Authored by Sven Henrich via NorthmanTrader.com,

The 2019 market uptrend is officially shattered. Yes China trade concerns are the trigger, but as I always say: Technicals paint a picture of things to come and when things line up markets will find a trigger to confirm the technical picture.

The break of these trends may have significant consequences yet to be realized and I’m stating this with eyes wide open to the binary situation markets are confronted with later this week in regards to Chinese tariffs on Friday: Will China blink, will Trump blink or will everybody dig in their heels? The outcome to these questions can result in either a massive relief rally or significant more downside.

Let’s evaluate the charts and understand the context.

I’ve been publicly warning about rising wedge patterns stating that they don’t matter until they do but when they break they can result in the release of a lot of energy.

Take these 2 prominent examples:

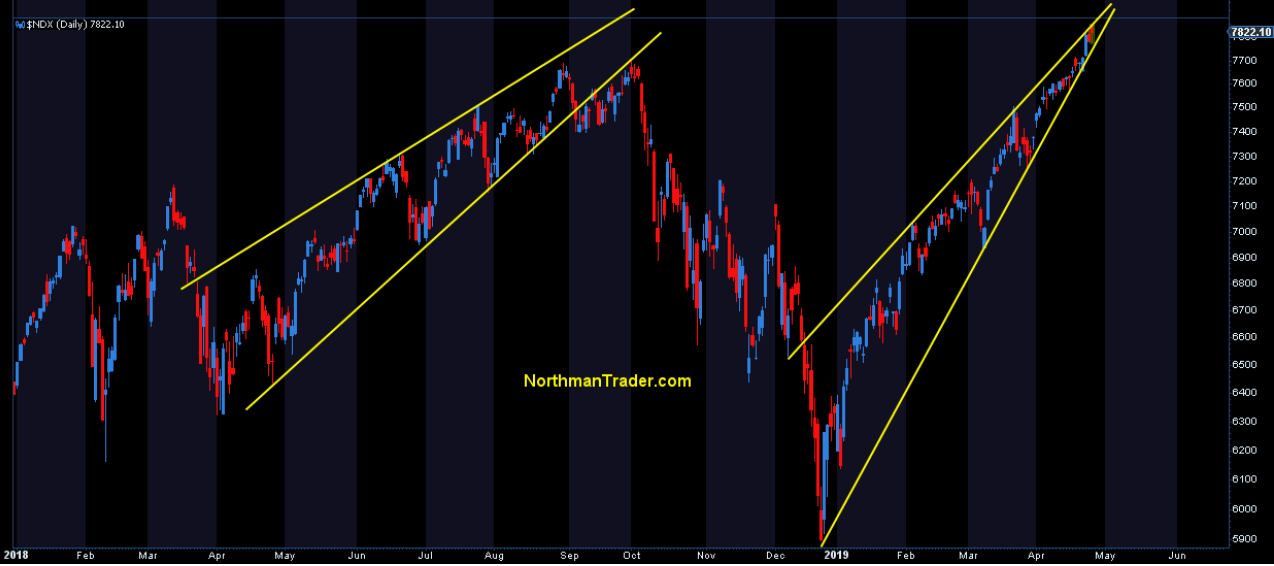

The $NDX rising wedge, most recently I outlined it in Danger Charts:

The point was the pattern was narrowing, unsustainable and was practically begging for a break and if it does watch out. We go the break last week and confirmation today:

In the same article I pointed to the $VIX wedge compression, oh so similar to the previous compression phases we’ve seen in recent years:

And boy, did the $VIX release a lot of energy coming out of the pattern:

And of course there were warning signs that something was about to happen.

Take the trend line in the $DJIA, it broke on April 25:

Something just broke on $DJIA pic.twitter.com/UbF71OytnZ

— Sven Henrich (@NorthmanTrader) April 25, 2019

A chart that was again highlighted in Trend Breaks:

That sent a signal that something was technically amiss, a leading indicator if you will. Of course we saw further bounce action in it, but the signal produced sizable results by filling 2 of the lower gaps:

The $DJIA specifically here is at an interesting spot everyone should be aware of. Unlike $SPX and $NDX it never made a new high and all of a sudden the rejection here raises larger concerns:

A potential major topping pattern.

And now that $SPX has rejected its marginal new highs the onus is on bulls to prove their case.

As I mentioned at the outset a turnaround on the China trade deal can produce a major relief rally at any moment. But clearly markets are rattled and success is not guaranteed either.

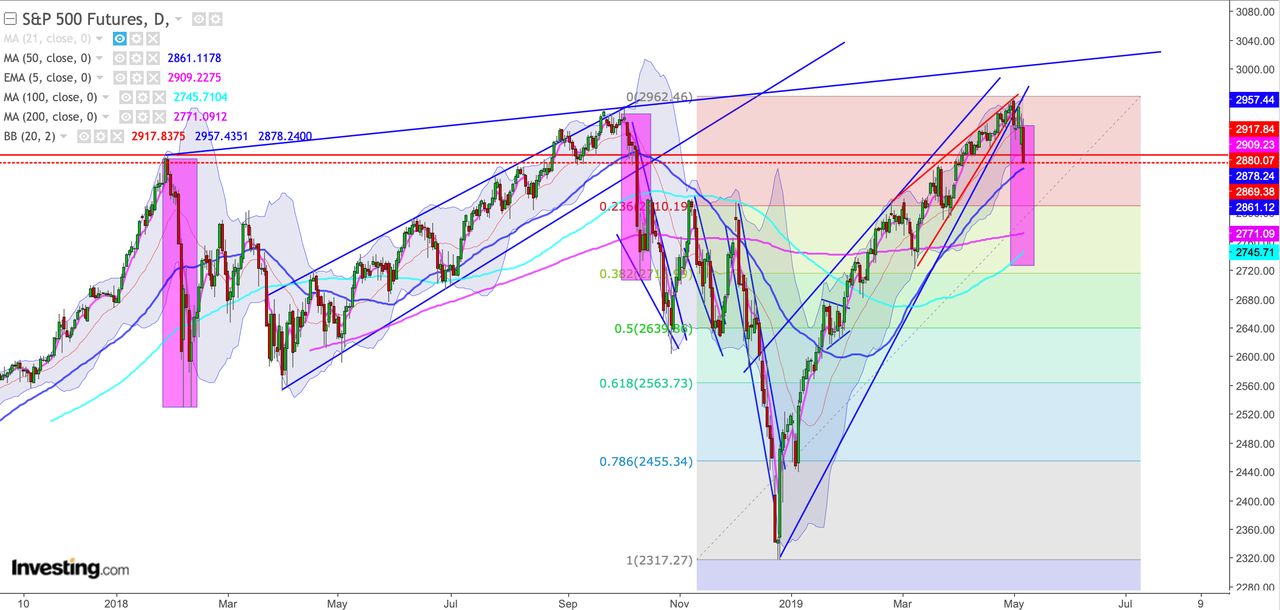

Hence further downside risk must be considered as well, especially since these patterns above have a lot of room to go lower should markets turn in earnest. While the $VIX is getting short term overbought $ES suggests risk of a repeat of February 2018 and October 2018:

Given the massive run markets have experienced in 2019 such a corrective move, should it unfold, should not surprise. Markets are now short term oversold and bounces and rallies are to be expected, but this week’s binary market event will likely decide the next big move into next week.

Be aware though, however these trade talks turns out market participants are on notice: The 2019 trend is officially shattered and the charts told you ahead of time that it was coming. Bulls have a lot of technical damage to repair and require new highs or are at risk of being confronted with major potential topping patterns.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2V9isqy Tyler Durden