Authored by Roy Sebag via GoldMoney.com,

Introduction

The purpose of this paper is to formally address public statements and representations made by Grayscale Investments, LLC (“Grayscale”) and its principal, Barry Silbert, beginning on or about May 1, 2019, through an advertorial campaign entitled: “DropGold,” which was ostensibly designed to educate precious metal investors on the relative advantages of Bitcoin, the digital cryptocurrency invented in 2009, in relation to Gold, the naturally-occurring element (Au) on the periodic table of elements. Before addressing these statements and representations, allow me to begin by sharing with the reader my qualifications in providing this sobering analysis that I hope will sufficiently falsify the core claims made by Grayscale.

Over the past 18 years, I have been a professional investor actively participating in global financial markets. I have managed an investment fund and have founded three publicly traded companies which, together, have created hundreds of millions of dollars in wealth for institutional and retail investors around the world. Over a specific period in my career (2008-2014), I was primarily involved in the extractive industries, investing, owning and exploring for the geological resources in the form of hydrocarbons (Oil, Coal, Natural Gas), base metals (copper, zinc, tin, lead), and precious metals (Gold, silver, platinum, and palladium). The main company and investment vehicle I have been associated with over the recent past is Goldmoney Inc., which owns Goldmoney.com—an online investment platform that safeguards nearly $2 billion of precious metals in 13 physical vaults around the world for nearly 1.5 million clients.

I have been actively involved with Bitcoin and cryptocurrency since their inception, and I have made my involvement public for at least eight years. I have owned and invested in Bitcoin since at least 2010, own multiple cryptocurrency patents, and have founded “BitGold.com,” which was the first blockchain based cryptocurrency-to-physical-Gold platform to reach any meaningful scale. In 2017, I founded Bitfarms, one of the largest proof-of-work cryptocurrency mining operations in North America, and I remain one of its largest shareholders. I am also one of the founders and the current Chairman of Fortress Technologies, which owns and operates a 2.5MW cryptocurrency mine in Washington state. I am a leader in both the cryptocurrency and precious metal industries, with a long-standing track record of success in both. Given this confluence of experience, I believe I am uniquely positioned to provide a well-reasoned, authoritative counter argument to the debate which has recently ensued as a result of the DropGold campaign.

I wish to stress that my desire here is purely intellectual. I abhor the phenomenon of bad information spreading its way into public markets, and feel a responsibility to rectify the public record when I identify a didactic void. It is my sincere belief that the public benefits from first-hand knowledge and lived experience that professionals with backgrounds such as mine have earned, and that people like myself have a shared responsibility to directly contribute to the discourse at hand when these impasses arise through reasoned discussion and debate. When society relies on flawed beliefs and dogmas that can be easily proven to be unfounded, untested, and unexamined, the collective intellect becomes restrained, leading towards significant misallocations of societal resources. Such misallocations have long-lasting effects, which transcend cultures and borders, weakening the social contract we are all party to as members of a global cooperative civilization.

The DropGold Campaign

The DropGold advertorial campaign has, in my personal view, been poorly conceived, and–as I have repeatedly stated via social media–is so preposterous in its nature as to be akin to uttering phrases like “drop Oxygen” or “drop Copper.” In short, I believe this campaign will not age well, and that it runs the risk of ultimately undermining the ideals and objectives of the cryptocurrency community, which, for the most part, are well-meaning in their desire to reorient society towards a return to the principles of sound commodity money which have underscored and amplified the proliferation of human cooperative societies from time immemorial until the very recent past (with Richard Nixon’s historically unprecedented and ostensibly temporary suspension of the Gold standard in 1971). To be even more explicit, I am sympathetic to the broad vision of the cryptocurrency community and feel that Grayscale and Mr. Silbert, through these actions, have made a critical error in judgement that is neither representative of the community nor beneficial to its core objectives.

The logic underlying the campaign doesn’t escape me. As the investment manager of the GBTC exchange traded fund, Mr. Silbert, as principal of Grayscale, hopes that investors in the GLD, CEF, and the other $98 Billion presently being invested in global Gold ETF’s, essentially log into their brokerage accounts and sell those instruments to buy GBTC. The incentives, too, are quite clear: while GBTC may appear to be a closed ended fund, and has yet to complete formal prospectus-level disclosure with the SEC, the vehicle has become the de facto investment security through which retail and professional investors alike instantly convert wealth within the financial system into cryptocurrency. The significant premium to Net Asset Value at which GBTC trades, along with its massive trading volumes, is indicative that GBTC has already become a conduit for far more capital from the regulated securities markets to unregulated crypto markets than it’s $2.0 Billion AUM may imply. For example, such large trading volumes and premiums to NAV motivate sophisticated investors and institutions to sell GBTC short and go long the physical cryptocurrencies or cryptocurrency futures, capturing a rich statistical arbitrage which is far beyond anything found in traditional investment markets.

This financial activity, in turn, creates a flywheel effect which benefits Mr. Silbert and certain cryptocurrency community members in a variety of ways. A small but instructive example is that in the fourth quarter of 2018, Grayscale raised $30 million for its private funds, which it invests directly in various cryptocurrencies and investments outside of its GBTC vehicle. These funds benefit from a rising Bitcoin price and can harvest gains, earn management and incentive fees, and even reinvest in other alternative cryptocurrencies. In summary, the incentive for DropGold is clear and the logic for why Grayscale would embark on such an unorthodox approach to promote its investment products is also clear.

My aim with this paper is to draw the reader’s attention to critical lapses in judgement on the part of Grayscale, its employees, and, most importantly, its legal advisors, in terms of how they formulated the fundamental thrust of the DropGold argument. Frankly, I’m surprised that Grayscale Securities’ counsel approved the type of marketing language that has been employed while relying on such weak primary research. In my humble opinion, and based upon my first-hand experience, risk factors are not enough when making statements of facts that compel an investment in securities. This aggressive approach has, in my view, suggested that perhaps Grayscale and Mr. Silbert know very little about cryptocurrency mining, Gold, Gold mining, and most embarrassingly of all, the basic mechanics of the natural world.

The multimillion dollar advertising campaign unveiled by GrayScale on May 1, 2019 was launched with an initial video, associated marketing pages, and infographics. These materials were then augmented by an aggressive television schedule, which included financial news networks such as CNBC, Fox News, and a well-attended institutional investor conference. By my estimation, over thirty independent articles by mainstream financial media outlets have been published about the DropGold campaign and hundreds of thousands of viewers have watched the video advertisement itself.

In preparing to write this paper, I have reviewed all of the materials and statements made to date. In essence, the argument of the DropGold campaign can be distilled down to two pillars of thought which include several easily falsifiable forms of misinformation put forward by Grayscale as statements of fact to induce the purchase of its securities:

Drop Gold Because…

-

Gold is an analog metal

-

Gold is heavy

-

Gold is weighing down your portfolio

-

Gold is archaic

-

Gold has no utility

Buy Bitcoin Because…

-

Bitcoin is digital and virtual

-

Bitcoin is weightless

-

Bitcoin is the future

-

Bitcoin is borderless

-

Bitcoin has utility

In the following sections, I shall show why both pillars amount to a confused mixing and matching of multiple concepts that have been poorly understood by the Grayscale team. Ultimately, these statements will be seen to be nothing more than incoherent ramblings that completely missed the mark. This essay not being a primer on Bitcoin, I shall skip the history and functioning of proof-of-work cryptocurrencies, which is well covered by others. My task is to dispel the core arguments of the DropGold campaign and show why and how they are false.

I will begin by focusing on an important theme within Grayscale’s ad: the notion that Bitcoin is weightless while Gold is comparatively and onerously heavy. In the opening scene of the video, we see a relatively thin male, of average height and build, effortlessly holding what appear to be at least eight good delivery bars of Gold (each of which weigh, in reality, 12.5 kilograms) while he absently ponders those passing by. In this first scene, we already encounter Grayscale’s first major misrepresentation. What we are presented with here is an impossible visual: a man holding 100 kilograms (over 220 pounds) of physical Gold, which surely exceeds the man’s own bodyweight. This misrepresentation of Gold’s specific gravity will become a recurring theme throughout the video, and it illuminates a fundamental misunderstanding of the natural order of the elements and the basic thermodynamic interplay which lies at the heart of all human action.

In the next scene, what appear to be 25 good delivery bars of Gold (which would weigh a total of 312.5 kilograms) are lugged around in a shopping cart, albeit with a little more effort on the part of the actor. In another scene, an actor is seen to be pushing a dainty, antique baby carriage made of a thin fabric with what appear to be 18 good delivery bars of Gold (which would weigh 225 kilograms). Thirteen seconds into the video advertorial and the viewer has already been falsely presented with at least three physically impossible visuals in relation to Gold’s specific gravity. Importantly, from a value density perspective, a total of $26 million worth of precious Gold has already been seen to be possessed by what we are led to believe are just three ordinary, off the street investors. Keep these two concepts in mind as we advance in our inquiry, as they will become increasingly important: weightand value density.

Returning to the video, the next important scene shows us a Ferrari towing what are, at minimum, 100 good delivery bars of Gold, which would weigh 1.25 tonnes and would carry a dollar value of $50.5 million. This is followed by a helicopter, which appears to be running into trouble carrying at least double the volume of the Ferrari, 200 bars weighing 2.5 tonnes or $100.5 million worth of Gold. I have not invested the time to assess whether the Ferrari and helicopter scene are physically plausible from a thermodynamic perspective because it is less important. What is important, however, is to note that at minimum, the precious metal represented in the video advertorial exceeds $200 million in value density, and there are at least three instances of misrepresented physics—no different than a Marvel movie where an action hero defies the laws of physics to fly or otherwise manipulate gravity.

This advertorial campaign not being a work of fiction, such as a comic action movie, but, ostensibly, the work of a regulated financial services custodian, these misrepresentations are tantamount to misfeasance, and, as such, had to be addressed. In my view, sufficient disclaimers should be added which make note of them. As far as I can tell, no such disclaimers exist on the materials I have reviewed. You might ask why I have chosen to focus on these theatrical foibles which can, perhaps, be viewed as merely entertaining and fun bits of artistic license. The answer is that the central thrust of the Grayscale argument is based on a fundamental misunderstanding of the laws of physics, to misrepresent Gold’s value density, owing to its specific gravity (or weight), as a negative. Having established this weak intellectual foundation through fictitious visuals, Grayscale builds on its campaign of misinformation by making a claim which (as I shall soon show) is preposterous: that Bitcoin is weightless, virtual, and, hence, more value dense than Gold.

The visuals play an extremely important part in this manipulation and misrepresentation. When we see something that defies our personal experience and understanding, we are capable of deceiving our minds into believing this to be possible. This is most especially true when the value density being presented is in the hundreds of millions of dollars, a physical amount of Gold most viewers of the advertorial will never experience first-hand.

I began my analysis this way to introduce the reader to an important curiosity. Why is so little Gold per physical volumetric space worth so much, and why does it weigh so much per the volumetric space that it occupies? The answer can be found through a meditation on the laws of physics, as understood through applied science—that is to say observable, measurable, repeatable, and, thus, predictable experimentation over time. Here, my use of the term “laws of physics” or “laws of nature” are not a reference to some decree by biblical prophets, academics, or legislative branches of government. When I use these terms, I am referring to the common-sense understanding of the world which anyone can reason to be self-evident by virtue of their personal experience in navigating life within their objective present. And for those less familiar with the world around them, there is an extensive repository of collective human knowledge spanning the vast spectrum of human history that shows most physical phenomena to be settled science—a body of knowledge which humanity has been synthesizing and refining from ancient times into the present.

Before we begin the process of systematically dismantling the Grayscale arguments, we must take a short detour to form a working understanding of these laws and why they are interconnected with all human action in what is, in modern times, commonly understood to be called an “economy”.

Understanding the Basic Laws of Nature, Beginning with the Elements

Everything external to the mysteries of the human mind is corporeal, meaning that it is comprised of a thing, matter, which we perceive through our human sense perceptions—smell, sight, taste, touch, and sound. This matter can be broken down to a certain observable quantity, at which point it is distinct from others. These irreducible building blocks of matter are known as elements, and, since ancient times, humans have been reasoning about the uniquely identifiable qualities that make one element distinct from another. While there have been many paradigms for describing the elements, today, these observable and measurable qualitative and quantitative attributes are recorded as immutable averages within the Periodic Table of the Elements.

This Periodic Table, introduced to most of us in grade school, shows that there are 90 naturally-occurring elements that avail themselves to our sense perceptions.[7] Each element, from hydrogen to carbon to Gold, has distinct qualities that are unique to it. Some are rarer than others, some are toxic to humans, some are better conductors of electromagnetic energy, and so on. While the list is extensive, there are known limits to these qualities, and, more importantly, there is an immutable, fixed relationship between the elements and their inherent qualities.

Immutability is the critical natural mystery at play here, for it denotes that time’s irreversible arrow, from whence causation arises within the corporeal world, has observable, repeatable, and, thus, predictable laws, which is what makes all naturalist conjecture–from literature to economics and beyond–possible. In other words, we are capable of making reasonably reliable predictions about the future because we understand the intrinsic properties of the physical world made available to our common senses from past experience. These predictions about the future, however, can never be accurate until they are weighted, that is to say measured in the objective present. The important point here is that predictability is endowed by fixed relationships between the elements within the natural order.

As it relates to a deeper understanding of money and why Gold is the best money nature has to offer, these immutable natural laws serve as the wellspring from whence productive natural inquiry must emanate—the tectonic plate, or grounding, for our enlarged comprehension. If the corporeal world, and the elements which make it up, were not observably measurable, repeatable, and, thus, predictable, there would be no means by which to induce human cooperation, measure toil, and incentivize merit, which, as I shall show, is what fosters collective prosperity in a non-clannish human cooperative society.

Money as a Self-Evidently Superior Embodiment of Metabolic Energy Induces Measurement and Motivation of Sustainable Human Cooperation

In order for a cooperative society to demand money, money must be an equitable measure of human agency, by which I mean toil, which is unchanging through time. When money is an objective and immutable constant, then it incentivizes a meritocracy of action which can be sustainably perpetuated into the future. Operating under such a money, those who work harder and produce a greater surplus of whatever skill or good they invest their metabolic energy into producing are rewarded with more money relative to others. This dynamic, in turn, motivates everyone else to wake up the next morning, ingest various localized information via their common senses relative to their personal wants and needs, and work more or less hard depending on their personal circumstances and desire for self-actualization. This circuitous relationship between Money as a measure and a reward for both toil and merit is what allows a complex, interdependent cooperative society to survive—that is to say achieve and maintain a state of collective prosperity and thus remain resilient through time.

Here, I use the term “prosperity” to denote a state of surplus metabolic energy. Owing to the inherent laws of nature, any cooperative society must first be sufficiently fed, sheltered, and kept warm in order to avoid social and political upheaval and, thus, create an environment for productive cooperative action. Therefore, this existential demand in a non-clannish society must always be maintained.[8] For just one example of the ramifications of a breakdown of this most foundational dynamic in any non-clannish society, look no further than Venezuela these days. It is important to stress that I am purposely avoiding the usage of abstract notions of “wealth,” “capital,” and other nominal mathematical measures. Such measures, employing the language of mathematics, may be helpful for communicating natural phenomena, but they do not explain the more fundamental dynamics at play.

The Natural Order ensures that none of these nominal calculations matter within the objective present as it relates to the existential demand to maintain a surplus of metabolic energy. The Natural Order enforces that every day, acts of human cooperation must continually transpire within the objective present because the past is entirely powerless, as are all cooperative acts which have taken place within it. As far as non-clannish human cooperation goes, it is only the future that matters. This is due, in part, to the self-evident reality that the laws of nature dictate that all of the most existentially-mandated goods and services suffer from diminishing marginal utility through time—things grow up and then they die back down, food and energy resources cannot last in their most immediately useful state without the need for a continued investment of energy in order to preserve them. Because of this, in a non-clannish cooperative society where various independent human agents are dependent on others and have no pre-arranged mandates or altruistic predispositions to produce what they need the next day, week, or month, it is only Money which survives into the new day as the measure and motivator of human cooperation.

Let us first focus on Money as an equitable measure of toil. The best measure is one that embodies the most energy and that can continue from the past through the present and into the future as an embodiment or representation of that energy effortlessly and unchangingly in the most efficient way through time. Such a measure, which must be self-evident to the primary cooperators within a given cooperative society (those engaged in producing the existentially-mandated surplus of metabolic energy) will be demanded as money through time by all members of the cooperative society (from the farmer to the software engineer and all individual cooperative nodes in-between).

It is from this understanding that the principle of “proof of work” arises—the notion that someone can instantly recognize and measure an equitable quantum of human action or metabolic energy expenditure from the past. This can be in the form of an investment of time, energy, thought, labor, or skill in the production of a service or a thing. As history has shown, abstractions–ranging from ideas to services–fail this first test because they wither with the advent of ever-changing paradigms and beliefs. The notion of “utility,” for example, can be correctly relegated to this intellectual tradition within economics. Aside from the core, primary, collective requirements of food, shelter, and energy for any cooperative society to exist, all other notions of utility are subjective. Therefore, the things that tend to last as objective measures or “proof of work” tend to be things in the corporeal world, which primary cooperators can perceive viscerally through their human sense perceptions. Once again, the elements and the natural order remind us of the primacy of such objective measures within human cooperative societies.

That “things” have the most equitably demonstrable “proof of work” is why luxury real estate is valued so highly. It is for this same reason that rare paintings, cars, and even company shares can serve as Money in relatively advanced societies. But these forms of Money, as history has shown, lose their appeal over time because they embody subjective human desires that do not directly correspond to the primary phenomenon of human cooperation that I just described. A farmer may want a luxury apartment in Manhattan today because they have been told it is expensive by Donald Trump, but that doesn’t mean the luxury apartment will remain valuable tomorrow.

Ultimately, the sheer complexity of non-clannish human cooperative societies exacts a requirement that the measure, if it is to be equitable, ultimately reflects a fungible unit which is neutral and relatable to all primary cooperators. From time immemorial, that fungible unit has been metabolic energy within the objective present. This makes perfect sense because the only thing we know for certain is that in the future, we will continue to wake up and need to eat, shelter ourselves, and stay warm. Everything else is a subjective preference. As the biblical proverb states: All human toil is for the mouth, yet the appetite is not satisfied.[9] In this case, the lack of satisfaction isn’t owing to the distaste of the food, but rather to the impossibility to maintain our basic units of metabolic energy through time.

Every day, we must wake up and continue to equitably measure the metabolic units of energy required to maintain our state of collective prosperity. The most efficient way to measure this, as history has shown, is through a proof of work in units of metabolic energy. The reason for this is that the laws of nature enforce fixed relationships between the elements which enable them to serve as self-evident measures of multifarious manifestations of individual proofs of work. I can reason that my neighbor has invested as much energy producing corn as I have producing apples because, ultimately, there is a neutral, natural, and self evident ratio of time, crop yield, and shelf-life of the weight of corn relative to the weight of apples produced. No doubt, the ratio at which we exchange apples to corn directly may rise or fall, but the measurement remains relatively fixed through time. I can always measure the weight of apples relative to corn within the objective present, and reason that ratio to be true. This is the key to understanding proof-of-work, and ultimately it corresponds to fungible units of metabolic energy.

The concept of Money as an equitable measure of toil, a proof-of-work, having been established, let us now turn our focus to Money being a motivator of merit-based action into the future. Herein lies a critical feature of Money which ensures continued cooperation in a healthy society. The measurable aspect of Money allows various cooperators to personally measure their individual activities against others, with those doing better accumulating a larger share of Money, and, thus, having responsibility over the allocation of societal resources from the past into the future. Continued, successful stewardship of the resources of metabolic energy will result in the maintenance of this status. Equally important, however, is the fact that any failure to maintain a state of surplus will lead towards a reversion from a relatively advanced and complex state of human cooperation to a relatively less advanced and less complex one. This dynamic, ongoing competition between individual human agents in any cooperative society is a critical feature of non-clannish human cooperation. It ensures that meritocracy over time guides human action towards collective resilience through collective prosperity. Time is the most important aspect here because the motivation of merit is achieved by instilling a sense of the future in the minds of cooperators in the present. Thinking about the future, planning for it, and working harder in the present in the aspiration of having to work less hard while enjoying more abundance in the future, is the natural human reaction to the ontological effects of Time—which conquers all things and enforces that the powers of entropy pervade all things. The prospect of failure, being the closest embodiment of entropy, ensures that merit and resources–no matter how great–never remain permanent.

This combination of equitable measure of toil and motivator of merit, through time, is why a reliance on abstract memories (rising prices) is not a strong enough feature of Money to induce continued cooperation. For a Money to be long-lasting and demanded into the future, it must be something anyone can self-evidently reason to best embody a surplus of metabolic energy in their objective present that will most efficiently survive into the future. Only in this way can money be a neutral measure of toil and a motivator of meritocratic human action through time. The past, in this case, is once again seen to be powerless. Historic price performance will not be enough to convince cooperators in the future that a Money is superior. Here, as some of my Austrian friends may note, I depart with Carl Menger and Ludwig von Mises with respect to the Regression Theorem. What these great thinkers lacked was a sufficient understanding of the inherently thermodynamic quality of all human cooperative societies and the ontological effects of Time upon them.

What follows, then, is that the thing to serve as Money must be rare, unchangingly so, and because it is a corporeal thing, embody the most amount of metabolic energy within the least amount of weight and volumetric space. Why are weight and volumetric space so important? Because physical weight and volumetric space are directly correlated to the metabolic energy density embodied within the thing. The less physical footprint a thing embodies, the more naturally efficient it is to store, transport, exchange, measure, and trade—allowing it to become, if necessary, a decentralized, fungible unit of exchange–money–which serves as a measure of toil and motivator of merit across Time and space.

The greater the physical footprint, the less efficient the thing will be. In economics, the term used to denote this phenomenon is “value density,” but the reality here is that any person reading this paper can understand the logic in storing as much value (that is to say their toil) in the most efficient way through time (that is to say the least amount of physical space and weight). Interestingly, value density is what ultimately contributes towards a Money proliferating throughout human cooperative systems, and, thus, becoming truly decentralized, which, in turn, leads towards independent nodes transcending geographic locations, cultures, political systems, and time zones, to maintain a network of cooperation by virtue of their adoption of such money. In this case, we can see that second-order features of cooperation, such as TCP/IP protocols and computing servers, need not be required because the laws of nature already make this phenomenon possible in the most elegantly efficient manner.

When I explain this feature of money to people, I often use the example of the shape of a sugar cube. A sugar cube of Gold embodies a tremendous amount of metabolic energy (as measured in weight), which was required to extract the Gold from the earth relative to all other elements using the same measure of weight (because it is the rarest natural element, and, therefore, requires the most metabolic energy to extract). That sugar cube also lasts longer on a relative basis to all other elements (because it does not chemically react when exposed to air). This means that the sugar cube of Gold is more value dense than the same sized sugar cube of silver. If I were to employ my kinesthetic sense perceptions within any present moment, I would invariably be able to reason that the Gold sugar cube weighs more, even though visually, the two are identical in size and occupy the same volumetric space.

Weight is a property of the natural laws of physics, as is the energy embodiment which arises from natural scarcity—the relative abundance or lack of abundance of all elements to one another in the earth. It is for this reason that a tonne of copper last traded at $6,000 while a tonne of Gold last traded at $41.8 million in commodity markets. The same weight, two different distinct elements, occupying completely different volumes of space, and requiring completely different amounts of metabolic energy to extract. This is also why a tonne of Gold occupies just two square feet of space, while a tonne of Copper occupies a warehouse.

An analysis of the Periodic Table of Elements shows us why. Gold, along with the precious metals Platinum, Palladium, and Silver, are the rarest non-toxic natural elements which do not react with air. This means they will always require the most metabolic energy to produce, and, due to their relative low abundance, physically embody that energy in the least amount of space for the longest period of time. What results is that precious metals serve as the best forms of Money, the ultimate embodiments of a surplus of metabolic energy through time.

This relationship between natural scarcity (how rare one element is relative to another), specific gravity (weight), and diminishing utility through time (how long one element lasts relative to another), is the basis on which all exchanges of metabolic energy can be objectively reasoned and why we see precious metals serving as Money since the oldest written account of a human cooperative society, the Code of Ur-Nammu (as I have written about in past papers).

It is often at this stage of presenting my natural philosophy of money that the skeptic will protest, raising questions about hypothetical elements or the ability to mine precious metals from asteroids. Both of these propositions stem from an unfortunate departure on the part of the applied sciences from that which is empirical and predictable to that which is incalculable and theoretical—the “ancient aliens” effect on modern science, if you will. This is a troubling trend indeed, one which can be attributed, at least in part, to the increasing manipulation of the measure of toil and motivator of merit in the modern western world.

Both asteroid mining and the theoretical elements with half-lives of days or weeks, are, as far as anyone employing their common sense is concerned, nothing more than academic myths. We can imagine them, sure, but have we ever seen them? Do we have any observable reason to believe that they have ever existed or will perpetuate into the future in their same form? Other elements which made their way onto the periodic table over the last century are literally toxic to humans either through touch or inhalation. These are nothing more than castles in the clouds, which suspend the laws of physics in service to some as yet undiscovered free energy source or for some yet to be understood utility. Do not fall for this nonsense. Before we pursue mining precious metals from the vacuum of space, we would have better luck mining them from the sediment in our ocean beds. There is a simple test which one should employ before discussing elements: as it relates to human cooperation within the objective present, we should be asking whether the element in question can be held in our hands, seen with our eyes, tasted with our mouths, heard with our ears, or inhaled through our nose. If it cannot pass this basic test, the element in question is useless in terms of its viability as Money.

With this important intellectual groundwork having been laid, we now have a more lucid understanding of Money and the importance for Money to be the most equitable measure of toil and motivator of merit, and why the most value dense embodiment of metabolic energy will serve as the most neutral, efficient, and longest-lasting money to be demanded in the past, present, and future. This having been established, let us now turn our attention back to Bitcoin and continue our methodical falsification of the DropGold campaign.

Bitcoin vs. Gold – A Definitive Comparison

My exposition of the soundness of Money may have already alerted you to some of the attributes that have made proof-of-work cryptocurrencies such as Bitcoin nascent Moneys over such a short period of time, especially as compared to baseless fiat currencies, which took millennia to be adopted by human cooperative societies. It is true that Bitcoin has been designed to mirror the properties which have made Gold the natural Money throughout history. It was precisely for this reason that I found myself involved with Bitcoin so early on and why, even today, the thrust of my efforts in this paper are not advocating the idea that investors should “drop” it. The issue for me is that the Bitcoin community cannot, on the one hand, base its entire future on the Proof-of-Work argument while maligning Gold, which is the natural ideal which any proof-of-work currency strives to embody. As I shall show in the remaining sections of this paper, pursuing this flawed intellectual path introduces a necessary comparison which, unfortunately for Bitcoin, renders it inferior to not just Gold, but most corporeal units of metabolic energy made manifest in naturally scarce elements that survive through time.

Bitcoin is a paradox. On the one hand, its creation involves a proof-of-work predicated on the exertion of metabolic energy (the massive energy expenditure made in the form of the electricity used by the computers that “mine” it). On the other hand, this exertion is an effective opportunity cost for a cooperative society’s surplus of metabolic energy, which, due to the infinite demands of Bitcoin, is unsustainable through time.

The reason for this is that without the act of “mining” Bitcoins, there could be no Bitcoins. That is because the genius of Bitcoin is also its Achilles heel: its apparently decentralized properties which induce cooperation to secure a growing ledger of transactions requires that an increasing amount of metabolic energy be invested in the validation of mining blocks every few minutes. Each block serves a dual purpose of validating the latest transactions and, equally important, as the definitive ledger that tells every holder how much Bitcoin they own. This interweaving of the payment systems with the actual ledger affirming who owns what is how Bitcoin attempts to emulate Gold’s physical properties as being a measure of toil and motivator of merit, and these attempts are what contribute to its adoption as Money. Alas, as we shall soon see, this adroit design was achieved by mortgaging the future, and presents a serious issue for Bitcoin in the long-term.

The term “mining,” in this case, is really a misnomer. Instead of the word “mining,” consider the Bitcoin proof-of-work hashing and block validation as a massive, continuous investment of energy to maintain the network. Without this investment, Bitcoin (or any other cryptocurrency for that matter) is merely an abstraction—nothing more than lines of code, or, more specifically, mathematical operations that any ordinary person could simply write down with pen and paper. In contradistinction, Gold is mined because it is naturally rare and naturally immutable according to the first-order laws of nature. The act of mining does nothing to validate Gold’s continued existence just as the act of breathing does nothing to validate the existence of Oxygen. As a natural element, Gold’s inherent attributes of being extremely rare and non-reactive with air make it a perfect embodiment of metabolic energy, allowing it to serve as a measure of toil and motivator of merit in the objective present within any human cooperative society while remaining physically constant through time. In other words, the natural properties of Gold make it Money par excellence.

Mining more Gold makes more Gold available, which then circulates forever within and between human cooperative societies. There is no existential need on the part of Gold for a continued investment of energy, and the Gold, which serves as an embodiment of previously expended metabolic energy, can be worn as a ring or stored in one’s place of shelter. There is no shared ledger here, nobody can truly know how much Gold exists or is being owned at any one specific moment in time.

The point here is that Gold doesn’t need to refer to a blockchain to know what it is…it merely exists and continues to exist effortlessly and without the need for any subsequent investment of metabolic energy. Both energy and entropy are intrinsic to our existence as first order properties of the natural order. Likewise, Gold is born of the same natural mysteries, a first order property of nature, but it is, in its physical form, the only matter in nature which is immune to the forces of entropy through time—an idea I initially expounded in my 2017 essay: The Natural Order of Money and why Abstract Currencies Fail.

Bitcoin and other cryptocurrencies require us to constantly divert our collective metabolic energy and time into supporting the integrity of a mathematical abstraction. This activity is, therefore, secondary to the first order laws of nature. When a farmer produces a crop, it feeds society’s hunger. When a miner produces copper, it powers society’s energy infrastructure. When a wildcatter discovers oil, it propels humanity’s transportation systems. When a miner decides to take a risk and mine Gold, that opportunity cost results in additional Gold which can be used in computer chips to conduct electromagnetic energy without tarnishing or be employed as money—a lasting, objective measure for the other, more quickly decaying first order products of nature.

Based on the experience of debating this issue for over a decade, I find that this concept has been very difficult to grasp for modern economists, academics, and members of the so-called “service economy,” but the simple fact is that it is a self-evident truth. On the other hand, I often find that primary cooperators have an easier time understanding this feature of our natural world. It is often members of the primary cooperative, such as farmers, fishermen, and miners, that recognize Gold is no different than the tomatoes or the lithium or the apples they toil so hard to produce. It is a first order manifestation of human toil and merit via direct negotiation with nature.

The secondary cooperative, the “service economy” (to use the current expression), is where Bitcoin lives. It is within this mathematical computation realm that crypto appears to be rare, appears to move around with ease, and seems to represent the realization of a long-lasting and immutable state. Alas, none of this is real. At the end of the day, Bitcoin is nothing more than a poorly conceived monetary system which taxes metabolic energy rather than preserving it—a system that simply tries to mimic what nature has already perfected and made self-evident.

If the world’s Gold miners stopped mining tomorrow, nobody that owns Gold would care. One gram of Gold would remain one gram of Gold. The Bitcoin story is different. Any owner of Bitcoin only owns what the latest version of the ledger says they own. That version exists based on the continued operation of massive computational servers somewhere out there requiring society to constantly divert its metabolic energy to maintain the apparent utility of the service.

Having laid out the foundational philosophical differences between Bitcoin and Gold, I shall now conclude my paper by providing several proofs for why Gold is superior to Bitcoin. I shall do so by employing the languages of mathematics to abstract physical phenomena from the natural world, and thermodynamic physics to convey the dynamics at the heart of the corporeal world.

Bitcoin, Far From Being Weightless or Virtual, is in Actuality Physically Heavier than Gold

One of the first issues with many Bitcoin proponents is their misleading claims about the immaterial nature or incorporeality of Bitcoin. In fairness to them, they have likely been imbued with this false belief by members of the service economy who foolishly tout the internet’s existence as a virtual informational exchange network while conveniently disregarding that by 2025, 30% of all electricity will be used to support just the digital data storage requirement demanded by the internet. This collective amnesia on the part of the Bitcoin community has been a source of strength for the DropGold campaign, and it ultimately comes down to this seed of misunderstanding: When one uses Bitcoin to store value or to affect a transaction, that act of human agency is virtual rather than physical. To use the DropGold’s campaign language: it is “borderless,” “digital,” and “weightless”.

As we will now see, these statements amount to sleights of hand which are demonstrably false. When I use my smartphone to create a Bitcoin wallet, transfer some coins in, and send them to a friend who’s using a smartphone halfway across the world, this activity may appear to be virtual to myself and my friend. The problem is that behind the virtual act, what is, in actuality, enabling all of this to take place is massive amounts of physical infrastructure in the natural world, comprised of computational hardware, energy transformers, physical space, and human computer engineers. That this infrastructure is not directly tethered to my act of communicating a transaction using the internet changes nothing.

It is intellectually dishonest, indeed it is a severe case of cognitive dissonance, to believe or otherwise misrepresent this fact—calling to mind that famous question posed by Berkeley: If a tree falls in a forest but there is no one there to see it did it really happen? Yes. It is happening, and it is currently consuming more energy each year than all of the six million citizens of the country of Switzerland combined.

At this point, a Bitcoin proponent may respond that, alright, the system may indeed exist in the physical world, and may even consume tremendous amounts of energy, but this is being done in a randomized and decentralized manner. If Bitcoin can still achieve the act of virtual payment efficiently, a native currency for the internet, it should be viewed as a necessary cost that there are some decentralized hardware and software systems running somewhere away from my immediate field of vision, so long as those costs still render the system an efficient unit of account, medium of exchange, and store of value. In other words, the cost being physically separated from the act makes Bitcoin unique as a Money with an inherent payment system.

In order to show why this position, which requires the Bitcoin proponent to already make an important concession (the corporeality of Bitcoin), is unequivocally false, we need to compare Bitcoin’s corporeality to Gold on a purely thermodynamic basis. Only then can we compare an apple to an apple, establishing Bitcoin’s monetary attributes as being a lasting store of metabolic energy which measures toil and incentivizes merit. Drawing on my experience in mining for cryptocurrency, I have taken a balanced perspective towards estimating the size and scale of the Bitcoin infrastructure at the time of writing (May 2019).[16] In the interest of avoiding the kinds of hyperbole found in the DropGold campaign, I have chosen to be conservative in my estimations and have avoided making projections about the future, even though a present understanding of Bitcoins source code all but ensures future corporeal demands to be exponentially greater. I am simply trying to understand Bitcoin’s characteristics relative to Gold, today, in the objective present.

As I detailed in the early parts of this paper, Grayscale began their advertorial with the notion of Gold’s weight, manipulating the laws of physics, on the one hand, while confidently asserting that Gold was far heavier than Bitcoin, on the other. Let us then, methodically, initiate our analysis into Bitcoin’s corporeality by first inquiring as to its true weight. The question we are trying to answer is this: Is Bitcoin lighter or heavier than Gold?

To earnestly answer this question, we must first estimate the infrastructure required to maintain the Bitcoin network. At minimum, we need to account for the specialized computer chips (known as “miners”), racks to support the computing infrastructure, and electricity transformers which harness and distribute the electricity from the grid into the computer equipment being employed. Again, without this basic equipment existing somewhere and consuming energy and operating at all times, Bitcoin as a unique mathematical abstraction ceases to exist.

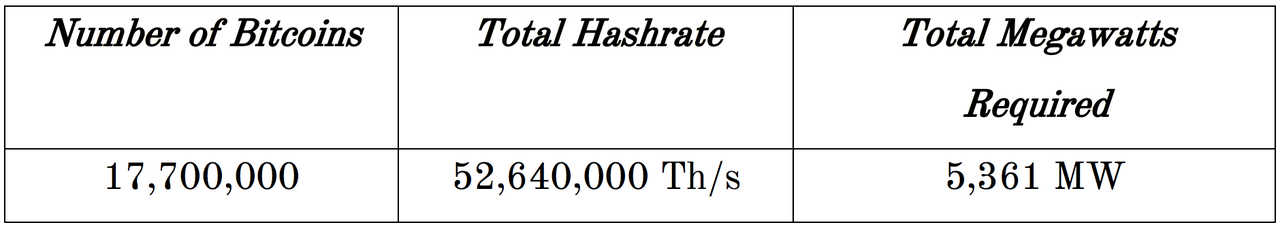

As of May 15, 2019, the key data-points associated with assessing the scale of the network, and thus its computational and energy requirements, are:

Given these inputs, let us now estimate the associated equipment and corresponding weights required to sustain the network at its present hash rate and energy requirement.

At this stage, we are able to estimate the corresponding physical weight of mining chips and energy transformers existentially required for every 1 unit of Bitcoin in the ledger.

By dividing the combined weight of 29,995,871 kilograms of hardware necessary to support the current hash rate of 52,640,000 terahashes per second by the 17,700,000 Bitcoins in existence at the time of writing, we arrive at a ratio that mandates at least 1.69 kilograms of physical hardware residing somewhere in the world for every 1 unit of Bitcoin owned by someone residing in some other place in the world. This fixed ratio of weight remains self-evident no matter how much we expand or contract the unit measurement in question for Bitcoin.

While Bitcoin proponents may rush to point out that a Bitcoin is fungible down to one Satoshi, I implore them to inquiry into the number of Gold atoms in one kilogram of Gold. Bitcoin units are abstractions while Gold units are atoms. Therefore, reducing the scale of measure only increases the corpulence of Bitcoin relative to Gold given that a Satoshi has a relatively miniscule lower bound of 100,000,000 while atomic physics deals with exponents in the “billion-billions”. As I shall further demonstrate, this initial calculation of weight is extremely conservative, for it excludes two additional thermodynamic dimensions for an intellectually honest assessment: volumetric space and the weight of thermodynamic energy and associated infrastructure required to perpetuate Bitcoin into the future. In any case, what we have already discovered at this stage of the paper is important because it puts forward a mathematical proof that Bitcoin is heavier than Gold.

Bitcoin Occupies More Volumetric Space Than Gold

Our inquiry into relative weights has been instructive, but our conservative analysis excludes an important input for any intellectually honest thermodynamic understanding: volumetric space. If we are to ultimately understand Bitcoin’s intrinsic monetary attributes relative to Gold, we must incorporate the physical footprint that Bitcoin occupies in the material world relative to the physical footprint occupied by Gold. Here, a skeptic may once again protest that in order to assess Gold’s physical footprint, one would need to include all the lands that are physically mined in the world, as well as the associated mining equipment. My response to this claim would be that it is my unwavering view, based on years of experience mining for Gold myself, that over the long-run, a well-managed Gold mining project terraforms back via reclamation with little disturbance to the natural world.[17] Therefore, in this case, land is not being employed indefinitely, and in terms of equipment, the equipment required to mine Gold can be used to mine any other important element or resource while the forms of equipment demands for mining Bitcoin are a specialized, second-order feature of our cooperative society.

Essentially this brings us back to the understanding that Gold is mined because it is Gold while Bitcoin isn’t really being “mined,” but, rather, is being powered into existence via a distributed infrastructure of equipment, land, and buildings, which must always be dedicated to that one act lest the whole monetary system falls apart. Moreover, as I shall show in the sections that follow, Gold is actually, ironically, an integral component in Bitcoin “mining” equipment, making the element an existentially-mandated ingredient in the Bitcoin infrastructure for which no substitute is available.

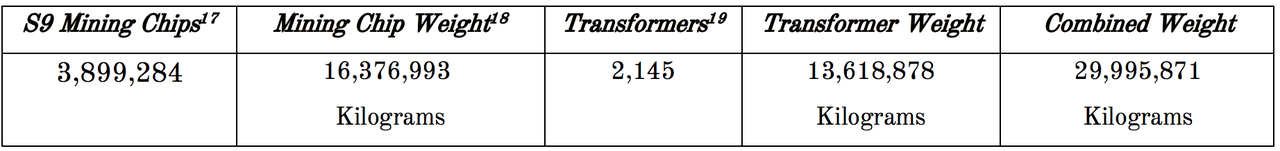

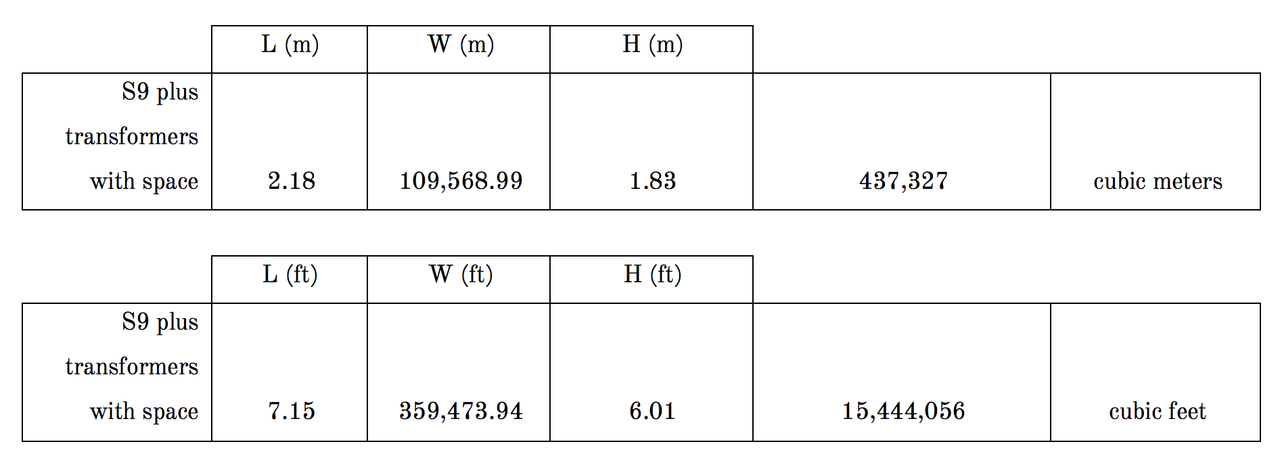

Having addressed the inherent differences between Gold mining and Bitcoin “mining,” let us continue into our analysis of Bitcoin’s volumetric space. What should now be clear is that a more appropriate and intellectually honest comparison for our purposes is to inquire into the relative attributes of already-mined Gold to already-mined Bitcoin. We have already established that Bitcoin is heavier than Gold, but we now need to answer the following question: How much volumetric space does that Bitcoin weight occupy? In order to understand the volumetric space that the Bitcoin infrastructure occupies, we will engage in the following measurement:

- Total physical footprint required to house the 3,899,284 Bitcoin mining chips, 2,145 transformers, racks and computing hardware associated with the 17,700,700 Bitcoins in existence at the current 52,640,000 terahashes per second network difficulty.

To calculate the physical dimensions that the Bitcoin mining operations require, we need to propose a realistic layout for distributing the hardware in a manner that allows it to actually function. One cannot merely pack together transformers and S9 chips in the same way one can densely condense atoms of Gold.

The most efficient layout that would also be representative of best practices in Bitcoin mining these days is to conceptualize a wall of S9 mining hardware. We have been working with a total number of S9s of 3,899,284, so, in our calculation, we will assume the wall is 6 units high, resulting in 649,881 S9s stacked side by side. Once the S9 mining hardware is installed and racked, there is a need for at least 3 feet of clearance on the fan intake side and the exhaust side, and a 6 inch gap vertically between S9s for the power supply and cables, and a 0.6 inch horizontal gap between S9s (accounting for the space occupied by the racks and supporting posts).

However, if we want to determine the physical footprint, that is to say the square meters or square footage in terms of length times width, required to support this infrastructure, we have to logically map out where each transformer would physically sit amidst our “wall” of S9s. I can make a basic assumption that they sit at even intervals along the wall of miners. This would result in the 2,145 transformers of 2.5MW, each capable of supporting 1,818 S9 miners, stacked 6 feet high. In other words, for every 303 columns of miners, we would require a 5 foot safety gap, another transformer, another 5 foot safety gap, and then another wall of miners.

Bringing this all together, the resulting supercomputer capable of supporting the entire Bitcoin network would have the following dimensions:

What we have now discovered is important and provides us with a new insight: Bitcoin requires physical infrastructure that, if condensed into one physical location, would require a building which was at least 2 meters high and 109,568 meters wide. As we can see, to merely house the physical infrastructure, which gives life to Bitcoin beyond the lines of code anyone could replicate manually, requires, at minimum, 15 million cubic feet or 437,327 cubic meters of volumetric space. Make no mistake about it, somewhere there are countless physical buildings housing all of this equipment. These buildings must be maintained through time if Bitcoin is to be sustained into the future, and their number will only grow if our current supply of Bitcoin is to ever increase.

How does this compare to Gold? While I am no fan of estimates of the total Gold stocks (for, as I mentioned, I believe it is a figure which is impossible to truly know, and the more important attribute is natural scarcity), in this instance, I believe it is instructive to rely on the general estimates of 171,000 tonnes.[18] With this weight of Gold, we are able to estimate Gold’s volumetric space. One of Gold’s key advantages over Bitcoin, here, is that it can be cubed by simply dividing the total weight by its specific gravity of 19,300 kilograms per meter cubed.

In contradistinction, one cannot cube Bitcoin, and my work above was extremely conservative in estimating the associated space and support structures required to power the Bitcoin network. The result is that all of the Gold in the world, 171,000 tonnes, would fit neatly within a soccer pitch, a cube of approximately 8,860 cubic meters in volumetric space, which, due to gold’s densely packed atoms would only measure just 20.7 meters on each side. I must admit that even I was surprised by how little space all the Gold in the world occupies relative to Bitcoins, even when considering that it possesses nearly 6 times as much weight (because in our quest to understand volumetric space, we are inquiring into all the Gold that exists vs. all the Bitcoin that exists). All told, we arrive at the insight that at the time of writing: all the Bitcoin-associated physical infrastructure already requires roughly 49 times more volumetric space and than all the Gold in the world would occupy. In this analysis bitcoin further benefits from the lack of visual illustrations in this paper. For example, the length of the Bitcoin cube is 109,568 metres or 5,293 times the length of the gold cube. Therefore, Bitcoin occupies more volumetric space than Gold.

Gold is, thus, More Value Dense than Bitcoin

Through our inquiry, we have established that Bitcoin requires a tremendous amount of physical weight and volumetric space to exist. In so doing, we have falsified the notion that a Bitcoin is purely digital or virtual, seeing such claims and misinformed assumptions to be nothing more than a misunderstanding of thermodynamics. Our insights can now provide us with an even deeper understanding of Bitcoin’s potential to serve as a long-lasting Money, measuring toil and incentivizing merit-based action into the future. Here, our focus is to merely compare Bitcoin’s attributes as Money to those of Gold.

We have now seen that Bitcoin is not only heavier than Gold in volumetric weight (1.69 kilograms per 1 Bitcoin), but also occupies at least 49 times more volumetric space and far more two-dimensional space (5,293 times). With these insights, we are able to proceed into the most important comparison as it relates to Bitcoin functioning as a Money that is demanded into the future, as Gold has done so effortlessly for thousands of years: Value Density.

An estimate of value density must aim to achieve two things: 1.) Ascertain how much metabolic energy per volumetric space is embodied; and 2.) How long will that metabolic energy last in its most perfect embodiment. Here, it should become clear that an estimate of value density changes our methodology from pausing time and simply comparing how much Gold vs. Bitcoins exist today, to an estimate of how well does the energy embodied in the Bitcoin cube last through time compared to the energy embodied in an equivalent Gold cube. Therefore, we must now adjust the weight and size of our Gold cube from estimates of the total Gold out there (which are irrelevant), to match precisely the weight of Bitcoins outstanding, a figure for which we have arrived at a conservative estimate.

Here a skeptic may once again jump in, asking why comparing the weight of Bitcoin equipment has anything to do with the weight of Gold. The answer lies in the fact that the associated weight of Bitcoin equipment reflects the proof-of-work embodied in Bitcoin, which is itself a reflection of the historic metabolic energy that went into its initial creation. The same is true for the weight of Gold, which represents the historic proof of work that went into the mining of the Gold. Said differently, we have two corporeal weights occupying varying volumetric spaces, that represent a historic expenditure of energy. Which one does a better job of maintaining that energy embodiment through time? Answering this question will unveil to us the relative value densities inherent in Bitcoin vs. Gold.

Let us begin by representing the 29,995,871 kilograms of associated Bitcoin infrastructure equivalent in the 437,327 m^3 cube we discussed in the previous section. This same cube of 29,995,871 kilograms of Gold would fit neatly in a 1,520 m^3 cube. We now have two physical cubes, both representing the same embodiment of metabolic energy (weight), but the Gold cube, as we can see, is far more efficient at storing this energy. Due to Gold’s specific gravity, the Bitcoin cube requires 287 times more volumetric space to represent the same physical weight.

This certainly came as a surprise to me, and in many ways this fact alone should be enough to settle the value density argument. However, the aims of this paper are to compare Bitcoin to Gold, and since that is my mandate, I have to point out another critical issue relating to value density vis-a-visthe Bitcoin cube’s basic capability to embody the energy through time. The problem is that if one truly considers the survivability of the Bitcoin cube weighing 29,995,871 kilograms and housed within 437,327 m^3 through any meaningful period of time into the future, one runs into an unshakeable reality: The Bitcoin cube requires a sustained amount of metabolic energy expenditure in order to perpetuate into the future, while the 1,520 m^3 cube of Gold does not. Mindful of our intent to be intellectually honest, we must try to understand what aspect of the Bitcoin cube is, at the least, “self deleting,” or essentially “melting” as a result of this continued energy requirement. This phenomenon is a real tax on any long-term owner of Bitcoin who believes it to be a store of value—before any analysis of custody, transaction, or other fees levied on the service layer of the Bitcoin ecosystem.

Again, I shall remind the reader that our task is to avoid the usage of nominal, abstract measures such as dollars. This is a first principles inquiry into the thermodynamics underlying two moneys: Bitcoin and Gold. We know the Bitcoin cube requires at least 5,361 MW of additional energy per annum to perpetuate into the future while the Gold cube can just sit there effortlessly while continuing to remain Gold. Our task, then, is to evince this 5,361 MW of energy in the form of physical weight and volumetric space. In so doing, we will have a clearer understanding of the visual analogy of a Bitcoin cube relative to a Gold cube as it relates to Value Density.

I am going to be extra nice to Bitcoin here by using the most energy-dense, non-theoretical fuel employed in the actual generation of electricity today: Coal. The energy density of Coal is roughly 33 megajoules per kilogram of weight. Knowing this, we can calculate that the 5,361 MW of energy demanded by the Bitcoin cube twenty four hours per day, seven days per week, and three hundred and sixty five days per year, would result in around 46,962,360 of MW/h. Bringing in the energy density of coal into our calculation results in an annual demand of 5,232,141 tonnes of coal to maintain the current Bitcoin cube.[19] It is surely disappointing to discover that, even when using the cheapest and most energy dense of fuels (coal), we can see that billions of kilograms of additional volume of fuel must be extracted, transported, stored, converted to electrical energy, and distributed to the Bitcoin cube of hardware each year. This helps us visualize that this tax on the network is very much real, certainly not virtual, and certainly not weightless. Unfortunately, it introduces another important insight: there is an inherent decay through time for the Bitcoin, or in options parlance: “theta bleed.”

In summary, we have established that Gold is far more value dense than Bitcoin, showing Bitcoin to be a terrible embodiment of metabolic energy through time and calling into serious question its integrity as a store of value that may incentivize merit-based action in the future.

Bitcoin requires more energy than Gold to exist in the present and to perpetuate into the future. Importantly, this insight has nothing to do with Bitcoin’s current market price. It would not matter if Bitcoin rose by 49 times in value because all of our calculations were predicated on thermodynamic units of weight and volumetric space rather than abstract, nominal units of mathematics. This annual requirement in the form of additional energy, weight, space, and other resources, must be taken into account when comparing Gold to Bitcoin because, as I explained in the introduction, the cube of Gold does not require any additional resources to continue to exist as Gold while Bitcoin requires more weight, more space, and a never ending supply of billions of tonnes of energy just to exist as anything more than lines of computer code.

Bitcoin Needs Gold to Exist, Gold doesn’t need Bitcoin to Exist

Thus far, we have established that once the metabolic energy has been expended to mine Gold from the earth, its natural properties guarantee that no further metabolic energy will ever need to be expended in order to maintain Gold’s constant, physical state. By contrast, we have seen how Bitcoin, once “mined,” requires the constant expenditure of metabolic energy in order to continue to exist through time.

Beyond this basic difference, unfortunately for Bitcoin, there is yet another fundamental difference between these monies: whereas Gold does not need Bitcoin in order to exist, Bitcoin cannot exist without Gold. The very computer chips used to “mine” Bitcoin must conduct electromagnetic energy at 300,000 km/s–the speed of light–if they are to be effective. The only material conductor in existence which is capable of handling that capacity is Gold. Therefore, in order for Bitcoin to be “mined” at all, Gold is an inherent prerequisite.

In contradistinction, no Bitcoin has ever or will ever be required in order to extract Gold from the earth—nothing more than a pan or a pickaxe are required to begin that process. This fundamental difference points not just to the primacy of Gold over Bitcoin (we can’t have the latter without the former), but to the clear absurdity of using something which can, in and of itself, serve as a perfect money (Gold) to create a manifestly inferior monetary substitute (Bitcoin). Put simply, by using Gold this way, we are taking something which perfectly realizes the intended outcome and using it to create something that does not.

Conclusion

The purpose of this paper was to dispute claims made by Grayscale via their DropGold campaign. Personally, I have been disappointed by the lack of response from the Gold community in this regard. While balancing my executive position in three companies, a busy travel schedule, and countless personal responsibilities, I have made an effort to spend several hours each day over the past two weeks to draft this paper. I did so because I felt it was in the public interest to crystallize this critical dismantling of Grayscale’s campaign of misinformation.

While there have been some cursory attempts by members of the Gold community, these have lacked the rigor necessary to truly speak to the essence of the issues with the Grayscale campaign. Some Gold investors, for example, rushed to point to the notion that Grayscale charges 2% per annum to merely hold Bitcoin, while the Gold ETF’s charge just 0.5% each year. To me, these analyses, while helpful, missed the more foundational issue at hand, which was that before making any comparison of nominal fees, one should first compare the true properties of both Gold and Bitcoin. The real issue isn’t that Gold ETFs are cheaper than what Grayscale has to offer. The issue is that Gold is naturally better.

By addressing this more fundamental issue, I was able to objectively analyze the merits of Bitcoin in the present, proving the claims made by Grayscale that Bitcoin is weightless to be preposterously wrong. Building on this understanding, I was able to show that Bitcoin is very much a physical entity, one which is indeed heavier than Gold. Introducing volumetric space, I was able to show that the weight embodied by Bitcoin means it is also far less value dense than Gold. Lastly, I was able to demonstrate that the continued energy demands of Bitcoin as manifest in the corporeal world, are a real tax on its ability to embody energy into the future. This showed that not only was Bitcoin clunkier than Gold, but that this introduces serious questions about its ability to sustainably serve as Money in the future.

Here, the argument moves beyond the comparison of Bitcoin to Gold into a comparison of Bitcoin to anything corporeal. This is a separate project to be taken up by other curious minds, one which will likely show that even Oil or Copper, which have rates of diminishing utility of ~2-3% per annum, are likely more efficient stores of value than Bitcoin due to their value density and first order properties. In this way, Bitcoin is a melting abstraction requiring ever more hardware and ever greater amounts of energy just to perpetuate its own existence. I have sufficiently shown this to be a literal weight which can be viewed to be increasing the size of the Bitcoin cube relative to Gold (inflating it), thereby decreasing the per capita ownership of Bitcoin in much the same manner as a negative interest rate does in modern economic theory. Even before any debates about a hard cap of 21 million coins, transaction fees, how miners can be incentivized into the future, and so on, the Bitcoin community must first address this acute question of how Bitcoin owners will pay for the annual existential requirement on the part of this melting abstraction to consume energy and add physical equipment and infrastructure. This question must be answered thermodynamically, because the physical world has real thermodynamic limits while the mathematical world circumvents these realities by using the intellectual hack called “infinity” to create virtual worlds which are artificially exempt from thermodynamic realities.

After demonstrating that Bitcoin was an inferior Money, I also drew attention to the irony in advocating for the comparative superiority of Bitcoin over Gold when the 4 million Bitcoin mining chips require Gold in order to engage in computations for any sustained period of time. The amount of Gold here is irrelevant, and this argument is largely beside the point, which is why I didn’t spend too much time on it. However, the primacy cannot be disregarded, and helps reconcile a lot of the other arguments I put forward throughout the paper.

It is, therefore, my hope that I have sufficiently falsified the DropGold campaign as a misinformed attempt to promote bad information to unknowing investors while arguing for Gold’s manifest superiority to Bitcoin as Money.

It is my final hope that the Bitcoin community will embrace this research and a shared understanding that the Gold and cryptocurrency communities should be working together rather than against each other as we march towards the inevitable demise of the fiat currency system.

Ultimately, what this paper reminds us of is that there is nothing new under the sun. There is no better designer, no better architect, and no better measure of toil and motivator of merit than a product of the first order laws of nature. Human abstractions can try to build a better mousetrap, but these are merely paradigms that fail when correctly pierced by sound meditation and analysis of our natural world.

via ZeroHedge News http://bit.ly/2WkwgmP Tyler Durden