Authored by Sven Henrich via NorthmanTrader.com,

Tech Oddity

Tech making new highs again in July as markets are anticipating rate cuts from the Fed later in the month. It’s still early in the earning season, but about to get heavy with reports.

$NFLX was a stinker last week, but $MSFT delivered, technically as extended as it may be.

All eyes then on the standard bearers for $FAANG, $GOOGL,$AMZN, $AAPL and $FB. But when an index makes new highs it’s always useful to look under the hood and there’s a signal chart that raises some eyebrows.

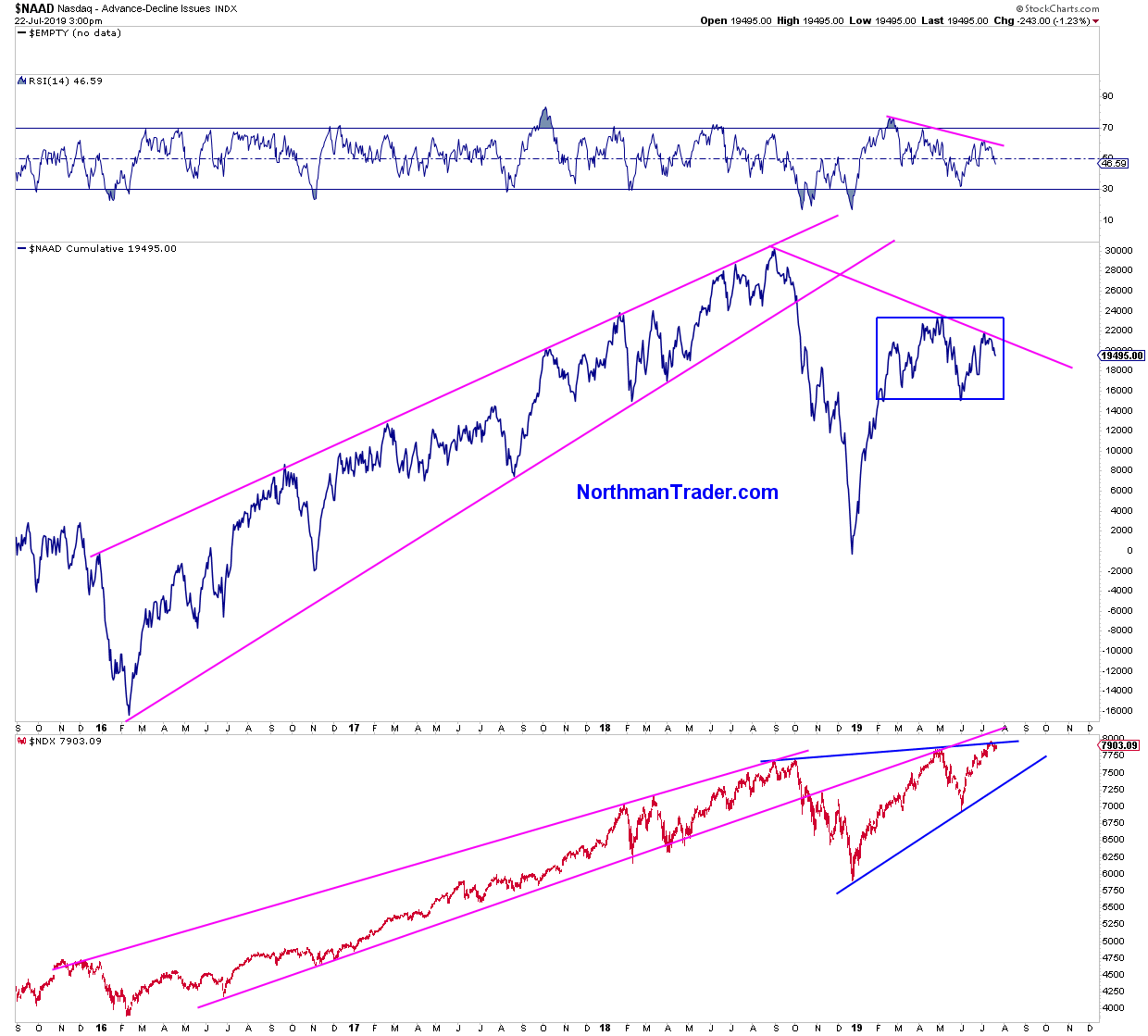

Indeed one might call it a tech oddity. New highs on $NDX? Yes, but check the cumulative advance/decline index $NAAD, it tells a very different story:

What does this chart tell us?

Well, for one, during the run up from the 2016 lows into the 2018 highs $NDX ran in a steady trend higher as did $NAAD. Very clean channel as a matter of fact. Then it all fell apart in Q4 2018. But on the heels of the Fed pivot markets recovered and are now back to all time highs. $NDX made a new all time high again in April and also last week in July.

But note $NAAD did not play along. Far from it. First making a notable lower high in April it made yet another lower high last week. And by doing so it has formulated a new trend line. Instead of a steady uptrend as in 2016-2018 it has formed a line of resistance & is potentially forming topping pattern.

Notable also the relative weakness on the RSI above.

What’s the message here from a technical perspective?

Firstly note that $NDX, despite making new highs remains below the broken 2016 trend line, but new highs are also coming on an ever weakening trend in the cumulative advance/decline index.

Something’s not quite right. This is not your 2016/2017/2018 bull market. This is a different animal, it’s an oddity. A tech oddity.

Ground control to Major Tech: Put your helmet on.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2GjVrg3 Tyler Durden