Authored by Sven Henrich via NorthmanTrader.com,

One day does not a confirmed reversal make, but I wanted to offer a couple of gut check thoughts and chart updates.

If you’ve been reading my weekly market briefs and some my public market analysis pieces you know I’ve been presenting the 2990-3050 $SPX range as a potential major sell zone. For most of July markets have been dabbling in this range and the July top range ended up being 3028 on $SPX.

Yesterday’s rejection of this range came on Jay Powell’s press conference. Past Fed chairs have been reluctant to give regular press conferences and for good reason. There’s an old adage: Better to remain silent and be thought a fool than to speak and to remove all doubt. That may be a bit harsh, but Jay Powell did himself no favors with that press conference today. Remember keeping confidence is the Fed’s hidden directive and Jay Powell no doubt lost some confidence yesterday. How this will all play remains to be seen, however keep in mind the technical context and this context may matter greatly.

Some chart updates then.

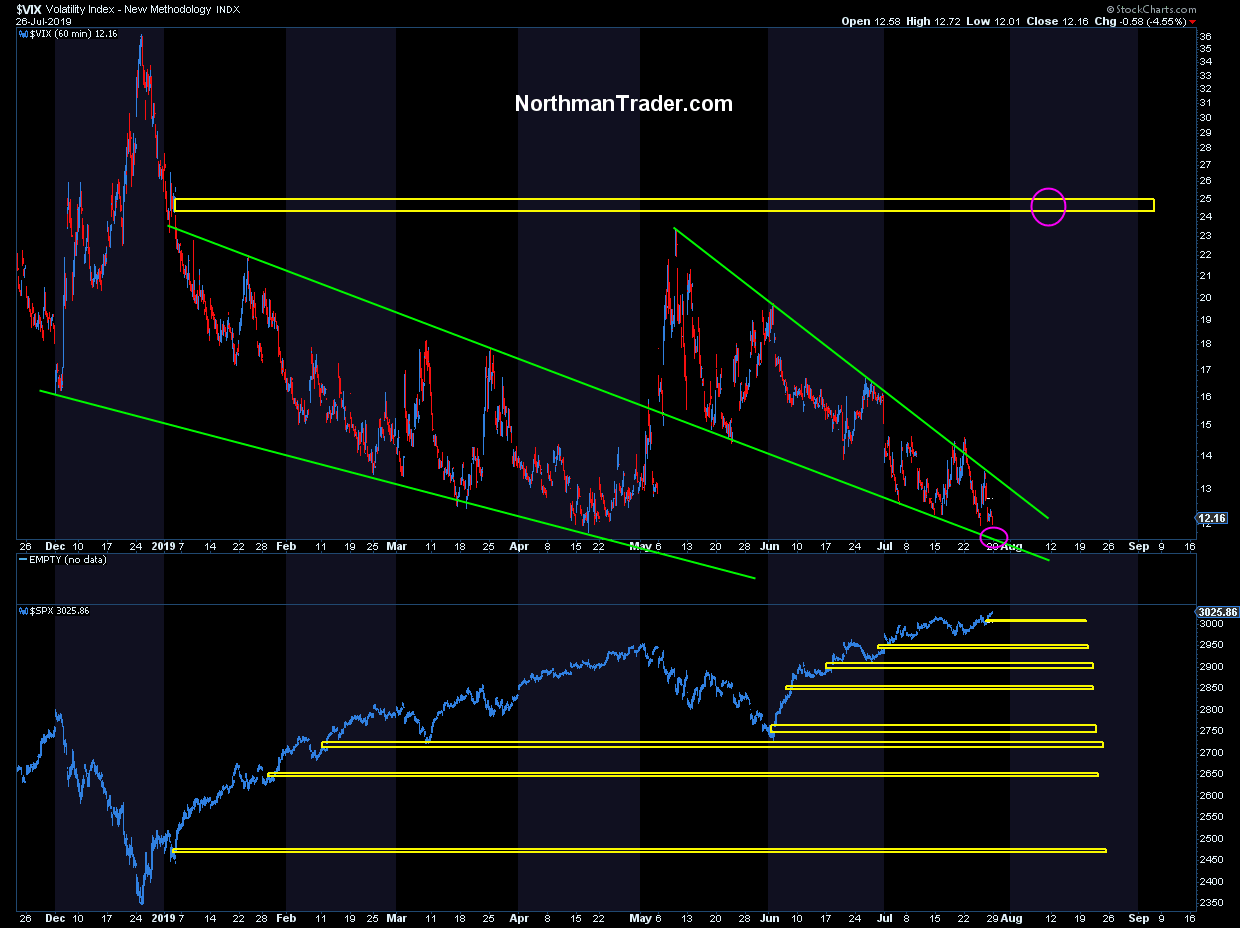

Firstly this is the $VIX chart I offered last week in VIXplosion:

And this was the discussion from Friday where I re-iterated the pattern and talked about a coming $VIX spike:

Here’s the updated chart:

Tell me again how you can’t chart the $VIX.

While many are just focused on the day to day action markets are a journey and structures matter. Now we’re far still from gap fill outlined above, but the pattern got triggered and we’ll have to see how it evolves in due time, but for now we can note that the pattern suggested a spike was coming and it did and a nice one to boot. Technicals matter.

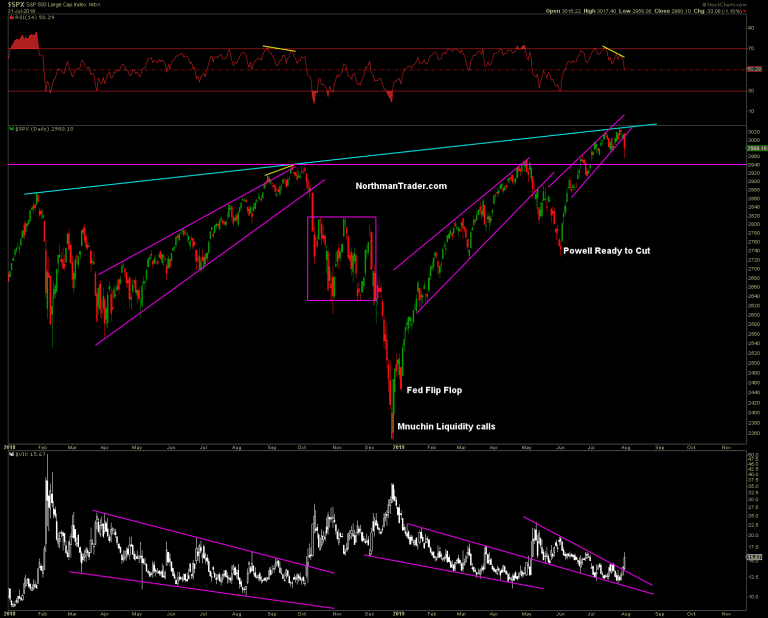

Also of note: The larger pattern structures held as resistance for now and we’re seeing some trend line breaks:

Also note highs came on negative divergences.

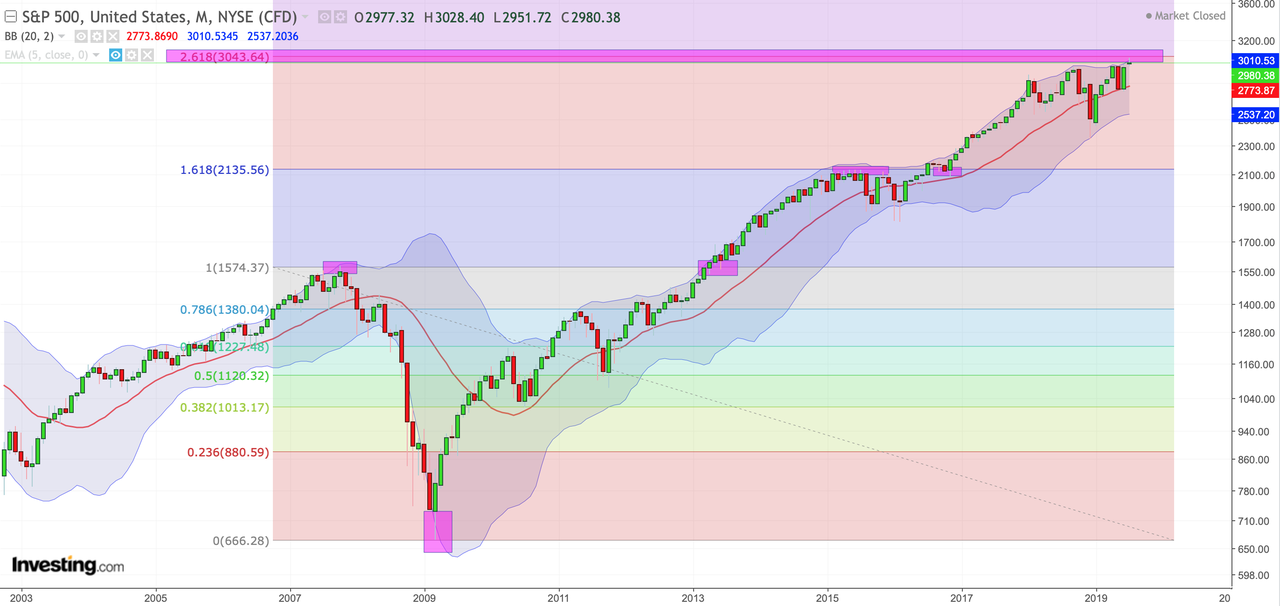

But no major damage has been inflicted on this market yet, but for now the Sell Zone has shown to indeed have produced a rejection:

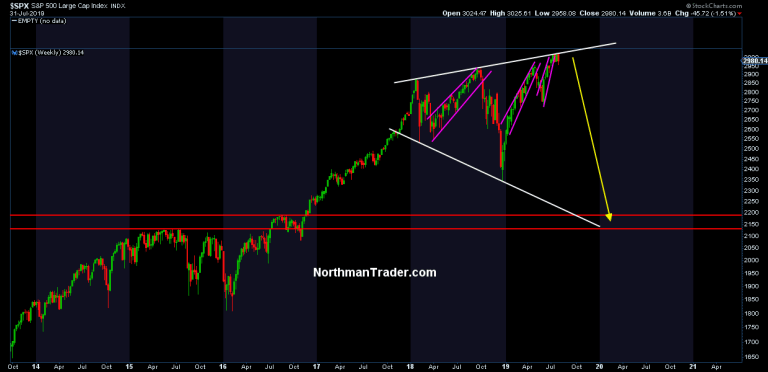

And as long as this is case this leaves room for the unthinkable:

But it’s very early and nothing’s been confirmed. But as I said on July 16:

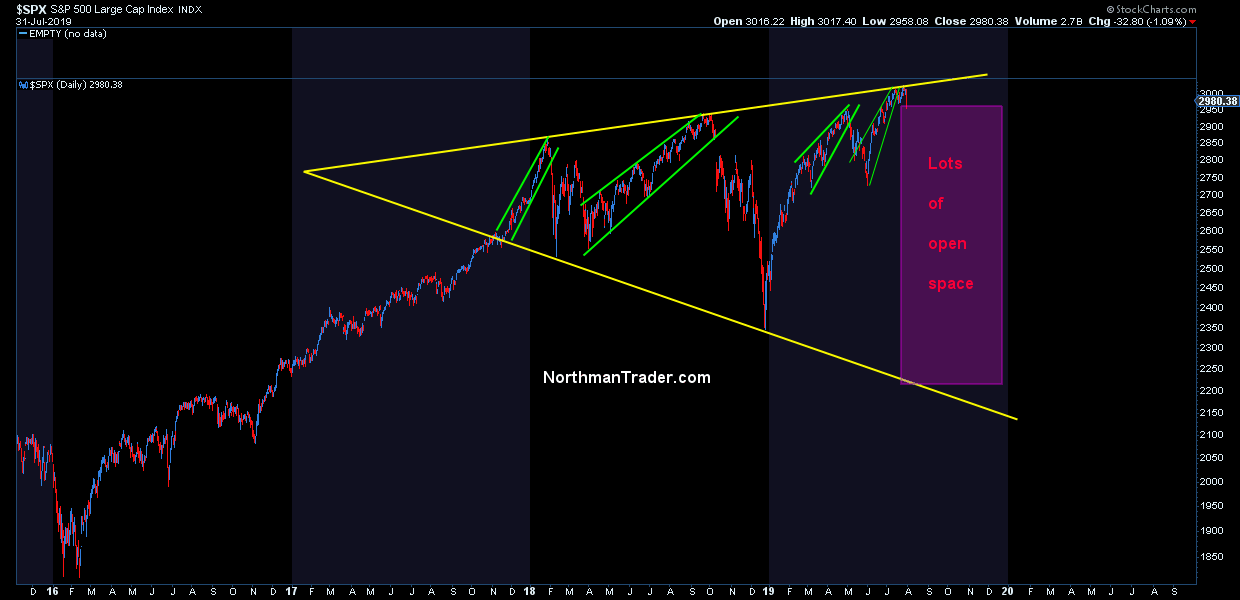

$SPX

Lots of open space pic.twitter.com/BYSEnd4fSB— Sven Henrich (@NorthmanTrader) July 16, 2019

And indeed there is:

Tops are processes and they take time with a bunch of back and forth and if this market is to evolve into a top I expect nothing different here. And don’t forget this market in particular remains subject to relentless jawboning and political influence more than any market in history. It’s a very complex environment.

And as I outlined before: Nobody rings a bell.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2OzyJam Tyler Durden