Authored by Sven Henrich via NorthmanTrader.com,

New highs are always informative from a technical perspective. What do the internals look like, are there divergences, positives or negatives, in short: How strong/sustainable are these new highs?

Well, $SPX made new highs last Friday and once again the rally looks the weakling. Central bank induced as all of June has been, the internal data just doesn’t scream conviction.

A few charts to highlight the message:

First on Friday:

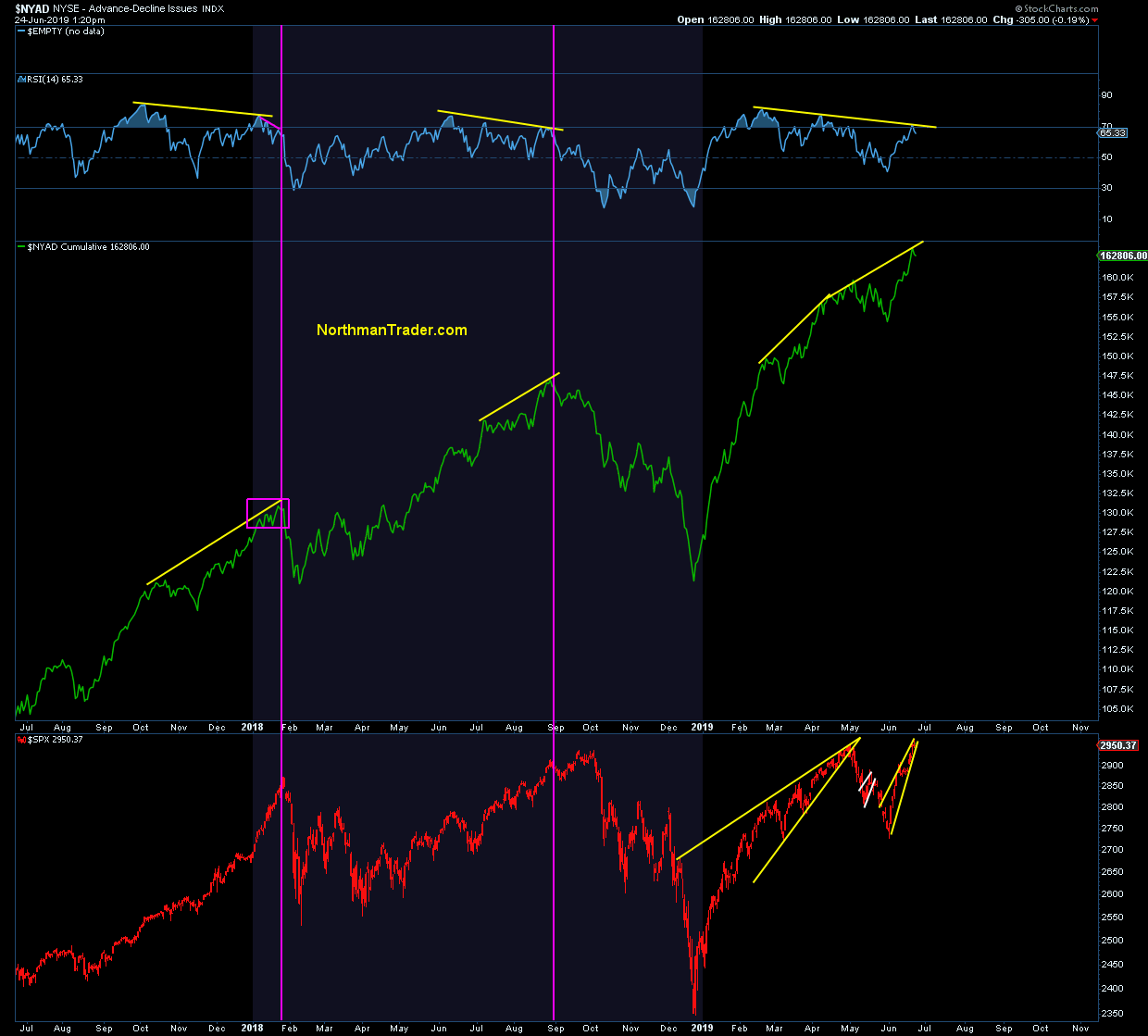

New all time highs $SPX on negative internals. $NYAD

Bravo. pic.twitter.com/bAcyfeqypD— Sven Henrich (@NorthmanTrader) June 21, 2019

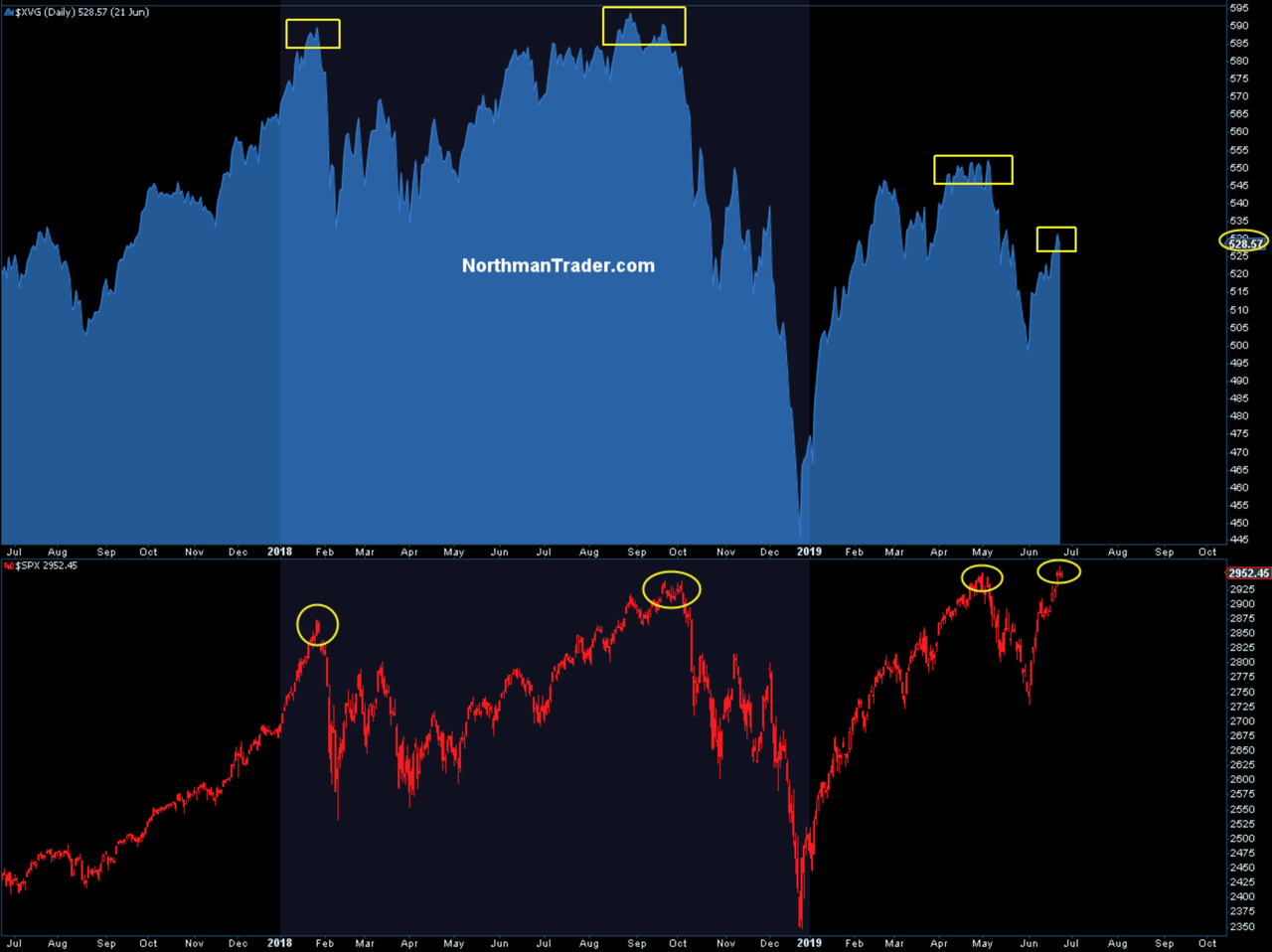

The equal weight picture which I explained in May (all things being equal) now updated:

This has been the weakest reading yet of all the 4 highs in the past 16 months.

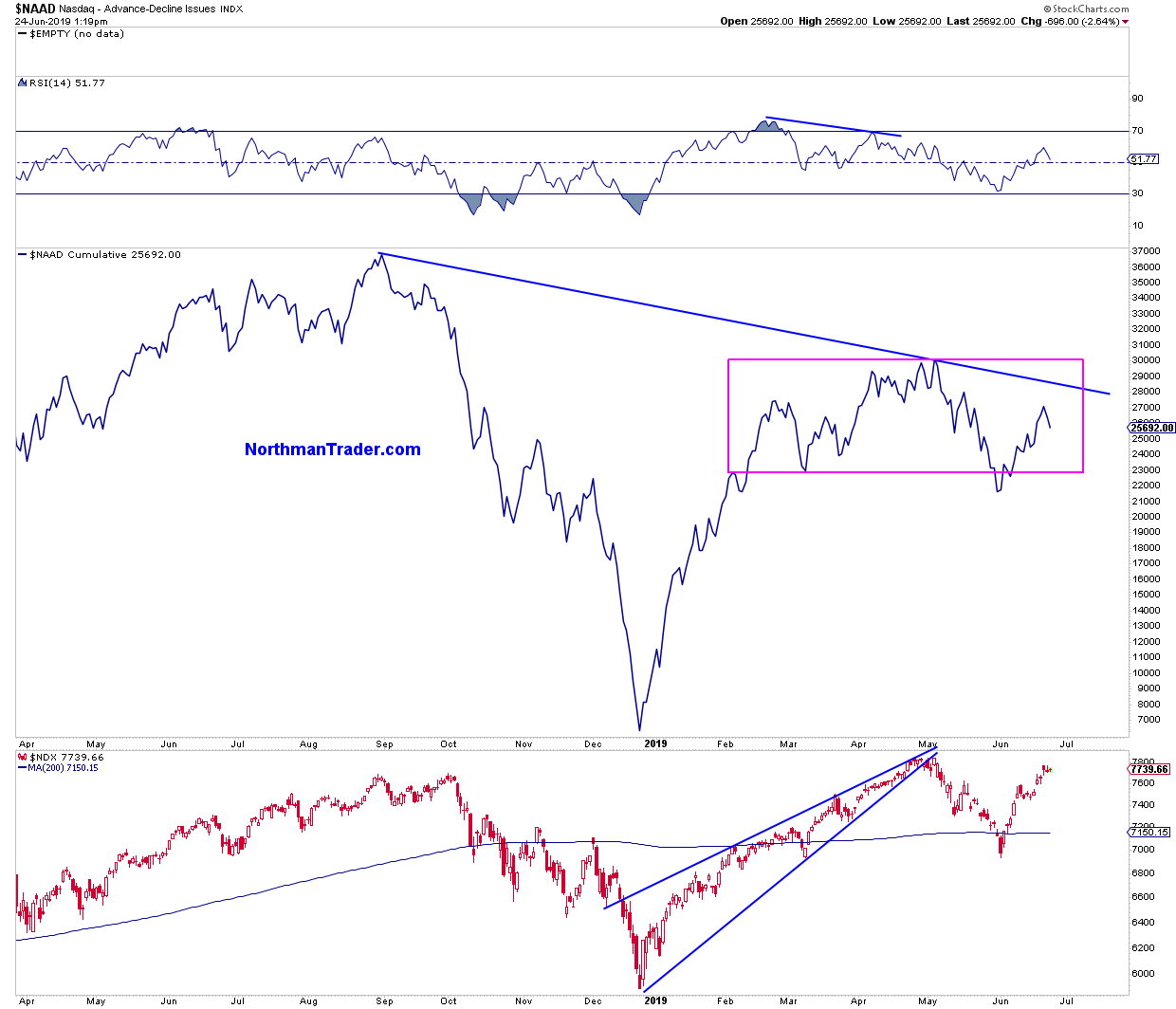

Nasdaq cumulative advance/decline issues? Meh:

The broader market? New highs on yet another negative divergence:

Oh look, another steep rising wedge on $SPX.

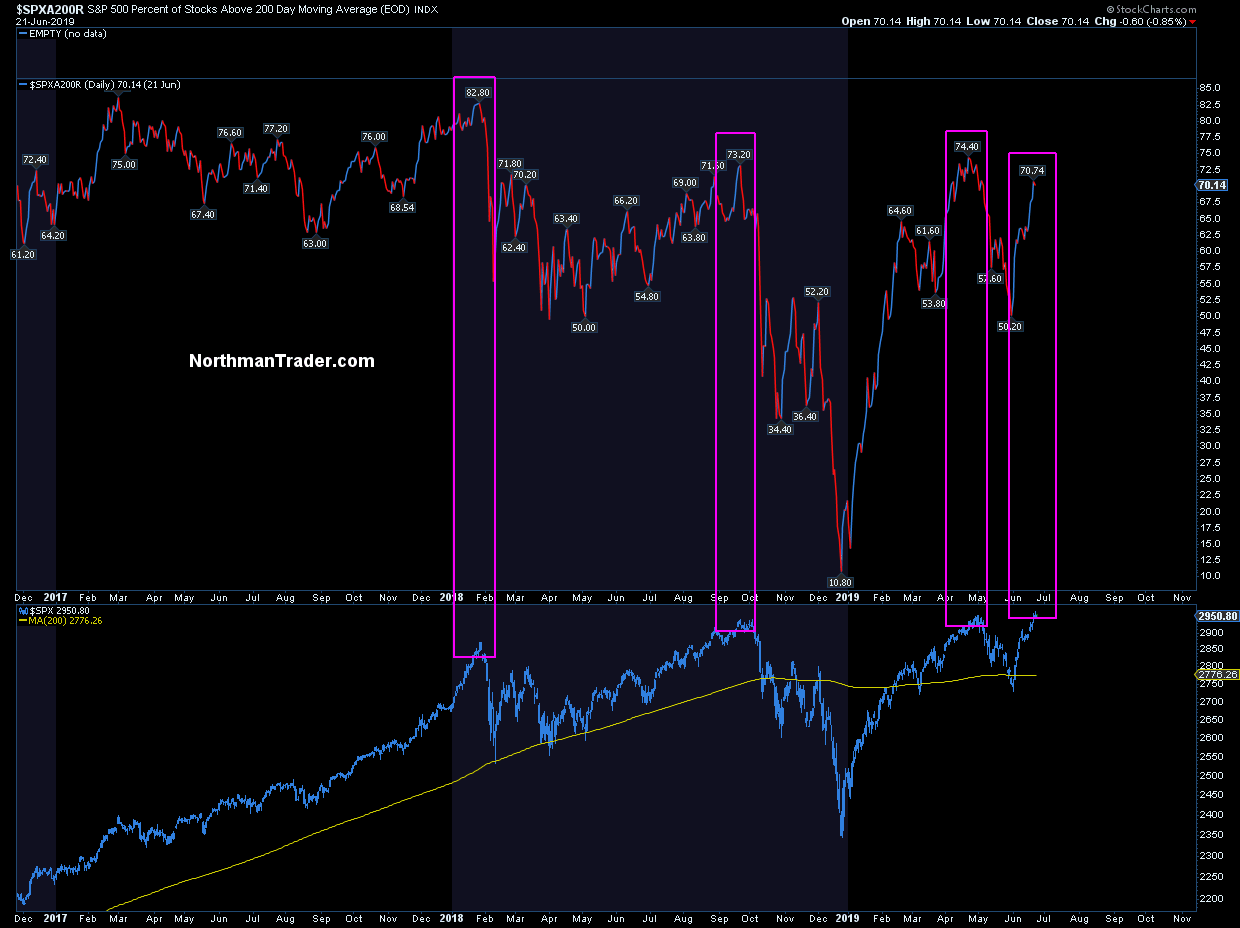

Components above the 200MA? 30% are below there 200MA, even weaker than the September 2018 highs:

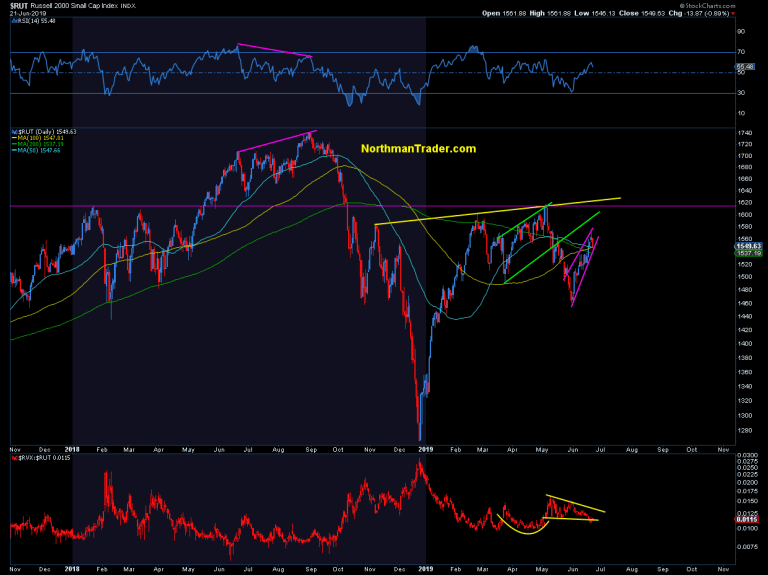

And small caps? Well they just fell below the 50MA and 100MA again and are clinging to the 200MA.

All this with all the central banks capitulating and 3 Fed rate cuts priced in by end of year.

Given all that monetary liquidity support this rally into this price zone looks, so far, to be the weakling out of the previous three.

What’s the message? Well, if you truly don’t know what this rally is made of….then maybe your best course would be to tread lightly:

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/31P6Xcx Tyler Durden