Oil prices have plunged overnight, erasing the spike gains from yesterday’s trade-tariff-delay headlines thanks to API reporting a surprise crude (and gasoline) build as well as ugly German GDP data.

“Yesterday was an eye opener on how much global growth fear hides in oil prices,” said Norbert Ruecker, head of economics at Julius Baer Group Ltd. in Zurich.

“The trade conflict has escalated and the latest batch of tariffs will bear economic costs.”

API

-

Crude +3.7mm (-2.5mm exp)

-

Cushing -2.5mm – biggest draw since June 2018

-

Gasoline +3.75mm

-

Distillates -1.3mm

DOE

-

Crude (-2.5mm exp)

-

Cushing

-

Gasoline (-1.5mm exp)

-

Distillates

Analysts expected a crude draw this week (despite last week’s surprise build and API) but like API, DOE reporteed a surprise crude build (the 2nd week in a row) of 1.58mm barrels. Cushing saw stocks decline as did Gasoline and Distillates.

“Trade tariffs are slowing global consumption, so perhaps foreign refiners are less in need of U.S. crude right now,” said Kyle Cooper,director of research at IAF Advisors.

“Exports have been down for a few weeks, so I will be looking at whether they have rebounded back”

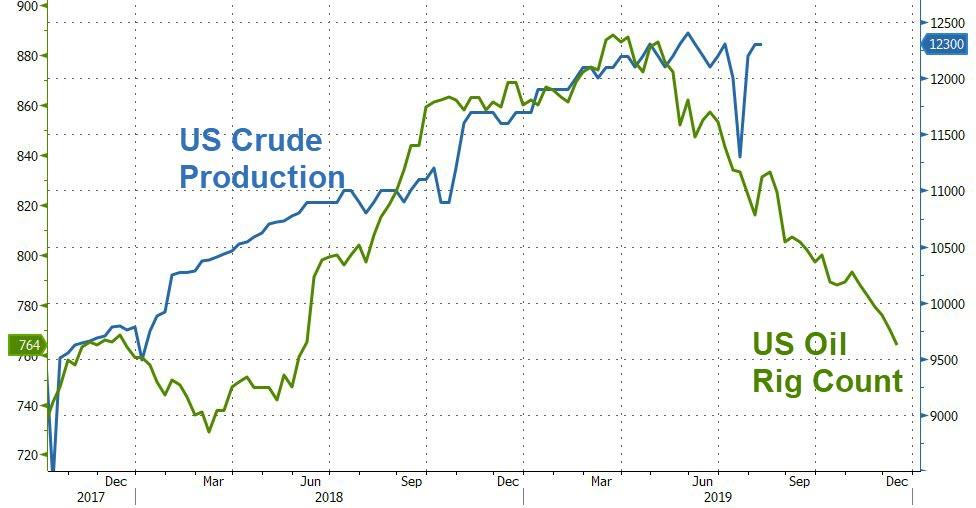

Production was flat on the week as rig counts continue to decline…

WTI has roundtripped into the DOE data as API triggered the start of a reversal that erased all of the tariff delay gains. WTI hovered at $55 ahead of the DOE data… and rallied modestly on the print (presumably on a smaller than API build and draws in gasoline)

“It is difficult for any meaningful rally in this risk-off environment and the potential increase in U.S. inventories adds further bearishness,” said Howie Lee, a Singapore-based economist at Oversea-Chinese Banking Corp.

“We have been here before — the on-off trade talks — and everyone remains skeptical.”

via ZeroHedge News https://ift.tt/2YIjgcu Tyler Durden