Free market groups are escalating their fight argue against the extension of the federal electric vehicle tax credit. In a letter to the leaders of the House and Senate tax writing committees, 34 groups claim that “…while the tax credit is misguided, at least its drafters had the wisdom to ensure that it applied only to the first 200,000 vehicles from a given manufacturer.”

The letter cites Sen. Orrin Hatch’s original comments upon introduction of the bill, where he said: “I want to emphasize that like the tax credits available under current law for hybrid electric vehicles, the tax incentives in the FREEDOM Act are temporary. They are needed in order to help get these products over the initial stage of production, when they are quite a bit more expensive than older technology vehicles, to the mass production stage, where economies of scale will drive costs down and the credits will no longer be necessary.“

The letter says that the restraint referred to by Hatch “should not be jettisoned now”. In addition, the letter makes the points that:

- Subsidies for electric vehicles are unpopular. As shown in recent polling, 67% of voters believe they should not be forced to subsidize electric vehicle purchases. Furthermore, 72% of voters do not trust the federal government to make decisions about what types of vehicles to subsidize.

- Subsidies for electric vehicles overwhelmingly benefit the rich. A recent study found that 79% of electric vehicle tax credits were claimed by households with an adjusted gross income of more than $100,000 a year. It makes no sense for the federal government to subsidize the purchases of wealthy individuals. Even Treasury Secretary Steve Mnuchin has made it clear that the rich don’t need and shouldn’t be able to take advantage of this tax loophole, stating, “I own a Tesla, and I didn’t need the $7,500 tax credit.”

- Electric vehicle subsidies are a wealth transfer to California at the expense of all other states. In 2018, over 46% of new nationwide electric vehicles sales were in California alone. In contrast, just 2.7% of new electric vehicles were sold in Massachusetts, and only 0.3% were sold in Iowa. Given that California represents only about 12% of the U.S. car market, this disparity means that the other 49 states are subsidizing expensive cars for Californians.

- Electric vehicles are not cleaner than modern internal combustion engines. As explained in a recent study from the Manhattan Institute, new internal combustion engines combined with low-sulfur gasoline emit barely any pollution. Indeed, electric vehicles, which draw power from the electric grid, likely produce more total pollution than new internal combustion engine vehicles. An even more recent study from the IFO Institute in Germany, which looked at life cycle carbon dioxide emissions of a new electric vehicle and a comparable new diesel vehicle, finds that even for just carbon dioxide emissions the electric vehicle does not outperform the diesel internal combustion engine.

- Expanding the electric vehicle tax credit will be a net harm to consumers. A recent study from NERA economists found that extending the tax credit reduces total personal income of all U.S. households by $7 billion in 2020 and $12 billion in 2035. Between 2020 and 2035, the net present value reduction in personal income of all U.S. households would be about $95 billion, or about $610 per household.

- Removing the cap on expenditures would be fiscally reckless. Limiting the tax credit to the first 200,000 cars provides an automatic limit on spending. With no cap, the liability to taxpayers is almost unlimited. Congress should not pile billions more in costs onto taxpayers, small businesses, workers, and ultimately, on future generations.

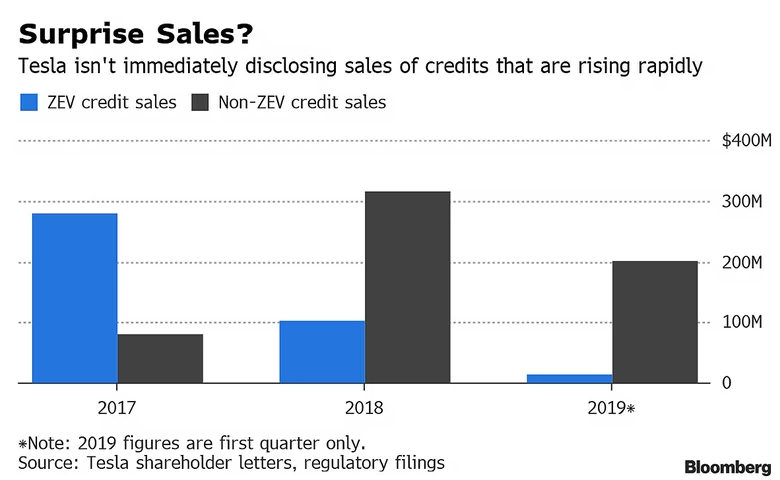

Why is this important? Because, tax credits such as these, have long been the lifeblood for EV companies like Tesla, who recently neglected to mention up-front that a major source of the company’s Q1 revenue was from the sale of about $200 million in ZEV credits.

The company has also noted in its most recent 10-K:

“The unavailability, reduction or elimination of, or unfavorable determinations with respect to, government and economic incentives in the U.S. and abroad supporting the development and adoption of electric vehicles, energy storage products or solar energy could have some impact on demand for our products and services.”

The letter was led by the American Energy Alliance and signed by groups like the Caesar Rodney Institute, the Center for Freedom and Prosperity, the Center for Individual Freedom, ALEC Action and Americans for Limited Government.

You can view the full letter here.

via ZeroHedge News http://bit.ly/2wgwXP7 Tyler Durden