China continues to escalate its capital controls with headlines today from Reuters that Chinese authorities have curbed private gold imports since May as the trade war escalated in a move that could be aimed at curbing outflows of dollars and bolstering its yuan.

According to sources, China’s gold imports are down 300-500 tonnes, with around $15-$25 billion, since May.

As Reuters details, the bulk of China’s imports – from places such as Switzerland, Australia and South Africa and usually paid for in dollars – are conducted by a group of local and international banks given monthly import quotas by the Chinese central bank. But quotas have been curtailed or not granted at all for several months, seven sources in the bullion industry in London, Hong Kong, Singapore and China said.

“There are virtually no import quotas now issued in China,” one source said.

In June and July “next to nothing” was imported by banks, they said.

It’s “unprecedented,” said an industry source in Asia.

“Gold going in is money going out,” said one of the people, adding that Chinese buyers tend buy dollars to pay for metal.

“It’s all linked to what’s going on in terms of how the central bank is handling the currency,” the person said.

Rather notably, after optically pegging the yuan to gold for the last few years, it appears the gold import curbs started as China lost control of its currency…

Source: Bloomberg

China has also restricted gold import quotas before – most recently in 2016 after the yuan weakened sharply, bullion bankers said.

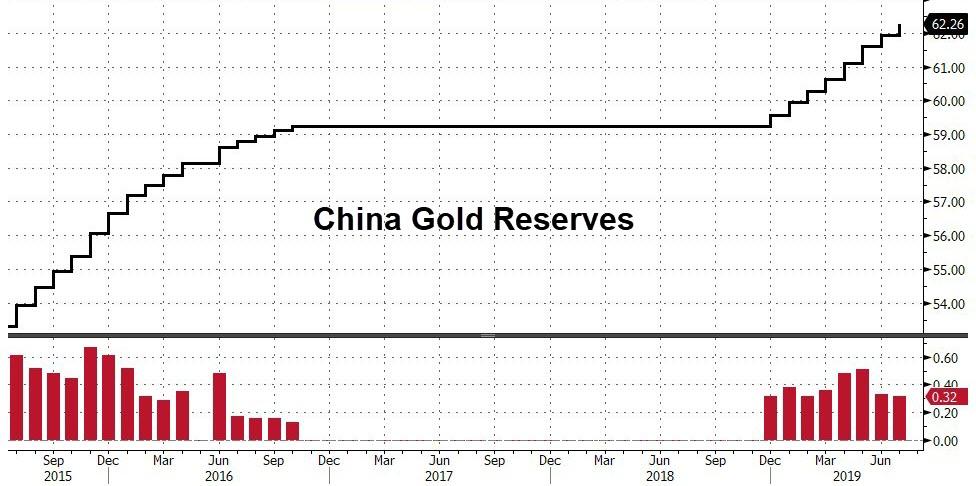

This could not be more ironic as SchiffGold.com reports, China bought gold for the eighth straight month in July, adding another 10 tons to its rapidly growing hoard.

The recent purchases boosted the People’s Bank of China’s gold reserves to 62.26 million ounces – about 1,945 tons. China has added about 94 tons of gold to its stash over the past eight months.

Source: Bloomberg

The Chinese continue to add gold to their reserves in an effort to reduce their exposure to the dollar. As one analyst told Bloomberg, “It is important for the country to diversify away from the US dollar. Over the long run, even relatively small-scale gold purchases add up and help to meet this objective.”

But China’s gold purchases, along with the buying spree in other countries, including Russia, also aim toward a broader geopolitical objective. They want to undermine dollar hegemony and reduce the United States’ ability to weaponize the dollar as a foreign policy tool. As we reported earlier this month, even the mainstream is beginning to pick up on this narrative.

Oversea-Chinese Banking Corp. economist Howie Lee told Bloomberg last month that he expects China to continue buying gold as it seeks to become a bigger player on the world stage.

Aside from its attempt to diversify its holdings of dollars, owning more gold reserves is also an important strategy in China’s rise as a superpower.”

As the Chinese buy gold, they have also been divesting themselves of US Treasurys. China dumped Treasuries for the third straight month in May, pushing their holdings to the lowest level in two years. Data for June should be released in the next few days.

SP Angel analysts said this move toward de-dollarization in China and other countries could boost the price of gold.

The recent increase in gold prices may be set to continue on the strength of a global push for de-dollarization…

Countries increasingly hostile to the US and dollar hegemony, such as Russia and China, are searching for alternatives to the dollar including gold.”

In December 2018, the People’s Bank of China announced the first addition of gold to its reserves since 2016. The Chinese have a history of going long periods without officially adding gold to its stores and then suddenly revealing a large increase in its reserves. In 2009, the People’s Bank of China stopped reporting its gold holdings. Then in June 2015, the Chinese central bank suddenly announced its gold hoard had grown by 57%.

For a little more than a year, the PBOC regularly announced additions to its gold reserves. Chinese gold holdings rose another 185 tons over the next 16 months before the bank suddenly went silent again.

During the last gold-buying spree, China was pushing for the inclusion of the yuan in the International Monetary Fund’s benchmark currency basket.

Many analysts believe China holds far more gold than it officially reveals. As Jim Rickards pointed out on Mises Daily back in 2015, many people speculate that China keeps several thousand tons of gold “off the books” in a separate entity called the State Administration for Foreign Exchange (SAFE). Given the political dynamics and the ongoing trade war, it seems unlikely the Chinese suddenly stopped increasing their gold reserves in 2016.

China isn’t alone in buying gold. Central bank buying helped boost overall gold demand 8% in the second quarter, according to the World Gold Council. Globally, central banks bought 224.4 tons of gold in Q2. That brought the total on the year to 374.1 tons. China and Russia have been the biggest buyers.

During an interview on RT Boom Bust, Peter Schiff called this a “global gold rush on the part of central banks” in preparation for a dollar crisis.

The days that the dollar is a reserve currency are numbered and the smart central banks are trying to buy as much gold as they can before the number is up.”

* * *

So the message is clear from CCP: Do as we say, not as we do!

via ZeroHedge News https://ift.tt/2z0xExI Tyler Durden