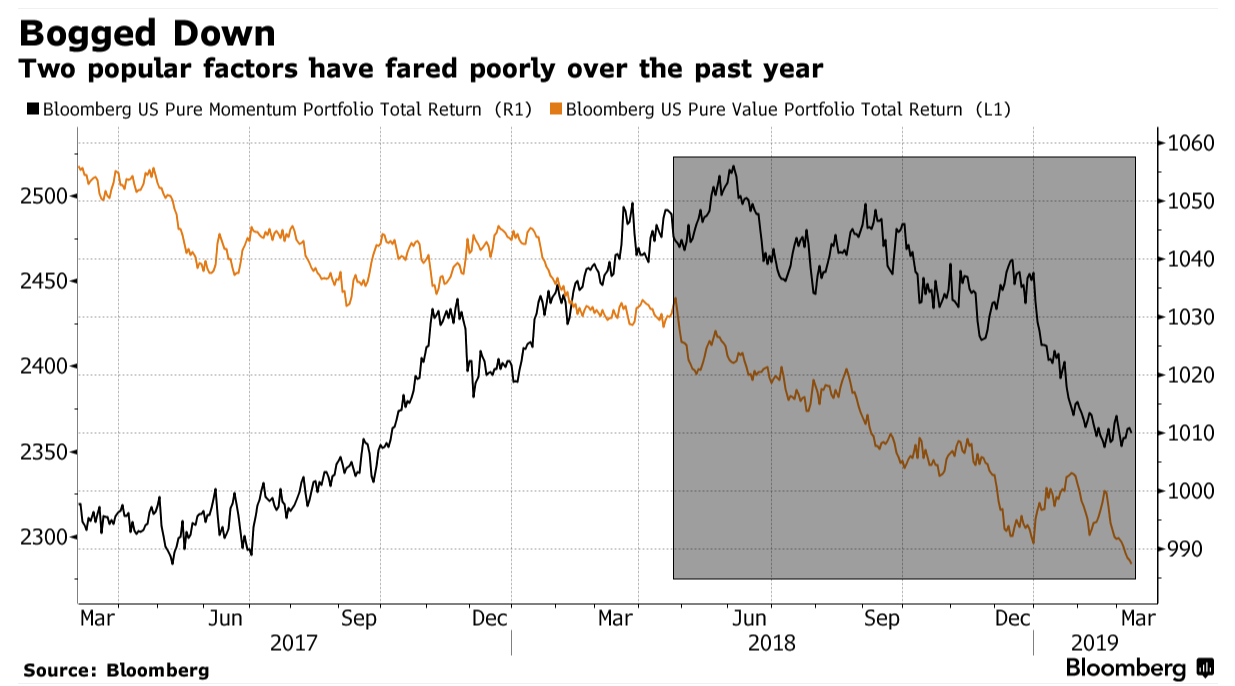

We pointed out earlier this year that “factor based” quant funds were having difficulty finding strategies to beat the market – especially now that all quant funds are doing the same thing. But now, the computer scientists at Cantab Capital, based out of Cambridge, have taken on another challenge: trying to create the next “bond king” out of algorithms and data, according to FT.

The company’s computer scientists have backgrounds in astrophysics and molecular biology and are trying to write programs that “surf the undulations” of the bond market in order to copy the best features from human traders, while leaving their frailties behind.

Anthony Lawler, co-head of GAM Systematic, the arm of the Swiss asset manager that owns Cantab said: “An active credit trader is ‘feeling the tape’. We want our models to replicate that behaviour.”

This is now the new world of bond investing, formerly an old-school industry that, for decades, had been limited to wealthy fund managers in places like London and New York. The rarely anointed title of “bond king” – usually used by the media – was reserved for traders like Bill Gross and Jeff Gundlach in the past. It’s now being sought after by computers.

Paul Kamenski, co-head of credit at Man Group’s Numeric unit said: “This feels like the early days of the ‘quant’ equity industry. A lot of the research is in the early stage but the pace of advancement is likely to be faster. There’s a realisation that this is an untapped market.”

Man Numeric launched a bond platform late last year that was initially focused on US junk bonds. Now, it plans on expanding into investment grade corporate debt.

Man doesn’t want to give away too much detail on its platform, but one thing it disclosed is that it is using “alternative data” – nontraditional data like credit card purchases, trade receipts and shipping data. They use this data to gain further detail on private companies that don’t disclose regular financial statements, as well as to map out links between companies that are competitors and clients. This can help exploit leads and lags between how bonds react to corporate developments.

FT offered one example:

For example, if a cement company seems to be doing well, then it might indicate that the homebuilders it supplies are also booming. One big barrier has been the complexity of the bond market — especially corporate debt.

Whereas a company may issue just one or two types of equity, it could issue tens or even hundreds of types of bonds, with varying legal safeguards, currency, maturity and coupon payments. Moreover, big macroeconomic shifts — such as interest rates — can have a major but unpredictable impact.

Advances in computing and cleaner longer-term trading data, combined with a “critical mass” of bond market research have now created a “tipping point” for systematic fixed income investing, according to Linda Gruendken, lead scientist at Cantab.

Naturally, those at well-established traditional bond firms like PIMCO, are not sold on the idea. Mihir Worah, one of Pimco’s top executives who leads its own quant efforts said: “It’s the next frontier. But the pickings may not be quite as fertile as some people think, as the easy pickings are already done.”

Liquidity also becomes one of the biggest issues. Trading volumes in bonds are generally much lower than equities and transaction costs are high. This automatically puts it at a disadvantage for high frequency and algorithmic trading. This also makes signals from the market difficult to exploit, especially in short order.

Cantab is trying to work on this problem by trading more liquid credit derivatives and indices of credit derivatives instead of the underlying bonds. But even at this point, it still needs a human touch. The company’s algorithm is named “Gekko” after Gordon Gekko from Wall Street. Its algorithm will come up with orders to place and give them to a trader in clear sentences, but from there, a human trader still has to copy the sentence and paste it into live chat windows that they have open with banks.

GAM is trying to revive its fortunes following a scandal surrounding one of its top fund managers which came after a large writedown due to the acquisition of Cantab. Cantab’s quantitative fund was down 23% last year, but has since rebounded and is up 22% this year. AQR, the quant investment group that launched its first systematic bond mutual fund last year, also faced similar challenges.

Scott Richardson, co-head of fixed income at AQR said: “When the rubber hits the road, someone sometimes has to do the trades. There are times the model will want to execute a trade and we can’t do it.”

Although it’s moving at a slower pace, bond markets are becoming reliant on machines similar to the way that equity markets were years ago. At this point, it’s just a matter of time before the same type of automation and algorithmic high-frequency trading follows.

Robert Lam, the other co-head of credit at Man Numeric concluded: “We are at the infancy of quantitative fixed income investing, but we are also at the infancy of electronic fixed income market-making. Structurally, credit markets are changing.”

While the financial media may not be able to refer to humans as “bond kings” anymore, one silver lining – just like with equities – is that the “boogeyman” algorithms will give them a perfect scapegoat when the bond market inevitably crashes during the next bubble burst.

via ZeroHedge News http://bit.ly/2IMvZQM Tyler Durden