. Bunds (+4.4bps) even hit the dizzying heights of -0.026% and had their weakest day since January 9th.

Asian markets are eking out modest gains this morning with the Nikkei (+0.12%), Hang Seng (+0.09%), Shanghai Comp (+0.41%) and Kospi (+0.24%) all up. Elsewhere, futures on the S&P 500 are down -0.14% while, 2y and 10y treasury yields are both back down c. -3bps this morning.

Coming back to the data, in the US the big highlight was that the March ISM manufacturing survey printed at 55.3 versus expectations for 54.5. It also represented a jump of +0.9pts from February while the details affirmed the solid print. Indeed the employment component jumped to 57.5 from 52.3 and new orders to 57.4 from 55.5. Interestingly the prices paid component also jumped to 54.3 from 49.4, its biggest rise since 2017 and its highest level since last year. However it does remain well off the >70 levels from Jan-Oct last year.

That data helped to offset what was at face value a broadly weaker February retail sales report, however upward revisions to January did at least help to take the sting out of the tail. Retail control in February printed at -0.2% mom (vs. +0.3% expected) however the January reading was revised up a significant +0.6ppts to +1.7% mom. That is actually the largest monthly print since October 2001 and further explains away the oddly weak December number of -2.2% mom that caused so much head scratching when it came out. Retail sales momentum is certainly weaker than last year, but the first quarter data is developing less poorly than expected. Elsewhere, construction spending rose a better-than-expected +1.0% mom in February (vs. -0.2% expected) and business inventories also climbed more than expected in January (+0.8% mom vs. +0.5% expected). We should note that the Atlanta Fed GDP tracker for Q1 is now up to 2.1%, up from 1.7% at the end of last week.

Core euro area equity markets (the DAX and CAC) did come off their highs in Europe early in the morning following the final March manufacturing PMI revisions, though the FTSEMIB and IBEX rallied further. For the euro area the broad reading was revised down -0.1pt to 47.5 which confirms it as being the lowest in nearly 6 years. France was revised down -0.1pts to 49.7 (a 3-month low) however the big headline grabber was Germany being revised down -0.6pts to 44.1. That puts it at the lowest level in 80 months. In the periphery Italy also disappointed slightly at 47.4 (vs. 47.5 expected) and the lowest in 70 months. The two bright spots were Spain hitting a two-month high at 50.9 (vs. 49.7 expected) and Greece a 12-month high at 54.7. Staying with Europe we also got the March CPI report for the Euro Area yesterday where the core metric dipped two-tenths to +0.8% yoy, one-tenth lower than expected.

The biggest stand out from the EU country PMIs however was the UK – a claim we can still hold for now – after it jumped +3pts to 55.1 and far exceeding the consensus for 51.2. However stockpiling was cited as a big reason for the jump so the quality of the details didn’t match the headline level and the likelihood is that we’ll see a sharp reversal soon.

Looking at the day ahead now, this morning it’s quiet for data releases with only the March construction PMI in the UK and February PPI report for the Euro Area due. In the US this afternoon expect there to be plenty of eyes on the preliminary durable and capital goods orders data in the US (+0.1% mom core capex orders data expected) especially for firming up Q1 GDP forecasts, while at some point we should also get March vehicle sales data. Away from that the ECB’s Praet is due to speak this morning in Frankfurt while the WTO will at some point release its trade forecast report for 2019-20.

via ZeroHedge News https://ift.tt/2Vf7IrE Tyler Durden