Blain’s Morning Porridge, submitted by Bill Blain

“When May is Gone, Put Your Buying Boots On…”

Reading the obituaries of the extraordinary Niki Lauda y’day I came across this great line referring to his rivalry with Hunt the Shunt: “Hunt died of a hard-earned heart attack in 1993”. What a succinct summation in a single phrase of Hunt’s marvellous life, and the era!

The sun is shining, so let me go on a short diversion as I compose the porridge on my way to work… This morning I walked along the highway to our local London polling station…. and kept walking.

Why bother? I am not going to vote in today’s European elections.

I can’t vote for Labour because I distrust Jeremy Corbyn’s leadership style and ability, and am disappointed the MPs lacked the guts to rebel to accept/positively amend the deal that was on the table.

I am not going to vote Conservative because the naked ambition of a few, and the lack of responsibility of the many, sickens me.

I am not going to vote Liberal because they are wrong – a vote is a vote is a vote. (While they may be very nice people, but they are generally wrong about everything.)

I am not wasting a vote on the Independents, although I have a great admiration for Chuka Umunna (having personally seen him face down with dignity an abusive slur at Waterloo one day).

Nether will I vote for the Brexit Party? Please… Nigel is a charmer, but not getting my vote because I see no truth in his one-dimensional vision of Europe which would set utterly the wrong basis for our future with our near and dear neighbors.

And, after their decent into darkness, a vote for UKIP would be a betrayal of what is so wonderful about the UK – our multicultural, cosmopolitan, yet still essentially British society.

If I could vote SNP, I might… but only to annoy my colleagues..

I won’t vote in today’s European election… unless anyone can persuade me otherwise. 😊

AND IT DOESN’T MATTER.

The UK is doing ok! There is some nonsense that the problems of Jaguar, the collapse of British Steel and the poor quality of M&S sandwiches is down to Brexit. Bollchocks.. We will do better when this Brexit nonsense is done and dusted.

Next few days I intend to do some work on opportunities in Sterling. I’ve a gut feel Theresa May is now the signal driving sterling weakness, and her eventual departure (this month, this year…) will be the signal to go long.. Interesting to note that PIMCO has been in buying UK retail parks! I will be back on this theme and its why the headline today is: When May is Gone Put Your Buying Boots On! There is nothing like a cathartic shock to boost sentiment and hike the market.

Politically, it would be positive to get some resolution of broken UK politics – but so many headlines are taking about the last few days of May, and that she will resign shortly, probably mean she will be there for years and years to come.. The number of times pundits have predicted her imminent demise are almost as frequent as the many times as I’ve predicted imminent utter and complete market crash. Neither actually happens!

Meanwhile back in the real world…

Increasingly complex world out there. Economic news is muddled – Japan down a bit, Germany up a bit. What does a strong Modi in India lead to? What about the Fed saying US economy doesn’t justify an ease – hardly a surprise. Get past the noise and work out the direction.

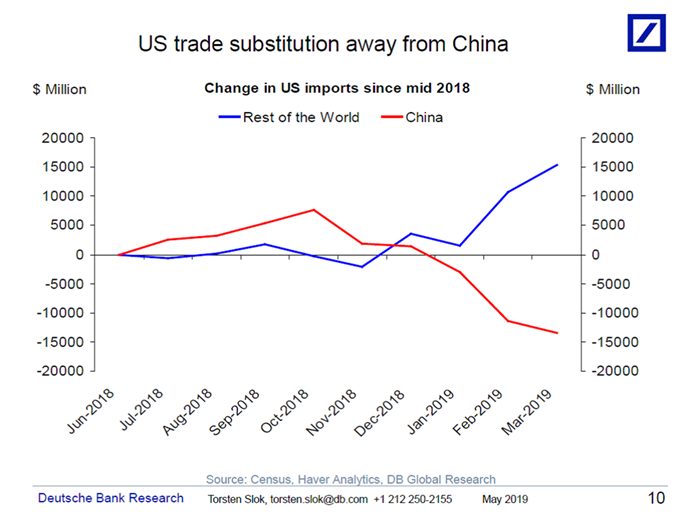

In terms of market action, trade fears really seem to have settled in as the dominant theme on markets. But if markets are simply wondering when there will be a solution, then they may be waiting for the wrong thing. While the mood remains negative as the market waits for a US/China agreement/resolution, maybe the new long-term reality is an increasingly and deliberately bifurcated global economy? The US and its allies vs China. If it sounds familiar – it should in terms of 1945-89. The West won the last Cold War on the same basis – and the economic benefits accrued to the free capitalist states, a theme the Neo-coms are increasingly banding around. You just imagine the scene in the war room: “This is time Mr President..”

Expect to see this theme develop in coming months. This is no longer a trade spat – this is morphing into full economic war. The US is willing to take a short-term hit in the form of higher consumer prices, and welcome inflation, from Chinese imports until global supply chains re-adjust and new domestic and international lines open, knowing the long-term damage is limited. Meanwhile, the hit to China is long-term and directly on production, thus right across the economy right at the most difficult phase of economic transition. Chinese economists are talking about a 1-2% hit to GDP. I suspect much more plus increased domestic social and political tension. Xi is in more trouble than we think.

On the basis Trump could not have come up with such a subtle plan – who did?

More importantly… Maybe it works?

It may take longer than we think – Bloomberg makes an interesting point this morning. The two largest US imports from China left un-tariffed are Laptops and Mobiles – many now assume they are next on the list as the US strategy to Chinese pilfer of IP now seems to be driving a wedge between Occidental and Oriental tech. Maybe not – the damage has already been done… Firms are cancelling tech orders from Chinese firms. But if you think how lucky you are not to own a Huawei, remember where your i-Phone was built.

Great rumors circulating about Apple making a bid for Tesla. How quaint and obvious way to hike the market. Nothing more than rumours… and why would Apple do that now Tesla looks increasingly discredited, the talk is of EV saturation (which I don’t believe), and driverless autonomy looks increasingly further away. These things are the future, and if Apple bides its time – the future for Tesla is much cheaper.

via ZeroHedge News http://bit.ly/2HQPhnn Tyler Durden