Authored by Sven Henrich via NorthmanTrader.com,

Fed Games

Clever markets. Many index charts have camped themselves inside tight key price zones ahead of the Fed meeting this coming week leaving potential for important breakouts or equally important breakdowns. The trigger to render the decision next week: The Fed of course.

Be very clear: What happens next week is a giant gaming exercise in expectations, confidence, control and reactions. But it won’t stop here for following next week’s Fed meeting markets will move straight onto gaming the upcoming G20 meeting at the end of June and its related potential for trade war progress or escalation. But the fun doesn’t stop there either as it’s then on to the next Fed meeting in July.

If you’re expecting a sleepy summer in markets let me disavow you of that notion. How these 3 events play will have a massive impact on prices, either to the upside or the downside.

But one event at a time.

This coming week markets will not only contend with the Fed, but also quad witch options expirations always a week for traders to expect the unexpected although OPEX weeks generally have an upward bias.

But make no mistake: This week’s about the Fed. In 2019 Jay Powell has bent over backwards to appease the market beast. First the stunning reversal in January following the December flush indicating flexibility on the balance sheet, then the March confirmation that QT will be ended in 2019 and then his speech following the steep May correction indicating readiness to act on rate cuts, all of which were cheerfully greeted by markets who want an interventionist Fed to extend the cheap money game that has dominated equity markets for the last 10 years.

But this move here is different. The Fed is on the defensive, not only having been forced to do a 180 on policy as the macro economic backdrop has deteriorated faster than they expected, but also because they have limited room to work with compared to previous cycles. The implications are profound and I’ve discussed this in Global Fail and in Curveball.

And now that the Fed has shown itself again beholden to the beast they’ve been feeding for years it can ill afford to disappoint markets that expect, want and demand that the Fed pleases them with dovish action, talk and positioning:

HOW MANY RATE CUTS DO YOU WANT???? pic.twitter.com/KnIBqSJtwC

— Sven Henrich (@NorthmanTrader) June 14, 2019

The outcome may be binary here: A surprise rate cut or surprise immediate ending of QT may be dovish enough to force equity markets higher on to new highs or a market disappointment that may lead to a larger sell-off with grave uncertainty ahead of the upcoming G20 meeting. The calculus: Should the G20 disappoint then the Fed may again be seen being behind the curve rendering a July rate cut a desperate measure to catch up to volatile markets under pressure. Cut now, get the rally and be seen ahead of the curve, but then get a positive resolution on the G20 and appear to have wasted precious rate cut ammunition on a cut that was not needed and set markets on a path to a massive bubble blow-off perhaps creating larger financial market imbalances.

When in doubt count on the Fed to rather have a bubble then risk a sell-off?

One can game all this until the cows come home. Either way Jay Powell and the Fed will spend this week carefully weighing their options and crafting language to aim to minimize any market disappointment. It is all about confidence at the end of the day and the reaction may well be measured in how the US dollar reacts.

I’ll throw you another potential scenario: If the Fed cuts here it may well produce a quick spike higher, but it may not have the calming reaction the Fed would intend. Why? Because cutting here may ultimately send a very different signal. A signal that says the Fed is scared and knows recession risk is much higher than they are willing to admit. Don’t forget sudden rate cuts at the end of a cycle have seen recessions follow within 3 months on average during the last 3 cycles.

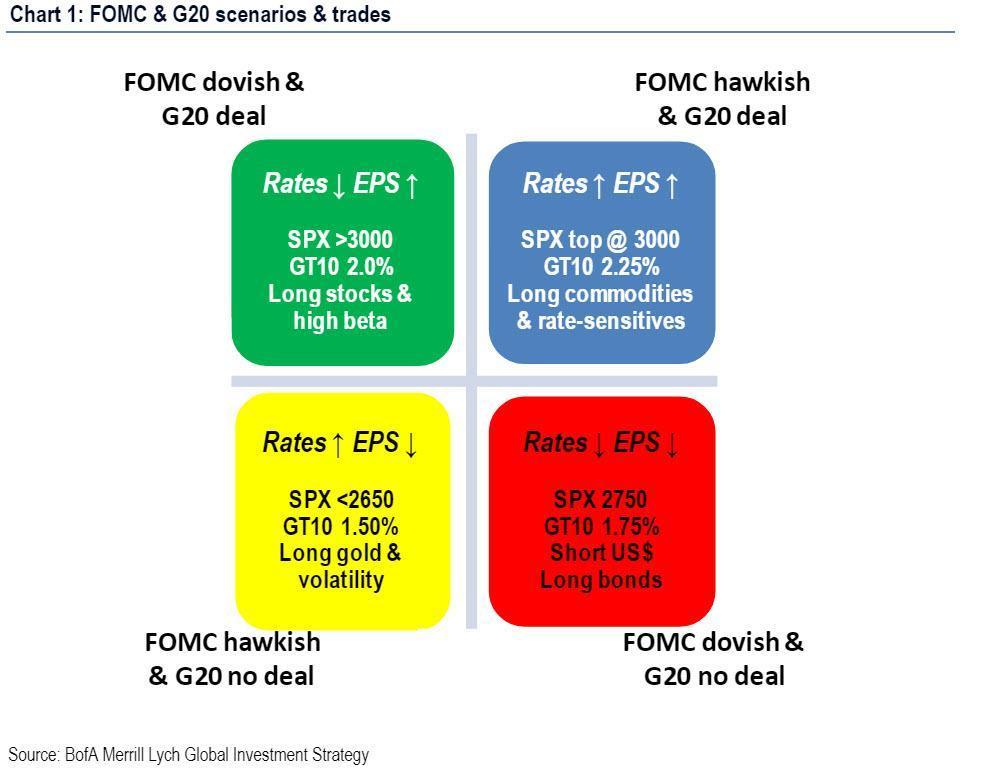

Even BAML, which is all bullish and is telling investors to jump into stocks and to sell volatility, has gamed wider price ranges as a result of the upcoming events:

There’s of course a 5th scenario that BAML is not mentioning here: One that says that a dovish Fed is not enough. One that says a global recession is unfolding into 2020 anyways, one that says central bank efficacy after 10 years of nonstop intervention is diminished. After all the current global economic troubles have come despite rates remaining near historic low levels, indeed negative rates are still in place in many places. Europe is in trouble despite negative rates and can only cut to more negative.

So while the Fed may manage to lift equity markets once again previous market cycle history suggests that initial Fed cuts are not a sign of good things to come, but rather are an opportunity to sell.

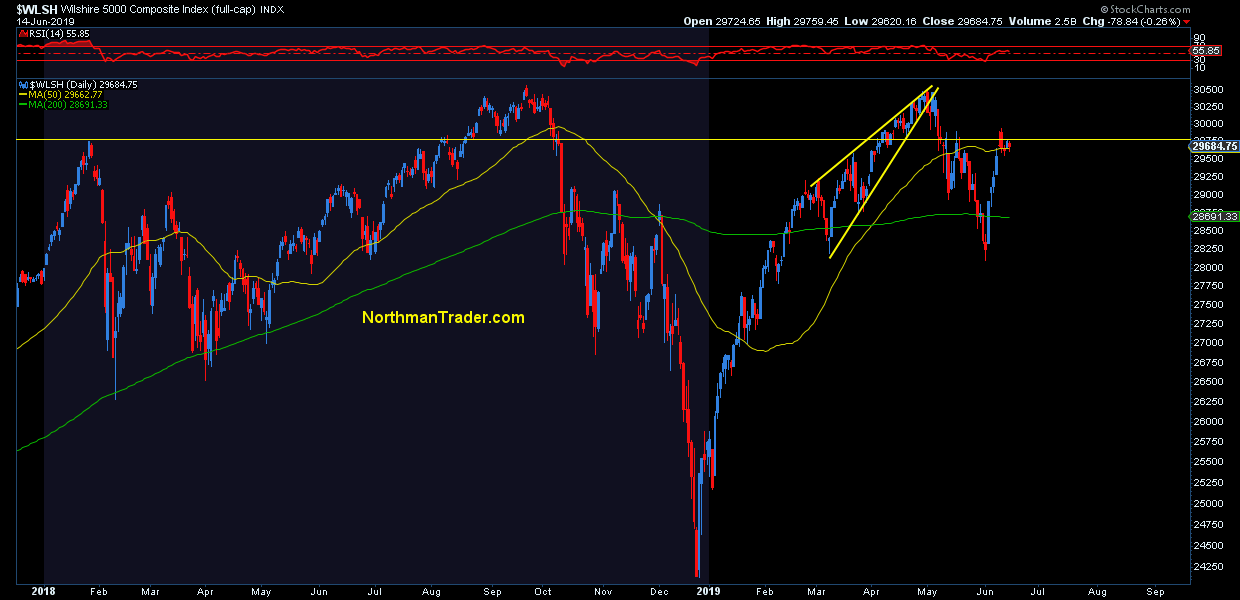

And so here we are coming into this Fed meeting and markets are at an interesting juncture, take the $WLSH the all market index:

The recent rally following Jay Powell’s “ready to act” speech has parked itself tightly between the January 2018 highs above and the 50MA just below.

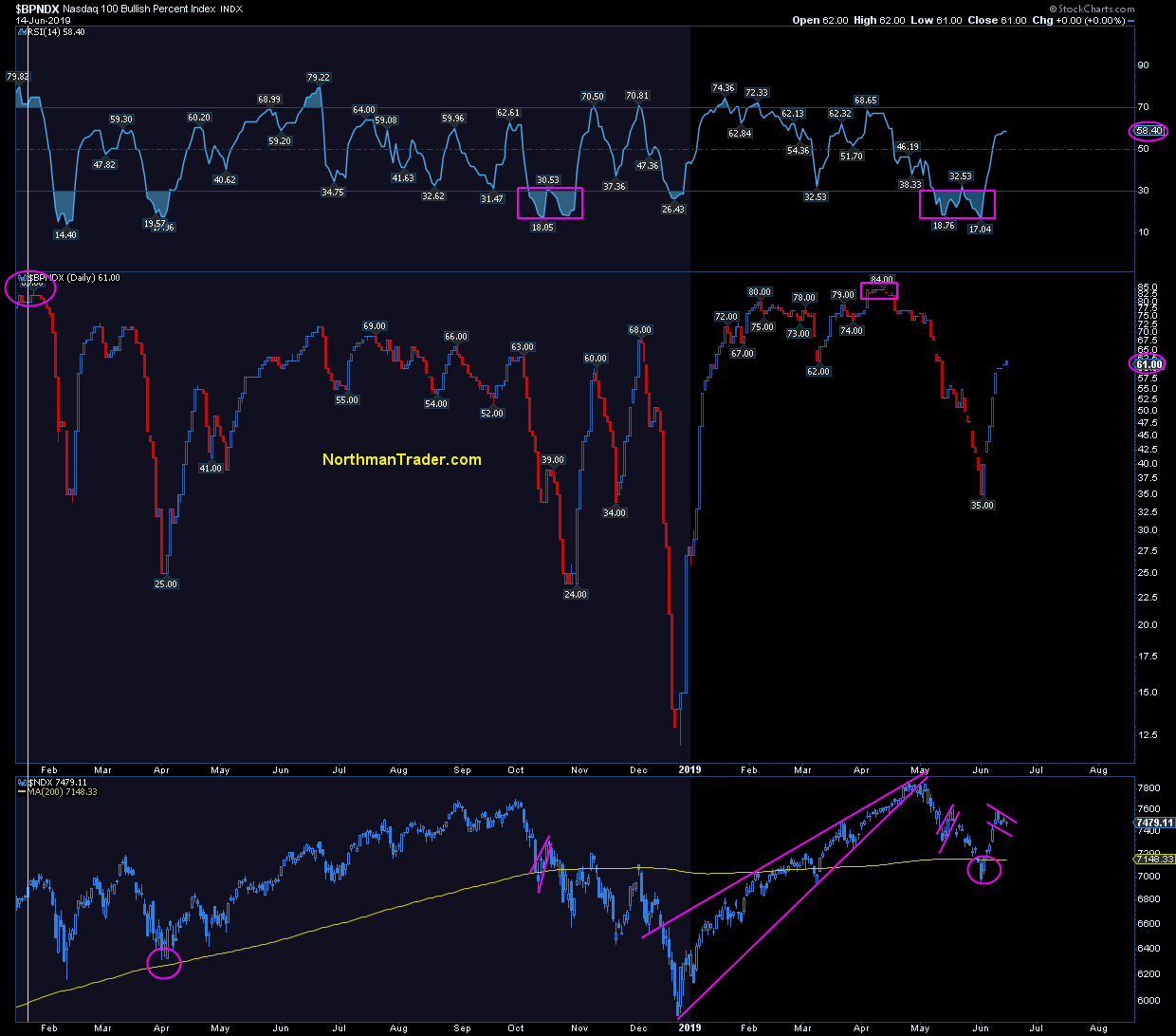

An added twist: Many signal charts are neither overbought nor oversold, example $BPNDX:

…leaving plenty of room for both price expansion or contraction.

So then here’s a genius prediction: At the end of the next week we’ll either close below the 50MA or above the January 2018 price range in $WLSH.

If the Fed succeeds in appeasing the beast price will close above and may embark on another run at highs or make new highs. If the Fed fails the recent rally will fail and risk major topping structures to kick in.

Yes it’s that binary. Once again the central bank overlords will be the arbiter of price and many investors once again believe the Fed will succeed in keeping the troubles away.

Understanding the technical backdrop then is key to assess how to navigate the possible ranges.

Welcome to the Fed Games:

* * *

To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2Kl9hCl Tyler Durden