Authored by Sven Henrich via NorthmanTrader.com,

The May correction was technically well advertised in April, even before that, but the run in April stretching to new highs on $SPX and $NDX was a tricky exercise to navigate through. Extremes become more extremes as I outlined in my 2018 market lessons.

The wedge patterns I outlined in advance finally met their end with downside breaks bringing us the May correction highlighting again that technicals matter. The wedge mattered. The weekly hanging man mattered. The trend breaks mattered.

And yes historic technical extensions mattered:

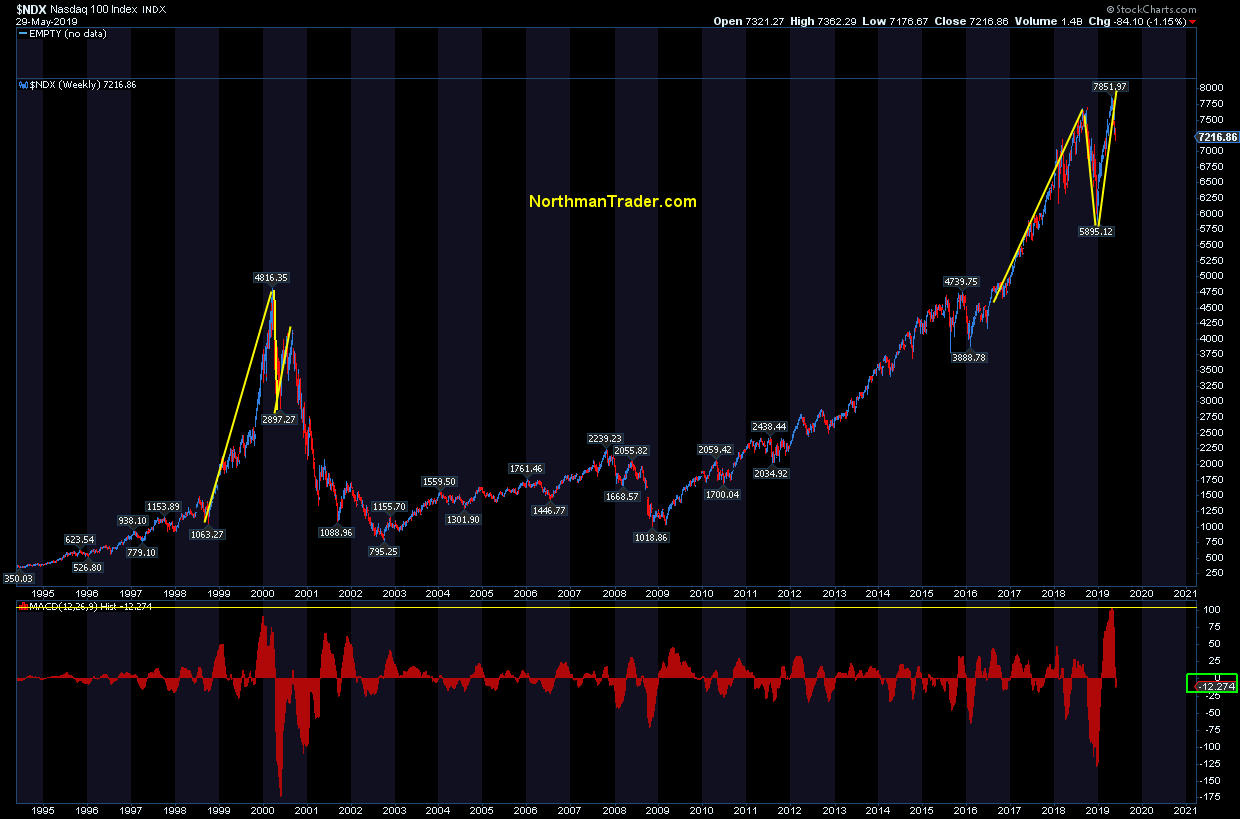

$NDX:

101.988 – highest weekly MACD upside deviation ever.

Ever is a long time.

You can choose to believe this is sustainable, or you may not. pic.twitter.com/a3O7BKPixm— Sven Henrich (@NorthmanTrader) April 23, 2019

That deviation having gone from most positive ever to now negative:

Also mattering: The negative divergences highlighted in Lying Highs II.

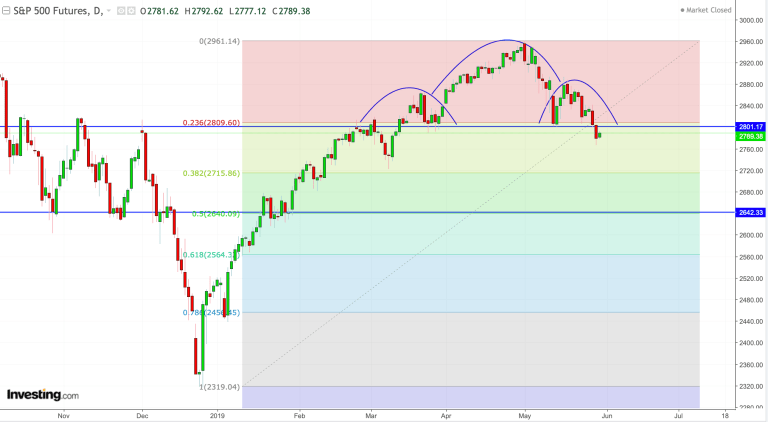

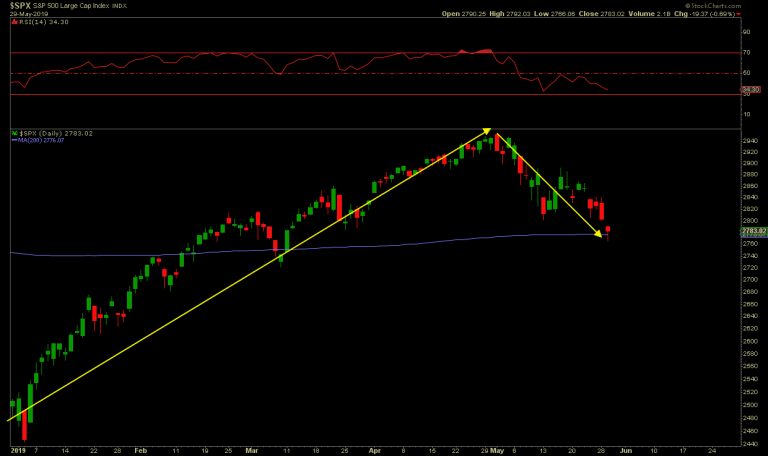

All of these factors have now resulted in a technical reaction that produced a retrace to not only the daily 200MA yesterday, but also the critically important weekly 50MA, another key support pivot:

$ES has reached a key support level, the weekly 50MA.

Bulls will want to defend and rally from here.

Close the week below risks further downside. pic.twitter.com/2yK90Kcqwe— Sven Henrich (@NorthmanTrader) May 29, 2019

See a sustained close below these MAs and bears may be devouring bulls.

After all this H&S pattern is triggered and it has a 2640 target and bulls need to step it up here today & tomorrow into the end of May and invalidate this pattern now that we’ve seen a break of the neckline:

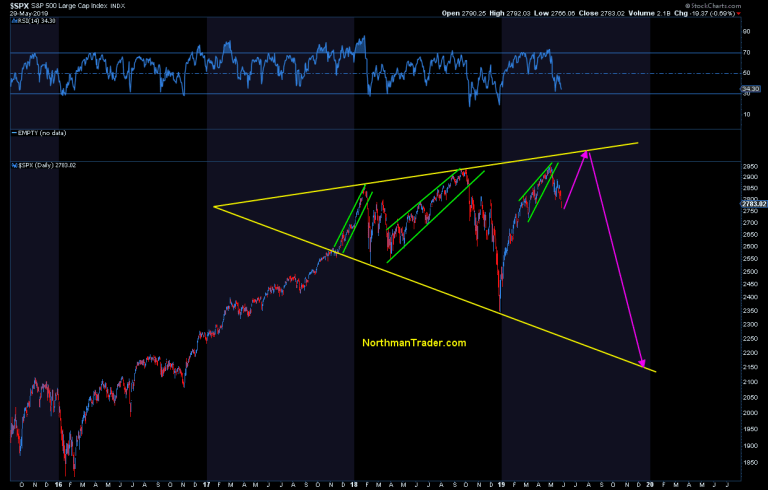

So let’s be very clear there are numerous critical technical concerns that very much suggest markets may be engaged in major topping patterns, the Wyckoff pattern I outlined on May 1 right near the top is still fully valid at this stage, and the ghost chart is casting a long shadow here as well. With the combined backdrop of an escalating trade war, yield curve inversions, slowing growth, trapped central banks and a toxic political climate there’s a lot that can seriously wrong for bulls here, a macro and technicals backdrop that is paving the path to intervention.

But navigating markets is a complex exercise that requires an open mind to the other side of any argument and now that May has brought the first correction of 2019 it may be worthwhile to take a look at the bull case from here.

Keep in mind that ,in context of the larger 2019 rally, the May correction has been run of the mill. A near 8.5% correction in $NDX a 6% correction on $SPX. Nothing super dramatic has happened yet and we remain inside the larger 2018 price range.

What is the bullish case then? Well, take out all the noise and all the headlines and let me highlight here a couple of interesting considerations.

As corrections unfold it’s always important to watch for potential signs of turns. I outlined one of these yesterday:

$NDX: potential bullish falling wedge in the making. pic.twitter.com/vGeeWYQVxp

— Sven Henrich (@NorthmanTrader) May 29, 2019

This potential pattern is by no means confirmed at this stage, but it leaves room for a bullish interpretation, at least short term if the pattern triggers.

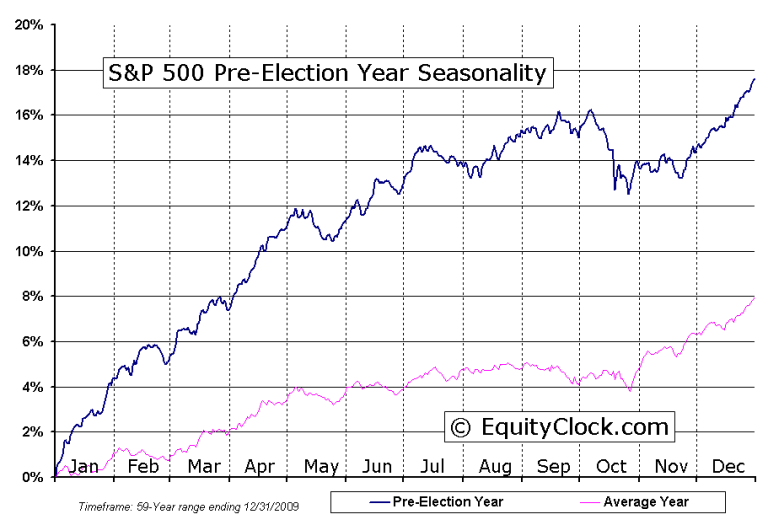

But let’s look at 2019 from a broader seasonal perspective:

Massive ramp up for 4 months straight, then a correction in May which may or may not be over yet as mentioned above.

But guess what year it is? Yea, I know, 2019, but what is 2019? It’s a pre-election year with 2020 being the next presidential election.

Now check this out this chart on pre-election year seasonality:

Look familiar? 4 month ramp out of the gate and then a correction into the end of May. Oops.

See it’s the what happens next on that seasonality chart that should scare the hell out of bears as it implies new highs to come if it plays out this year again.

Also keep in mind the megaphone structure I first outlined in Combustion is still out there as well:

Without a fast close above 2800 this week into next this scenario may be quite moot as the H&S pattern may trigger, but it’s best to keep an open mind and an eye on a broad range of possible outcomes. Levels, patterns and signals will keep us appraised as to the next big move.

A more in depth analysis of the technical factors/signals weighing the bull versus the bear case can be read in Fire Hazard.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2Z1OeZ1 Tyler Durden