Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

Many of Chicagoland’s elite know exactly how to pass the property-tax buck onto other residents. For decades they’ve used their powerful connections to cut their own property tax bills and push the costs onto other unsuspecting residents. And that’s left many lower-income homeowners footing ever-larger tax bills.

The latest, most blatant example is Gov. J.B. Pritzker’s removal of toilets from one of his two Chicago mansions. Pritzker ripped out the toilets and convinced then-Cook County Assessor Joseph Berrios the home was “uninhabitable.”

That move tanked the assessed value of the home and reduced Pritzker’s property tax bill by nearly $100,000. His tax savings became tax hikes for other homeowners.

While Pritzker’s actions are scandalous, they are nothing new in Illinois. House Speaker Mike Madigan and Chicago Alderman Ed Burke’s law firms have been helping commercial property owners in Chicago lower the assessed values of their buildings for decades, to values far lower than the buildings are worth. That’s where the big dollars are, as we highlight later in this piece.

But Pritzker’s actions exemplify exactly how the system works. Learn the tricks, “torture the data,” hire a well-connected lawyer and get the assessor’s buy-in. And just like that, a tax bill is cut.

Smaller tax bills for some doesn’t mean a local government takes in less in taxes. Instead, the city and county’s remaining residents are required to make up the difference.

That problem – how lower-income homeowners have been hurt by tax shifting – was well documented by the Tribune in 2017 in a four-part series covering the full extent of the assessment process and its corruption.

The struggling residents in Chicago’s south suburbs have suffered the most from the unfair assessment process. Wirepoints recently highlighted how residents in that area are now living with collapsed home prices and sky-high effective property tax rates that sometimes reach double digits.

Using the system

Pritzker used the corrupt system run by Berrios to successfully lower the assessment on his Chicago mansion back in 2015. The mansion was originally valued by the assessor at over $6 million. That was until Pritzker had the toilets removed.

Under a murky rule that allows properties to be deemed “uninhabitable,” Berrios lowered the assessed value of the property to just under $1.1 million. That dropped Pritzker’s total tax bills over several years by a total of more than $330,000 – much of which was passed on to other residents within the same tax jurisdictions in the form of higher tax bills.

Pritzker eventually paid the money back, and the scandal didn’t stop him from getting elected governor. But it could add Pritzker to the growing list of indicted Illinois governors. As it turns out, the feds have been investigating the whole toilet scheme since October of last year.

Regardless of how that plays out, Pritzker’s actions provide the perfect example of how property scams and deals impact other people’s properties, their taxes and their lives.

That same tax shift happens when lawmakers like Madigan and Burke engage in the appeal process through their high-powered law firms. They use their influence and relationships with politicians like Berrios – the assessor was also simultaneously the Cook County Democratic Party Chairman for many years – to bring down the property values of major Chicago properties.

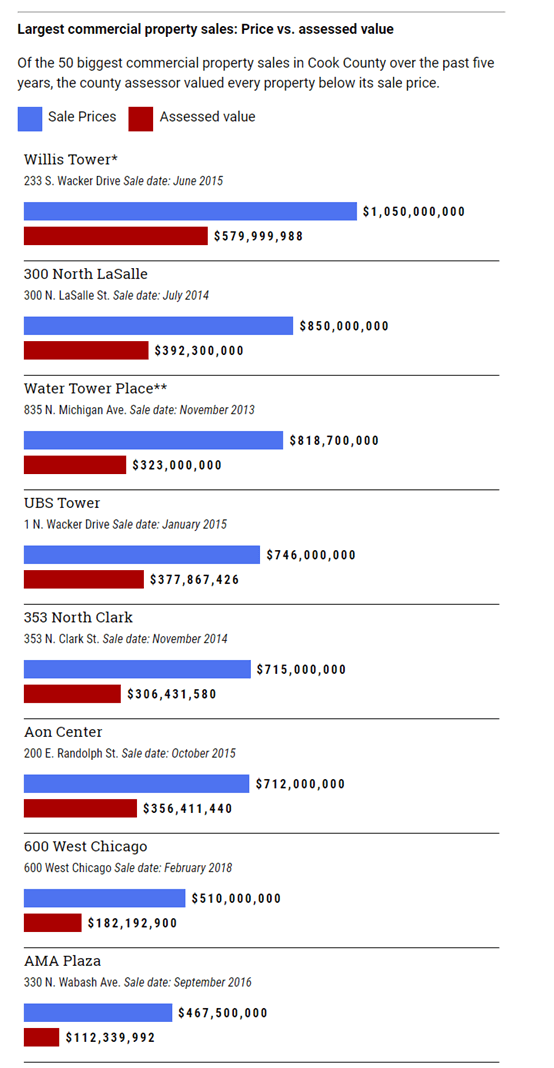

Crain’s recently looked at how top commercial properties in Chicago are assessed and compared them to the recent sales prices of those same buildings. The flaws in the process – and the impact they have on Chicagoland residents – becomes evident quickly.

Crain’s analysis looked at:

“the 50 biggest property sales in the county over the past five years and compares the sales prices with the values of the same properties as estimated by the assessor’s office. The gap is stark: The prices of all 50 properties add up to $17.1 billion, while the assessor values them at only $7.8 billion.

The difference between sale prices and assessments, according to Crain’s, was $9.2 billion. That’s equivalent to the cost of more than 40,000 median-priced Chicago-area homes.

Those billions in lower values resulted in higher tax bills for residents across Cook County.

Beyond Cook County

Low skyscraper assessments in Chicago also have an impact beyond Cook County. The more poor Chicago can make itself look, the more it gets in state education subsidies. And that means there’s less funding to go around for other more needy districts around the state.

On the flip side, communities in South Cook are disproportionately harmed. Their proportionally higher assessments mean that school districts in those communities get less state money than they otherwise would.

Simplicity and transparency

Cook County’s new Assessor, Fritz Kaegi, says he’s committed to reversing the corruption inherent in the assessment process. We’ll see how that turns out.

At the very least it’s going to be a messy few years as the relative value of assessments shift from South Cook to wealthier suburbs and from residential to commercial properties.

Whatever his methods, Kaegi’s end result has to be an assessment process and a property tax system that is more simple and transparent.

If Kaegi and other officials can’t accomplish that, then those willing to cheat the system will continue to find ways to push the nation’s highest property taxes onto ordinary Illinoisans.

And that will continue the flight of Chicagoans out of the city.

Read more about Illinois’ property taxes and the crisis in South Cook and beyond:

-

Illinois’ lethal combination: Rising property taxes and stagnant incomes

-

Sticker shock: Some New Trier residents stunned by property assessments

-

Chicago’s south suburbs struggle under Springfield’s continuing neglect

-

Beyond Harvey: Many Illinois municipalities running out of options

via ZeroHedge News http://bit.ly/2Ll7GxE Tyler Durden