Authored by Sven Henrich via NorthmanTrader.com,

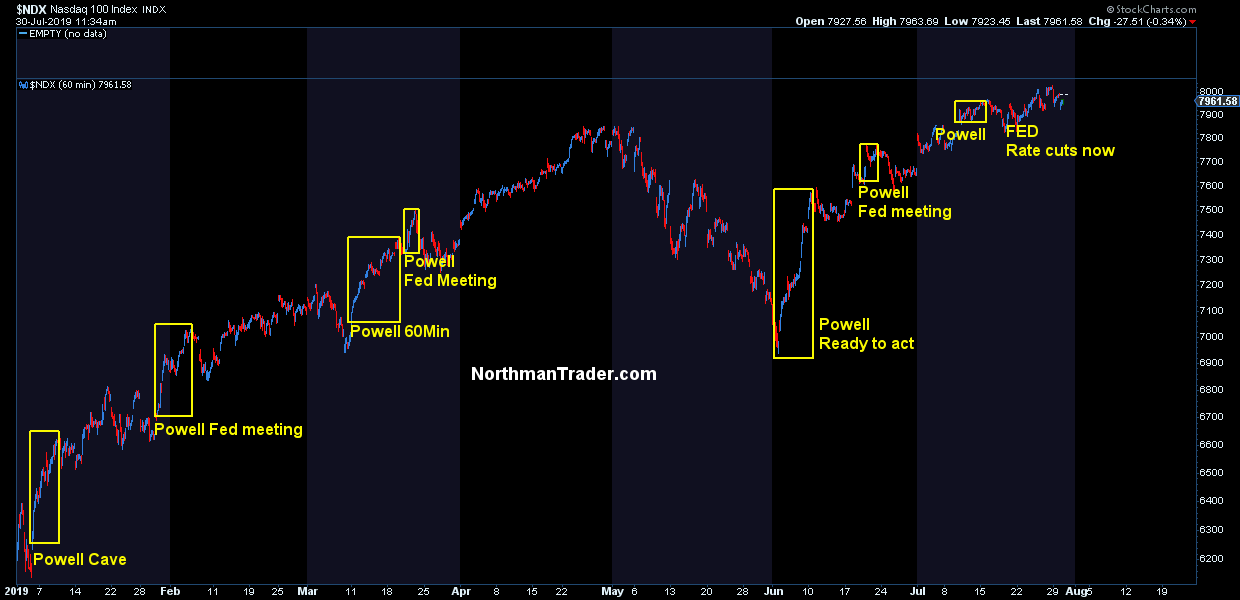

The circus is back in town and it’s putting on a major show, the rate cut show.

Some thoughts for your consideration:

Firstly, the expectation is for a 25bp rate cut. That’s what all signaling by the Fed has led to. That’s the market’s expectation. There is no way, no how, that they will not cut. The risk of stock market carnage would be to high. They can simply not afford to disappoint markets. Fact is a market sell-off of size would virtually set the stage for a massive reversal in confidence which in turn could be self fulfilling given slower growth.

One other piece of evidence: The Fed’s in a blackout period. Cute then that they paraded out Greenspan and Yellen in the past couple of days to give cover for a rate cut. Don’t think this was not done without behind the scenes approval and encouragement. Everything is a big game of managing expectations.

Powell has already declared that their goal is to extend the business cycle which, by the way, is a monumentally bad idea in my view because the only way they can extend the business cycle is by deepening the market bubble.

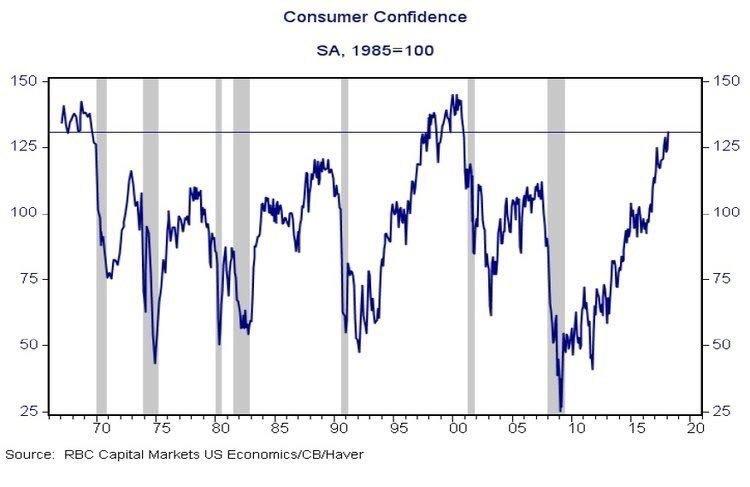

Cut rates here with consumer confidence at 135.7?

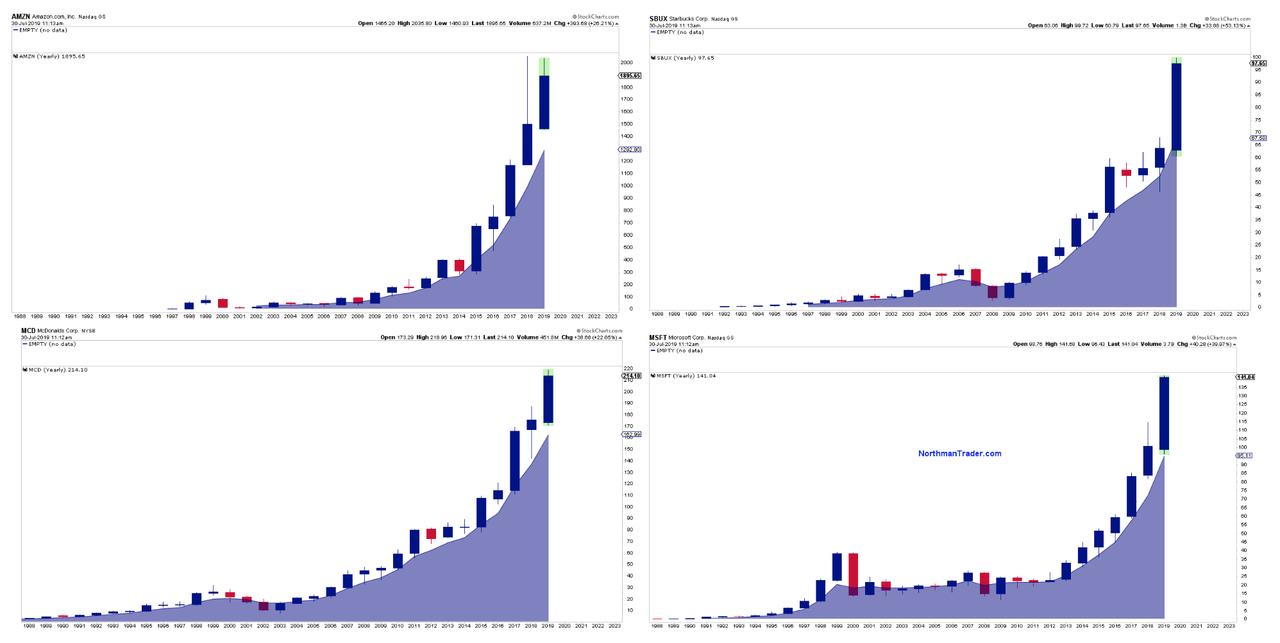

Cut rates here with key market cap stocks massively and historically extended after having rallied virtually non stop for 10 years?

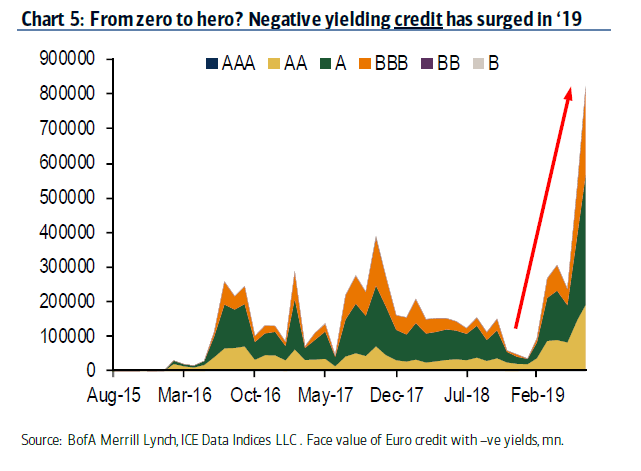

Everything is distorted and propped up by central banks and it’s causing massive dislocations, look no further than European bonds:

About €825bn of corporate debt in Europe now trades with negative yields, a chunk of that is rated triple-B.

When markets do extreme things that are completely outside the norm of history everybody better pay attention. Dislocations lead to relocations.

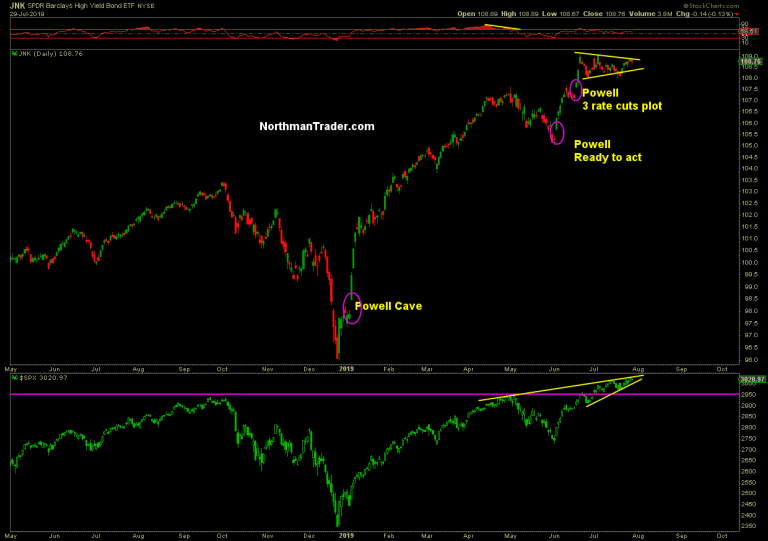

And let’s be clear without the surge in high yield credit this year stock markets wouldn’t be anywhere near here.

For the Fed it has to be all about not disappointing and managing market expectations. What if they cut 25bp and they have 1,2 or even 3 dissenters on the vote?

Markets don’t like an internal Fed fight. Rosengren wants to wait he said on Friday.

And you know what? Cutting in my view is a mistake here from a managing the economy perspective. From a managing the stock market perspective it makes sense to cut, from an economy perspective it’s a mistake. Why? Again, the Fed has limited ammunition, it should use it judiciously and not waste it on insurance. If you have limited ammunition, make it count, a big bang, shock and awe if you will.

If the slowdown is persisting, and CAPEX, business investment and global PMIs are telling you that a recession is coming and not an expansion, then you better have all the ammunition available to you to combat that. But US data has been beating on some key reports, so why diddle with a 25bp cut here? Because you are beholden to the market’s reaction and can’t disappoint. Well, that’s just pitiful.

But if the threat is real, and suppose you even have a peek at Friday’s job’s numbers ahead of time and you see bad news coming down the pike, then it may make sense to shock the market right here and there and do a 50bp cut even though you dialed back expectations for a 50bp rate cut following the William’s speech.

Here’s the evil alternative: Maybe, just maybe, the Fed wanted to surprise markets with a 50bp rate cut and Williams bollixed it up when he gave his speech and expectations were moving in the 50bp direction. In this context suddenly it made sense why the Fed came out and dialed back expectations. Now 80% think it’s a 25 bp rate cut so mission accomplished.

But there’s a problem with a 50bp rate cut, while perhaps causing another market rally on the surprise the underlying message is one of panic. Things are worse than they seem, the ghosts of 2001 and 2007 would make their presence felt and that could be damaging to confidence, and when you damage confidence you lose buyers or, worse, invite sellers.

Bottomline:

-

If it’s a decision to manage markets they need to cut either 25bp or 50bp.

-

If it’s a decision to manage the economy they shouldn’t cut yet. Why? Because they have limited ammunition & need to make it count when it matters.

They can’t afford frivolous cuts.

The irony: If they don’t cut to appease marktes, markets would sell off hard resulting in an adverse economic reaction & loss of confidence forcing to Fed to cut rates.

Nice circle jerk they got themselves into.

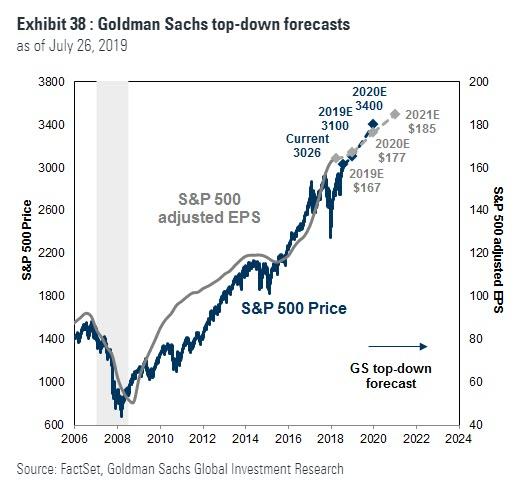

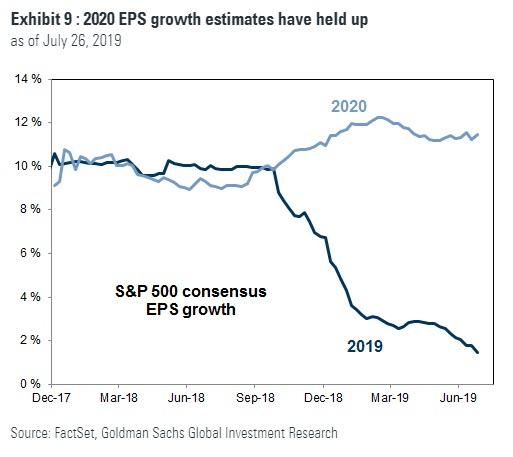

But no worry, Wall Street sees no downside either way, only multiple expansion. Case in point: Goldman raised its price target today for $SPX, 3,100 in 2019 and 3,400 in 2020. Their rationale: Not earnings expansion, no Sir, rather it’s earnings growth reduction and multiple expansion courtesy the Fed:

“David Kostin, the bank’s chief U.S. equity analyst raised his target for the S&P 500 stock index despite lowering his estimate for 2019 earnings-per-share growth from its November estimate of 6% to 3% today, resulting in a higher expected price-to-earnings ratio.

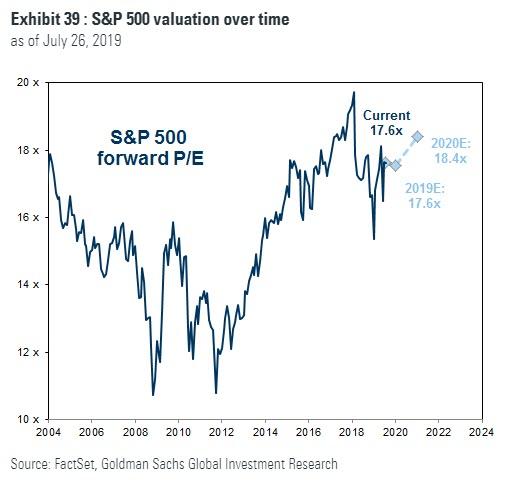

“Our target implies a 3% appreciation through year-end 2019, implying a 24% fully year-gain,” Kostin wrote. “Valuation models have expanded by 22% year-to-date, and the S&P 500 trades at roughly fair value relative to interest rates and profitability.”

Goldman analysts now predicts the S&P 500 forward price-to-earnings multiple will end the year at 17.6 times earnings, a marked increase from the 16 times predicted in their 2019 outlook published in November.

The bank sees Federal Reserve policy as a key driver of higher valuations, as it earlier predicted the Fed would raise interest rates 100 basis points in 2019, but now see the fed funds rate ending the year 50 basis points lower.”

As I’ve said many times: The Fed is the market’s primary price discovery mechanism and looks like Goldman implicitly agrees.

And it is very much self evident in investor behavior:

Whatever decision the Fed will make on Wednesday be sure it will be keeping 3 data points in mind: $SPX, $NDX & $DJIA.

Enjoy the rate cut show.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2ypIixA Tyler Durden