Oil managed gains today after 4 straight days lower as Saudi Energy Minister Khalid Al-Falih said he’s committed to doing whatever it takes to stabilize markets.

“Underpinned by rising trade tensions, the global economic picture has deteriorated,” said analysts at Citigroup Inc. led by Ed Morse. “Yet this macro pessimism masks tangible bullish oil market fundamentals.”

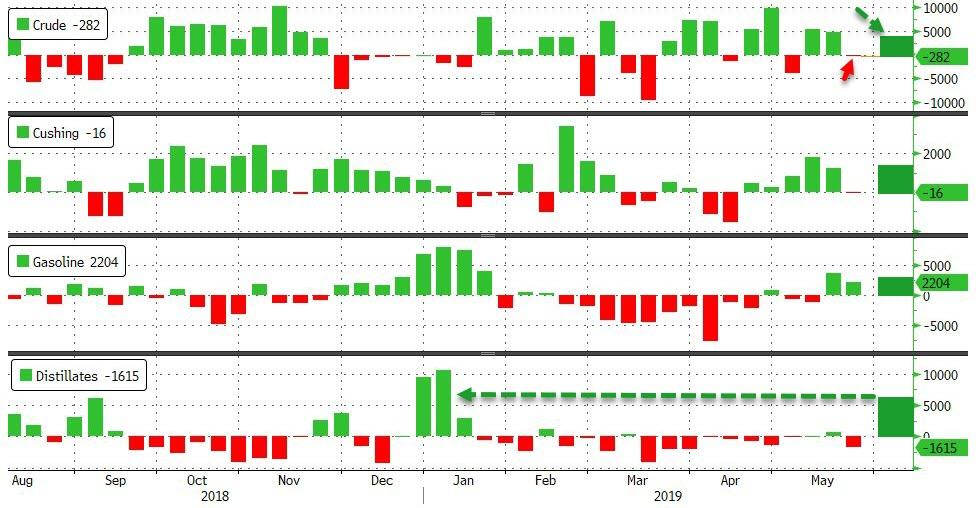

API

-

Crude +3.55mm (-1.8mm exp)

-

Cushing +1.408mm (-800k exp)

-

Gasoline +2.696mm (+500k exp)

-

Distillates +6.314mm (+600k exp)

After last week’s small draw, expectations were for another larger crude draw this week, but API shocked markets with a 3.55mm build (along with builds across all Cushing and a huge distillates build)…

“It’s pretty clear that demand concerns still have the market at its grip,” said Gene McGillian, manager of market research at Tradition Energy.

“But, maybe some of these demand fears may have extended itself. Refinery utilization jumped back above 90 percent and WTI should pick up again.”

WTI managed some gains on the day, hovering around $53.50 ahead of the API print but tumbled after the data hit

Bear in mind that last week API reported inventories down 5.3mm barrels and EIA printed -282k.

via ZeroHedge News http://bit.ly/2ImPVtn Tyler Durden