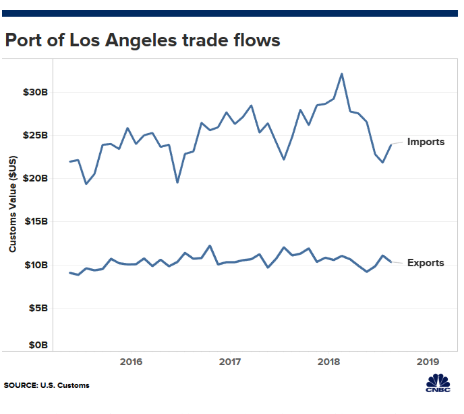

Data released by the Los Angeles and Long Beach ports, America’s two busiest container ports, reported declines in export volumes in May, as trade tensions between the US and China continued to intensify into summer. The report marks the 7th consecutive monthly decline in exports for Los Angeles, reported CNBC.

The Port of Long Beach printed a disastrous 19.5% drop in imports in May, which some economist suggested America’s top importers, big-box retailers, are finished pulling forward inventory to beat potential duty hikes.

“The best we can say right now is that importers – at least through the Southern California ports – were concerned probably more about the size of the inventories right now than with anything else,” said Jock O’Connell, a California-based international trade advisor for Beacon Economics.

“Having already brought in vast numbers of commodities in anticipation of previous tariffs, they are pretty well stocked up.”

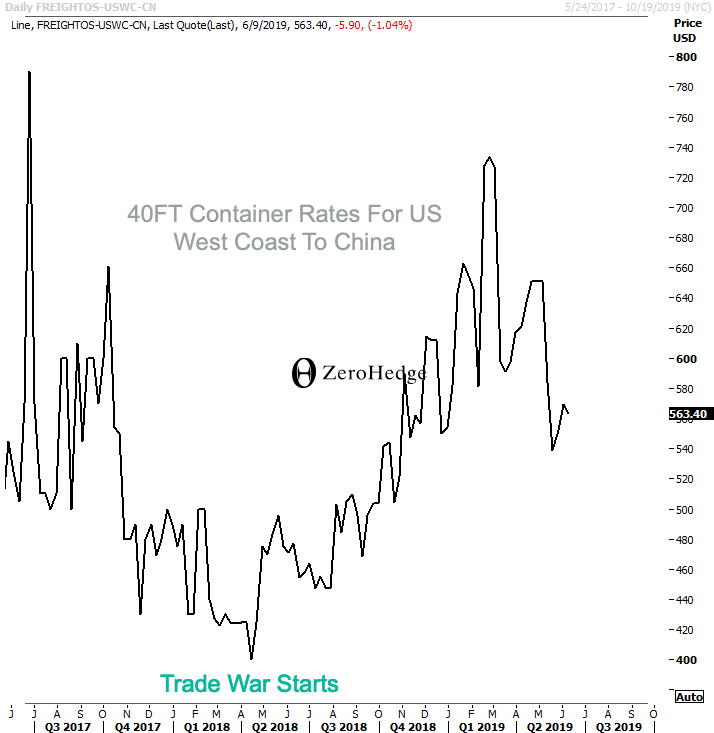

The trade war forced American importers to pull inventory forward all at once; this created a massive influx of containers at both ports from 2H18 through May 2019.

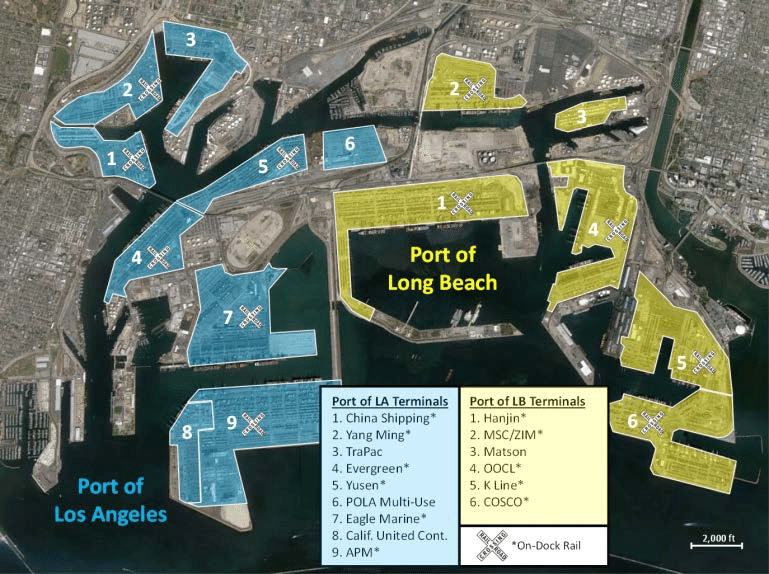

O’Connell said retailers have no more warehouse space to store goods. The Los Angeles and Long Beach port handle about 47.5% of US containerized trade with China.

“The warehouse and distribution centers in Southern California and ports themselves are just so stocked up (with) imports that were brought in previously, that there’s no place to put them,” O’Connell said.

Port officials continue to monitor the trade war with China. Last month, the Trump administration slapped a 25% tariff on $200 billion worth of goods. China responded with 25% tariffs on $60 billion in US goods.

Trump has threatened to slap tariffs on another $300 billion of Chinese exports if China’s leader Xi Jinping doesn’t meet him at the 2019 G20 Osaka summit in Japan. The move could hurt the port’s business.

“With a major tariff increase already announced and the possibility that tariffs could be impose of nearly all goods and inputs from China, retailers are continuing to stock up while they can to protect their customers as much as possible against the price increase that will follow,” Jonathan Gold, National Retail Federation’s vice president for supply chain and customs policy said last week.

Last month, the Port of Los Angeles reported import volumes increased by 5.5% from a year ago, which compared with significant declines in import volume at Long Beach. When import volumes from both ports were combined, there was a 7% drop in total imports.

As for exports, the Port of Los Angeles showed a dip of nearly 1% in May after registering a 6% drop in April. The port has posted export declines since November 2018.

“As we prepare for our traditional peak shipping season in the months ahead, we’re closely monitoring global trade tensions that have created heightened unpredictability,” Port of LA Executive Director Gene Seroka said Tuesday.

It’s not just the ports that are feeling the pressure from the trade war, trucking, railroads, warehousing, construction, manufacturing, and farming, have also been impacted in the surrounding counties. About one million jobs related to international trade in a five-county region are also in question as the trade war deepens.

Trade chaos has “really gummed up the operations of the supply chain,” said Eugene Seroka, executive director of the Port of Los Angeles. “We’ve got a lot of cargo coming in that just sits.”

“Containers are stacked high. Truck lines are long. And warehouses are bursting at the seams.”

There is so much inventory piling up at Southern California’s warehousing and distribution complex, the largest in the world, that it has less than a 1% vacancy, down from the average of 5-7%, he added.

“A lot of money is sitting on the sidelines,” he said. “Do you buy more trucks? Do you hire more people? Do you build another warehouse? Do you invest in digital technology?”

“Few companies want to invest at this point in time in the supply chain, not knowing where it is going in the future.”

A full-blown trade war would be absolutely devastating for the California economy.

“It won’t have a catastrophic effect on the Southern California economy,” O’Connell said. “But if you are a company struggling to do business with China, it could be devastating.”

As the US economy cycles down into the summer with the threat of a full-blown trade war, the business cycle has become vulnerable to shocks, and it’s trade war shock that is likely to usher in the next recession in 2020.

via ZeroHedge News http://bit.ly/2RfdKad Tyler Durden