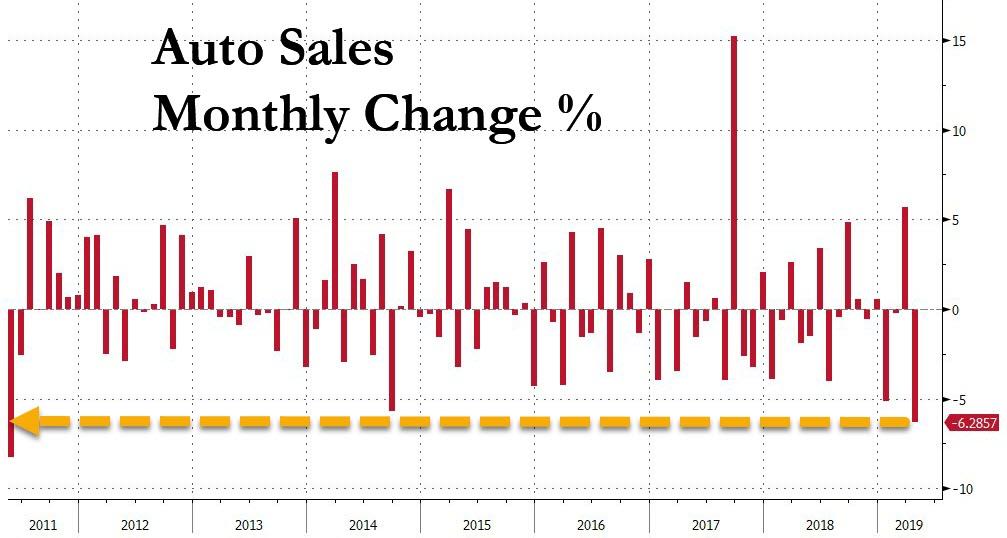

After auto sales crashed 6.1% in April, marking the industry’s worst slide in 8 years, the bleeding appears to have momentarily stopped. May’s U.S. auto sales data came in higher, year over year, for the first time in 2019. Fiat, Toyota and Nissan posted sales gains for the month, while Ford sales reportedly fell 4.1%, extending the automaker’s streak of declines to four months. Toyota posted a 3.2% sales increase, boosted by demand for its Camry sedan. Some of the other strongest models in May were also sedans:

Strong performers in May:

Fiesta +50.7%

Jetta +41.5%

Fusion +38%

Camry +20.8%

Altima +5.2%— Daniel Ruiz (@DRuizG80) June 4, 2019

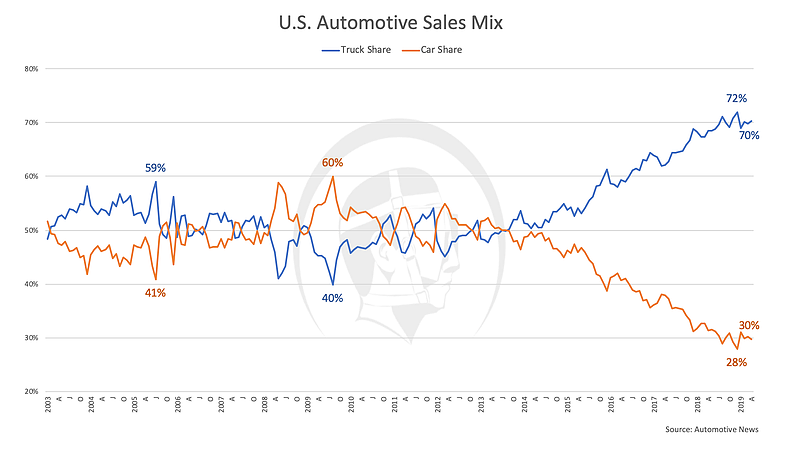

Ford’s fall was the result of its F-series posting lower sales for a fourth straight month. The Ford brand fell 4% while the Lincoln brand fell 5.8%. Meanwhile, May was the best month in nearly two years for the Ford Fusion and in almost four years for the Fiesta, marking the possible end of the SUV divergence from sedans that started several years ago.

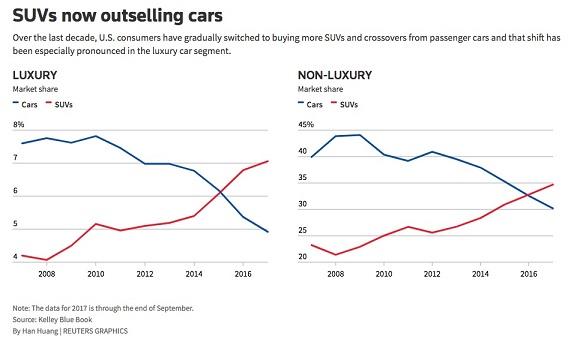

SUVs were one of the sole remaining bright spots in the rapidly slowing U.S. auto market. Despite the fact that they were crippling traditional sedan sales, Americans’ transition to SUVs was seen as a silver lining, prompting many automakers to make infrastructure changes to account for the change in demand.

Fiat saw a 2.1% increase in sales, as demand for their pickup trucks remained strong and the Dodge Ram saw a 33% gain over May 2018. Fiat also reportedly “leaned heavily” on channel stuffing fleet sales, which increased 46% in May versus last year. Fleet sales were 31% of all sales for FCA last month, according to the Detroit News.

Zo Rahim, an economist for Cox Automotive said: “To maintain sales, auto companies are pulling the fleet lever, as FCA clearly did in May.”

Another catalyst was that interest rates for new vehicles came in at 6.1% in May, compared to 6.27% in April, according to data provided by Edmunds. But at the same time, monthly payments reached record highs — $559 a month.

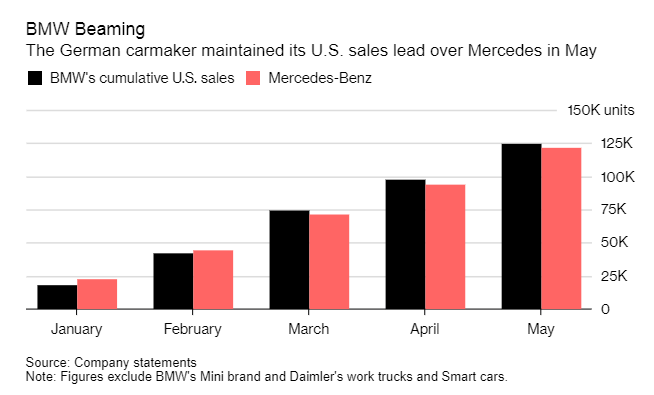

BMW kept its dominance over Mercedes in tact, catalyzed by the X7 and its new lineup of SUVs. Sales of BMW’s namesake brand were up 1.7% to 27,109 units, beating Mercedes’ gain of 0.4% to 27,080. BMW has delivered more than 2,100 X7s in each of the first three months it’s been in U.S. showrooms, according to Bloomberg.

Nissan saw its sales eek out a gain of 0.1%, driven by SUV and truck demand, while Honda reported a 4.9% fall in sales for May as demand for their sedans fell. May’s data comes amidst a worldwide global automotive recession that has crippled vehicle production across the world.

Year to date, through April, U.S. new vehicle sales were down 3%, setting a grim tone for the remainder of the coming year. And the downturn threats continue despite May’s report, due to President Trump’s recent threats of imposing new tariffs on all Mexican imports. Put simply, this means more volatility could be on its way.

Charlie Chesbrough, an economist for Cox Automotive said: “Volatility is a new ingredient in the market, and it’s likely to be like this for the rest of the year. It’s hard to know if May’s results are an indicator of a robust summer ahead or more volatility ultimately leading into a downward trend for the year.”

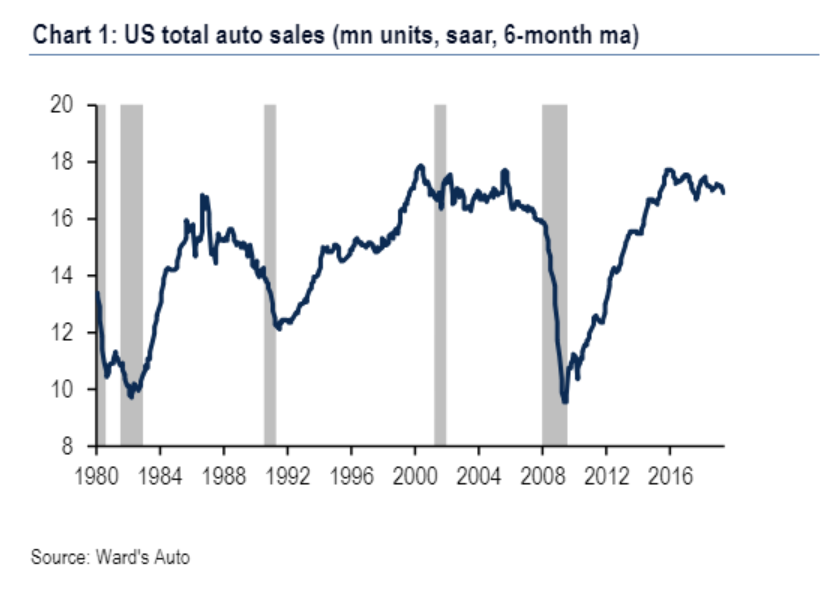

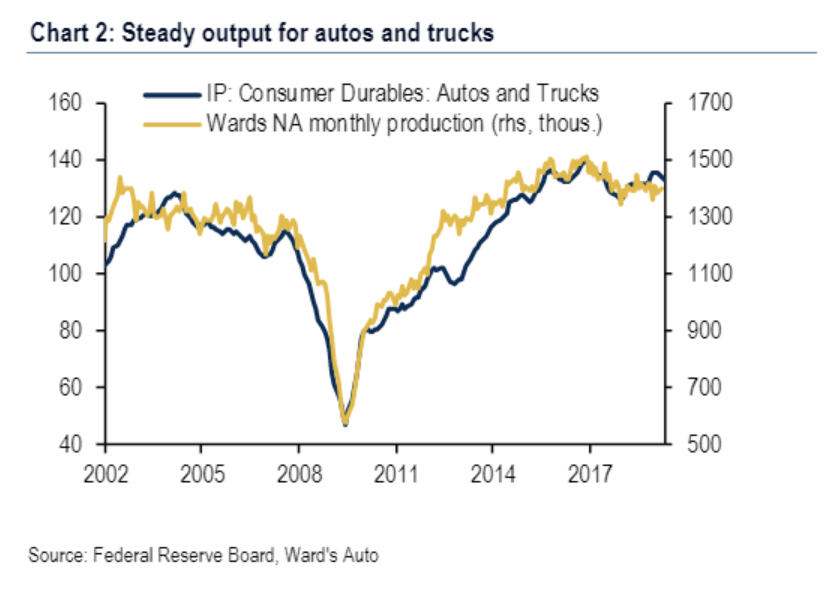

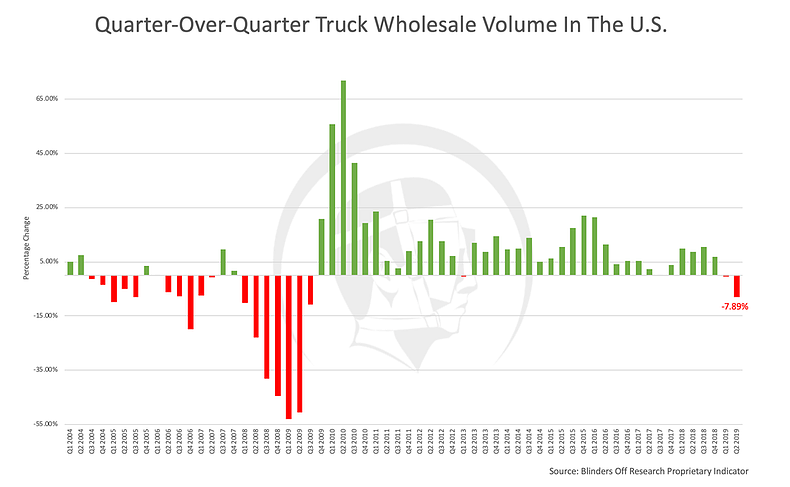

We noted just days ago that Bank of America believes that the auto cycle “has peaked”.

The note showed that total auto sales have appeared to peak…

…while at the same time output remained high…

Days before that, we noted JD Power’s pessimistic look at bloated inventory and stuffed channels in the automotive industry.

US auto sales in April tumbled by 6.1% – the biggest monthly drop since May 2011 – to just 16.4 million units, the lowest since October 2014. Aside for an incentive-boost driven rebound in March and May’s gain, every month of 2019 had seen a decline in the number of annualized auto sales.

via ZeroHedge News http://bit.ly/2IjuDfY Tyler Durden