Authored by Sven Henrich via NorthmanTrader.com,

Is this the Combustion scenario unfolding here? The blowoff move? Sure seems like it.

$SPX and $NDX closing at all time highs, a vertical move out of the gate today and people throwing all caution to the wind chasing stocks with 80+ RSI readings. Risk assets? What are risk assets? These are risk free assets.

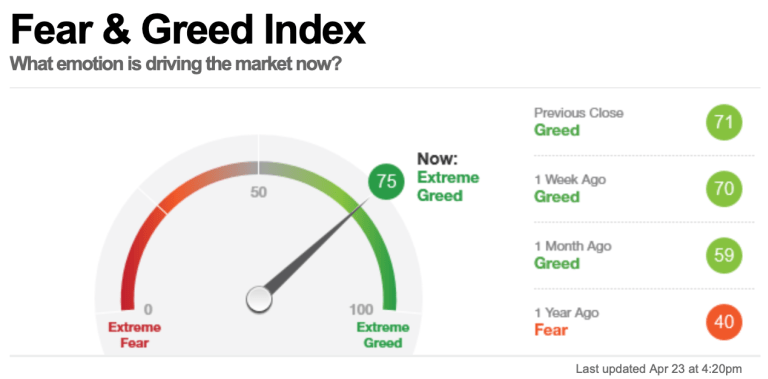

Greed is back:

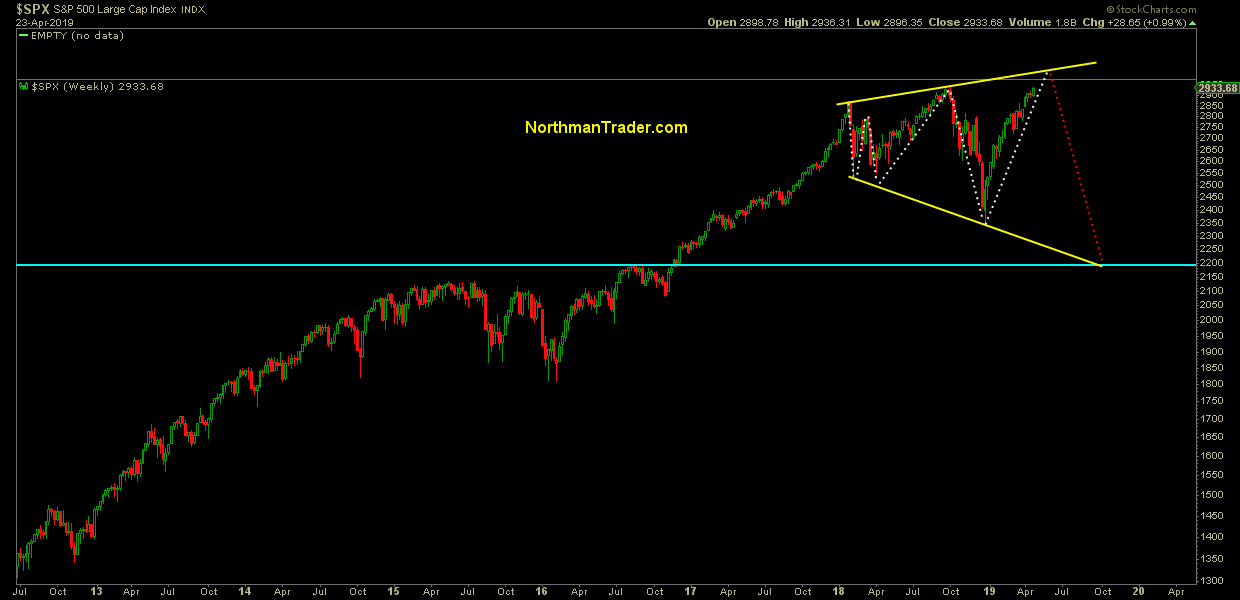

And $SPX seems to relentlessly move toward the upper trend line in the pattern we discussed in Combustion:

For all the hype let me share some observations.

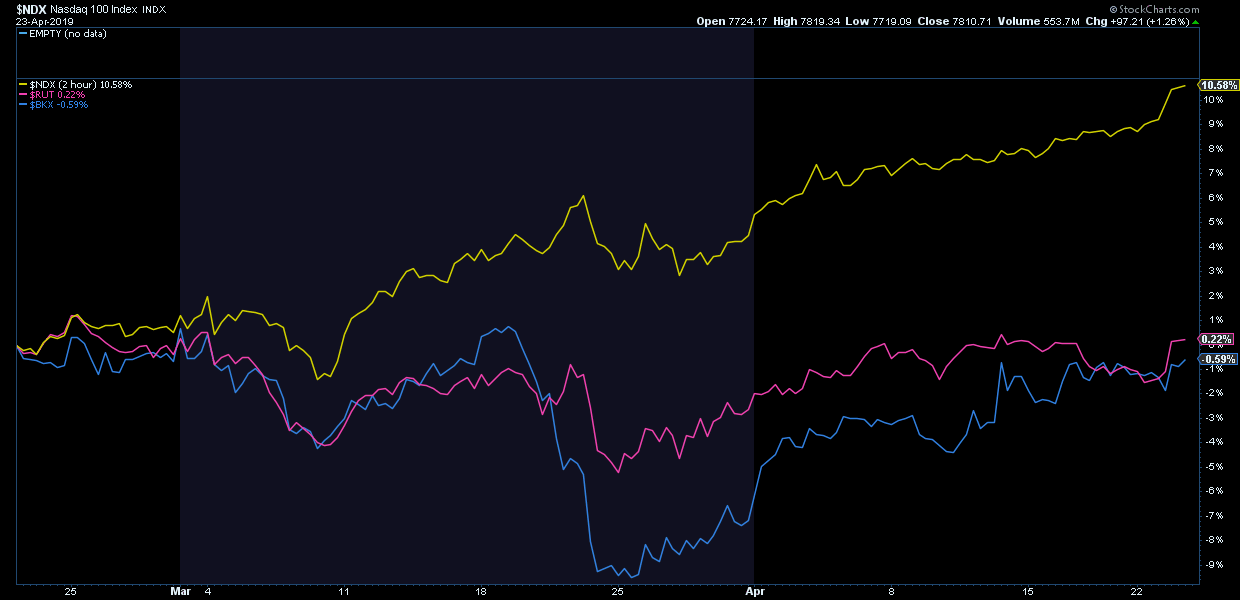

Since February 21 since $RUT made its highs (so far) for the year, this is actually how it and the banking sector compare to $NDX:

These 2 important sector have gone nowhere. It’s tech, tech, tech.

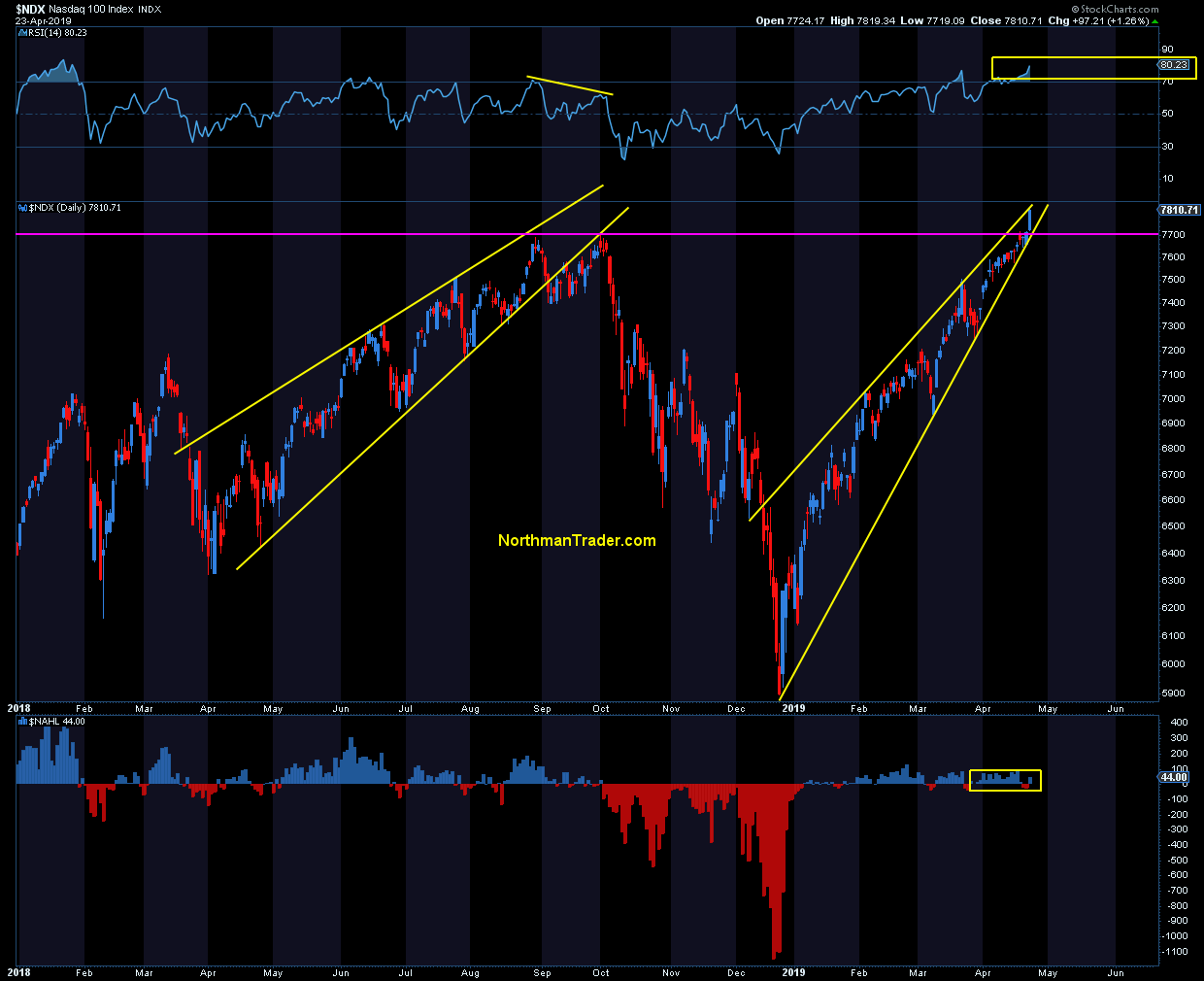

I’ve mentioned the wedge before. It keeps building and price continues to track the pattern closely and religiously:

80+ RSI reading. Expansion in new highs vs new lows? Non-existent as you can see at the bottom of the chart.

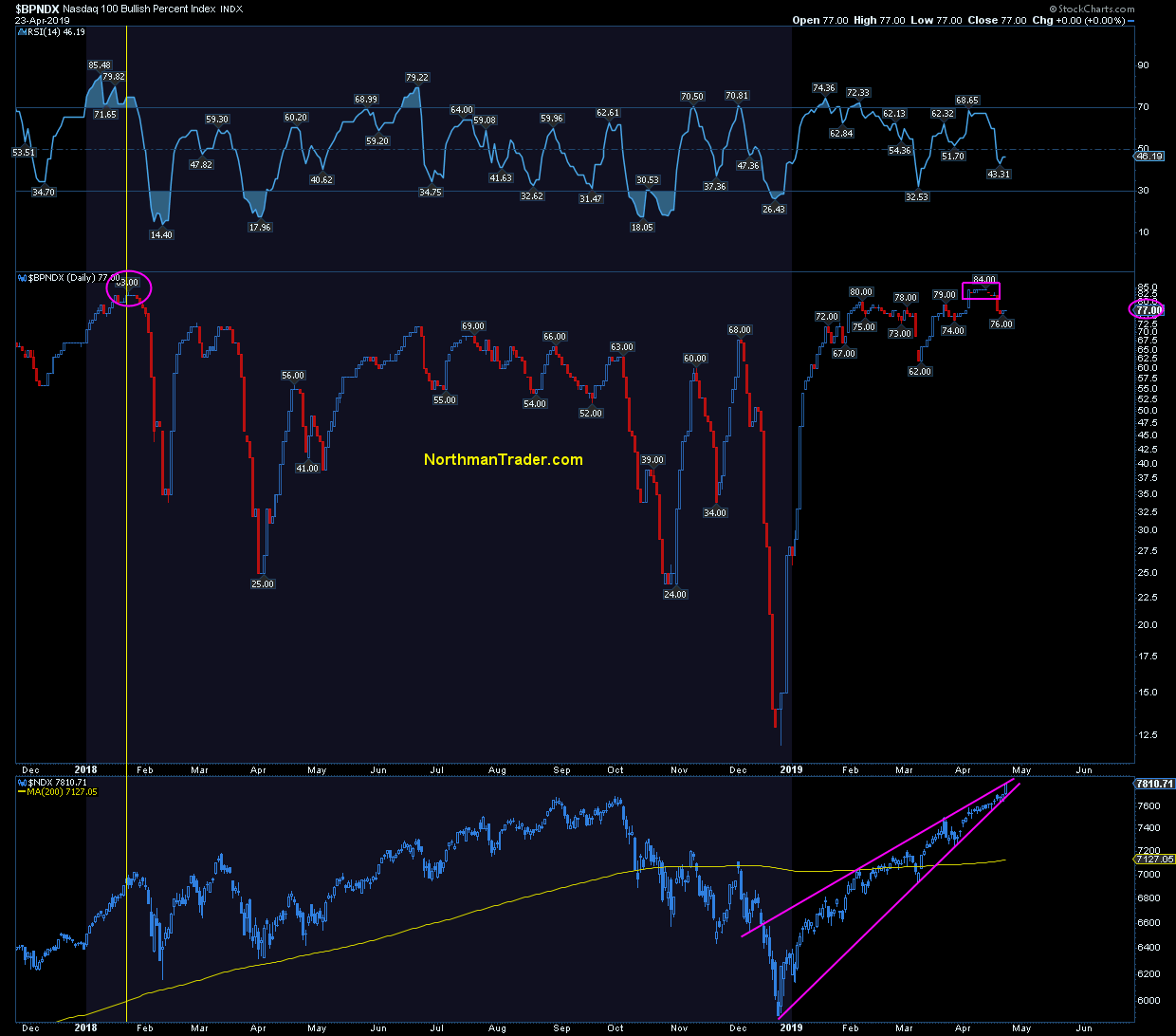

$BPNDX? What rally?

And then there’s that:

$NDX:

101.988 – highest weekly MACD upside deviation ever.

Ever is a long time.

You can choose to believe this is sustainable, or you may not. pic.twitter.com/a3O7BKPixm— Sven Henrich (@NorthmanTrader) April 23, 2019

As I’ve said before: As long as nothing breaks this can continue and the weekly $SPX chart above suggests where this could be headed.

I’ve learned a long time ago not to argue with drunks at the bar. And if history is any guide they’ll chase tech until the heat peels the skin off their faces. And then everybody gets burned.

Keep watching that wedge. It reeks of blow-off.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2ICLoFx Tyler Durden