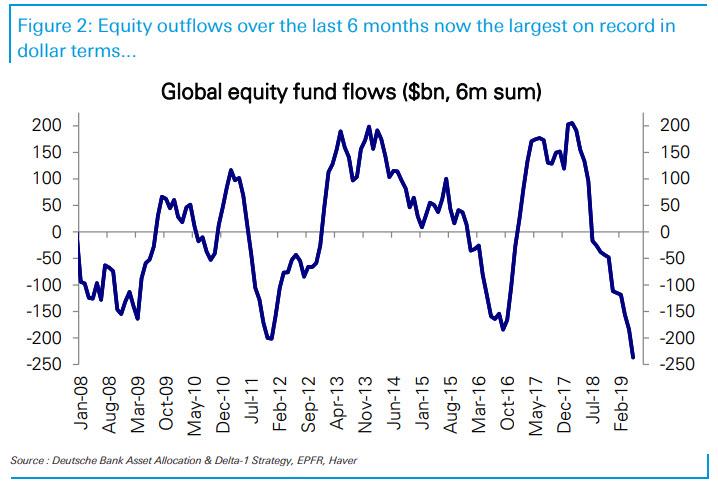

Last week we highlighted a shocking Deutsche Bank report that showed global equity fund outflows over the last 6 months in dollar terms have now been larger than over any prior 6-month period.

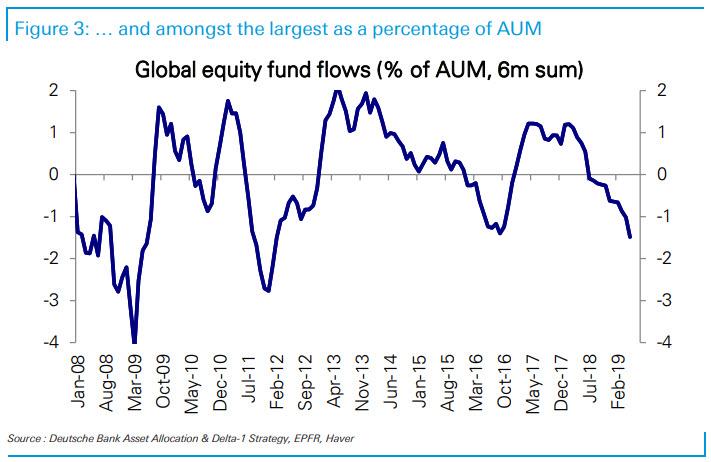

As a percentage of AUM, the latest half-year outflows were only exceeded by those seen around the 2008-09 recession and the European financial crisis.

That investor exodus recently spread to the credit markets, with HY funds seeing huge outflows as prices plunged ominously.

With HY credit markets screaming about dead canaries in coalmines…

And now that investor exodus has spread to other segments of the credit markets…

As Bloomberg reports, the biggest leveraged loan ETF, BKLN, had its largest ever daily outflow in the most recent session for which Bloomberg has data…

Additionally, State Street’s High-Yield Muni ETF, HYMB, also saw a record daily outflow on June 3…

“While we’re working through this dual threat of new worries around trade and the re-rating at the front end of the curve, you want to be cautious for credit assets,” Rob Waldner, chief fixed income strategist at Invesco Ltd. said on Bloomberg TV Tuesday.

And where are those de-risked assets seeking safe-havens? Gold!

GLD – the Gold ETF – saw its biggest single-day asset inflow since Brexit yesterday.

via ZeroHedge News https://www.zerohedge.com/news/2019-06-04/gold-sees-biggest-inflow-brexit-investor-exodus-contagion-spreads-credit Tyler Durden