Overall, U.S. total cross-border investment was an $8.1 billion outflow in March, consisting of:

-

Foreign net selling of Treasuries at $12.5b

-

Foreign net selling of equities at $23.6b

-

Foreign net buying of corporate debt at $1.1b

-

Foreign net buying of agency debt at $4.7b

The biggest seller of Treasuries was our friends to the north – Canada – who dumped $12.5 billion, the biggest drop since July 2011.

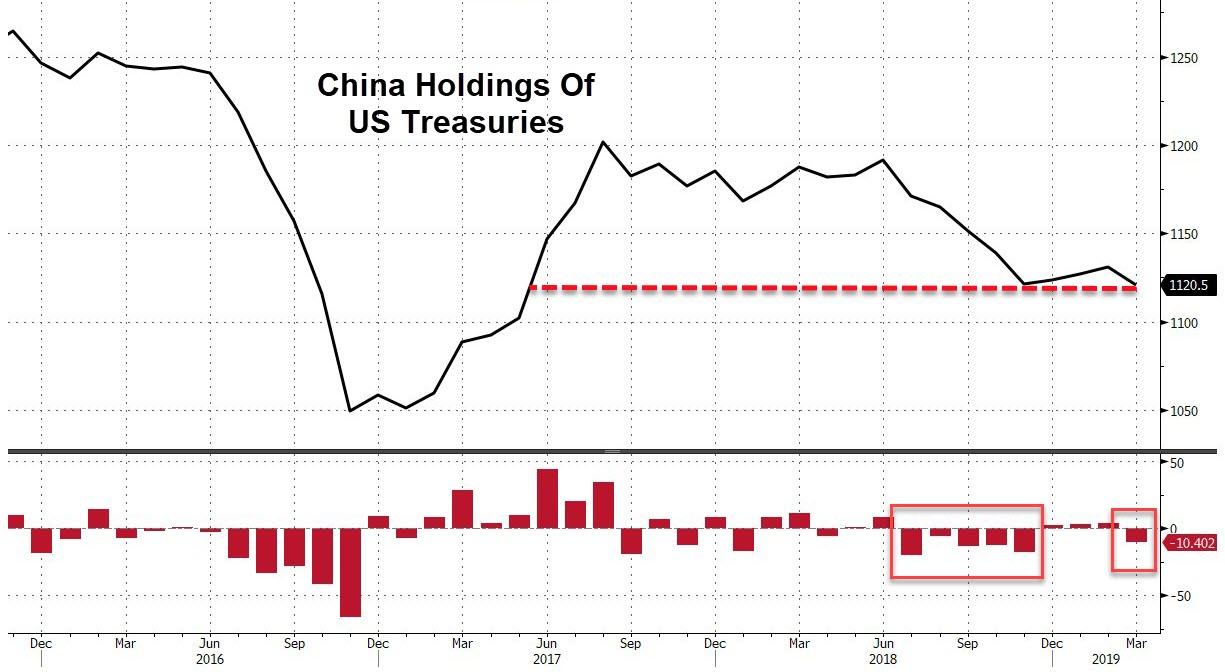

And China was the second biggest Treasury seller (which comes at an awkward moment after the proxy threats in the last week).

After 3 months of buying, China resumed its previous trend of selling US Treasuries in March, dumping over $10 billion worth taking the holdings to their lowest since May 2017.

The Cayman Islands were the month’s biggest buyers (typically proxy for hedge funds), adding $9.4bn

Along with Singapore, India, Japan, Hong Kong, and Belgium (often considered another proxy for China).

via ZeroHedge News http://bit.ly/2EchkwJ Tyler Durden