In what was mostly a very quiet day, with traders refusing to trade in size ahead of tomorrow’s main event, J-Powell’s J-Hole speech, we got a glimpse of what will happen if the Fed chair disappoints the market’s expectations for committing to further rate cuts.

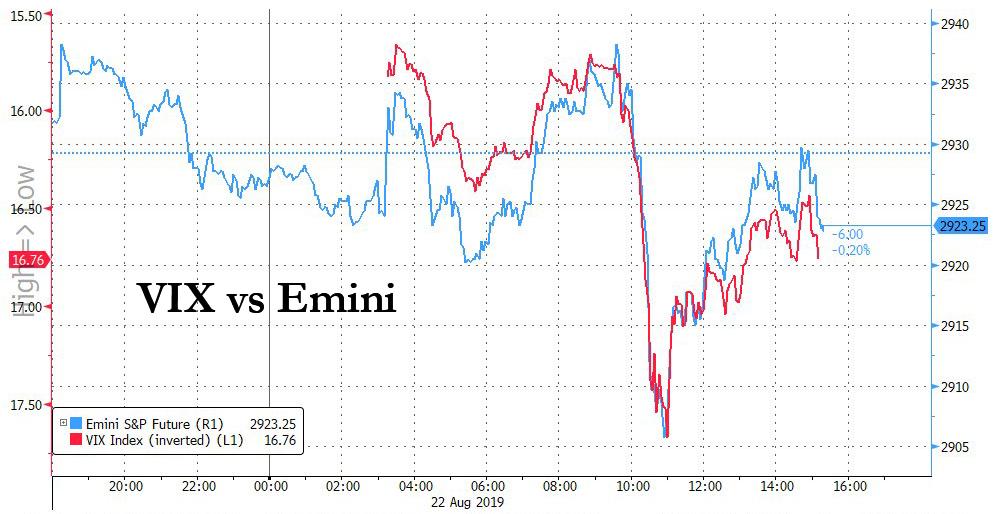

After spiking in early trading, stocks slumped to session lows and the VIX jumped back over the key 16 threshold, after Philly Fed’s Harker joined other regional Fed presidents in pouring cold water on hopes for more rate cuts, and instead saying that he expects not to vote for more easing.

The unexpected hawkishness sent 2Y yield surging, as suddenly the consensus case for 2 more rate cuts this year, and another 2 in 2020 seemed in jeopardy.

The drift higher in short-term yields came even as Markit reported the first contractionary manufacturing PMI in ten years, at 49.9, while the services PMI stumbled as well, making the case for a recession that much more likely.

Also not helping the dovish case was news from Germany, that Bundesbank economists now expect Q3 GDP in Europe’s strongest economy to print -0.1%, meaning Germany has now entered a technical recession with two consecutive sub zero GDP prints.

In any case, the surprising hawkishness out of Fed presidents, and the spike in 2Y yields, meant that the 2s10s yield curve inverted again – yet another recessionary indicator – and was flipping between negative and positive for much of the day.

Looking at sector performance, banks were the clear winners despite the fresh curve inversion, with homebuilders also positive, while all other sectors were either flat or negative, with tech stocks suffering a surprising drop.

And while the S&P traded mostly flat, the Dow outperformed thanks to a Reuters report that Boeing was hoping to produce a record number of 737 planes in Q2 2020… assuming the company got clearance to fly the infamous 737 Max plane again.

Away from the US, euro-area government bonds slumped as the ECB, in its latest minutes, expressed concern that investors were losing faith in its ability to revive inflation. Investors agree, and have pushed the European 5Y5Y inflawtion swap to near record low levels.

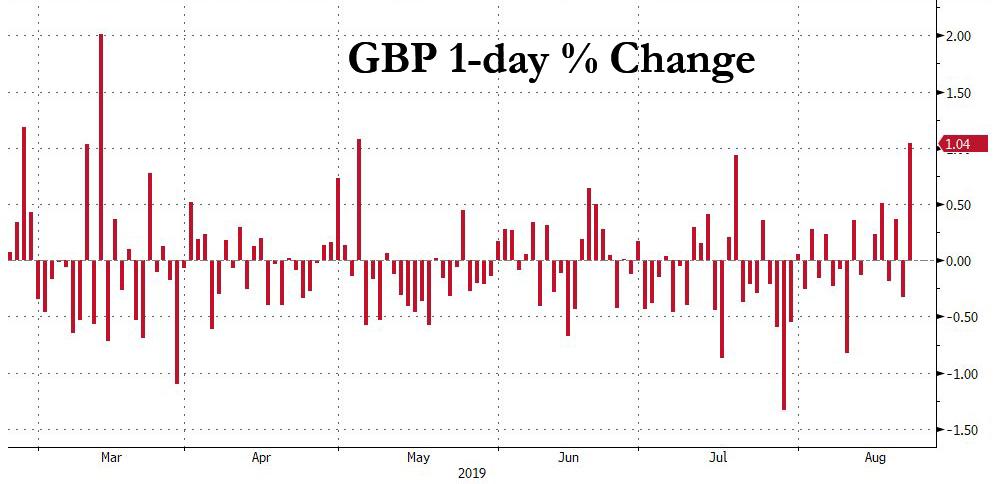

Meanwhile, the British pound surged over 1%, its best one day return since May, as investors seized on hints from European leaders that a Brexit deal could still be reached.

And so with the S&P closing flat, Chris Zaccarelli, CIO for Independent Advisor Alliance, summarized it best: “The big question mark is just going to be Jackson Hole — what’s Powell going to say You’re seeing the market going higher and lower this week heading into tomorrow, where we could get some market-moving commentary out of Powell’s speech.”

For those curious what Powell may say, and why he will likely disappoint, read our preview of tomorrow’s J-Hole main event here.

via ZeroHedge News https://ift.tt/2KQcyIM Tyler Durden