Blain’s Morning Porridge, submitted by Bill Blain of Shard Capital

“My heart will never break… but it will stop beating..”

So much noise out there this morning!

Someone must have told Trump his electoral chances would not be enhanced by a miserable Christmas on Main Street USA, so he held back some selected consumer-good tariffs till December. Effectively this confirms a stark reality – its US consumers who are paying the costs of Trump’s tariffs on China. Its not de-escalation, its just more policy on the hoof. Anyone betting the US and China are about to kiss and make up is in La-La Land.

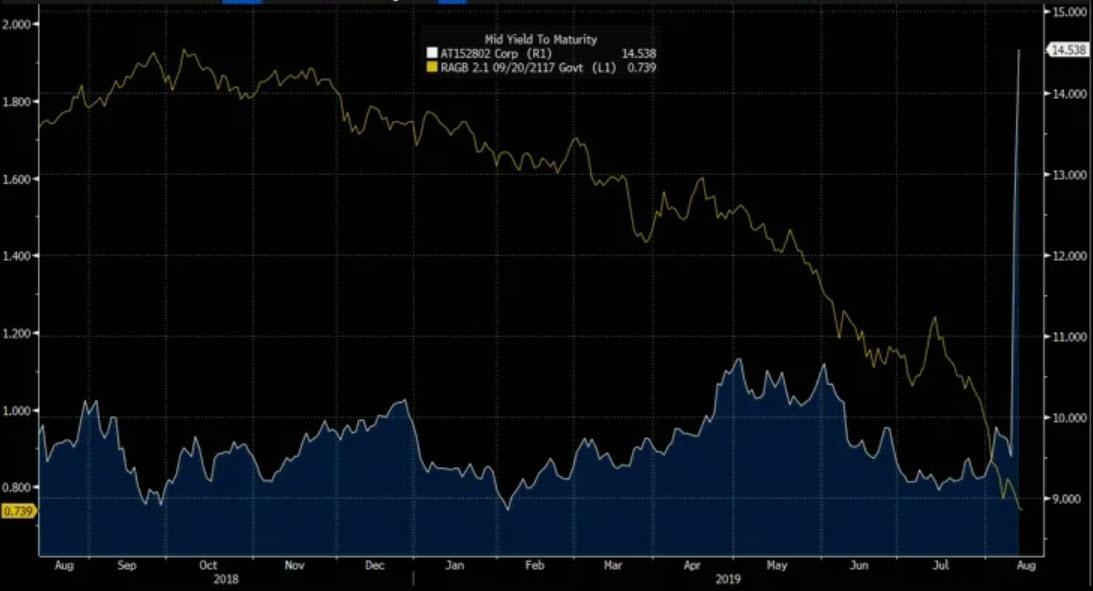

Meanwhile, I’ve appended a graph showing the performance of the Argentina Century Bond vs the Austrian Century Bond. You are unlikely the two bonds mixed up – although I’m told it’s happened… One of them yields nothing for 98 years. The other yields lots… Do you care if you don’t get your money back? Probably not.. but you are equally unlikely to get any coupon… Zeros?

There is one very important secondary observation to make on the Argentina melt-down: one of main reasons we saw such a dramatic crash in bonds and the near 50% tumble in the stock market was the complete absence of serious market makers or broking. This isn’t due to investment banks and traders not seeing opportunity in over-sold Argentina, but more a result of how capital regulations and trading rules have made it utterly non-economic to trade smaller, illiquid, risk markets. The market was opportunistic. We saw bid/offers wide enough to turn a supertanker thru – and it proved very difficult to execute any client orders.

The Implications are serious – if we see a breakdown, then the collapse of liquidity across markets like High-Yield (now officially defined as anything yielding anything) and corporate bonds will be crushing. Wide bid/offers and chronic illiquidity will massively exaggerate losses and deepen any sell-off. It’s going to hit less liquid equity markets also – look how wide Burford whipsawed last week, and it’s the biggest AIM stock on the London market. Sell-off’s are a bargain hunting opportunity… but who is prepared to take Argie risk..? (If you are interested, let me know if you are a buyer.. we may be able to help..)

Watching the Hong Kong situation I can’t think there is a screaming, massive obvious short out there. Who? Sorry, but its HSBC. They have apparently attracted the ire of the Chinese Government over the accusation they gave confidential info on Huawei to the US investigators. If/when China clamps down on the protests, they stand to see 90% of the current profit base disrupted. Worst case scenario is they are effectively chased out. Best case is they still find themselves in a position of weakness. Its down 7.5% since it sacked its CEO. How much lower will it go if the People’s Army marches in? If there are reasons to be positive please share

Inversion Recession?

Where do we go next? The US 2s/10s yield curve inversion looks a very real threat (currently 2s yield 1.63% and 10s yield 1.65%). The conventional wisdom is any inversion where Bonds yield less than short-bills screams recession. The joke is inversions have predicted 10 of the last 3 recessions. (The truth is, an inversion is usually correct.)

But a 2s/10s reversion is a serious deflationary signal. T-Bills (short-dated obligations of the government) say little about inflation and are usually bought by money market and short-term funds. 2-year Notes do factor future inflation and are bought by institutional investors as part of long-term investment strategies. It means the real money market has serious doubts on the future.

For investors predicting a stronger economy and rising bond yields, then 2-year T-Notes would be the place to play the pivot towards higher yields. What an inversion says when 2-year yields more than longer bonds is a massive recessionary signal and a strong indicator of long-term deflation – it suggests investors think rates are going lower for longer, hence looking to lock in 10-year plus returns now! That is frightening… suggesting the market thinks this lasts for a decade or more!

No wonder folk are thinking about Gold, while some idiots still think BitCoins are the answer. If you think so, be my guest. There is no positive question to which BotCoin is ever the answer.

Were you aware one of the top performing markets this year has been Carbon Credits? Its been a strange and curious market – subject to all kinds of shenanigans and difficulties in the past. The market now looks more established. European governments have been handing carbon credits to industrial producers for years. Since 2017 European governments have been slashing the supply of credits. Supply is being cut by 24% per annum for the next 5 years! This year the sweltering July drove up power demand, pushing prices higher!

US Carbon offset credits are also rising – especially in California which has managed to reduce Co2 emissions below 1990 levels, largely by hitting transport sources via emission taxes. While the state posted 3.7% growth in 2017, Co2 emissions actually dropped! New Californian “Low Carbon Fuel Standard” laws demand transport sector reduce Co2 emissions. As a result Californian Carbon Offset prices are going through the ceiling. It’s becoming a multi-billion dollar market.

Young Greta Thunberg sets off today on her 2 week voyage across the Atlantic to save the Carbon a 8 hour flight would have generated. I admire her for doing it. Listening the Generation Z on BrekDrek this morning – they absolutely believe. Carbon Nuetral politics is not only here to stay, but is going to become more and more influential. I do feel sorry for Greta. She is not a sailor, and the weather pattern she is sailing into means a massive storm and high winds will hit tomorrow, making her first day on the boat miserable. The problem with sea-sickness is that on the first day you are scared you are going to die. On the second day, you are scared you are not!

Carbon pricing is here to stay, and its going to be massive. One of the alternative asset deals we’re currently marketing produces CO2 Carbon Offset by extracting CO2 out of carbon fuels which can then be buried (sequestered) in old gas and oil fields and saline aquifers. Give me a shout and I will tell you all about it.

Blain’s Brexit Watch

We still have no idea on what Europe might be prepared to discuss, or even if they will. In London lots of angry noise from Remainer Parliamentarians determined to thwart a No-deal. There is a massive game being played. Boris would like to call an election – the polls now say he could win, but he can’t unless he recalls parliament, and force a no-confidence vote. He still might lose. So he waits. And Waits. Nothing is apparently happening except lots of squawking ducks… while Boris paddles furiously beneath the surface.

Brexit.. what a laf!

via ZeroHedge News https://ift.tt/2Z5AsEi Tyler Durden