Ranges have been small. Asset price-wise, nothing especially untoward has happened. But, as former fund manager and FX trader Richard Breslow notes, it all feels remarkably sloppy.

Via Bloomberg,

The fact that it is month-end and the big news of the day won’t happen until the U.S. afternoon sets things up to have a skittishness that will drive people trying to follow the ins and outs of the day’s activity positively to distraction.

To make matters worse, we have two sets of traders operating uncomfortably beside each other.

-

Some that will not change their views short of some — unlikely — major event that can’t be planned for anyway.

-

And the others, who seem to be having the worst time holding onto anything. But more interestingly, they seem to change what they purport to be their big picture outlook based on the latest news and market gyration.

We are operating in an unusually uncertain world, but they seem to have taken it to the extreme.

The Australian dollar has had a rough patch. And for understandable reasons. Disappointing numbers at home. Not a great external environment. A dovish central bank. But after eight straight down days, it fell to a support zone that has meant something for the last three months. Frankly, it was due for a bounce. It got the excuse by a small beat from CPI. Fair enough and hardly a surprise.

Yet along with the modest bounce in the currency came a serious repricing of the likelihood of near-term interest-rate cuts. Short-dated OIS made a surprisingly swift move. That was simply too much from a statistically insignificant deviation from expectations. Especially with the rest of the newsflow of the day. And, to be fair, three-year yields were only fooled for a few hours.

Nevertheless, all eyes will now be on whether or not we close above Thursday’s high for the next technical sign to run with.

It did leave me wondering, however, how little it might take for traders to begin questioning the narrative about how the whole world is barreling toward lower official rates. Try to resist the temptation. My working assumption has to be that we very much are.

But for trading purposes, as the dog days of August are set to begin, it really does put a premium on how the Fed Chair explains whatever they end up deciding to do. This is not the time of year where short and medium-term players are apt to over-think things. For my money, the discussion around the balance sheet is an even bigger deal than it is being given credit. Although, how hard he hits the “U.S. is doing great” story line should also matter.

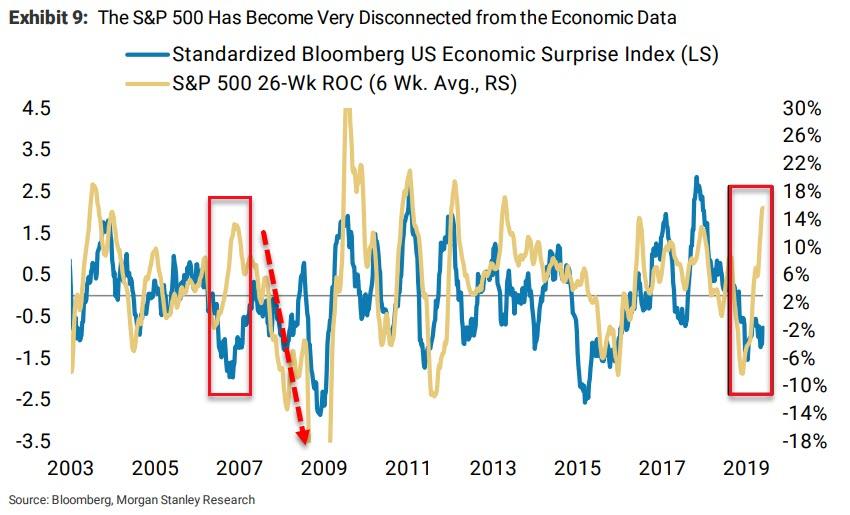

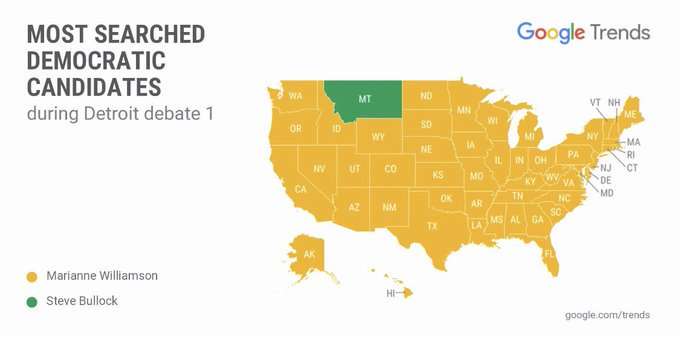

Global equity markets know what they want to hear. And they want simple and direct assurances that they will receive the rate support they have come to expect and demand. It’s a clear worldwide phenomenon. Just consider the blah reaction to this week’s Chinese Politburo announcement of economic plans for the second half of the year. You can clearly witness the sapping of momentum higher every time traders don’t receive comfort in the form they most want.

When it happens, you can almost imagine them telling the central bankers to go back and try again. Or face the consequences that we know they don’t want.

Looking at the charts, it seems odd to say after such a good year-to-date run that many indexes look to be at some sort of decision point. Now we’ll see how the next chapter of the story plays out.

via ZeroHedge News https://ift.tt/2OtozI8 Tyler Durden