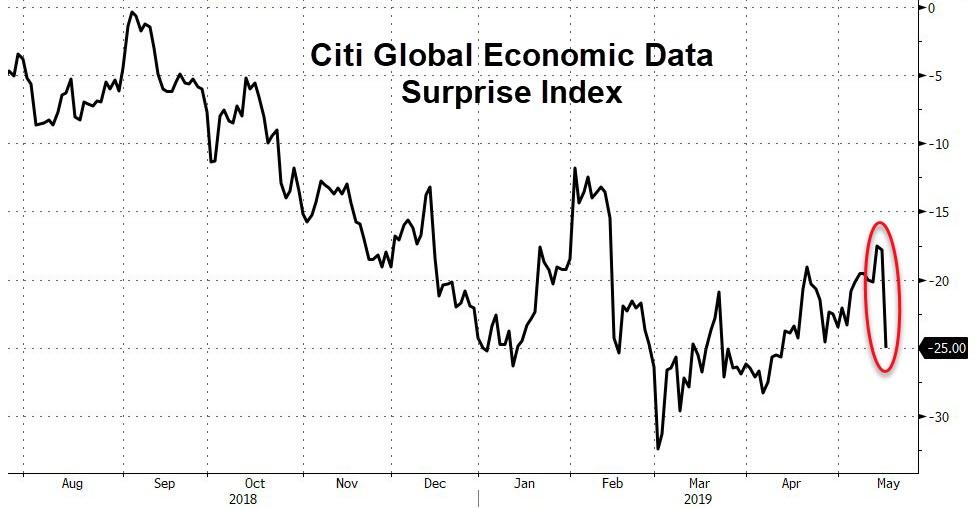

The last 24 hours in global economic data has been the second biggest disappointment in over 5 years…

So it all makes perfect sense that stocks were bid…

Chinese stocks rallied because bad news (dismal industrial production and retail sales) is good news for more stimulus, right? because that has worked so well before?

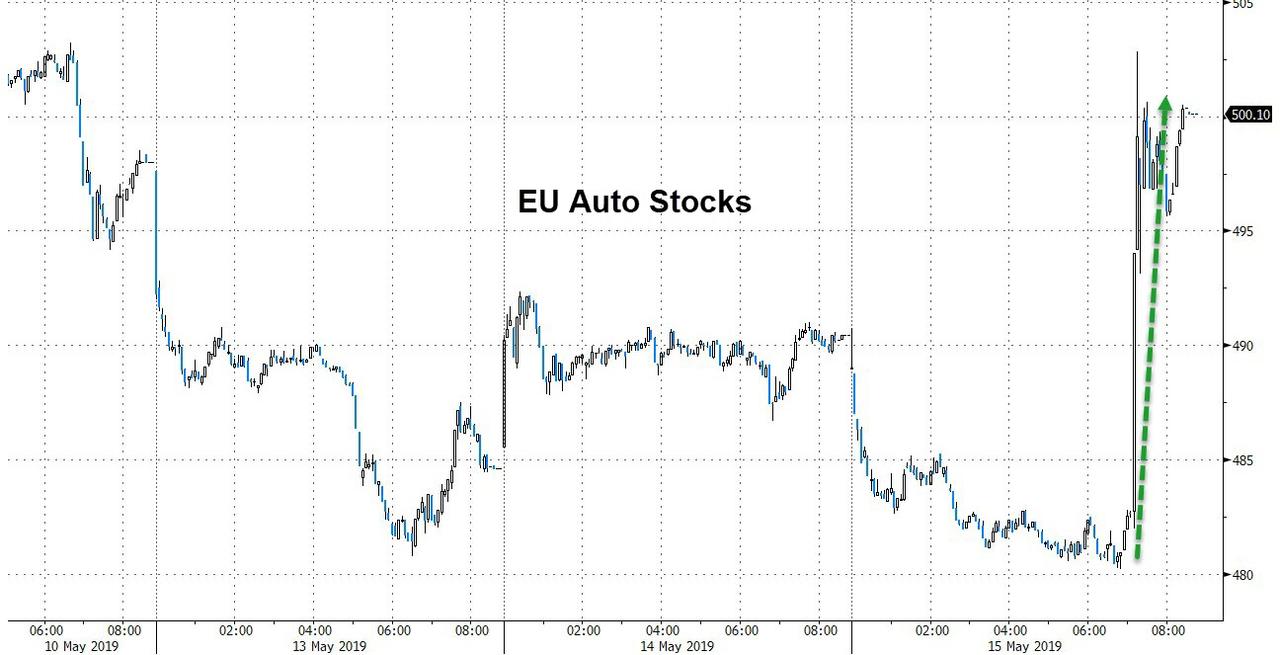

European stocks also soared after headlines reported that Trump may delay auto tariffs by six months…

EU Autos soared on the headlines…

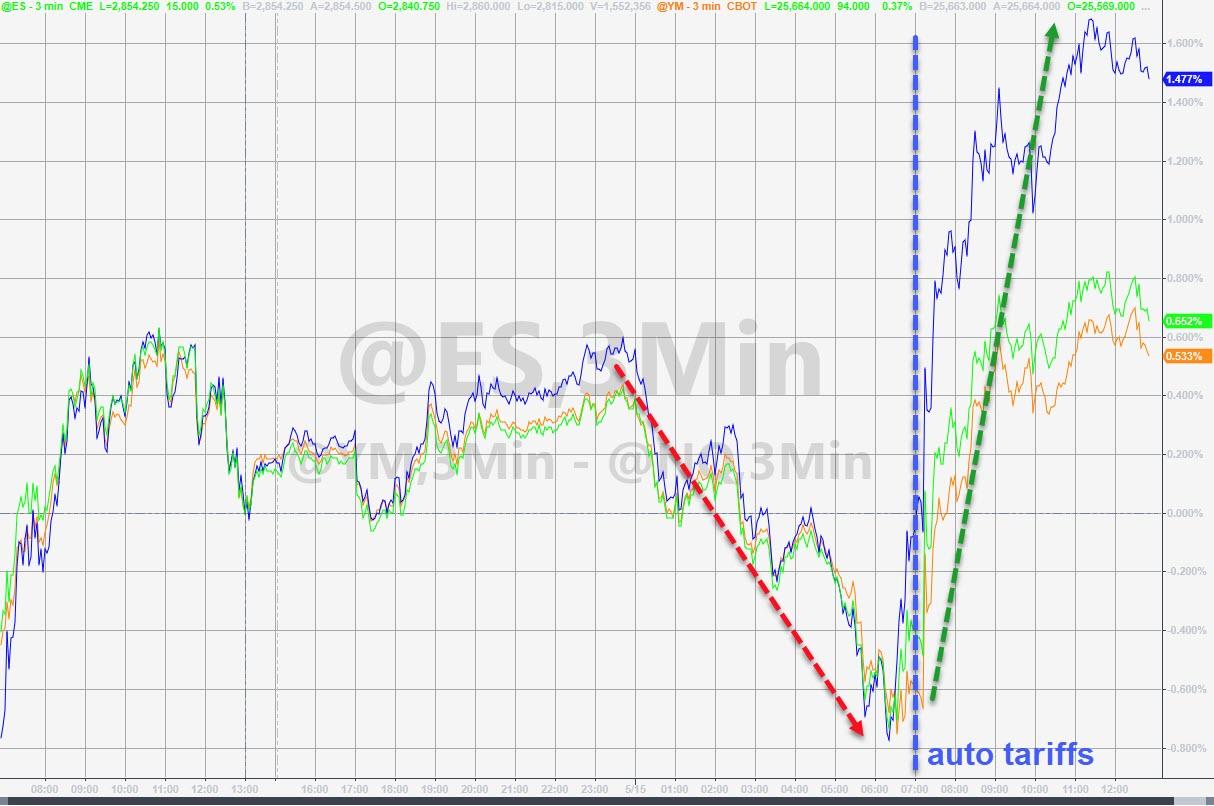

US markets were a combination of shitty data (yay easy Fed) and delayed tariffs (yay buy auto makers) that levitated stocks in a deja vu move from yesterday…

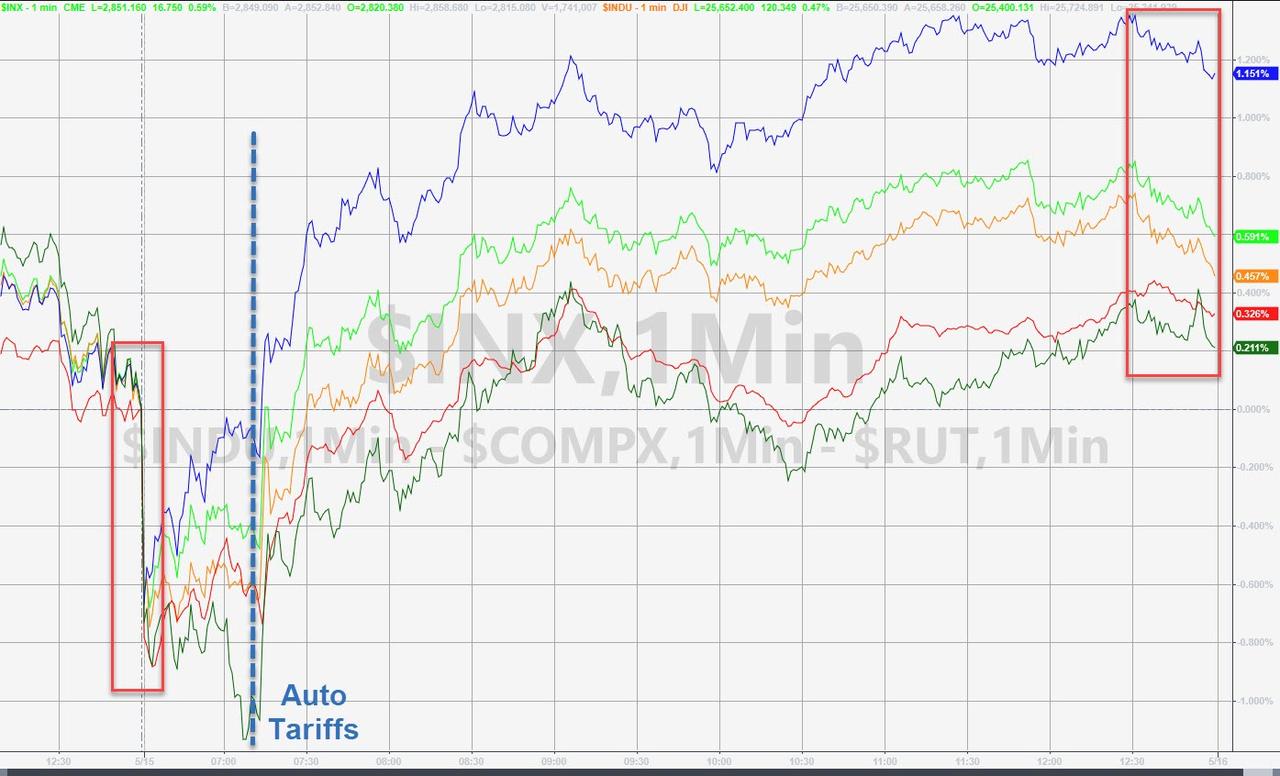

The tariff delay headline hit at 1010ET

Nasdaq led the bounce followed by S&P after a weak overnight and open…and following yesterday’s pattern of a dead cat bounce, it was an ugly close…

Lower lows and lower highs…

Big short squeeze delivered the gains today…again…

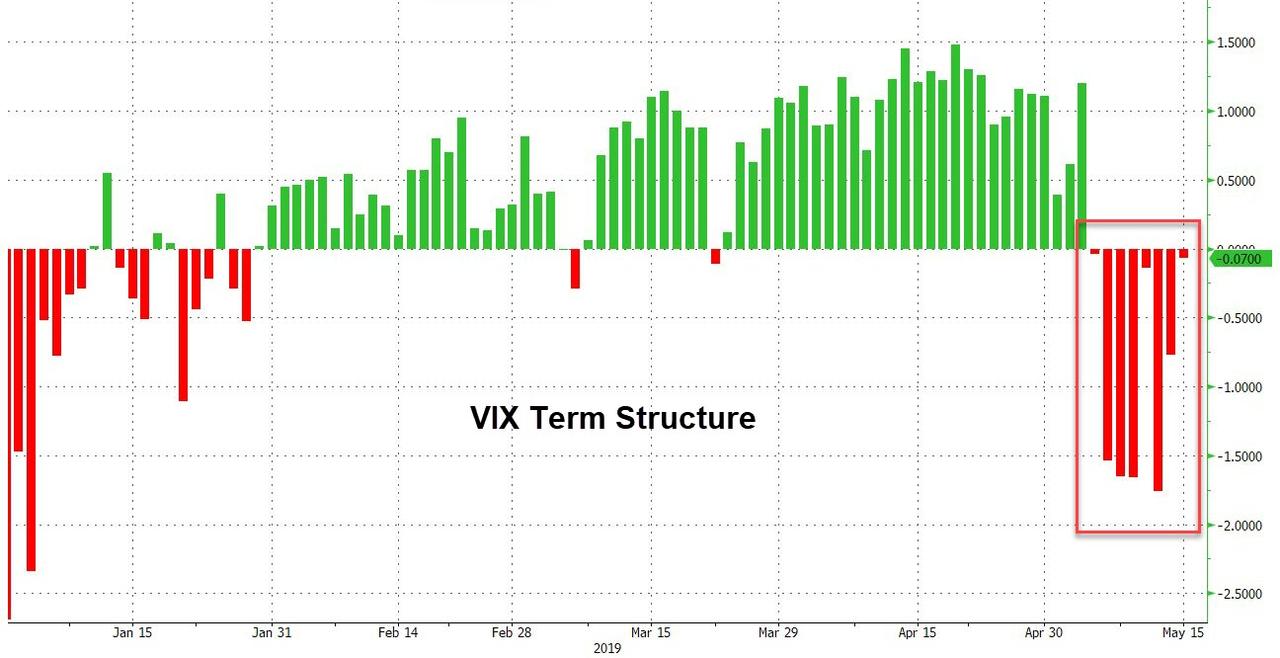

The Vix Term structure remains inverted for the 8th day in a row…

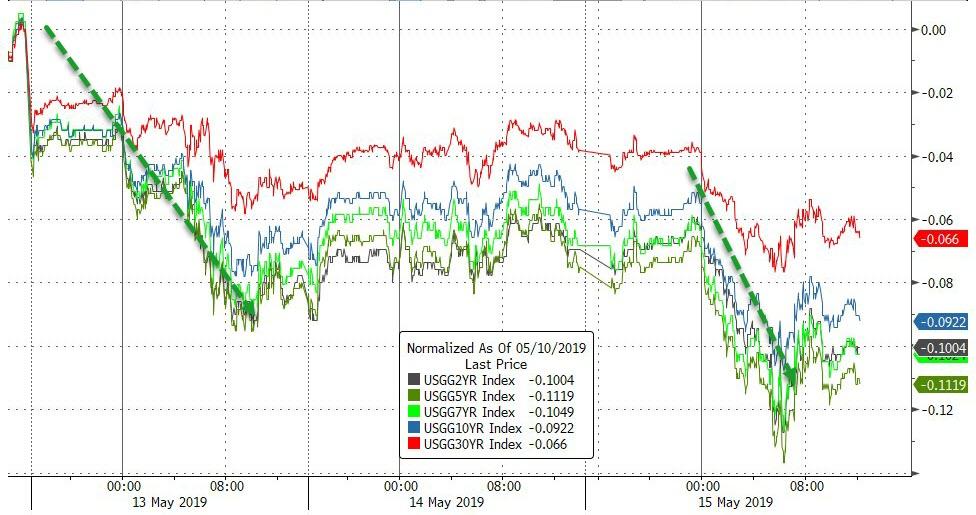

There was a notable decoupling between bonds and stocks on the day

Treasury yields were down around 3bps across the curve today, even as stocks soared

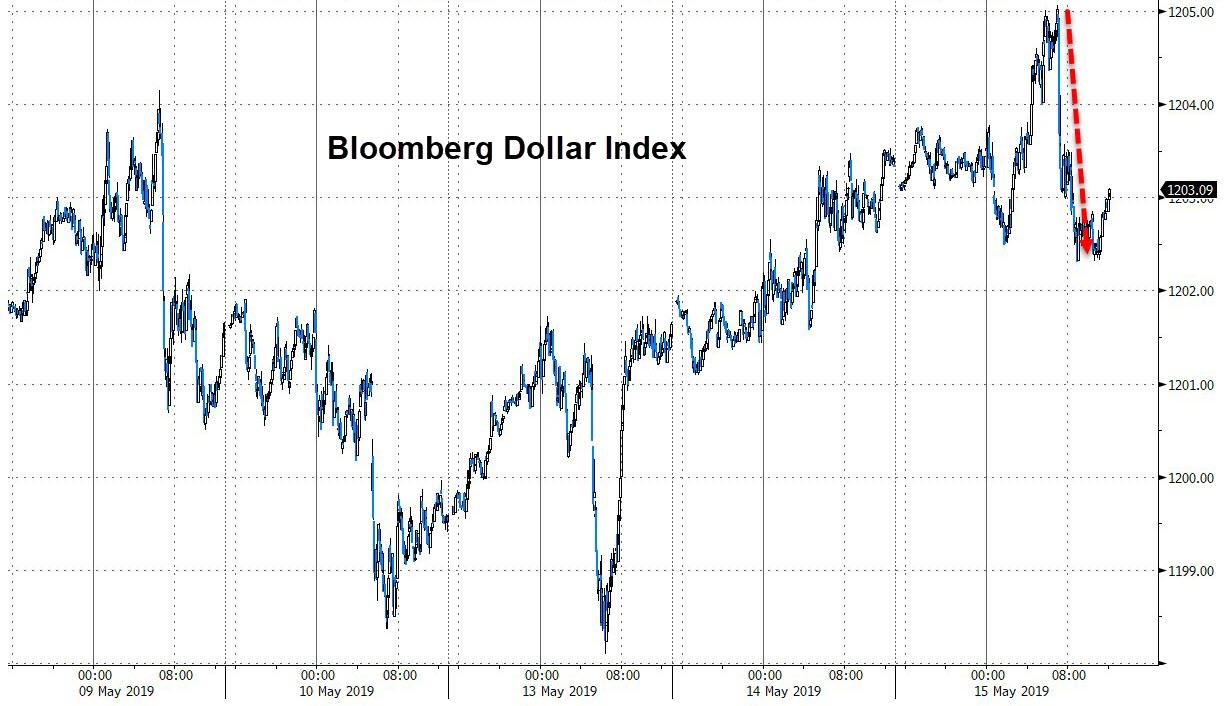

The Dollar Index extended gains overnight but plunged when the auto tariffs headlines hit sparking a big bid for Euros…

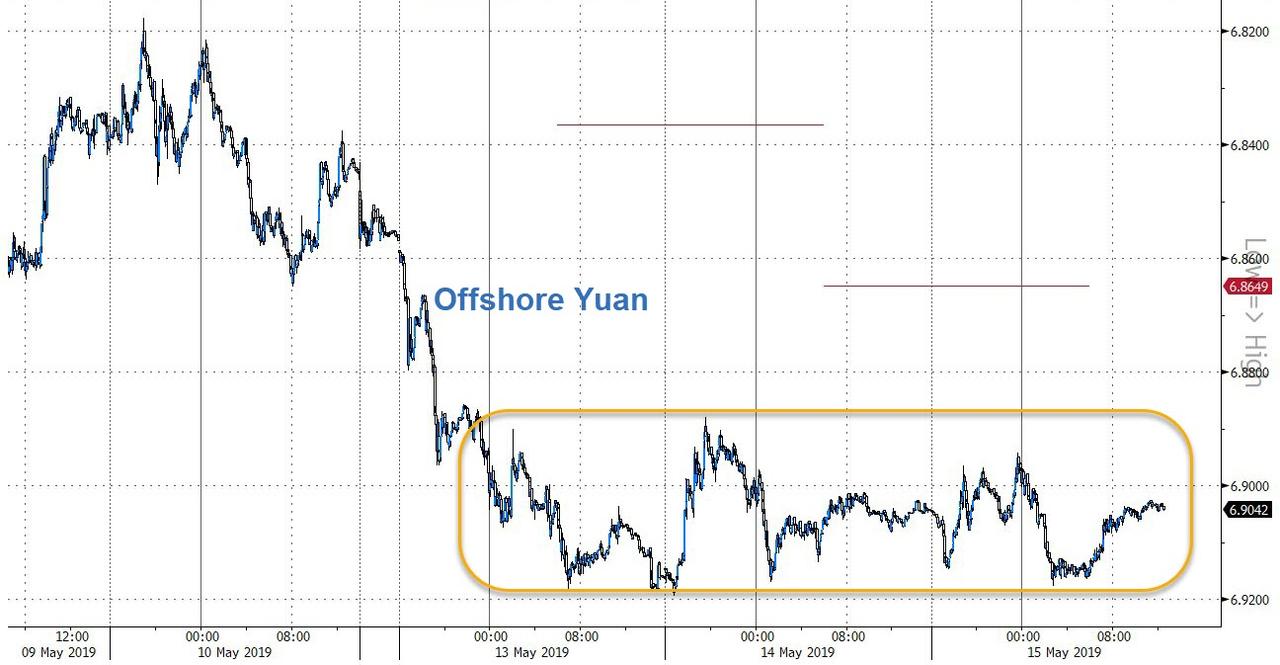

China is managing offshore yuan very well the last two days…

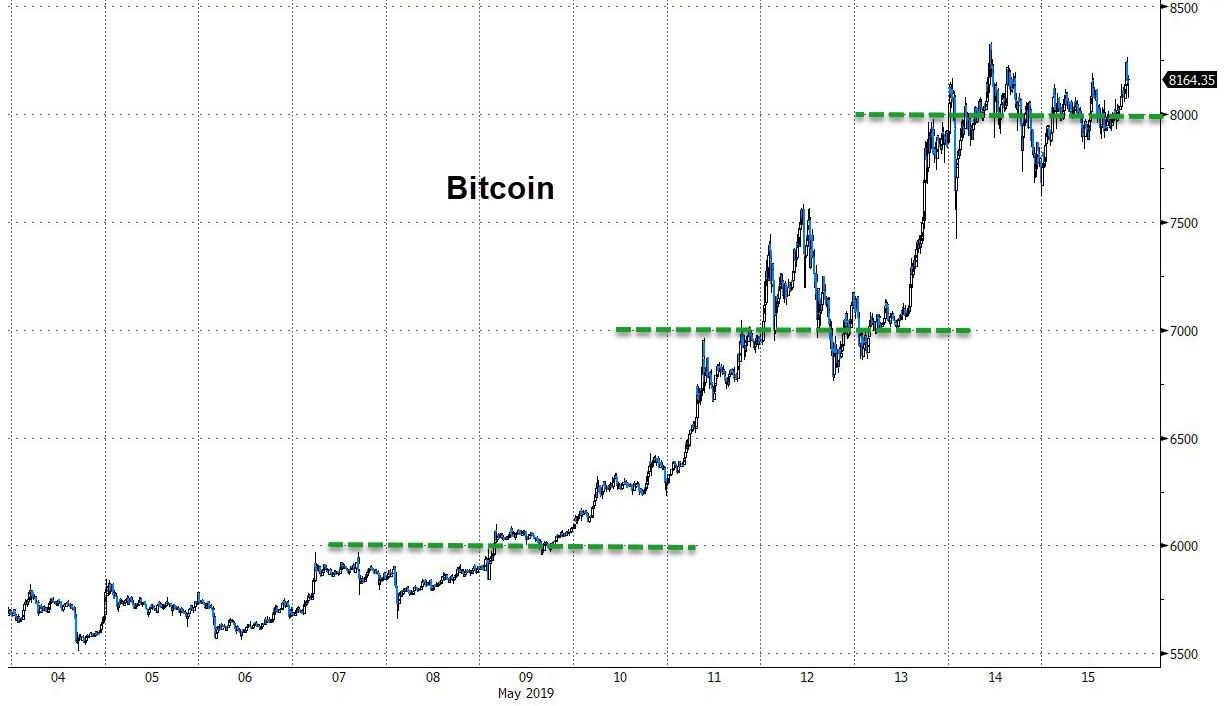

Cryptos continued to rally…

With Bitcoin back above $8000…

In keep with the rest of the idiocy, copper and crude rallied after the crap china data (more stimulus). PMs trod water…

Finally, global money supply and fundamentals are no longer supporting stocks…

And despite all the talk about how bad Europe is compared to ‘green-shoot’-ing America – US markets are now priced for a more dovish Fed this year than the ECB…

via ZeroHedge News http://bit.ly/2Vr9zss Tyler Durden