Since Wall Street banks started re-entering the market for synthetic CDOs, securities that are remembered by some as one of the worst excesses of the pre-crisis era, the market for synthetic CDOs is booming once again, as the Financial Times reported on Friday.

But, before observers start squawking about how the rapid growth in both synthetic and traditional CDOs is a ‘sign of the top’, the banks and their risk managers would like you to hear them out: These products are much safer than their crisis-era counterparts, they say, in part because, this time around, they’re tied to corporate debt, instead of risky mortgage bonds.

And as any regular Zero Hedge reader would probably know, the US corporate debt market is sound, deeply liquid and in no way resembles a ticking time bomb with enough exposure to precipitate a re-run of the crisis.

Wall Street banks who are issuing the synthetic CDOs (a group that includes Citigroup, BNP Paribas and Société Générale while Barclays) insist that they are exercising “prudent risk controls” this time around. Meanwhile, hedge funds like Anchorage Capital Group and Fortress Investment Group who have muscled into the market for issuing CDOs, believe the business will prove profitable during the next downturn, Bloomberg reports.

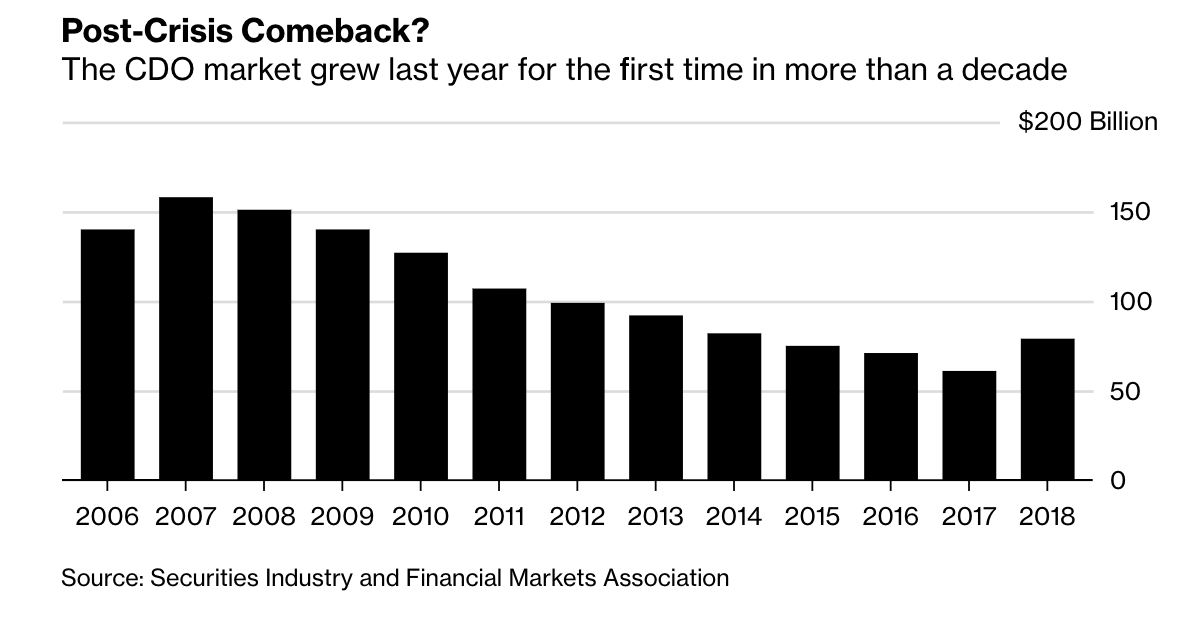

Though the CDO market remains smaller than its rival CLO market, it grew last year for the first time since the financial crisis.

Risk managers for funds issuing CDOs and Wall Street banks expanding their synthetic business agree that the securities are much safer than their crisis-era analogues, in part because they’re tied to corporate bonds, a more stable market – at least in theory. Though some would disagree.

“It’s almost beyond belief that the very same people that claimed to be expert risk managers, who almost blew up the world in 2008, are back with the very same products,” said Dennis Kelleher, chief executive of advocacy group Better Markets.

And as far as synthetic CDOs are concerned, the stigma from the crisis has lingered.

“As soon as you think synthetic CDOs, you think of the financial crisis. It has taken investors some time to get over that,” said Peter Tchir, chief macro strategist at Academy Securities. “On a scale of one to 10, with one being very cautious and 10 being very aggressive, this is only around a five.”

In case you weren’t trading securities during the Bush era, or were simply too young to remember the financial crisis and the esoteric credit products that contributed to the near-collapse of the global financial system, here’s a quick explainer:

As buyers scramble for yield as credit spreads collapse, one can’t help but wonder…have we reached the point where savvy investors are willing to ‘short everything they touch’?

via ZeroHedge News http://bit.ly/2PJpK3g Tyler Durden