Authored by Sven Henrich via NorthmanTrader.com,

They’re right. It IS different this time. It’s worse. Much, much worse. What is? Everything.

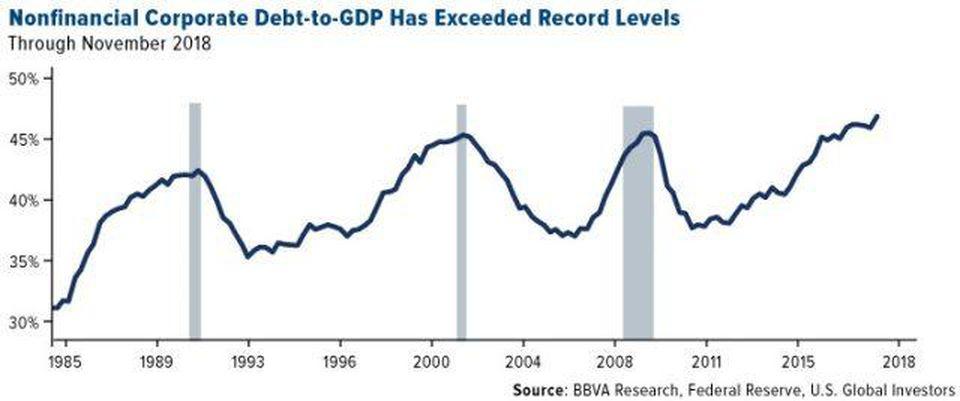

In terms of preparedness for the next recession that is. Debt is higher than ever, be it corporate debt, government debt, central banks balance sheets, available ammunition to deal with a new recession, wealth inequality, the social divisions and political extremes, and now trillion dollar deficits, everything points to a much more fragile system. Oh yes on paper low rates keep it all afloat, but the context is as ugly as it gets.

Here we are, the great collapse unfolding in front of us. With yesterday’s Fed meeting we witnessed a confirmed breakdown in central bank narratives over last the year, an utter capitulation to market realities that are forcing central banks to commence the new easing cycle. No, this is not a temporary little rate cut event they are promising, it’s a new cycle. The Fed yesterday offered a 3 rate cut outlook, precisely what markets had been pricing in. The Fed bowing before market demands. Give us drugs. Yes, whatever you want, you got it.

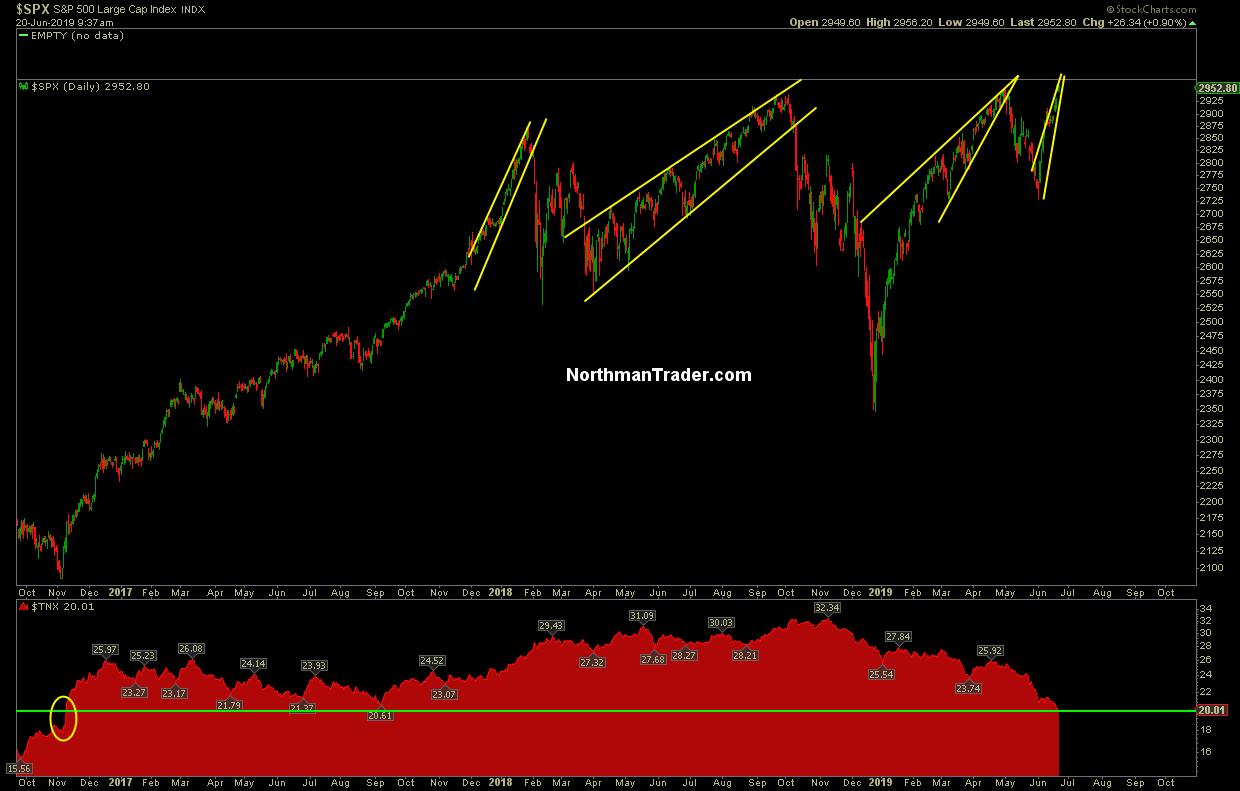

The response: An overnight collapse in yields to now below 2% on the 10 year, the lowest reading since the US election in 2016.

It was all bullshit:

The glorious growth stories everybody told, the tax cuts that were supposed to bring greatness, all nonsense. Instead we’re now stuck with trillion dollar deficits, collapsing yields, and a renewed TINA effect as money doesn’t know where to go but stocks, chasing whatever they need to chase.

Or, if you don’t want to chase, you can lend money and pay people to borrow from you. It’s all the rage:

Over $12 trillion of negative yielding debt floating about there. Quite the recovery.

But be clear the bond market is screaming recession is coming, none of this is fundamental based:

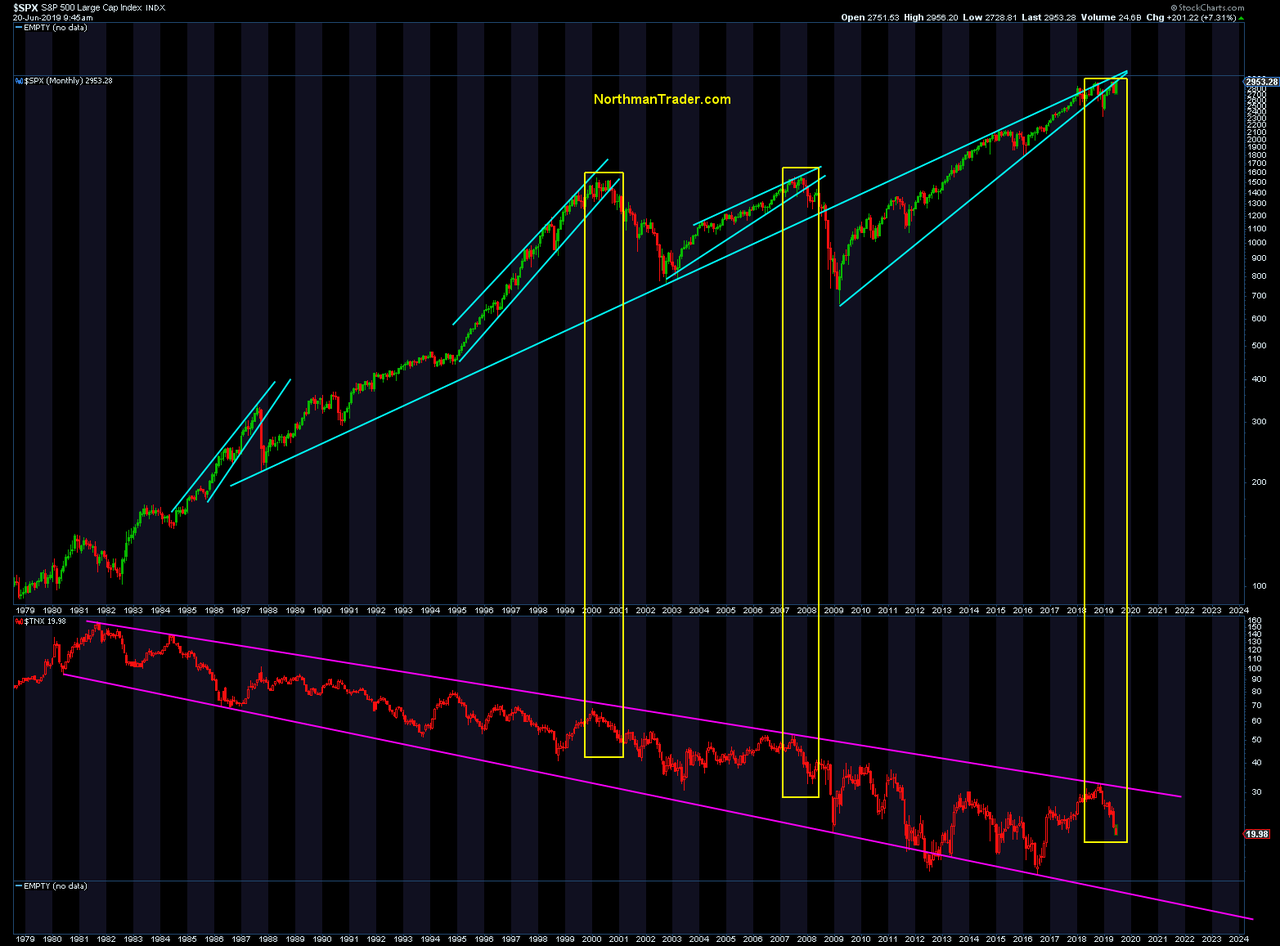

It’s central bank driven, desperate to prevent what happened during the past cycles when dropping yields marked tops in cycles:

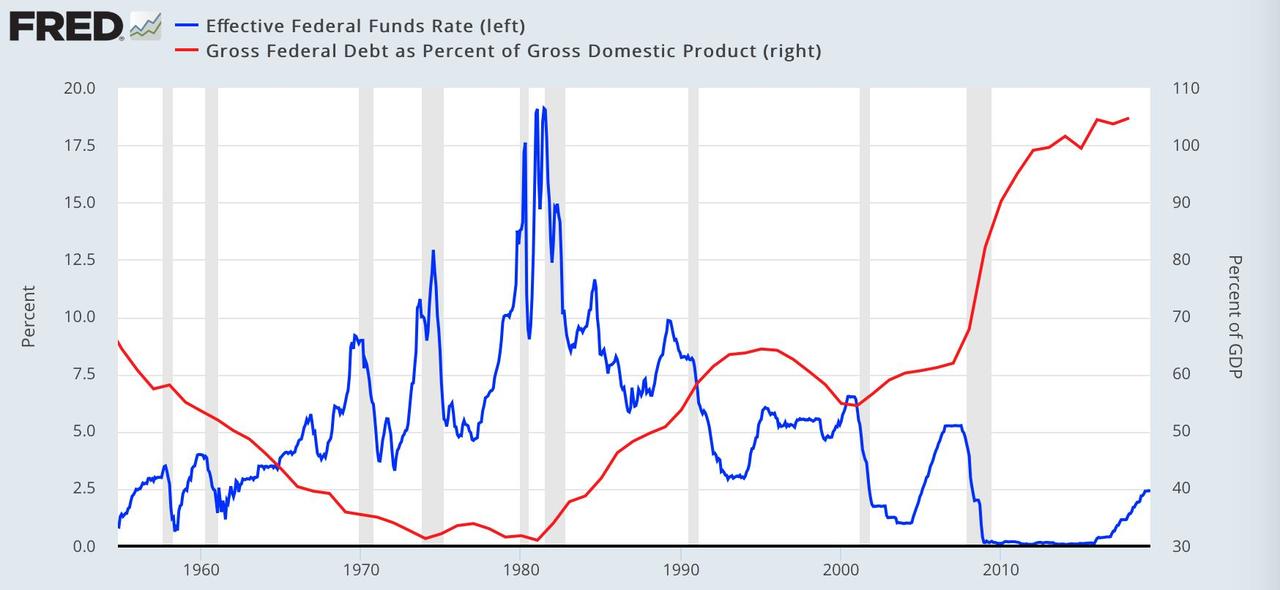

You know things are bad when a FRED chart goes viral:

Fun historic fact:

Every single time the Fed cut rates when unemployment was below 4% a recession immediately ensued & unemployment shot to 6%-7%.

Again: Every. single. time. pic.twitter.com/OyV8lNkRwz— Sven Henrich (@NorthmanTrader) June 19, 2019

Why is it going viral? Because it’s true. We’re at 3.6% unemployment with a 105% debt to GDP ratio and the Fed is signaling 3 rate cuts. The track record is clear, it’s not good news for the economy and ultimately not good news for stocks either.

If you are arguing that rate cuts are good for stocks you’re willfully ignoring this:

And this:

Yet, eyes wide open, we may see the combustion scenario here, complete panic TINA chase, central banks throwing free money around again and the same idiocy that has structurally produced nothing over the last 10 years going back into full swing.

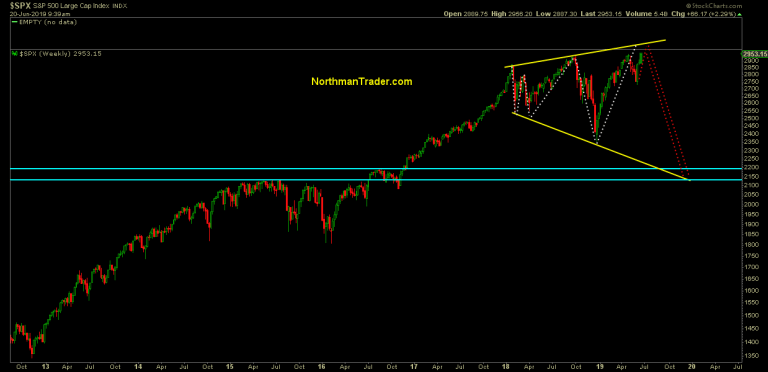

Yet it is the combustion scenario that also outlined that the chasing into stocks on the premise of cheap money again may set up for a valley of tears and hence perhaps is setting up for the the biggest selling opportunity in a decade:

For things are not better this time, they are worse, much, much worse and central banks are reacting to it again. Because they have to.

What is the end vision here? What do central banks have to offer but a dystopian vision of the future?

Can we just skip to the part when central banks own all stocks, the top 1% own all land, and MMT governments print guaranteed incomes for the rest so they can play Fortnite 35 while AI bots drone deliver burgers and toys to their 3D printed homes?

— Sven Henrich (@NorthmanTrader) June 19, 2019

For cutting rates again is making wealth inequality even greater, is again punishing savers, pushing wealth toward the asset class holders and encouraging ever more debt accumulation. In short: Make the bubble even bigger. Debt is higher than ever, growth is weak and 10 years of cheap money policies by central banks have failed to produce growth and/or meet artificial inflation targets.

Let’s do it all again, except it’s different this time. It’s worse. Much, much worse.

But no central banker will never admit it.

I can’t emphasize how pitiful all this is. Bulls, not one having predicted the 10 year to drop below 2% this year, are getting bailed out again by central banks:

Hi I’m a professional Wall Street economist with a PhD . Now let me tell you where the 10 year is going. I’m here to help.

h/t @pcordway pic.twitter.com/8H10Bntu83— Sven Henrich (@NorthmanTrader) June 10, 2019

At least for now. Central banks have once again set in motion an environment where all asset classes are inflating. All of them. Stocks, bonds, gold, crypto, you name it. Everything is appreciating. Growth may be slow, but assets are flying higher everywhere. Asset inflation without growth. We are the US Federal Reserve. Always wrong about growth and inflation, but always easy on the money front.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2x7aAwa Tyler Durden