Yet another major oil company has backed away from one of the frontier oil discoveries of the late 20th century that not only cushioned them from OPEC, but helped them learn to drill in some of the most difficult areas of the globe.

After six decades, BP has officially exited Alaska with the sale of its business there for $5.6 billion to Hilcorp Energy, according to Bloomberg. The deal makes Hilcorp the second largest producer in the state behind ConocoPhillips. The deal includes BP’s stake in Prudhoe Bay, which is the largest producing oil field in U.S. history. It also includes BP’s Alaskan pipelines.

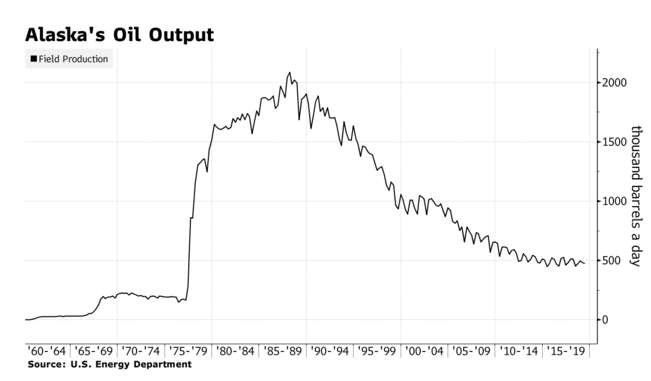

Alaska, meanwhile, is receding into a second tier oil province as a result of field depletion, cost-cutting and the rise of shale. The state’s oil output has slumped from its peak in the 1980s, as discoveries have dried up and major producers seek to produce crude elsewhere, most recently from shale in Texas.

Hilcorp and ConocoPhillips are two of the few big remaining oil companies still interested in investing fresh capital in Alaska.

Oswald Clint, an analyst at Sanford C. Bernstein Ltd. said:

“The divestment prov[es] that no asset is sacred even if it is 60 years old and synonymous with the company. We see the transaction as a positive catalyst, which should help the shares recover lost ground this year.”

The divestiture includes BP’s stake in the Trans-Alaskan pipeline system, which has been running below capacity for years as a result of declining oil production. Wood Mackenzie, Ltd. values the asses at a “slight premium” to the $5.6 billion purchase price, almost 1/3 of which will be paid subject to production over time. It’s a strategic move for BP, as the company looks to shift more towards shale basins and natural gas.

Jason Gammel, an analyst at Jefferies LLC, said:

“The Alaska transaction puts BP in a good position to reach its divestiture target. The transaction is expected to close in 2020 and the upfront cash would reduce BP’s gearing by 2 percentage points.”

Meanwhile, Hilcorp has bought more than $6 billion of oil and gas assets over the last five years and produced about 108,000 barrels of oil equivalent a day. The company in 2017 also acquired assets in the San Juan Basin of New Mexico for $3 billion and has holdings in both Alaska and Wyoming.

Prudhoe Bay has produced about 13 billion barrels over its life and has another billion barrels of potential, according to BP.

Biraj Borkhataria, an analyst at RBC Europe Ltd., said:

“Our production estimates for Alaska upstream are declining by about 5% to 7% per annum. This deal highlights that it remains a buyers’ market for upstream assets, and big price tags require selling high-quality assets such as this one.”

BP was one of the original partners in building the 800 mile Trans-Alaskan Pipeline system in 1977, which was designed specifically to bring oil from the North Slope to the port of Valdez on Alaska’s southern coast. It was one of the largest privately funded construction projects in history. BP holds a 49% stake in the pipeline, with ConocoPhillips, Exxon and Unocal Pipeline holding the rest

Exxon could also soon be on the list to sell their Alaskan assets. The company is looking to raise $15 billion from sales globally by the end of 2021. Over the last few years, companies like Anadarko Petroleum, Pioneer Natural Resources, and Marathon Petroleum have all sold out of Alaska.

Alaska’s annual production peaked at 2 million barrels a day in 1988, the year before the Exxon Valdez oil spill. Last year, it averaged just 479,000 barrels a day.

The US Interior Department is also preparing to sell drilling rights in the Arctic National Wildlife Refuge (ANWR) later this year. The refuge’s coastal plain is said to contain billions of barrels of oil, but tapping it was off-limits due to regulation for decades until 2017, when Congress ordered the government sell drilling rights there.

via ZeroHedge News https://ift.tt/2LlaY0W Tyler Durden