Following two strongish coupon auctions, with both the 2Y and 5Y stopping “on the screws” earlier this week, moments ago the Treasury sold $32 billion in 2Y notes in the weakest auction this week. The offering priced at 2.426%, up from the 2.281% in March which was the lowest since 2017, and also a 0.5bps tail to the 2.421% When Issued.

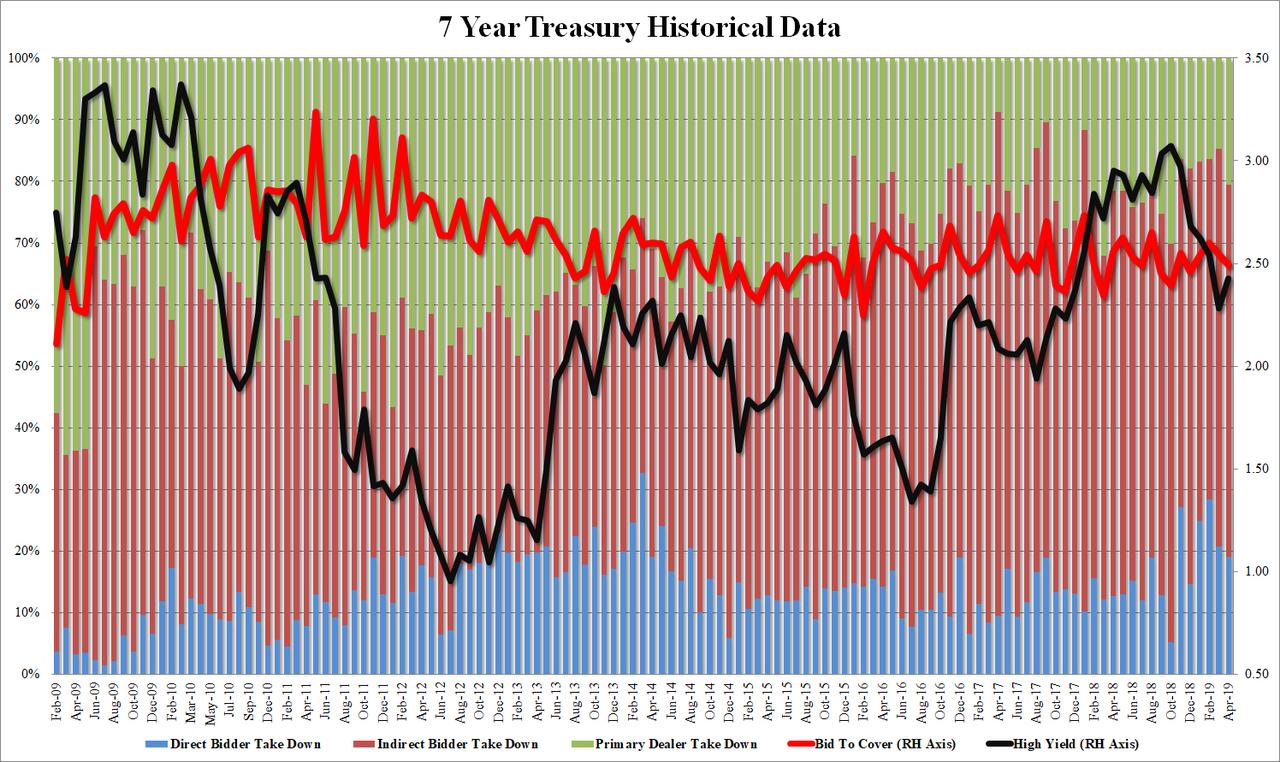

All the internals also priced just below the recent average, with the Bid To Cover sliding from 2.54 to 2.49, below the 6 month average of 2.51. Directs were allocated 19.1%, the lowest since December, and below the 20.1% six auction average. Indirects took down 60.4%, also a drop from last month’s 64.5%, while Dealers were left with 20.6%, the highest allotment since October 2018.

Overall a mediocre auction, and one which printed just as the 10Y yield had risen back near session highs, although it wasn’t so bad as to move the market.

via ZeroHedge News http://bit.ly/2W5Gd41 Tyler Durden