Authored by Sven Henrich via NorthmanTrader.com,

In lieu of my weekly technical update this opinion piece instead: The free money whores are back again. Harsh? Perhaps. Untrue? Not really. As I’ve stated before our market system is broken, central banks, originally created to save economies from disasters have now become the prime movers in preventing so much as a cold propagating free money socialism for the top 1%. Indeed after a series of financial panics (particularly the panic of 1907) the Fed was created in 1913 for central control of the monetary system in order to alleviate financial crises.

Now they are in the business of managing markets full time, all the time and have become the primary focal point of price discovery.

It is self evident:

According to Jay Powell the Fed’s primary mission is now to “sustain the economic expansion.” I’ve never used the term “manipulation” before, but let’s just be clear what “sustain the economic expansion” really means: To prevent natural market forces from taking hold. That’s manipulation.

Business cycles are natural. They serve a purpose, they lay the foundation for new growth, they weed out the excess, they permit for a reset of an aging expansion, for a renewed flourishing of innovation, new solutions, creativity, and yes growth.

Of course because of all this recessions bring about temporary pain, but nobody wants pain anymore, and hence central bankers with hero magazine covers have now taken on a new role, that of preventing a recession altogether. Yes, that is the message that continuously being sent:

Breaking: Fed claims no more recessions ever. We have the tools. https://t.co/DubDbcwEXd

— Sven Henrich (@NorthmanTrader) June 21, 2019

No more cleansing, no more resets, but only ever more excess and propagating the notion that they alone can prevent the cleansing process from taking place with their favorite and only method: Free Money.

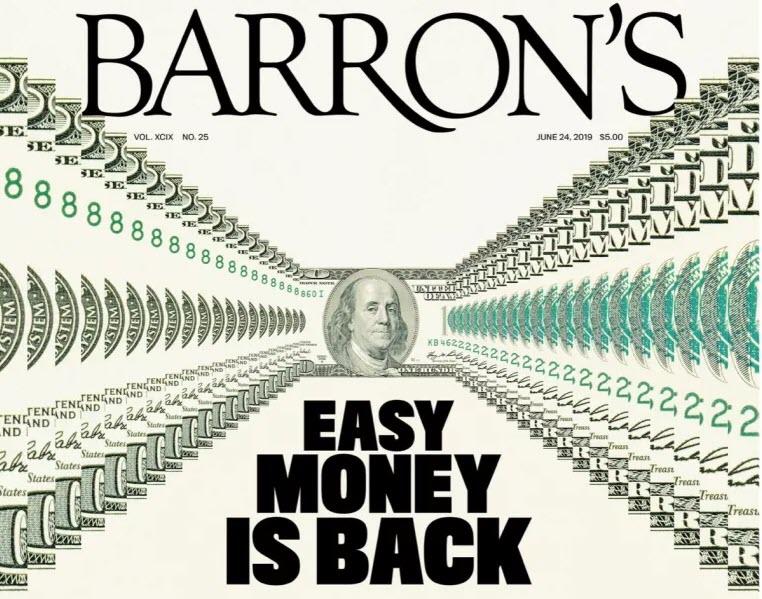

Of yes, here we go again:

Oh yes, the free money whores are here again. Hurry back into stocks:

“Now, interest rates are coming down en masse. Investors who adjusted their portfolios for a high-rate environment must readjust. That means leaning into growth stocks again, scouring Asia for opportunities, and earning income from investments that won’t succumb to the low-rate trend and will also hold up in a shaky economy”.

Barron’s calls the Fed flip flop “graceful”. I call it disgraceful.

Just stop. It’s 2019, wealth inequality is higher than ever, corporate debt is higher than ever, and growth is slowing. Innovation is hampered by a system that has benefitted the few which have grown into bloated monopolies, and the entire system itself remains held afloat by massive and ever more expending debt.

After all there is zero intellectual integrity to anything that is being propagated. In recent times Fed chairs have bemoaned rising wealth inequality, oh how un-American it all is, and rising corporate debt being a threat to the economy, but then they proceed to again exacerbate both by promising more easy money, their default solution in the misguided attempt to bail investors out from all pain and any bad decisions.

And that is the beauty of being a bull in these times of permanent easy money: Live off the central bank bailouts. So what if you’re wrong on fundamentals? Central bank daddy is always there to bail out the narrative.

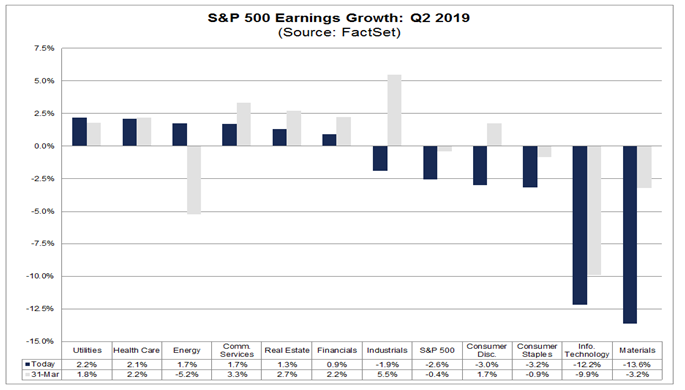

Q2 earnings will be worse than Q1 earnings and they are worse than earnings last year:

It matters not because free money is back and hence $SPX made new all time highs last week in spite of the data.

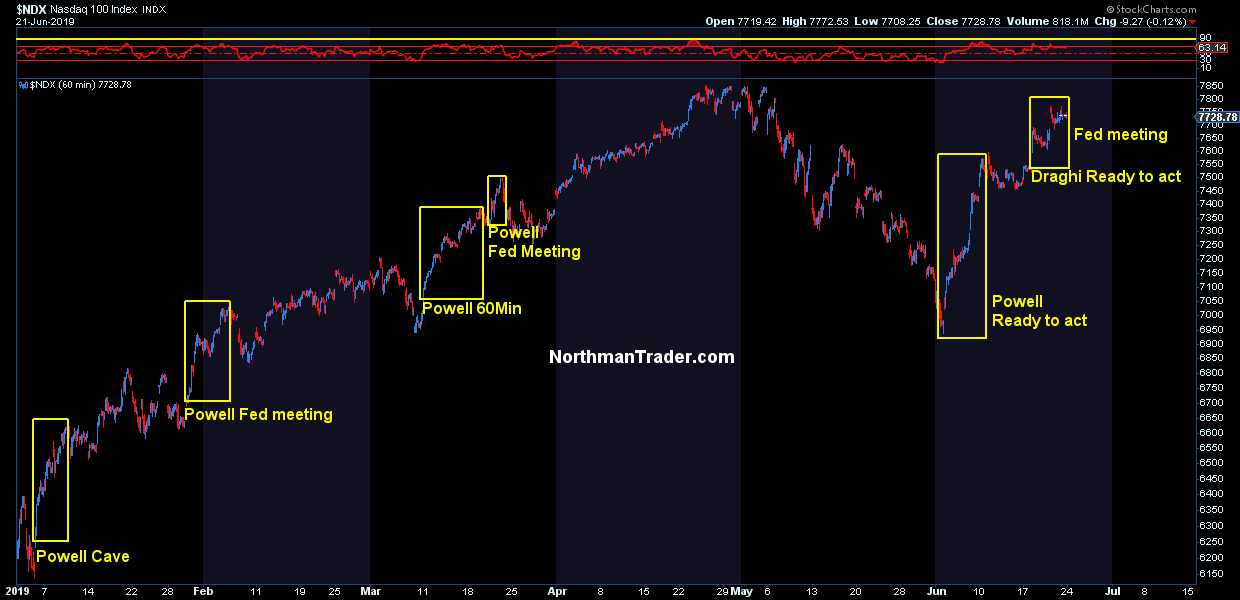

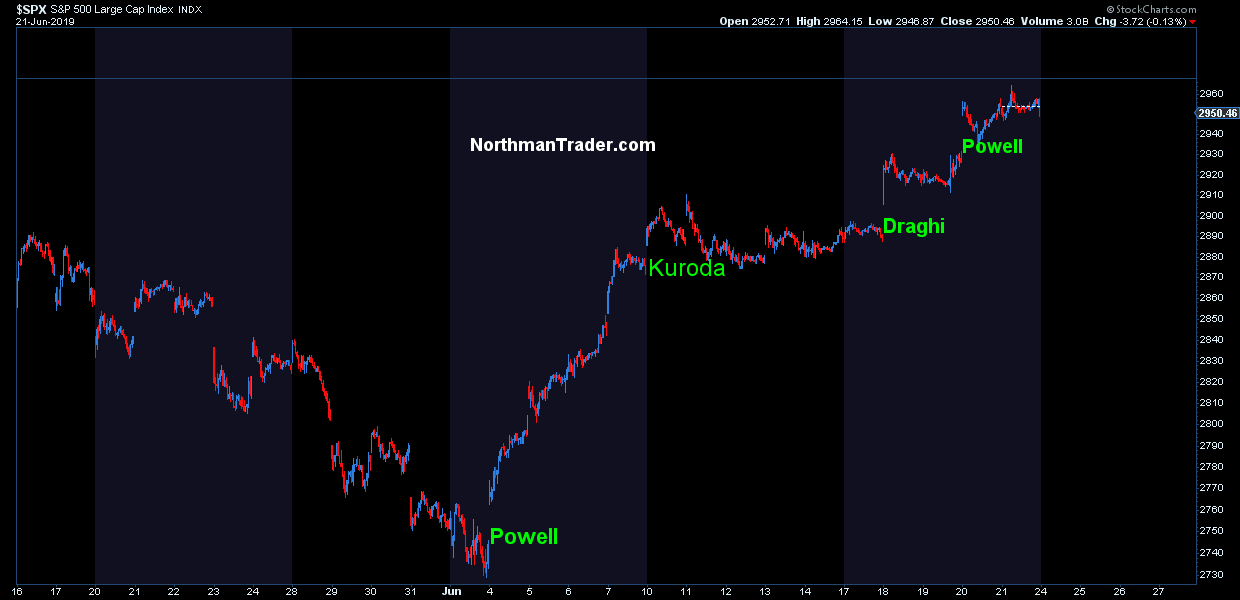

Again, it’s self evident, the month of June, seeing one of the biggest June rallies in history, was a central bank affair of promising more free money:

Yes, thank you central banks. But facts don’t stop some people from congratulating themselves:

Stock Market is on track to have the best June in over 50 years! Thank you Mr. President! @WSJ

— Donald J. Trump (@realDonaldTrump) June 22, 2019

Oh yes, intellectual integrity is hard to come by in this day and age.

Yes, we were oversold and a rally was technically setting up as I outlined on May 30th in “The Bull Case“. Yes technicals work, and they work nicely, but in no way can one ignore the extremes that are bestowed on these markets by central bank manipulation. Yes I now have to call it that as it is self evident.

And so we are jumping from one vertical rally to the next. During the past year and a half markets have been subject to wild and massive swings, a battle zone between deteriorating fundamentals in context of an aging business cycle, and desperate attempts to levitate markets with tax cuts, buybacks and central banks promising ever more free money, hence we get charts like these:

Will the free money gang succeed again? Will they trump the reality of what the banking sector and yields are signaling (Watch This Space)?

Will they be able to ignore the reality that the constant interventions with free money have made things much worse in this cycle?

And that is the question investors have to ask themselves as they are asked to jump in on the new free money train at all time highs. All time highs accomplished via central bank speeches, a free money train that promises more wealth inequality, more corporate debt, more government debt, but no solutions other than free money.

Capitalism’s success was predicated on rewarding risk taken with the knowledge that failure was possible, it was based on the competition of ideas, free flow of markets and capital in search for rewarding successful business models and innovation.

This system here does not punish failure, it rewards failure, it rewards slow growth by offering more free money in response, it subsidizes non performance with a constant safety net, and yes, it is the antithesis of free flow of markets as it forces capital into specific asset classes because there is no alternative. And a result it not only produces capital inefficiencies, it promotes them, the extends them, it creates a circular reference error that stifles growth. What? You think $13 trillion in negative yielding debt is a sign of efficient allocation of capital? A sign of free market capitalism?

I humbly submit this has nothing to do with capitalism, but it is socialism with a specific audience in mind:

For everyone whining about socialism: It already exists.

It’s called central banking.

Socialism for the top 1%.— Sven Henrich (@NorthmanTrader) April 21, 2019

A system that has produced and continues to produce what Janet Yellen once called un-American: Ever more wealth inequality. If you truly want capitalism and a road to eventual higher growth, reject this form of socialism, let the world cleanse itself and, from the pain, let free market economics do what its best at: Produce real growth. Stop with the constant daddy bail-outs. It is unbecoming of capitalism.

So go ahead celebrate new market highs. Just don’t call it free market economics, call it what it is: Free money socialism:

$SPX 2950.

It’s amazing what one can do in 10 years with $4T in QE, $6T in corporate debt/buybacks, $12T in new government debt and the weakest rate hike cycle in history, off of zero bound no less.

By all means let’s celebrate this accomplishment of free market economics.— Sven Henrich (@NorthmanTrader) June 21, 2019

Central banks are not saving capitalism. They’re ruining it.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2WYfWUU Tyler Durden