Here Is The Most Remarkable Thing About The Historic Quant Crash

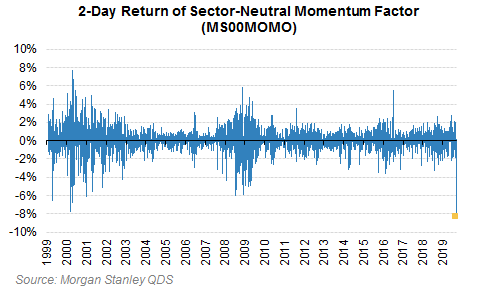

By now everyone knows that over the past week, quants suffered an “incredible painful move” as Morgan Stanley put it, one which saw the worst ever 2-day return in the sector-neutral momentum factor…

… as momentum stocks sold off while an unprecedented wave of short covering lifted value/low-vol stocks.

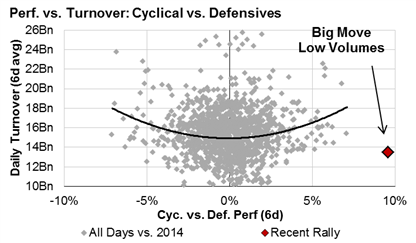

What traders may not know, however, and what is emerging as one of the most remarkable aspects of the historic, multi-sigma quant crash is that as Morgan Stanley’s Rob Cronin points out today, spot outperformance/rotation of this size implies volumes should have been ~70% higher!

This also means that the market is increasingly prone to violent, destabilizing moves on increasingly lower volumes – clearly a function of declining market liquidity – until such a time as a handful of trades can launch a market melt up… or melt down.

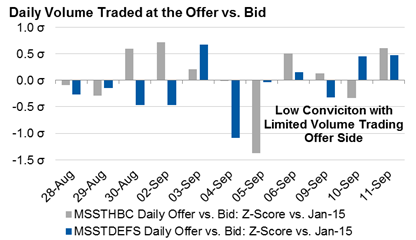

More to the point, the relatively low volume traded on the offer side (0.3σ for cyclicals over last 2w) indicates the low conviction/low urgency of the move which nonetheless was tremendous. While this explicitly confirms just how little liquidity is present in the market, as a very low volume move has resulted in such an outsized outcome, these gapping rallies have less follow through typically, according to Morgan Stanley.

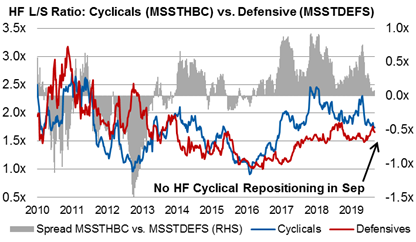

Another notable feature of the recent quant crash is that the overall hedge fund L/S ratio spread between Cyc/Def has barely moved in last 2w (from 45th %-ile to 47th %-ile). The L/S ratios are now roughly equivalent @ 1.7x apiece (Cyclicals high, given growth risks). In other words, macro and L/S hedge funds have not chased cyclicals during the recent upside, yet both were sellers of Cyclicals for the last 2w.

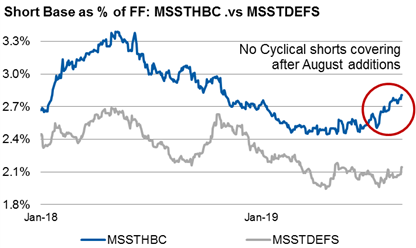

At the same time, cyclical shorts added in August were paradoxically not covered, despite the historic short squeeze observed in the past few days, as spot rallied in Sep. Why? According to Morgan Stanley, the MSSTHBC short base remained flat @ 2.8% of FF (42nd %-ile vs. 2Y) since start of Sep (vs. 2.5% at start of Aug), which begs the question: who was covering what.

The answer: while traditional, human-intermediated funds were largely dormant during the recent volatility, quants were main actor – net buyers of Cyclicals & sellers of Defensives each of the last 4 weeks. Though the z-score of these flows were modest, range bound between a max buying of cyclicals of +1x vs max selling of defensives of -0.5x.

Morgan Stanley’s summary:

- The 10% Cyclical vs. Defensive rally over the last 2 weeks (a 3.5σ event) is now at risk of unwinding. Why? Because “all the data points to a low conviction rally, directional HFs refuse to chase it and Quant/Systematic interest has waned in last 48h.”

- By contrast, the August Cyclical vs. Defensive unwind was very convincing – Cyclical short base grew by 12% & the move was flow driven (more volume traded net @ offer vs. bid). And HF positioning spread between CyC and Def, which was in its 65th %-ile in July (too high vs. weak growth data) massively unwound falling to its 45th %-ile – see HF L/S chart.

In short, this adds more fuel to the raging feud between JPMorgan’s quants, which as we noted believes this move can last for quite a while, and Morgan Stanley’s quants, who believe that the violent quant reversal is almost over.

Tyler Durden

Thu, 09/12/2019 – 12:00

via ZeroHedge News https://ift.tt/30cWZ2z Tyler Durden